What is Cryptocurrency? A Complete Cryptocurrency Guide For Beginners

About a decade ago, the world’s first cryptocurrency, Bitcoin (BTC), was launched. Since then, the field of cryptocurrency has taken the world by storm with the market launch of thousands of different types of cryptocurrencies within such a short span.

Despite skepticism about the future of cryptocurrency, the adoption rate continues to surge. By the end of March 2021, there were more than 70 million blockchain wallet users.

Last year, Nike collaborated with a UK-based startup Plutus to offer cashback rewards on online cryptocurrency purchases to its customers. Giants like eBay are also exploring the option of accepting cryptocurrency as a form of payment.

What is Cryptocurrency?

The term cryptocurrency defines virtual or digital currencies that are encrypted using cryptography to secure, process, and verify transactions. They are built typically by software developers on a distributed and decentralized ledger (computerized database) technology known as a blockchain.

Data added to the database is in the form of blocks. Every new block is chained to the existing blockchain by adding the hash and ID of the new block first. The data becomes immutable, and any edit between the existing chain will need recomputing all hashes after that.

Suggested Read: What is Cryptocurrency in Hindi

How Cryptocurrency Works?

Cryptocurrencies exist in the form of tokens or coins in the ledger and are usually intangible. Unlike common digital currencies, these are not controlled by any institution, governmental or otherwise. There is a limited amount of cryptocurrency that can exist to maintain its perceived monetary value. You use a digital currency exchange for asset transactions usually.

The importance of a cryptocurrency is evaluated in terms of the customer base, market capitalization, and popularity. It can even serve economies that cannot use traditional banks and have no investment opportunities.

What are the Different Types of Cryptocurrencies?

Cryptocurrencies can be of two types. Coins that include Bitcoin and the alternative cryptocurrency coins (Altcoins) compromise the set of all coins other than Bitcoin. Bitcoin’s security features make it the most popular crypto coin.

Altcoins are built on the same foundational framework as Bitcoins but with additional features for different purposes and applications. Examples of Altcoins include the recently popular Dogecoin, Namecoin, Litecoin, Peercoin, among others.

Further, there are crypto tokens given out like a stock offering and denote an asset or specific purpose. They are created via an initial coin offering. They can be used for investment, storing value, security of accounts, or making purchases for different applications. Bitcoin Cash and Ethereum’s Ether are examples of crypto tokens.

Best Cryptocurrency to Invest in 2022: Cryptocurrency List

Here’s a list of cryptocurrencies for investment, making purchases, and more.

- Bitcoin

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Litecoin (LTC)

- Stellar (XLM)

- Cardano (ADA)

- Dogecoin (DOGE)

- Monero (XMR)

- Binance Coin (BNB)

- ChainLink (LINK)

- Tron (TRX)

- Bitcoin

Bitcoin was created in 2009 by an individual with the pseudonym Satoshi Nakamoto. Users can make transparent peer-to-peer transactions worldwide using the underlying blockchain technology.

Bitcoin uses SHA-256 for encryption. Being open-source software, any user can view bitcoin transactions, but only the bitcoin owner can decrypt it using his/her unique private key.

There are more than 18.6 million bitcoins in circulation, with each block adding 6.25 bitcoins. After it reaches 21 million, the protocol will be changed to allow more coins into existence.

- Bitcoin Cash (BCH)

Bitcoin Cash was developed in 2017 because of a change in the original Bitcoin code to form a separate new chain. This was due to disagreements between miners and developers to improve some features like the scalability of Bitcoin.

In the crypto world, this change is called a fork, and each modification is considered a prong of the fork. Forks can be soft where the old version accepts new changes. For example, Bitcoin Cash was a result of a hard fork of bitcoin. In a hard fork, the old protocol is no longer valid, and they cannot function together. Therefore, bitcoin cash is a separate entity.

Bitcoin cash can process more transactions due to the bigger size of blocks (8MB) holding them compared to that of Bitcoin (1MB). Therefore, it removed the Segregated Witness protocol used to change block size limit by removing signature data from bitcoin transactions.

- Ethereum (ETH)

Ethereum was launched in 2015 to focus on smart contracts and decentralized applications (DApps). It is the second-largest cryptocurrency by market cap after Bitcoin. Ethereum is like a store that can be accessed by anyone globally. Work is being done for lowering power consumption and increasing transaction speed on the network.

The financial applications can run on its platform-specific crypto token according to the code instructions. There are no downtime issues, censorship, third-party interferences, and fraud. Ether is also used by app developers and customers as currency and by investors to buy other currencies. Only the original creator can modify the applications.

In 2016, the old version of Ethereum- Ethereum Classic (ETC) was separated from Ethereum. The Ethereum community had rejected a hard fork modification. It uses the classic ether token for financial transactions related to products and services.

- Litecoin (LTC)

Litecoin was launched in 2011 and functioned like Bitcoin but with shorter transaction times due to a faster block generation rate. Often called the silver to Bitcoin’s gold, Litecoin was developed by a former Google engineer Charlie Lee. It is open-source and operates on a scrypt algorithm that can be decoded by consumer-grade CPUs too.

The coin limit is capped at 84 million. The fees are lower than Bitcoin, and there are more concentrated miners. It is mainly used by developers and merchants globally for payments.

- Stellar (XLM)

Stellar was developed in 2014 by Ripple Labs co-founder Jed McCaleb. It enables money transfers through currency exchange. In addition, it has a cross-border payment system to facilitate international transactions.

This makes it possible to conduct huge international transactions between financial institutions like investment firms and banks. The process becomes faster, and there are no intermediaries.

It serves typically as a blockchain for enterprises. All the transactions on the network take place through Stellar’s native currency, Lumens. As a result, there are no additional charges which lower expenses.

- Cardano (ADA)

Cardano was launched by Charles Hoskinson, co-founder of Ethereum, after thorough experimentation by programmers and rigorous peer-reviewed scientific research. It uses a robust proof-of-stake consensus model that makes it stand out among other cryptocurrencies, including Ethereum.

The focus is on sending and receiving digital funds. It is used for decentralized financial solutions, chain interoperability, legal contract tracing, fraud prevention, and much more. But it is still at an early stage.

Dogecoin was created as a joke on the growth of altcoins by software engineers Billy Markus and Jackson Palmer in 2013. It uses the Scrypt algorithm and is a derivative of Lucky coin that was forked from Litecoin.

It has 1-minute block intervals for faster transactions compared to currencies like Litecoin. It is mainly used as an Internet currency where social media users tip others that provide them interesting content. It is the first cryptocurrency that funded a space mission.

Suggested Read: How to Buy Dogecoin in India?

- Monero (XMR)

Monero is an open-source secure and private cryptocurrency launched in April 2014 through the efforts of community and donations. It focuses on decentralization, scalability, and privacy.

It has unique security mechanisms which make it practically untraceable. One of them is the concept of ring signatures in which a real cryptographic signature cannot be differentiated from the invalid ones, and a real one always appears in groups with them. This way, the users remain anonymous, and no outside observer can find the source, amount, or destination.

- Binance Coin (BNB)

Binance Coin is a cryptocurrency founded by Changpeng Zhao that was originally an ERC-20 token operating on the Ethereum blockchain. It is based on the proof of stake consensus model and was aimed at solving the problems with cryptocurrency trading.

It is used to trade and pay fees for trading on the Binance Exchange. Anyone who uses Binance Coin on the platform gets a discount in payment based on their membership. It only transacts in cryptocurrencies as opposed to other cryptocurrencies, which allow fiat currencies.

- ChainLink (LINK)

Chainlink is a cryptocurrency developed by Sergey Nazarov and Steve Ellis and launched in 2017. This tokenized oracle network does not have its own blockchain and can operate on several blockchains at once.

It aims to solve the problem with smart contracts and provides the ability to securely connect them with outside data like price and other information. This helps in successfully executing smart contracts related to real-world issues like monitoring pollution and setting up fines for violations.

- Tron (TRX)

Tron was launched by Justin Sun to decentralize the Internet and provide a boost to decentralized applications. It is highly reliable, has a low fee, and can process a large transaction rate at once. It initially began on Ethereum and then migrated to its own independent blockchain in 2018.

It provides an easy and cheap way to share digital content by eliminating any third party between the creators and end consumers.

Suggested Read: Stock Market Software | Investment Management Software

What is Cryptocurrency Mining?

Cryptocurrency mining refers to the process of validating and keeping a record of every new transaction on a blockchain. It involves solving a computational puzzle or finding a cryptographic 256-bit hash that encrypts block data into a unique string of text and keeps it secure. This results in the addition of a new block to the blockchain.

The user, who successfully hashes the block and makes it safe for sharing across the internet, is given a monetary reward in the form of digital currency for the operation.

How to Mine Cryptocurrency?

There are four ways of mining cryptocurrency.

Cloud Mining: Cloud mining is a cycle where you pay somebody (frequently it’s a major enterprise) a particular measure of cash and “lease” their mining machine called a “rig”, and the way toward mining itself.

CPU Mining: This uses processors to mine digital forms of money. It used to be a suitable alternative once upon a time, yet presently, less and less individuals pick this strategy how to mine digital money every day.

GPU Mining: GPU mining is likely the most famous and notable strategy for mining digital currencies. On the off chance that you google “digital money mining”, GPU rigs will be a portion of the principal things that you’ll see.

ASIC Mining: ASICs (Application-Specific Integrated Circuits) are special devices that are designed explicitly to perform a single task, which in this case is crypto mining.

What’s the Role of Crypto Miners in Cryptocurrency?

You can get cryptocurrency by simply buying or trading it on an exchange using cryptocurrencies that you possess. Some online platforms also pay individuals in crypto. But there is a unique way for earning cryptocurrencies or even receiving voting power on the platform.

Cryptocurrencies work on decentralized systems that have protocols that incentivize people to help maintain them. Crypto miners are individuals who use mining computers to solve hashing puzzles and add new blocks to the blockchain. Unfortunately, cracking the codes involves a lot of guesswork.

Types of Cryptocurrency Mining Models

There are mainly two models that cryptocurrencies use, namely, proof of work and proof of stake.

- Proof of Work: The miner who solves the puzzle share the results with others in the community who verify that the encryption is safe and work is complete. After verification, the miner adds a new block to the existing chain. After that, all the other nodes update their copies. This approach is known as proof of work.

- Proof of Stake: In the proof of stake consensus algorithm, the miner creates a new block depending on how much they have staked. The value of stake depends on the number of crypto coins a miner has for the blockchain they wish to mine. The reward is like traditional interest.

What is Cryptocurrency Mining Software?

Cryptocurrency mining software offers specialized tools to mine cryptocurrencies via the computing power of the user’s device. The work done in a period depends on the computational abilities of the computing system used. After setting up your mining hardware, you connect to a mining pool to share your device’s resources over the internet.

Most of the tools are automated, reducing the need for technical expertise on the user’s end, and anyone interested can use them to manage crypto mining. Cryptocurrency mining software also provides detailed reports depending on how much you earn.

How Do Cryptocurrency Miners Get Rewarded?

The currency that miners receive as a reward gives them confidence that their hard work is worth it. This mechanism was introduced in Bitcoin, where miners received newly minted bitcoins as a reward for processing transactions via the proof of work approach. For Ethereum, there is an ongoing effort towards changing the algorithm from proof of work to proof of stake.

Individual miners who do not have the powerful but costly equipment and electricity to mine a block make profits by joining mining pools. In mining pools, miners combine their hashing power and divide their earnings. The mining profit each member receives is proportional to the contribution made by the individual in the total mining power of the pool.

What is Cryptocurrency Exchange Software?

Cryptocurrency exchange uses software to manage their customer base and the trading of different types of cryptocurrencies. The cryptocurrency exchange software provides a consolidated view of all the transactions and is scalable enough to accommodate the increasing customer base.

With the best cryptocurrency exchange software, you can add new cryptocurrencies and modify the existing ones in terms of confirmations, transaction fees and a lot more.

Top Cryptocurrency Exchange Software: Coinbase | Binance | Coinmama

How Does Cryptocurrency Trading Work?

Cryptocurrency trading involves speculating the ups and downs in cryptocurrency prices using a Contract for Difference (CFD) trading account without taking ownership of the underlying crypto coins. For example, you can buy the crypto if you think its value will rise and sell it if you estimate that its value will decrease through an exchange account.

In CFD trading, you can invest in an asset by engaging in a contract with a broker. You need to add a small deposit to open a position and get complete exposure to the market. Profit and losses are based on the full size of your position. Since CFDs are leveraged products, they magnify both gains and losses.

In an exchange account, you put up the full values of the asset to open a position and keep crypto tokens in your wallet. They are expensive to maintain and usually have limits on deposit amount. Most people prefer CFD to exchange due to the better customer service of the former.

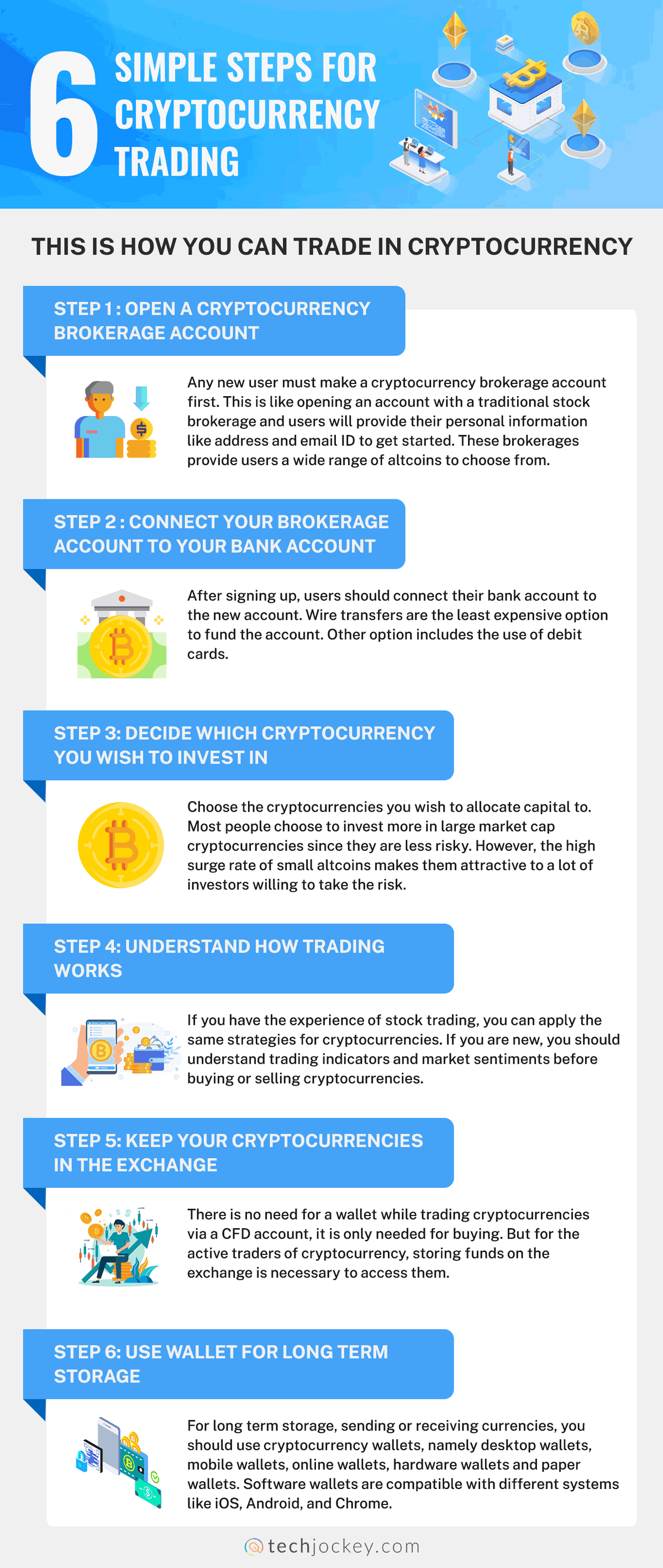

6 Simple Steps for Crypto Trading For Beginners

This is how you can trade in cryptocurrency:

Step 1: Open a cryptocurrency brokerage account

Any new user must make a cryptocurrency brokerage account first. This is like opening an account with a traditional stock brokerage, and users will provide their personal information like address and email ID to get started. These brokerages provide users a wide range of altcoins to choose from.

Step 2: Connect your brokerage account to your bank account

After signing up, users should connect their bank account to the new account. Wire transfers are the least expensive option to fund the account. Other option includes the use of debit cards.

Step 3: Decide which cryptocurrency you wish to invest in

Choose the cryptocurrencies you wish to allocate capital to. Most people choose to invest more in large market cap cryptocurrencies since they are less risky. However, the high surge rate of small altcoins makes them attractive to many investors willing to take the risk.

Step 4: Understand how trading works

If you have experience in stock trading, you can apply the same strategies for cryptocurrencies. However, if you are new, you should understand trading indicators and market sentiments before buying or selling cryptocurrencies.

Step 5: Keep your cryptocurrencies in exchange

There is no need for a wallet while trading cryptocurrencies via a CFD account, it is only needed for buying. But for the active traders of cryptocurrency, storing funds on the exchange is necessary to access them.

Step 6: Use wallet for long term storage

For long-term storage, sending, or receiving currencies, you should use cryptocurrency wallets, namely desktop wallets, mobile wallets, online wallets, hardware wallets, and paper wallets.

Software wallets are compatible with different systems like iOS, Android, and Chrome. However, the hardware ones are more secure since they store currencies on a physical device online.

Is Crypto Trading Safe & Profitable?

Out of the thousands of cryptocurrencies available, many have no following or trading volume and are worthless. While authentic and high-quality cryptocurrencies have enormous popularity among dedicated groups of backers and investors.

Both are entering and participating in the cryptocurrency market is very simple. However, skepticism among people that invest in cryptocurrencies has significant risks due to their unreliable economic status. They can be used for illegal transactions, thefts, and scams with no authority to control and access them.

However, investment is never a safe bet. Even though the risk associated with cryptocurrencies is high, the returns and profits are higher.

Conclusion

Slowly but steadily, more people have started investing in cryptocurrency worldwide. Enthusiasts see vast potential while critics see the risks.

More cryptocurrencies and changes to the existing ones will come, but only the promising ones will remain. Given the growth of cryptocurrencies, it is here to stay. However, there will be many changes in the future, especially in terms of regulations drafted by different countries.

FAQs

Which Cryptocurrency is best?

Here’re the top cryptocurrencies, which show the immense potential for growth like Bitcoin, Bitcoin Cash, Litecoin, Dogecoin, Ethereum, Chainlink, Tron and Binance Coin.

What are the top three Cryptocurrency?

Top three cryptocurrency in terms of their value are:

Bitcoin value: $55,700

Ether value: $3,960

Binance Coin Value: $655Is cryptocurrency legal in India?

No, cryptocurrency isn't illegal in India.

Is Bitcoin banned in India?

No, Bitcoin is not illegal in India currently, as the Supreme Court has lifted the RBI Ban of 2018 on Crypto trading.

Can I convert Bitcoin to cash in India?

No, Bitcoin is not yet convertible to cash in India. However, you can perform peer-to-peer trading for Bitcoin.

How to buy cryptocurrency in India?

Cryptocurrency exchange allows the user to buy, sell or trade cryptocurrencies.

How to trade cryptocurrency in India?

You can trade cryptocurrency using any of the Cryptocurrency exchange software. The best platforms to trade cryptocurrency in India are WazirX, BuyUCoin, Bitbns and CoinSwitch.

Ayushee is currently pursuing MBA Business Analytics from SCMHRD, Pune with a strong background in Electronics and Communication Engineering from IGDTUW. She has 2 plus years of full-time work experience as an SEO content writer and a Technology Journalist with a keen interest the amalgamation of business and... Read more