Sprintax vs TurboTax: Which Tax Software is Right for You?

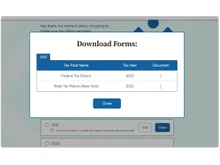

Sprintax is a special tax application that targets the non-resident aliens residing in the U.S. (students, scholars, and temporary employees). It will ease the process of submitting documents such as 1040-NR and 8843, and will also guarantee one hundred percent compliance with the IRS amongst the visa holders.

TurboTax is, however, customized to suit the residents and citizens of the U.S, and it provides easily navigable features to file standard 1040s, get maximum deductions, and file state and federal returns effectively.

Use Sprintax when applying as a non-resident or international student, as it requires precise compliance with non-resident tax. Select TurboTax for tax filing in all its simplicity, resident-based, and with easy-to-follow directions and wide financial integration.

Sprintax and TurboTax: Comparison Table

| Feature |

Sprintax |

TurboTax |

| Target Users |

International students, scholars, and nonresident taxpayers |

U.S. residents, freelancers, and small business owners |

| Tax Filing Focus |

IRS-compliant nonresident federal and state returns |

Federal and state returns with deductions and credits |

| Investment & Dividend Reclaim |

Supports cross-border dividend tax reclaim |

Not available |

| Automation & Assistance |

Step-by-step guidance for nonresidents |

Guided filing with expert help options |

| Support |

Multi-channel support for non-resident issues |

Expert assistance via chat, phone, or video |

| Cost |

Custom pricing is available |

Pricing starts from USD 79 |

Detailed Feature Comparison of Sprintax and TurboTax

Tax Filing Focus

- Sprintax is aimed at international students and scholars, temporary visa holders, and other non-resident taxpayers, emphasizing filing IRS-compliant federal and state returns.

- TurboTax is designed to serve the residents of the U.S., freelancers, and owners of a small business, helping the user with all the filing stages by asking automated questions, data imports, and maximizing the refund.

Compliance & Management

- Multi-jurisdiction tax management has been achieved by Sprintax with its Calculus tool, whereby an organization can manage employee withholding, determination of residency, and compliance of its vendors all through a single dashboard.

- TurboTax is also concerned with domestic tax accuracy, which ensures that there are no errors in its results, which are always accompanied by audit services, and that the system considers all IRS changes to assist users in producing accurate and correct results.

Automation & Integration

- Sprintax connects with the major payroll and HR solutions used in the US to automate tax calculation and reporting in global companies. Its API facilitates easy and smooth exchange of data to ensure uninterrupted compliance.

- TurboTax implies the automation of the importation of documents and computations, retrieving tax information from employers, banks, or financial institutions, and facilitating mobile filing to submit the taxpayers faster and e-filing.

User Experience & Accessibility

- Sprintax provides an exclusive experience to non-residents, providing university and corporate adherence to assisted filing services and convenient access to the Internet worldwide.

- TurboTax offers an easy, stepwise interface, has an intuitive design, and can be accessed on multiple devices. This is how people can complete even complex returns without prior understanding of tax laws.

Support & Guidance

- Sprintax provides the privilege of live chat client care, email, and comprehensive tax information. So, the worldwide users can get expert client care regarding the specific visa and residency-related tax matters.

- TurboTax offers live and full-service, and real-time expert support, in which professionals view or file taxes directly on behalf of the users.

Ideal User Base

- Sprintax is suited to international students, J-1 visa holders, au pairs, and multinational organizations that must handle the nonresident tax obligation.

- TurboTax is ideal for U.S. residents, gig workers, and small business owners who require maximum refunds, expert-provided services, and full-fledged filing.

When to Choose Sprintax or TurboTax?

| Use Case |

Choose Sprintax |

Choose TurboTax |

| Tax Residency |

Nonresident aliens needing IRS-compliant filing |

U.S. residents and citizens filing federal and state taxes |

| Specialized Filings |

J-1, F-1, H-1B visa holders, au pairs |

Self-employed, investors, or homeowners needing standard forms |

| International Investments |

Reclaim dividend withholding tax (DWT) |

Focus on domestic investment and retirement accounts |

| Organizational Compliance |

HR or payroll teams managing global employees |

Individual or small business filing without corporate oversight |

| Partnerships & Integration |

Universities, multinational corporations, and institutional partners |

Personal or household-level tax management |

| Filing Guidance |

Step-by-step support for nonresident tax scenarios |

Guided assistance for maximizing deductions and credits |

| Refund Optimization |

Ensures treaty and nonresident benefits are applied |

Maximizes standard tax refunds and credits for U.S. residents |

Final Verdict: Sprintax or TurboTax

Sprintax is specifically developed to cover the international students, scholars, and visa holders as non-resident taxpayers that offering an accurate IRS-compliant tax filing, tax treaty advantages, and recovering dividend withholding tax. It suits well with those individuals or entities dealing with non-resident compliance in the various jurisdictions.

TurboTax targets United States residents and citizens, providing them with a convenient way of filing in federal and state taxes, maximizing standard deductions, credits, and refunds, and expert guidance throughout the process.

Select Sprintax to complete the compliance with non-resident tax and international investments reclaim. Meanwhile, TurboTax has the advantage over the other as it would better suit the requirements of U.S. residents who are interested in the convenience of a guided tax filing experience with maximum refund guarantees.

1 Ratings & 1 Reviews

1 Ratings & 1 Reviews