Tax filing doesn’t have to be confusing, especially if you are eligible to file using the income tax return form 1. Designed for individuals earning up to INR 50 lakh, this form is one of the easiest ways for you as an Indian taxpayer to stay compliant.

However, the real question is: how to file ITR-1 in a timely and effective manner? Well, this is exactly where you will find a detailed answer to that, as we break down the ITR-1 filing process for you, one key aspect at a time.

Besides, with more and more income tax software solutions coming to the fore, having an in-depth understanding of how to file ITR online has never been more important. So, if you are ready to take control of your taxes, let’s dive into the essentials, shall we?

What is ITR-1 (Sahaj) Form & Who Should File It?

ITR-1 (Income Tax Return Form 1) or Sahaj serves resident individuals whose total income is up to INR 50 lakh.

- You are eligible for ITR-1 return filing if…

- You are a resident individual.

- Your total income is up to INR 50 lakh.

- Your income sources include salary, one house property, pension, agricultural income (up to INR 5,000), and certain long-term capital gains.

- You have income from other sources like interest on savings accounts, bank deposits, or income tax refunds.

- You do not have income from business, profession, lottery, racehorses, or more than one house property.

You cannot participate in the ITR-1 return filing if…

- You are a non-resident (NRI) or resident but not ordinarily resident (RNOR).

- Your income exceeds INR 50 lakh.

- You have income from more than one house property.

- You have capital gains exceeding the limit or from sources like unlisted equity shares.

- You have income from a business or profession, or if you are a company director.

Suggested Read: What is ITR-1 Form? A Complete Guide for Taxpayers

Pre-Requisites for Filing ITR-1

Before filing ITR-1, keep the following documents handy…

- Form 16

- Form 26AS (make sure the TDS mentioned in Form 16 matches the TDS in Part A of your Form 26AS)

- If you couldn’t submit proof for exemptions or deductions like HRA, Section 80C, or 80D to your employer in time, keep the receipts ready. You can still claim them directly while filing your income tax return form 1.

- PAN card

- Bank investment certificates

How to File ITR-1 Step by Step Guide: ITR-1 Filing

Here is the step-by-step process of how to fill up the ITR-1 form online efficiently for the Assessment Year 2025-26 (and beyond)…

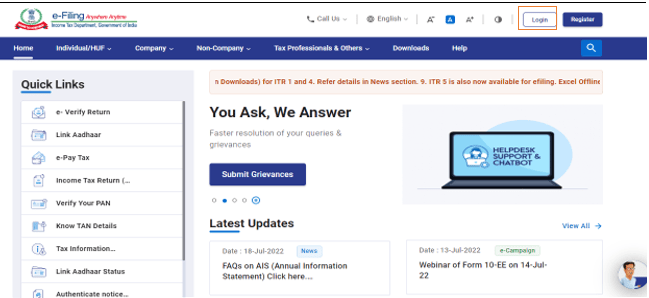

Step 1: Log In to the Income Tax e-Filing Portal

- Visit incometax.gov.in.

- Click on Login and enter your PAN/Aadhaar and password to access your profile.

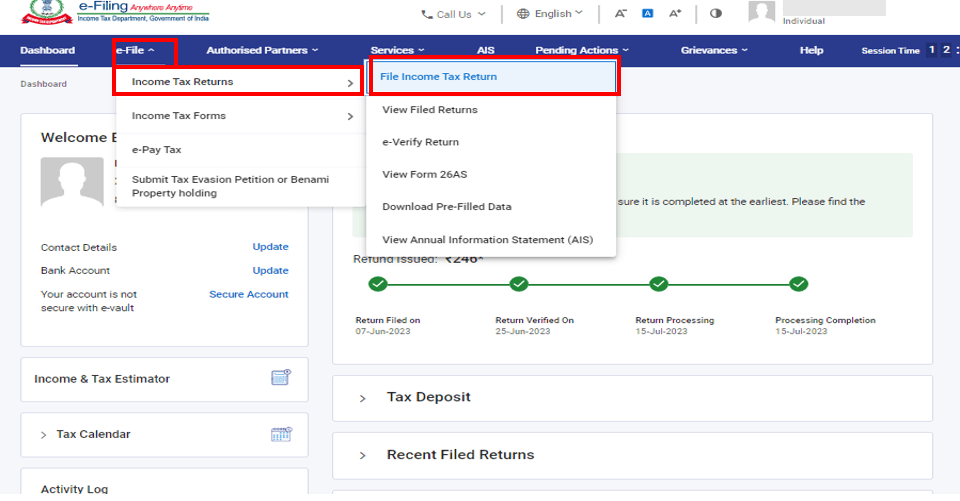

Step 2: Navigate to the ITR Filing Section

- Once logged in, go to e-File > Income Tax Returns > File Income Tax Return.

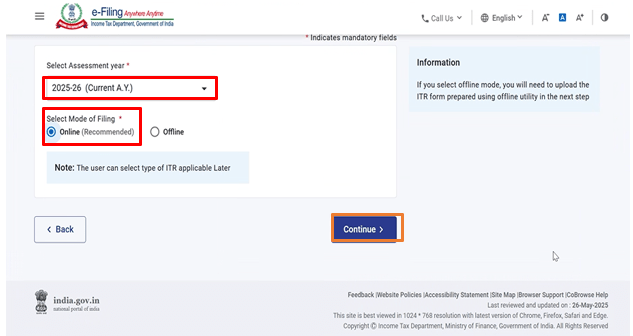

- Select Assessment Year as 2025-26.

- Choose the mode of filing as Online.

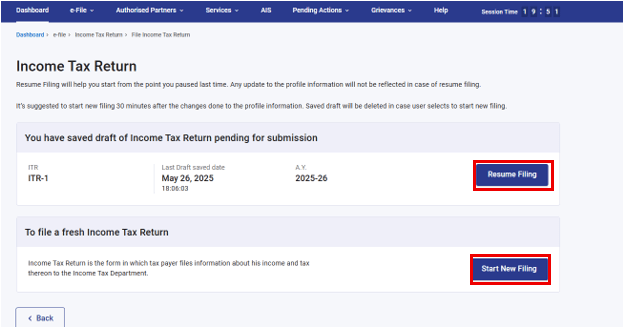

Step 3: Start New Filing

- Choose Start New Filing unless you have a saved draft.

- Select your filing status as Individual and click on Continue.

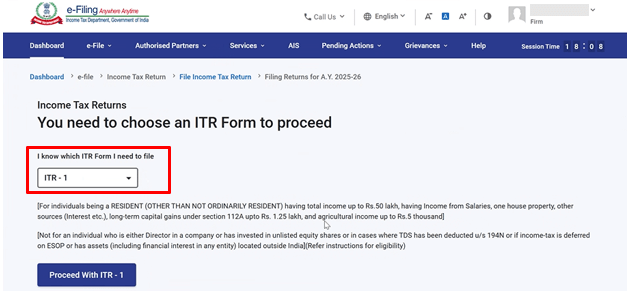

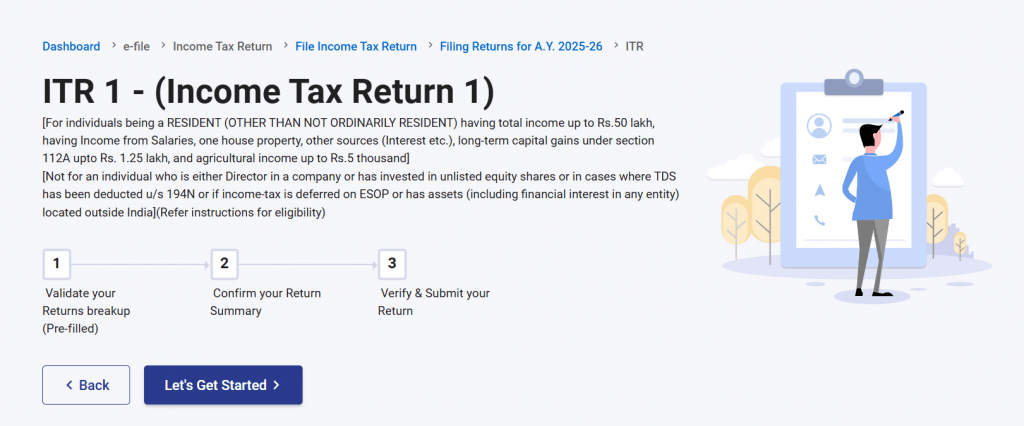

Step 4: Choose Form ITR-1 (Sahaj)

- Select ITR-1 from the list of available ITR forms.

- Click on Proceed with ITR-1 and then click on Let’s Get Started.

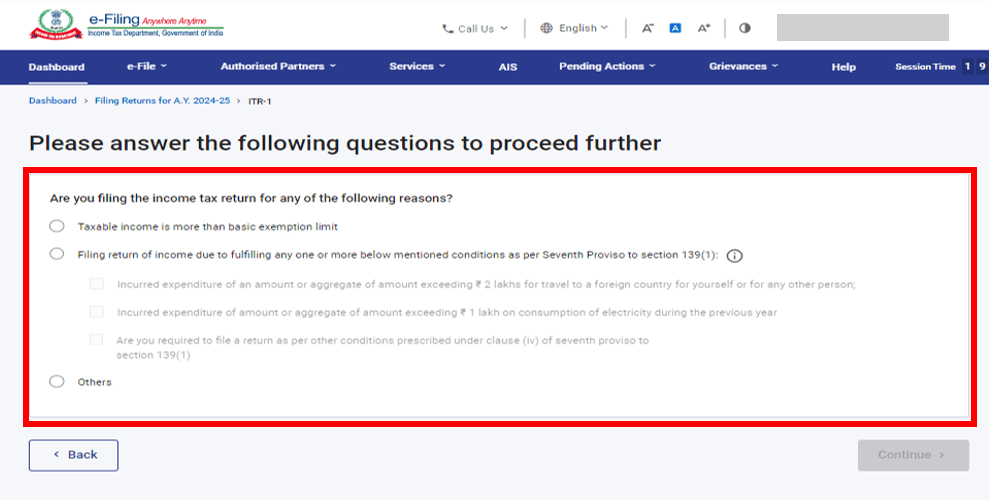

Step 5: Select Reason for Filing

- Choose the appropriate reason for filing your return, like taxable income is more than the basic exemption limit.

ClearTax Income Tax

Starting Price

Price on Request

Step 6: Review and Edit Personal Information

- The portal will pre-fill your personal details from your profile.

- Validate or update contact details, filing type, and bank information.

- Choose the appropriate tax regime (New Tax Regime is the default; opt out if desired).

Step 7: Enter Income Details

- Confirm or edit income details from salary, house property, long-term capital gains, and other sources.

- Add any exempt income if applicable.

Step 8: Declare Deductions

- Add deductions under sections like 80C, 80D, and others as applicable.

- Note that under the New Tax Regime, only select deductions are allowed.

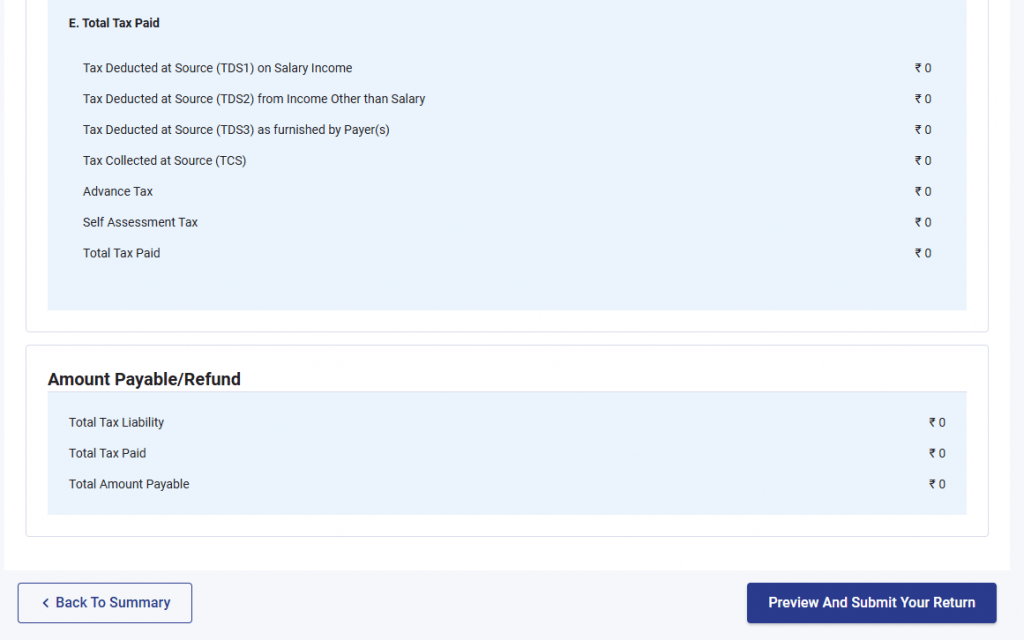

Step 9: Verify Tax Paid

- Review TDS, TCS, advance tax, and self-assessment tax details pre-filled in the return.

- Ensure these are accurate and reconcile with your Form 26AS or AIS.

Step 10: Check Tax Liability

- Review the computed tax liability as per your income and chosen tax regime.

- If tax is payable, use the Pay Now option to avoid interest and defaults.

- If eligible for a refund or no tax payable, move to the next step.

Step 11: Preview and Submit Return

- Preview your completed return for any errors.

- Confirm all details and submit the return.

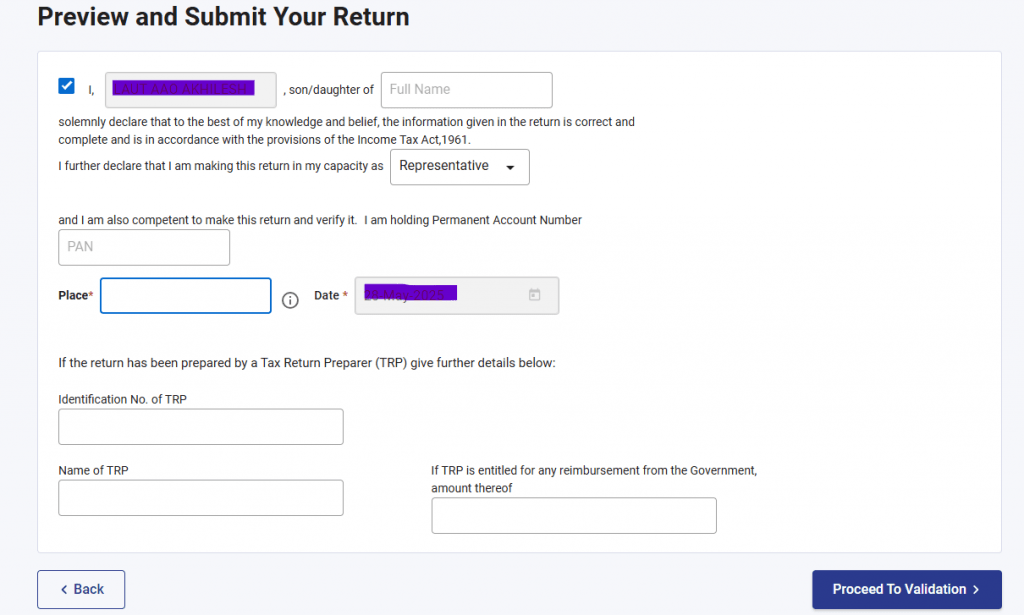

Step 12: Fill Out the Declaration

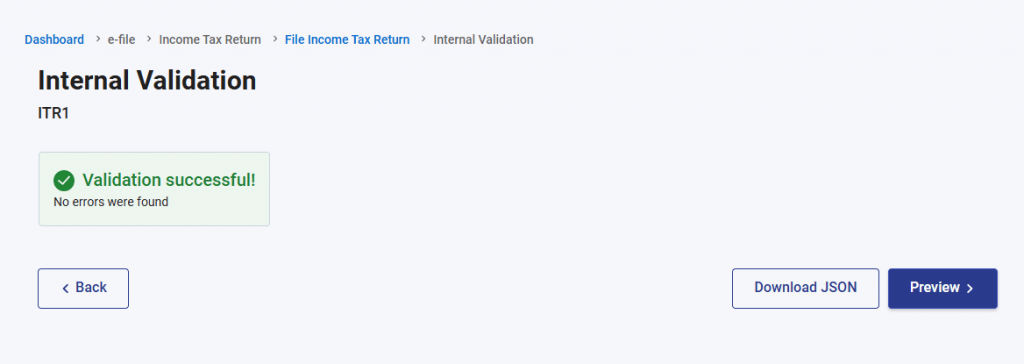

- On the Preview and Submit Your Return page, select the declaration checkbox and click Proceed to Validation.

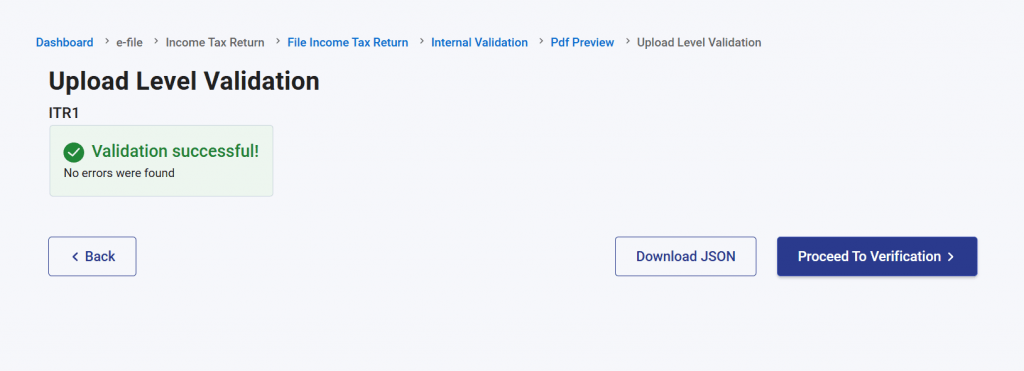

- Once the return is successfully validated with Upload Level Validation, click on Proceed to Verification.

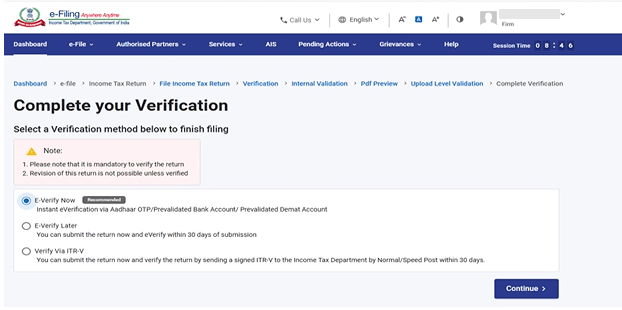

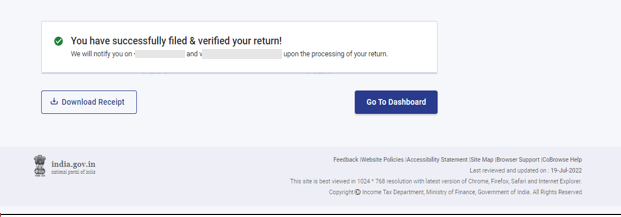

Step 13: E-Verify Your Return

- E-verify instantly through Aadhaar OTP, net banking, or Electronic Verification Code (EVC).

- Alternatively, you can verify later or send a signed physical ITR-V acknowledgment to CPC Bengaluru within 30 days.

How to Download ITR-1 Form?

If you wish to prepare your return offline, you can download the ITR-1 form from the Income Tax Department portal. Here’s how…

- Visit the e-Filing portal.

- Go to the Downloads section.

- Choose the ITR-1 Excel or Java utility.

- Fill the form offline and upload the generated JSON file to the portal.

ITR 1 filing last date for FY 25-26

Common Mistakes to Avoid While Filing ITR-1

If you want the tax season to be in your favour, please don’t make the following set of mistakes whilst filing ITR-1…

- Do not forget to verify your eligibility for ITR-1. If used incorrectly, it might delay processing by a lot.

- Do not fill in incorrect personal information, for mismatched PAN, Aadhaar, or bank details can cause refund delays.

- Always reconcile Form 26AS to ensure all taxes paid are accounted for.

- Know which deductions are claimed under the Old vs New Tax Regimes.

- If you don’t verify the returns on time, they will be treated as unfiled, attracting penalties.

- ITR-1 late filing attracts fees and loss of some benefits, like carry forward of losses.

Here are some extra tips that you can follow for a smooth ITR-1 return filing…

- Gather all necessary documents before beginning.

- Use the e-Filing portal’s pre-filling feature to save time.

- Keep choosing the right tax regime based on your tax-saving priorities.

- Double-check your bank account details to receive refunds speedily.

- File well before the deadline to avoid last-minute errors.

Suggested Read: 10 Common ITR Filing Mistakes You Should Avoid

Conclusion

Now that you know how to file ITR-1 step by step, you can save a lot of time and also ensure you stay clear of common challenges. Just keep using the official portal for safe filing and choose your tax regime wisely. The rest will follow, as it always does!

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more