E*TRADE vs Robinhood: Which Brokerage Platform Is Easy to Trade Stocks, Bonds, ETFs, and Mutual Funds?

In the online brokerage space, choosing the right financial management software is pivotal. And, two big names in this category are E*TRADE and Robinhood.

E*TRADE often attracts serious investors and traders who want full-featured tools, a wide asset range, and strong research. On the other hand, Robinhood appeals to newer investors or those seeking a simple mobile experience and minimal costs.

If your priority is a robust trading and investing platform (with mutual funds, bonds, futures, advanced order types, and broad account types), then ETRADE is likely your best option. If you're looking for a mobile-first experience with ultra-low cost, and you’re starting or focusing primarily on stocks/ETFs and crypto, Robinhood might fit better.

In this guide, we’ll cover the key differences between Robinhood and E*TRADE, present a side-by-side comparison, dive into detailed feature comparisons focused on specific investor needs, highlight when each platform is most suitable, and provide our verdict.

Key Differences Between E*TRADE and Robinhood

- Investment Product Range: E*TRADE offers mutual funds, bonds, futures, and retirement account types. Whereas Robinhood is more limited to stocks, ETFs, options (and crypto).

- Fractional Shares & Crypto Support: Robinhood supports fractional shares and crypto trading. On the other hand, E*TRADE historically lacked some of that flexibility or had fewer crypto options.

- Platform Tools & Research Depth: E*TRADE provides deeper charting, extensive research, and trading tools. In contrast, Robinhood provides a simpler, streamlined interface with fewer advanced tools.

- Customer Support & Account Types: E*TRADE offers 24/7 phone support, live chat, branch offices, and a wide variety of account types (custodial, SEP/SIMPLE IRAs). Whereas Robinhood is more limited in support and account variety.

- Best User Case: E*TRADE suits more advanced or long-term investors/traders. In contrast, Robinhood suits beginners, mobile-only investors, or those prioritizing simplicity and minimal cost.

E*TRADE vs Robinhood Comparison Table

| Basis |

E*TRADE |

Robinhood |

| Account Minimum / Fees |

$0 minimum for brokerage account; no inactivity fee. |

$0 minimum; no account maintenance fee. |

| Investment Product Variety |

Stocks, ETFs, options, mutual funds, bonds, futures, and retirement account types. |

Stocks, ETFs, options, crypto (in many states); no mutual funds or broad bond offerings. |

| Fractional Shares / Crypto |

Limited fractional share support (via DRIP, etc), no broad crypto. |

Strong fractional share support; crypto trading of multiple coins. |

| Trading Tools & Platform Depth |

Advanced charting, desktop, mobile, conditional orders, futures, research tools. |

Simplified mobile-centric interface, fewer advanced orders, and charting features. |

| Research, Education & Support |

Broad research library, webinars, 24/7 phone support, and branch access. |

Basic support channels (in-app, email) with more limited research tools. |

| Best For |

Intermediate to advanced investors/traders with long-term planning. |

Beginner investors, mobile-first traders, and small-dollar investments. |

Detailed Feature Comparison of Robinhood vs E*TRADE

Here we examine specific features that users often compare when choosing between the two trading platforms:

Investment & Asset-type Support

One major distinction is how many types of investments are available. ETRADE supports a broad spectrum like stocks, ETFs, mutual funds, bonds, futures, and multiple IRA account types (including SEP, SIMPLE, rollover IRAs), enabling broader long-term and diversified investing. In contrast, Robinhood is more streamlined and supports stocks, ETFs, options, and crypto in many states, but lacks robust mutual funds and bond markets. So, if you foresee investing across many asset classes or retirement vehicles, ETRADE offers more flexibility.

Fractional Shares, Crypto & Small-Dollar Investing

If your focus is investing small amounts or dipping into crypto, Robinhood stands out. It supports fractional shares (which ETRADE only offers in a limited option) and allows crypto trading for eligible users. ETRADE is more oriented toward full-share trades and traditional investments. Hence, Robinhood may have the edge for new or micro investors wanting exposure to high-priced stocks or crypto.

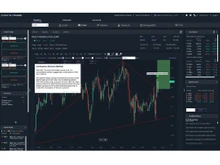

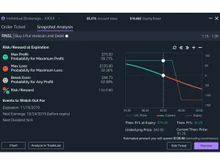

Platform Sophistication & Order Types

E*TRADE shines when it comes to trading platform depth, such as desktop and mobile apps, advanced order types (such as conditional orders, OCO/OTO), real-time data, and extensive charting tools for active traders. Whereas Robinhood offers a very user-friendly mobile interface but limits the advanced order types and customization that more seasoned traders may want. Therefore, if you’re an advanced trader needing precision tools, ETRADE is the stronger choice.

Research, Education & Investor Support

Investors looking for research and learning resources will appreciate ETRADE offers, including extensive articles, webinars, portfolio analytics, and responsive multi-channel customer support (phone, chat, and branches). On the other hand, Robinhood provides more of the basics, such as simplified educational content, newsletter-style reads, and mobile-focused features. However, it offers fewer advanced research tools and fewer channels for immediate human support. So for those seeking to grow their investing knowledge or get frequent help, ETRADE is advantageous.

Account Types, Retirement Support & Long-Term Planning

E*TRADE supports many account types, such as individual taxable accounts, joint, custodial, various IRAs (Traditional, Roth, rollover, SIMPLE, SEP), which makes it suited for investors with children, retirement planning, or business-plan investing. On the other hand, Robinhood primarily supports taxable brokerage accounts and Roth/Traditional IRAs in many cases, but has less breadth in family or business-oriented account types. Thus, for long-term financial planning or complex account structures, ETRADE has a clear edge.

Costs, Fees, and Margin Rates

Both platforms offer commission-free trading of stocks and ETFs for many users, but there are nuances. For example, options pricing differs, and margin rates vary: Robinhood has very low margin rates in many cases (especially for smaller balances), which appeals to frequent traders or margin users. E*TRADE’s rates tend to be higher, but you get more tools, more account types, and more assets. Also, transfer out fees, inactivity, etc, may differ. For cost-conscious traders, Robinhood may seem more attractive in pure fees, but you pay in trade-off for fewer features.

When to Choose E*TRADE or Robinhood?

| Use Case |

Best Platform |

| You’re starting out, want a simple mobile interface & low cost, trading stocks/ETF occasionally. |

Robinhood |

| You want full asset class access (mutual funds, bonds, futures) and retirement planning. |

E*TRADE |

| You invest micro-dollars or want fractional shares and crypto access. |

Robinhood |

| You’re an experienced trader needing advanced order types, a desktop platform, and deep tools. |

E*TRADE |

| You need multiple account types (custodial, retirement, SEP/SIMPLE). |

E*TRADE |

Final Verdict: Robinhood or E*TRADE?

In the matchup between Robinhood and ETRADE, the winner really depends on your investing style, goals, and experience. If you’re relatively new, prefer a streamlined mobile experience, small investment amounts, or dipping into crypto, Robinhood offers a compelling, low-barrier option. But if you’re looking for serious investing tools, multiple asset classes, retirement/long-term planning, and deep support, E*TRADE is likely the better choice. Reach out to our software experts for a free consultation and a demo to help you select the best online brokerage platform for your trading and investing needs.

11 Ratings & 11 Reviews

11 Ratings & 11 Reviews