Buy Now

Buy Now

Calculated Price (Exclusive of all taxes)

₹ 1800Calculated Price (Exclusive of all taxes)

₹ 3000We make it happen! Get your hands on the best solution based on your needs.

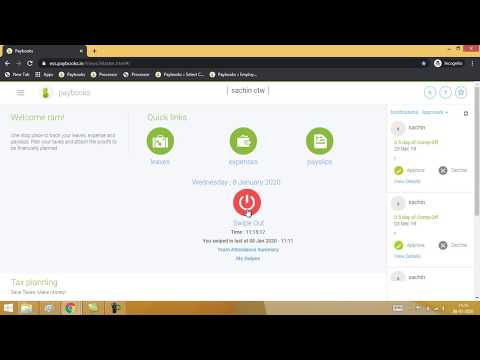

Attendance Management

Integrate biometric device(s) and keep track of all your employees’ attendance as Paybooks record every entry.

Employee Self service

Provide your employees with self-service access to their essential data like leaves, tax documents, provident fund details, et

Reimbursement & Claim Management

Settle all the claims raised by your employees with regard to company policies by adding it to their salaries. Paybooks help you

Salary Management

Take care of your entire organizations’ payroll with few clicks. Paybooks offer you the best salary computation solution to

Guided Payroll Run

The run payroll wizard in Paybooks software ensures that you run your payroll in few clicks and pay accurate salaries and taxes.

Automatic Updates

The payroll system auto syncs with your biometric devices and captures attendance, overtime, and leaves in real time for payroll

Auto generate salary slips

Once you confirm payroll, salary slips are automatically generated in payroll system and employees can view them from mobile

Ready Bank Statements

Pay salaries and expense reimbursements to your employees using the ready to upload statements specified by your bank

Employee Exit Management

Auto generated full and final settlement reports help you to quickly make final payments to employees when they leave.

Tax Management

PT calculation is supported for all states in India and reports are auto generated for easy payment and filing.

Pay Slips & Reports

Your employees will love the anytime, anywhere access to pay slips, salary statements, flexi benefits reports, Form 16 and other

Leave & Expense Management

The interactive app will help employees and managers to collaborate and manage leave and expense claims and approvals better.

Better Income Tax Planning

The inbuilt tax planner lists all deductions available in neatly grouped lists to enable employees to be aware of all tax saving

Complete Employee data

Employees get to view details of their profile including information of their managers, salary hikes, PF and ESI nominations etc

Document Management

Store documents of employees such as experience letters and address proofs online and view them from anywhere, anytime.

API Access

Get API integration with your office workflow system and improve your output and efficiency.

Loan Management

Increment Details

Full & Final Settlement

Biometric Intergration

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

| Brand Name | Paybooks |

| Information | Paybooks |

| Founded Year | 2012 |

| Director/Founders | Gururaja upendra |

| Company Size | 1-100 |

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers