Moomoo vs Robinhood: Which Platform Offers the Best Trading Experience?

Moomoo and Robinhood are two of the most popular trading platforms in the U.S. Both offer $0 commissions on U.S. stocks, ETFs, and options (under qualifying conditions), but they differ significantly in terms of features, market data, international access, and crypto support.

Robinhood is built around simplicity, a mobile-first experience, and easy access for beginners. Moomoo, on the other hand, targets more active and sophisticated traders with advanced tools, deeper analytics, and access to global markets.

In this guide, we’ll compare Moomoo vs Robinhood across key categories so you can decide which trading platform better fits your needs.

Robinhood vs Moomoo: Comparison Table

| Feature |

Moomoo |

Robinhood |

| Minimum Deposit |

$0 with no minimums |

$0 with no minimums |

| Commissions |

$0 for U.S. stocks, ETFs, and options |

$0 for U.S. stocks, ETFs, and options |

| Tradable Assets |

U.S. stocks, ETFs, options, fractional shares, crypto, global markets |

U.S. stocks, ETFs, options, crypto |

| Market Data & Tools |

Advanced charts (100+ indicators), Level 2, screeners, heatmaps, paper trading |

Basic charts; more tools unlocked via Gold |

| Crypto Trading |

Yes, 50+ coins |

Yes, support 40+ Crypto |

| Fractional Shares |

Yes |

Yes |

| Margin Rates |

6.8% for US margin accounts |

4.7%–5.75%: lower with Gold |

| Account Types |

Individual taxable; IRA options vary |

Individual, Margin, Cash, IRAs |

| Customer Support |

Phone (market hours) + 24/7 inquiry |

24/7 chat/email; phone support available |

| Best For |

Traders who need advanced tools and global access |

Beginners who want simplicity and crypto access |

Moomoo vs Robinhood: Fees and Pricing

Both Robinhood and Moomoo offer $0 commission trades on stocks, ETFs, and options for eligible U.S. customers. Here’s a closer look at their pricing structures:

Moomoo Pricing (U.S.)

- Stocks / ETFs / Options: $0 commissions for U.S. residents trading U.S. markets.

- Options Contracts: No per-contract fee on equity options; standard regulatory and exchange fees still apply.

- Index Options: $0.50 per contract, plus regulatory fees.

- Crypto: Available through Moomoo Crypto Inc.; fees apply (approximately 0.49% trading fee plus spread). Crypto is not SIPC-protected.

- Margin Rates: Around 6.8% annually for debit balances under $25,000; rates vary by balance tier.

- Transfer-Out Fee (ACAT): Typically around $75 for a full account transfer.

Robinhood Pricing

- Stocks / ETFs / Options: $0 commissions for U.S. stocks, ETFs, and options.

- Options Contracts: No per-contract fee; standard regulatory and exchange fees still apply.

- Crypto: Crypto trading available in-app. Robinhood does not disclose exact spreads; network fees may apply.

- Margin Rates: Around 5.25% for lower balances, with potentially lower effective rates for Robinhood Gold subscribers.

- Transfer-Out Fee (ACAT): $100 for full account transfers.

Assets & Investment Options

Moomoo allows you to trade U.S. stocks, ETFs, options, and fractional shares. It also supports crypto trading in dozens of coins (availability may vary by state), though these crypto assets are not SIPC-protected. In addition, Moomoo provides access to select international markets, making it attractive for traders interested in global exposure. However, it does not support mutual funds or traditional bonds.

Robinhood also offers trading in U.S. stocks, ETFs, options, fractional shares, and cryptocurrencies. However, it does not offer access to international equity markets or futures trading in its standard setup, so your investing universe is primarily U.S.-focused.

Moomoo vs Robinhood: Trading Tools & Learning Curve

Moomoo comes with advanced trading tools, including real-time charts, 100+ technical indicators, multiple drawing tools, heat maps, depth-of-market views, and built-in paper trading so you can practice with virtual money. These features provide greater depth for active traders, but they also add complexity and a steeper learning curve for beginners.

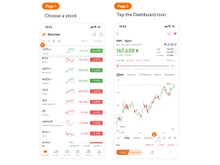

Robinhood prioritizes simplicity and speed. Its interface is clean and intuitive, with basic charts and a limited set of indicators. While Robinhood Gold unlocks additional data and features, the platform is still designed as an entry-level trading app—ideal if you want something straightforward and easy to use rather than highly technical.

Platform Coverage & Customization

Moomoo is available on mobile, web, and desktop. It offers advanced layouts and highly customizable workspaces, which are particularly useful for active traders who rely on multi-screen setups and detailed dashboards.

Robinhood is also available on mobile and web, with a desktop experience that mirrors its minimalist design. However, its layouts are less customizable than Moomoo’s. Robinhood focuses on quick, simple trading flows rather than deep interface customization, which makes it better suited for casual or long-term investors who don’t need complex workspaces.

Education & Resources

Moomoo provides more advanced educational content, including tutorials, in-depth market insights, and the ability to practice with paper trading. These resources help users learn advanced trading strategies and technical analysis over time.

Robinhood offers bite-sized educational content through simple articles, explainers, and in-app news. The focus here is on beginner-friendly learning rather than comprehensive trading education.

Premium Plan

Robinhood Gold costs $5 per month. This premium tier includes:

- Access to margin trading (subject to approval).

- Nasdaq Level 2 market data.

- Morningstar research reports.

- Higher instant deposit limits.

- Competitive APY on uninvested cash (e.g., 4% APY, subject to change).

- Additional perks such as IRA match programs (e.g., 3% IRA match, 1% transfer match, where available).

Moomoo takes a different approach. Many of its advanced features—such as real-time quotes, advanced analytics, priority customer support, and attractive cash sweep APY (e.g., around 4.1%)—are available without a separate monthly subscription. In other words, Robinhood adds value via its paid membership, while Moomoo bundles a lot of powerful features into its base offering.

When to Choose Robinhood or Moomoo?

| Choose Moomoo if… |

Choose Robinhood if… |

| You don’t mind a steeper learning curve and want advanced tools. |

You want the simplest, fastest way to start investing. |

| You want Level 2 data, advanced indicators, paper trading, global assets. |

You’re okay with basic charting and simpler research. |

| You want deep analytics, screeners, advanced strategies. |

You trade casually and value simplicity. |

| Moomoo offers international stocks and crypto (state-dependent). |

Robinhood covers U.S. stocks/crypto and is very beginner friendly. |

| Check Moomoo’s transfer-out fees & policies. |

Robinhood charges standard transfer (ACATS) fee. |

- Choose Robinhood if you:

- Are a beginner or casual investor who wants a simple, mobile-first trading app.

- Primarily trade U.S. stocks, ETFs, options, and crypto.

- Value a clean interface and fast account setup over advanced charting and tools.

- Want access to extra perks like IRA match and higher APY through Robinhood Gold.

- Choose Moomoo if you:

- Are an active or intermediate/advanced trader who needs deeper tools and analytics.

- Want richer market data, advanced charts, and more technical indicators.

- Are interested in international markets in addition to U.S. assets.

- Prefer having many premium-style features (like real-time data and advanced layouts) included without a separate subscription fee.

Final Verdict: Moomoo or Robinhood?

If you’re looking for a simple, mobile-first investing experience with quick access to U.S. stocks, ETFs, options, and crypto, Robinhood is an excellent choice—especially if you’re just getting started or prefer a clean, minimalist interface.

If you’re a more active trader who values deep market data, advanced trading tools, and broader asset coverage, and you’re willing to invest time in learning a more powerful platform, Moomoo may be the better fit.

Both platforms offer strong features for U.S. investors. Ultimately, the right choice depends on your trading style, how much time you plan to spend analyzing markets, and which features matter most—simplicity and ease of use, or advanced tools and global reach.

5 Ratings & 0 Reviews

5 Ratings & 0 Reviews