Filing your ITR-5 form at the eleventh hour? Struggling to make your way through the sundry tax documents and filing necessities it imposes on you? Well, you have landed at the right place, for we have just the guide for you.

Read on as we explain how to file ITR-5 in simple terms, so tax filing becomes easy for you as a young professional, a business owner, or a savvy taxpayer.

What is the ITR-5 Form?

ITR-5 is an income tax return form created for business entities like partnership firms, LLPs, associations of persons (AOPs), bodies of individuals (BOIs), trusts, estates, and other artificial juridical persons.

It’s specially designed for those who don’t fall under company or individual categories, including everything from business income to speculation gains and local authority earnings.

The following people should file ITR-5…

- Partnership firms (excluding those requiring ITR-7)

- Limited Liability Partnerships

- Associations of Persons (AOP)

- Bodies of Individuals (BOI)

- Trusts, estates (other than charitable/religious)

- Societies, cooperative banks, investment funds

The following set of people cannot file ITR-5…

- Individual taxpayers

- Hindu Undivided Families (HUF)

- Companies

Prerequisites for Filing ITR-5 Form

Before starting the ITR-5 filing process, assemble the following documents and info…

- PAN card of the entity

- Latest audited financials: balance sheet, profit and loss, trading/manufacturing accounts

- Bank account details

- Form 26AS, TDS certificates

- Books of account (as per Section 44AA for audit cases)

- Previous year’s income/expense details

- Investment details, proofs for all deductions (Chapter VI-A)

- Audit reports, if applicable

- Digital Signature Certificate (DSC) for audit cases

- GST turnover details, foreign asset declarations, and any relief claims

- Advance Tax and Self-Assessment Tax payment copies

Note: Even if your income is below INR 5 lakhs, filing is mandatory for partnership firms, LLPs, AOPs, and trusts.

How to File ITR-5 Online: Step-by-Step Guide

Here’s a no-step-missed process for filing form ITR-5…

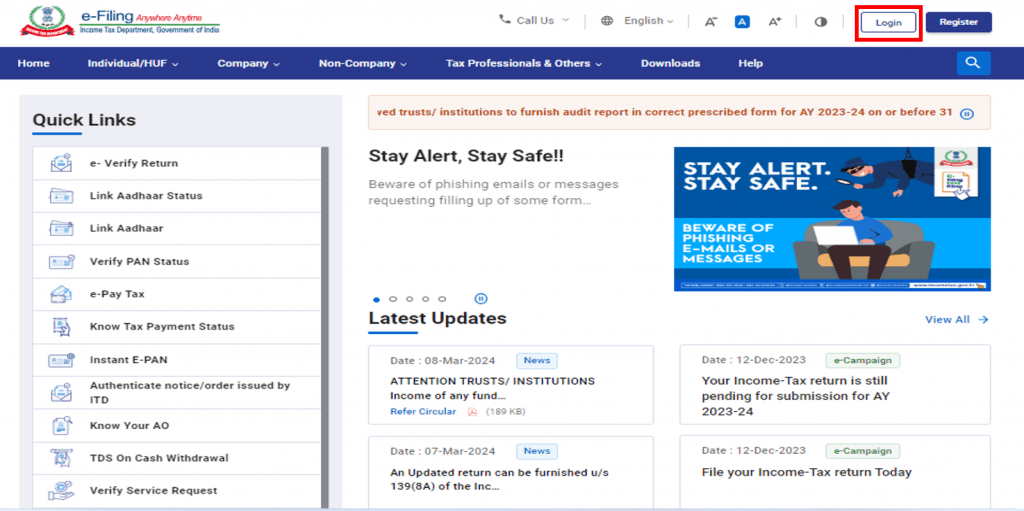

Step 1: Register/Login to Income Tax E-Filing Portal

- Go to www.incometax.gov.in.

- Create an account (for new users) with PAN, entity details.

- Log in with PAN, password, and secure OTP.

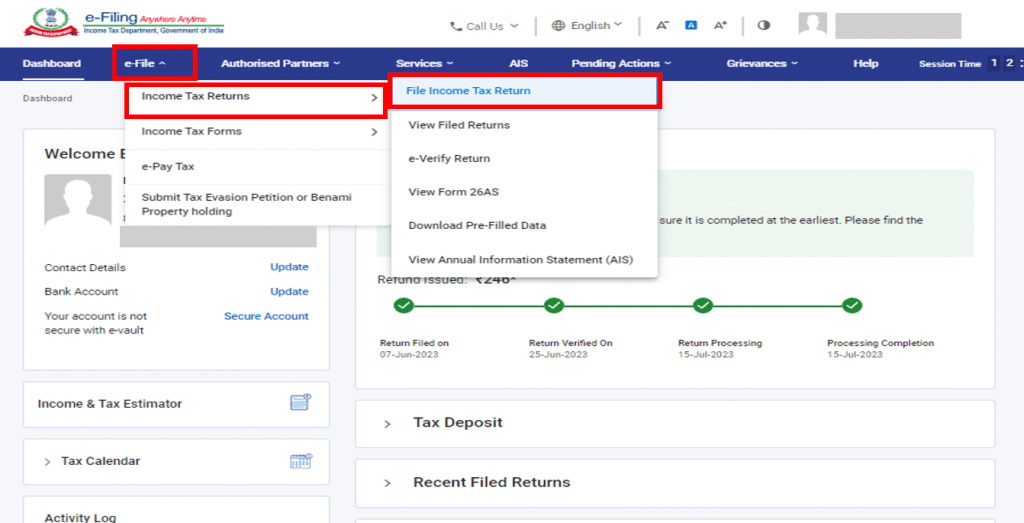

Step 2: Select File Income Tax Return

- Navigate: E-File > Income Tax Returns > File Income Tax Return.

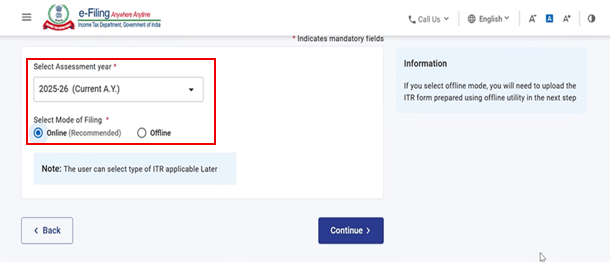

Step 3: Choose Assessment Year

- Pick current AY (e.g., ‘AY 2025-26’ for FY 2024-25).

Step 4: Filing Mode Selection

- Choose the Online method for live portal entry OR

- Choose Offline to download the utility, fill details, generate & upload the JSON file.

Step 5: Entity and ITR Selection

- State entity status (Firm, LLP, Trust, Society, etc.).

- Select the ITR-5 form.

- Confirm eligibility (not eligible for ITR-7, not an individual/HUF/company).

Saral IncomeTax

Starting Price

₹ 5500.00 excl. GST

Step 6: Reason for Return/Filing Type

- Specify reason: regular, revised, belated, or filed in response to notice.

Step 7: Gather and Validate Pre-Filled Data

- Review auto-imported data on PAN, basic details, and bank accounts.

- Confirm or edit phone/email, business address, date of formation, and commencement.

Step 8: Fill General Information (Part A)

- Accurately enter personal/entity info: name, address, formation date, sub-status, contacts.

- Legal identifiers like LLPIN (if applicable).

- Due date for filing selection.

Step 9: Fill All Schedules

Go through each schedule thoroughly…

- Schedule BP: Business and profession income details

- Schedule HP: Income from house property

- Schedule CG: Capital gains

- Schedule OS: Other sources of income

- Schedule MAT/MATC/AMTC: Minimum Alternate Tax computations

- Schedule SI: Income chargeable at special rates

- Schedule FSI, TR, FA: Foreign sources, income, and assets

- Schedule GST: Report GST turnover/gross receipts

- Schedule TDS/TCS: Tax deducted/collected at source details

- Schedule IT: Details of tax payments (Advance Tax, Self-Assessment Tax)

- Schedule VI-A: Deductions from total income (Sections 80C onwards)

- Schedule 115JC/115JD: Alternate Minimum Tax (AMT) and Credit Computations

- Schedule EI: Details of exempt income

- Schedule IF: Information for business trusts/investment funds

- Schedule partnerships: Details of partnership status or income received

- Audit Reports: Upload as per Section 44AB requirements (if applicable)

- Quantitative Details: Manufacturing/trading account info for relevant businesses

Step 10: Tax Computation & Auto-Calculation

- Verify the portal’s auto-computed tax from your entries.

- Confirm all tax sections are included (education cess, surcharge, if any).

Step 11: Income Details Verification

- Double-check all sources of income, investments, deductions, and relief accurately reported.

Step 12: Attach Required Documents

- While e-filing, no physical documents are required, except for audit reports and digitally signed verification, where mandated.

Step 13: Validate and Preview

- Use the portal’s Validate button to check for errors/missing info.

- Preview full return (including all schedules) for omissions or mistakes.

Step 14: Final Submission

- For audited cases: submit using Digital Signature Certificate (DSC).

- For non-audited: submit online and proceed to verification.

Step 15: Return Verification

- E-verify via Aadhaar OTP, bank EVC, or digital signature.

- Alternatively, download the ITR-V acknowledgement, print, sign, and post to CPC Bangalore within 120 days.

- Keep the second copy for records.

Step 16: Confirmation & ITR-5 Download

- Post-submission, download the filed ITR-5 and the acknowledgement from Filed Returns.

- Save PDF/JSON files for future access, audits, and corrections.

Pro Tip: Many tax filers wonder if ITR-5 is not available for e-filing. If you see this error, check if you are selecting the correct entity type, assessment year, and digital requirements. The portal may temporarily restrict forms during updates, but ITR-5 filing is almost always enabled for eligible entities.

ITR-5 Last Date for FY 2025-26

For FY 2025-26, the last date to file ITR-5 is 31st July 2026 for firms, LLPs, AOPs, BOIs, and other entities whose accounts are not subject to audit. If audit is applicable, the due date extends to 31st October 2026. Filing ITR-5 before the deadline helps avoid late fees, interest charges, and ensures faster refund processing while staying compliant with income tax regulations. For entities involved in international or specified domestic transactions, the due date extends to 30 November 2025.

How to Download ITR-5 Form?

Downloading your filled ITR-5 is essential. Here’s how you can do the same…

- Go to View Filed Returns in the e-filing portal.

- Locate your filed ITR-5 for the relevant assessment year.

- Click Download to save the ITR-5 filing acknowledgement and filled form, either in PDF or JSON format. This step ensures you keep a record for future audits, corrections, or loan applications.

Common Mistakes to Avoid Whilst Filing ITR-5 Form

Even seasoned tax filers can stumble. Here’s what NOT to do…

- Choosing the incorrect form of AY

- Skipping any schedule (especially GST, partnership/investment funds, foreign assets)

- Errors in PAN, bank, or personal details

- Missing audit report uploads/digital signatures for audit cases

- Not filing at all for entities with income below INR 5 lakhs (mandatory for most)

- Forgetting to e-verify or send the ITR-V within the time limit

- Failing to reconcile financials with Form 26AS/TDS

- Disregarding online vs. offline instructions

Conclusion

The ITR-5 filing process isn’t a walk in the park, but with due diligence, anybody, even a first-time filer, can file it, and how! You just need to follow the abovementioned steps and the rest will follow.

If you need any sort of technical assistance in the process, we, at Techjockey, have all the income tax software solutions you can make use of, and the best part is, we are just a call away! So, phone us now!

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more