E TRADE vs Interactive Brokers Comparison FAQs

Software questions,

answered

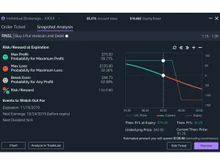

On both platforms, commissions on stock and ETF trades are free. Nevertheless, IBKR offers lower margins and other competitive futures trading rates, which makes it possibly cheaper to trade actively.

E TRADE has around-the-clock customer service through phone, chat, and email, and offers ready customer services. IBKR also has 24/6 support with several channels, with a global clientele.

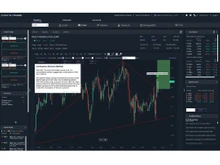

Select E TRADE because of its convenient interface and powerful learning materials, which would suit a novice. IBKR is the right choice when you are a professional trader in need of sophisticated trading services and international access.

They are both popular online brokerage websites that provide an extensive variety of investment opportunities and are often compared to each other to allow investors to pick the platform that suits their needs the most.

E TRADE may be used in case of individual investors interested in the U.S. markets and a simple interface. IBKR, however, can be a better fit for more sophisticated traders who should have access to global markets and have more sophisticated tools.

In the case of simple stock and options trading, the two websites can be competitive on the pricing front. Nevertheless, the low margin rates and futures trading fees offered by IBKR can make it cheaper for active traders.

In the case of simple stock and options trading, the two websites can be competitive on the pricing front. Nevertheless, the low margin rates and futures trading fees offered by IBKR can make it cheaper for active traders.

E TRADE offers a platform that is user-friendly and offers various educational materials that could be available to individual investors, and it improves the user experience.

Users like the ease of use and the strength of the educational capabilities of E TRADE. IBKR customers attach importance to its sophisticated trading platforms and markets worldwide.

E TRADE has integrations with a wide range of financial tools and platforms, which improve the user experience. Bigger traders are served by IBKR, which offers wide integrations with professional trading systems and instruments.

E TRADE will serve the needs of individual investors and individuals who may want to invest little by little. IBKR is meant to support high-volume and institutional traders, and it is more scalable.

11 Ratings & 11 Reviews

11 Ratings & 11 Reviews