Robinhood vs Tastytrade Comparison FAQs

Software questions,

answered

Robinhood is aimed at easy access, low fees, and ease of use for newer investors people and Tastytrade is aimed at active traders requiring sophisticated tools, strategy support, and options depth.

It depends on your choice. Robinhood is simpler to use and start trading. Tastytrade suits complex strategies of experienced traders.

Robinhood is a provider of several commission-free trades with other possible charges; Tastytrade has expenses per contract with options and is designed to trade more volume strategies.

Robinhood provides basic support and educational resources. Tastytrade offers more in-depth education, community tools, and features designed for dedicated traders.

Both platforms serve U.S. retail investors but appeal to very different types: one for simplicity and accessibility, the other for depth and active strategy.

If you’re a casual investor focusing on straightforward trades, yes. But if you need advanced options strategies and tools, Tastytrade remains superior.

Robinhood is cost-effective for basic investing. Tastytrade offers better value for frequent or complex traders who utilise its advanced features.

Yes, some users keep Robinhood for long-term holdings and use Tastytrade for active options trading, leveraging the strengths of both platforms.

Robinhood offers ultra-simple onboarding, a mobile-first experience, fractional shares, and commission-free trades, features ideal for beginners.

Users often praise Robinhood for simplicity and low cost, but critique its advanced tools. Tastytrade is applauded by active traders for power and depth, but noted as less beginner-friendly.

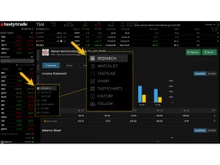

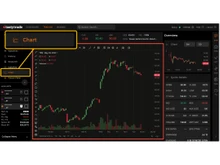

Robinhood is beginner-friendly, with standard broker tools and an accessible API for basic use. Tastytrade supports more advanced analytics tools, portfolio trackers, and integrations suited for active strategy execution.

Robinhood scales easily for everyday investing and growing portfolios. Tastytrade scales better for high-volume, options-centric traders who require robust infrastructure and advanced capabilities.

26 Ratings & 21 Reviews

26 Ratings & 21 Reviews