GnuCash vs QuickBooks: Which Accounting Software is Right For You?

GnuCash and QuickBooks are two options that are popular when it comes to accounting software. Both allow saving money, measuring costs, and handling accounting effortlessly. But they have a different way of functioning and are aimed at different users. GnuCash is free (open-source) software mostly aimed at individuals and small businesses seeking a simple way to keep track of personal or business funds. QuickBooks, on the other hand, is a commercial software that is widely utilized in smaller to medium-sized businesses. It includes more features, automation, and integrations.

Your needs, budget, and familiarity with technology would determine the choice between the two. This guide will cover the differences that are necessary between GnuCash and QuickBooks so you can choose the one to use.

Key Differences Between GnuCash and QuickBooks

- Ease of Use: QuickBooks can be used by non-experts, and its design is simple, whereas GnuCash is more advanced and older.

- Features: QuickBooks includes other functionality, including invoicing, payroll, and tax, whereas GnuCash includes only the bare minimum of accounting.

- Integrations: QuickBooks offers many integrations with applications and banks, but GnuCash does not offer many integrations.

GnuCash vs QuickBooks: Comparison Table

| Feature |

GnuCash |

QuickBooks |

| Automation |

Mostly manual, bank transactions need to be imported manually. |

Automates banking, recurring invoices, and smart transaction matching. |

| Invoicing |

Can create basic invoices; limited templates and features. |

Professional invoices, recurring options, and online payment support. |

| Reporting |

Offers simple profit-and-loss and balance sheet reports. |

Provides detailed, customizable, and industry-specific financial reports. |

| Multi-User Access |

Single-user only; no team collaboration or access controls. |

Multiple users are supported with role-based permissions on higher plans. |

| Security |

Data stored locally; user is responsible for backups and security. |

Cloud security with encryption, safe backups, and managed protocols. |

| Deployment |

Desktop software is installed locally on Windows, Mac, or Linux. |

Cloud-based or desktop, accessible anywhere with an internet connection. |

| Mobile Access |

Limited Android app; does not sync automatically with desktop. |

Full mobile apps on iOS and Android, fully synced remotely. |

| Customer Support |

Community forums, tutorials, manuals; no formal customer support. |

Offers live chat, phone support, and certified bookkeeping assistance. |

| Ideal For |

Best for freelancers, individuals, and very small businesses. |

Suitable for growing and established small to medium businesses. |

| Pricing |

It is available for free. |

Pricing starts at USD 38 per month for the simple start plan. |

Detailed Feature Comparison of GnuCash and QuickBooks

Double-Entry Accounting

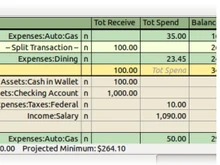

GnuCash follows the principle of strict double-entry accounting, in which each transaction leaves an impact on two accounts, resulting in accurate books. QuickBooks also utilizes the concept of double-entry, but does it automatically. This assists small businesses to remain accurate without the profound knowledge of accounts, minimizing errors and readily monitoring revenues, costs, and balances.

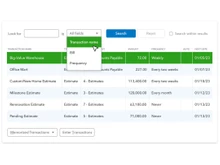

Scheduled Transactions

GnuCash allows you to create recurring payments as a manual task, such as bills or transfers. QuickBooks automates repetitive invoices and payments, and time is saved, and deadlines missed deadlines. Automation enables organizations to work on subscriptions, billing of clients, or routine costs with ease, cutting down on manual tracking and errors.

Multi-Currency Support

GnuCash is capable of supporting a variety of currencies, although exchange rates have to be updated manually. On the other hand, QuickBooks has an automatic way of monitoring a variety of currencies, converting in real time, and changing the rates accordingly. QuickBooks helps US companies with international clients or suppliers simplify their transactions and reduce the number of errors in foreign currency.

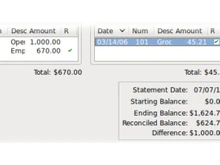

Reconciliation

GnuCash involves balancing bank accounts and transactions manually, which can be time-consuming and subject to errors. In contrast, QuickBooks is linked to bank accounts, automatically compares transactions, and highlights discrepancies. This simplifies month-end closing, increases precision, and makes financial statements a statement of actual balances.

Budget and Cash Flow Management

GnuCash offers manual and limited basic budgeting and project tracking tools. QuickBooks also provides in-depth budgeting, cash flow prediction, and Project-level tracking. But, there is no need to always compute numbers by hand, as business plan expenses, income tracking, and positive cash flow can be maintained.

Tax Management

GnuCash enables users to manage taxes such as GST manually, which is demanding. QuickBooks takes the hassle out of calculating taxes, incorporates US sales tax and payroll tax regulations, and provides tax-ready reports. This saves time and eliminates errors, which helps small business owners with filing taxes.

Project and Sales Management

GnuCash lacks specific sales management, invoicing automation, and project management. On the other hand, QuickBooks is an application that assists companies in the management of projects, sales, invoices, and purchase orders. It enables monitoring of revenue, handling of client work, and control of inventory or services, and provides business owners with a global picture of operations and profitability.

When to Choose GnuCash and QuickBooks?

| Use Case |

GnuCash |

QuickBooks |

| Simple Invoice Tracking |

Works for occasional client billing without online payment options. |

Ideal for businesses needing recurring invoices and professional client billing. |

| Experimenting with Accounting |

Good for learning basic accounting concepts and bookkeeping. |

Less suitable for learning; more focused on automation and real-world business use. |

| Low-Tech Setup |

Works on older computers and offline environments without internet. |

Requires cloud or internet for full functionality; the desktop version needs modern systems. |

| Non-Profits or Small Clubs |

Easy for small organizations needing simple fund tracking and donations. |

Useful if the organization needs advanced reporting, donor management, or multiple users. |

| Small Service Businesses |

Sufficient for sole proprietors or freelancers managing basic client work. |

Best for service businesses needing invoicing, time tracking, and multi-client project management. |

Final Verdict: GnuCash or QuickBooks

GnuCash and QuickBooks are both great accounting programs, although the best option is based on your requirements.

GnuCash suits people, freelancers, or small companies that require simple accounting, control over local data, and a free solution. QuickBooks is appropriate for expanding companies that need cloud-based functionality, multi-user capabilities, high automation, invoicing, payroll, and integrations. It is easy to manage finances and grow with the business.

To get expert advice and an actual experience, contact our software experts or the Techjockey Team to get a free demo. We can assist you in identifying the right accounting software to use in your business.

10 Ratings & 10 Reviews

10 Ratings & 10 Reviews