View Gallery

Brand: PitBullTax Software

Get Free Expert Consultation

Let us know your business needs clearly

Verified & Trusted

Vendors

Safe & Secure

Payment

Personalized

Experts Support

$ 130.00 /Month

Features

Tax Preparation & Filing

Tax Preparation & Filing  Income & Deductions Management

Income & Deductions Management  Compliance & Audit Support

Compliance & Audit Support  Business & Enterprise Features

Business & Enterprise Features  Integration & Automation

Integration & Automation See all

We make it happen! Get your hands on the best solution based on your needs.

Tax Preparation & Filing

Income & Deductions Management

Compliance & Audit Support

Business & Enterprise Features

Integration & Automation

Security & Data Protection

Analytics & Reporting

| Brand Name | PitBullTax Software |

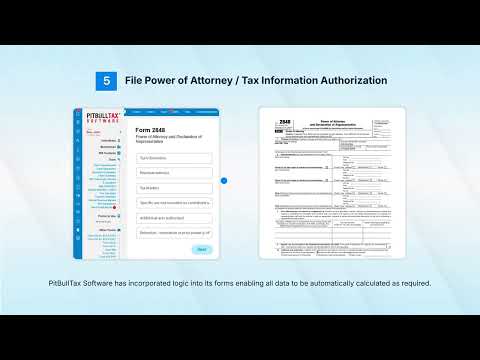

| Information | Software made for tax professionals looking to increase revenue, expand their practice, and streamline case load. Featuring all IRS forms that are automatically populated via a client questionnaire. |

| Founded Year | 2010 |

| Director/Founders | Irina N. Bobrova, Jose L. Alfaro |

| Company Size | 1-100 Employees |