Charles Schwab vs Moomoo: Which Platform Offers the Best Trading Experience?

Charles Schwab and Moomoo are well known investing platforms in the U.S. Both allow trading in stocks, ETFs, and options, yet they differ significantly in platform focus, trading tools, account variety, and investor experience.

Charles Schwab is widely used by users for long term investments, retirement plannings, and users who need a full service brokerage support. Moomoo, on the other hand, is popular among traders who want advanced charts, real-time data, and detailed market insights. But, which one is good for you?

Let’s compare both platforms across key criteria so you can decide which trading platform fits your investing style and goals.

Charles Schwab vs Moomoo: Comparison Table

| Feature |

Charles Schwab |

Moomoo |

| Minimum Deposit |

$0 for standard brokerage accounts |

$0 for brokerage accounts |

| Commissions |

$0 for stocks and ETFs; options $0.65 per contract |

$0 for stocks, ETFs, and options |

| Tradable Assets |

Stocks, ETFs, options, mutual funds, bonds, CDs |

Stocks, ETFs, options |

| Margin Rates |

It is tied to the Base Rate (10%) and can exceed 11% |

6.8% for US margin accounts |

| Research & Tools |

Strong research, screeners, planning tools |

Advanced charts, Level 2 data, technical indicators |

| Account Types |

Taxable, IRAs, custodial, trusts, retirement accounts |

Taxable brokerage, IRAs |

| Customer Support |

Phone, chat, and in person branch support |

Online and in app support |

| Best For |

Long term investors and retirement planning |

Active traders and data driven users |

Charles Schwab vs Moomoo: Pricing & Fees

Both Charles Schwab and Moomoo offer commission free trading on U.S. stocks and ETFs, but pricing structures differ slightly based on use case.

Charles Schwab

- Stock/ETF Trades: $0 commissions.

- Options Contracts: $0.65 per contract.

- Mutual Funds: Thousands of no transaction fee funds available.

- Bonds and CDs: New issue Treasuries often have $0 fees.

- Margin Rates: Base rate (which is 10%) + Others (With balance less than $500k)

- Transfer Out Fee: Typically, $50.

Moomoo

- Stock/ETF Trades: $0 commissions.

- Options Contracts: $0 commissions plus regulatory fees.

- Market Data: Free Level 2 data included.

- Margin Rates: 6.8% annually for debit balances under $25,000

- Transfer Out Fee: Around $75 for ACAT transfers.

- Index Options: $0.50 per contract, plus regulatory fees.

Charles Schwab versus Moomoo: Assets & Investment Options

Both platforms allow stock and ETF trading, but the depth of investment options varies.

Schwab has a wide range of investments such as US and international stocks, ETFs, options, mutual funds, bonds, and CDs. Schwab Stock also provides fractional shares. The platform facilitates diversification of portfolios and long-term investment. However, its direct crypto trading is minimal and is typically traded either by ETFs.

Moomoo focuses on U.S. stocks, ETFs, and options that are highly actively traded. It also offers fractional shares, and the system focuses on the current day's market action as opposed to the long-term portfolio creation. Nevertheless, Moomoo doesn’t support mutual funds, bonds, CDs, and wider retirement investment products.

Moomoo vs Charles Schwab: Trading Tools & Learning Curve

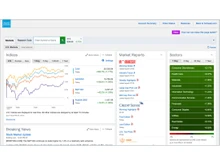

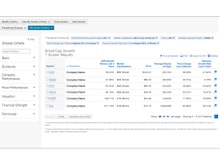

Charles Schwab offers excellent research reports, market comments, screeners, and planning tools that can be used by investors to make their decisions based on the information provided. The platform has user-friendly features, but the tools are meant to be more for investment than quick trading.

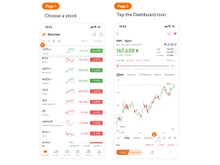

Moomoo provides high-end charting, several technical indicators, Level 2 order book data, heat maps, and thorough statistics. The timeline is longer to learn, but the traders do get to understand the market better on a deeper level.

Charles Schwab or Moomoo: Order Types and Execution Options

Charles Schwab provides numerous order types, which embrace market, limit, stop, stop-limit, trailing stops, and conditional orders. Schwab's routing and execution quality have been fully attuned to the needs of both highest reliability and best execution.

Moomoo allows for placing standard orders such as market, limit, stop, and OCO (one cancels the other) only. Charles Schwab has an upper hand over Moomoo, because it offers a broader selection of complex order types for long term and tactical investing.

Moomoo versus Charles Schwab: Research Reports and Market Insights

Charles Schwab has a clear upper hand as it incorporates third-party research from Morningstar, exclusive market commentary, fundamental data, earnings calendars, and analysts' insights. Moomoo does offer access to real-time financial data, earnings, news, sentiment indicators, and community insights, but it is not as good as Schwab’s research reports and market insights.

Moomoo or Charles Schwab: Options Trading Experience

Schwab provides tools focused on education, risk analysis, and strategy planning. It suits investors who want structured options trading.

Moomoo wins in terms of option trading because it offers detailed options chains, real time Greeks, payoff diagrams, and volatility data designed for active options traders.

Charles Schwab vs Moomoo: Regulation & Safety

Charles Schwab and Moomoo are both members of SIPC, so customer accounts are covered up to the amount of $500,000, of which $250,000 is for cash balances. Charles Schwab has been operating for a long time and is subject to strict regulatory supervision, which is a plus for investors.

When to Choose Charles Schwab or Moomoo?

| Choose Charles Schwab if… |

Choose Moomoo if… |

| You want guidance and education |

You are comfortable learning tools |

| You want retirement planning |

You focus on active trading |

| You need trusts or custodial accounts |

You only need a basic brokerage |

| You want phone and branch access |

You prefer digital support |

| Basic tools are enough |

You want Level 2 data and indicators |

Final Verdict: Charles Schwab or Moomoo?

If you want a reliable, full-service brokerage with extensive research, retirement planning, and a wide range of accounts, then Charles Schwab is your choice. It is perfect for long-term investors and those who seek stability and help.

On the other hand, if you are looking for a platform that provides advanced trading tools, instantaneous market data, and a modern interface, then Moomoo is the perfect choice for you as an active and analytical trader.

Are you still having a hard time making a decision? Get in touch with our software experts or the Techjockey Team for a free consultation on the best U.S. investing platforms for your needs.

11 Ratings & 11 Reviews

11 Ratings & 11 Reviews