An Income Tax Return form is used to report your income, expenses, deductions, and taxes to the ITR department. There are different types of ITR forms that are made for multiple categories of taxpayers.

Out of them, ITR-2 is the one used by individuals and Hindu Undivided Families (HUFs) who do not earn any money through business or profession but make it through the salary, capital gains, house property, or foreign property.

Now, the question is if you are eligible to file the ITR-2 form, then what documents are required, and how to file it?

This blog will cover every little detail about how to file ITR-2. Let’s begin.

So, before you go and start the process of filing ITR-2, you must make sure that you have the following documents:

While filing, you’ll see multiple schedules in the ITR-2 form. These cover different types of income, deductions, and taxes:

Step 1: Sign in to the ITR e-filing official portal by visiting https://incometax.gov.in.

Step 2: Now, a Dashboard will appear. Click e-File > Income Tax Returns > File Income Tax Return. Select the assessment year and choose Online Mode to file ITR.

Note: As linking PAN to Aadhaar is necessary, if it’s not so, you will see a pop-up stating that your PAN is inoperative. You can link it at the moment of filing by clicking on the button Link Now.

If already linked, choose “Continue” to proceed (though linking is strongly recommended to avoid restrictions).

Step 3: Select Filing Status as Individual or HUF, then click Continue.

Step 4: Select the ITR-2 from the dropdown menu and click Proceed with ITR.

Note: In case you don’t know which form to select, you can click on the button “Help me decide”. You will be asked a few questions, and the system will suggest the correct form.

ClearTax Income Tax

Starting Price

Price on Request

Step 5: Collect all the required documents as stated above. The portal will show you a list of documents like Form 16, Form 26AS, bank details, etc. Review all the documents thoroughly and click on Let’s Get Started.

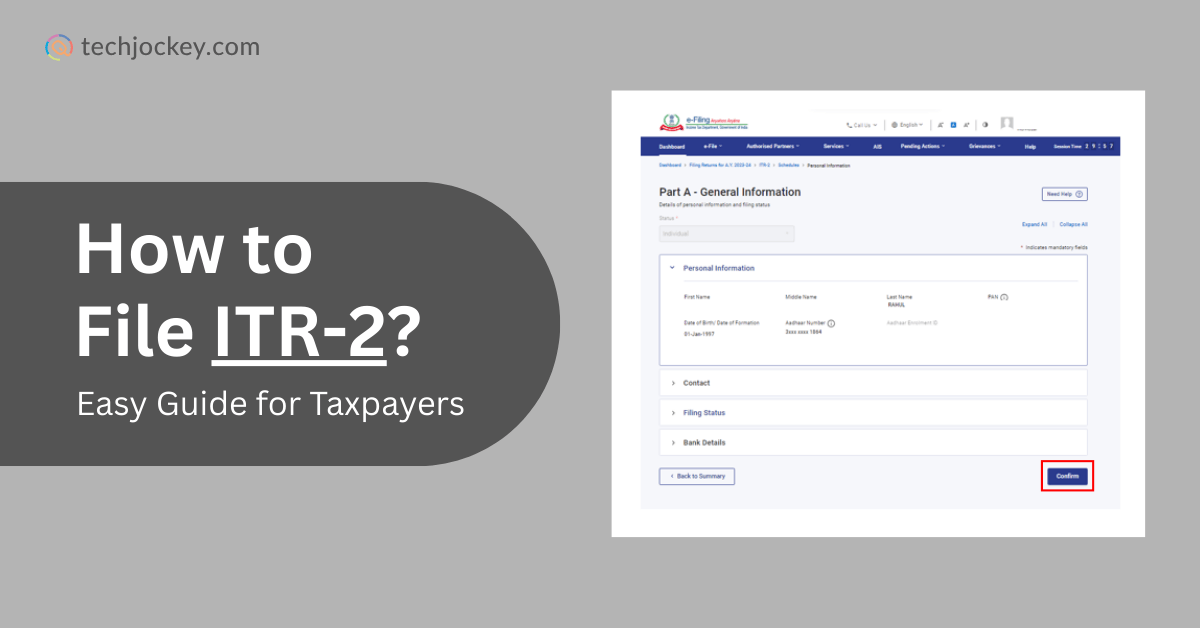

Step 6: PAN, Aadhaar, bank details, salary income, TDS, etc., are filled automatically. Verify each pre-filled data carefully.

If required, update or edit the details.

Step 7: Enter Income & Deduction Details

Fill schedules as applicable:

At the end of each section, click Confirm to save your entries.

Step 8: After confirming all sections, click Proceed. The system will auto-generate your Total Income (Part B – TI) and show a tax summary.

Step 9: Review your tax liability, if any. If there are any taxes payable, you will be shown two options: Pay Now or Pay Later. Pay Now is highly recommended to avoid interest/penalty.

After successful payment, you’ll be redirected back with a confirmation message.

Step 11: Click “Preview Return” to see the full draft of your ITR-2. If any errors appear, correct them before moving ahead.

Step 12: You must verify your return within 30 days of filing. Options include:

Once verification is complete, you’ll receive an acknowledgment with Transaction ID and Acknowledgment Number by SMS and email.

Note: You can also file ITR-2 using any good third-party income tax software to make the process a little easier with automation

Conclusion

ITR-2 can feel like a complicated form to fill in, but it is easy when you have all your required documents and you follow the step-by-step guidelines. The e-Filing portal allows pre-filled data, hence saving time.

As a reminder, you must review all of your schedules, pay pending taxes, and carry out e-verification within 30 days. The correct and properly filled ITR-2 filing will not only ensure compliance but also assist you in getting the refunds at the earliest.

Employee engagement has of late emerged as primary measure for seeing if a brand… Read More

HR operations may seem easily manageable on paper, but real experiences often tell different… Read More

Healthcare often feels complicated, slow, and scattered across many disconnected systems. Patients carry reports, repeat… Read More

The present-day workplace hardly bears any resemblance to the traditional setups of bygone eras. Diverse… Read More

Fruitful interaction in the modern market requires rapid speed, rich context, and genuine empathy. Shoppers… Read More

Staying compliant is one of the most important parts of running business. Labor laws,… Read More