An Income Tax Return form is used to report your income, expenses, deductions, and taxes to the ITR department. There are different types of ITR forms that are made for multiple categories of taxpayers.

Out of them, ITR-2 is the one used by individuals and Hindu Undivided Families (HUFs) who do not earn any money through business or profession but make it through the salary, capital gains, house property, or foreign property.

Now, the question is if you are eligible to file the ITR-2 form, then what documents are required, and how to file it?

This blog will cover every little detail about how to file ITR-2. Let’s begin.

What Documents Are Required for Filing ITR-2?

So, before you go and start the process of filing ITR-2, you must make sure that you have the following documents:

- An active PAN and a valid login ID and password for the e-filing portal

- Your PAN should be linked to your Aadhaar card

- Pre-validated bank account nominated for refunds.

- You must have a valid phone number and a registered email ID

- Form 16, Form 26AS, AIS & TIS statements for income details are required

- Investment proofs & deduction documents u/s like 80C, 80D, 80G, etc.

- Capital gains details (if any)

- Income details from foreign assets (if any)

Structure of ITR-2 Form

While filing, you’ll see multiple schedules in the ITR-2 form. These cover different types of income, deductions, and taxes:

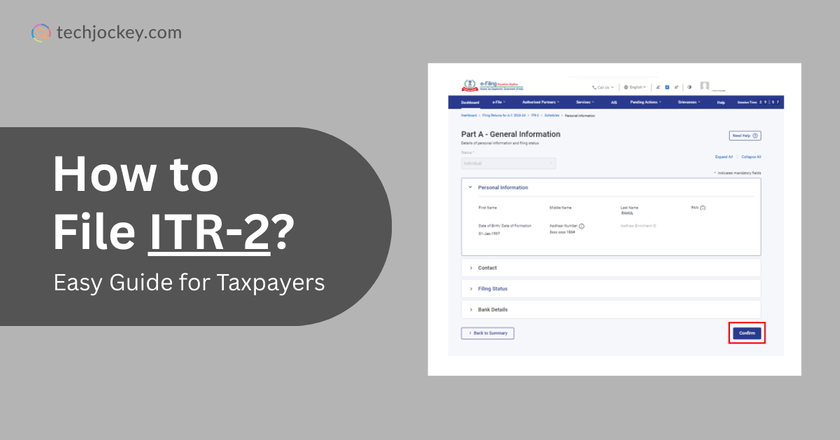

- Part A-General Information: Personal info, filing status, residential status, bank details.

- Schedule Salary: Income from salary/pension.

- Schedule House Property: Income from house property (self-occupied, let out, deemed let out).

- Schedule Capital Gains (CG): Short-term and long-term capital gains/losses.

- Schedule 112A & 115AD: Equity share/fund/unit transactions where STT is paid (112A) and similar for non-residents (115AD).

- Schedule VDA: Income from virtual digital assets (like crypto/NFTs).

- Schedule Other Sources: Interest, dividends, winnings, etc.

- Schedule CYLA/BFLA/CFL: Current year’s loss set-off, brought forward losses, and carry forward losses.

- Schedule VI-A: Deductions under Chapter VI-A (80C, 80D, etc.).

- Schedule 80G/80GGA: Donations.

- Schedule AMT/AMTC: Alternate Minimum Tax and related credits.

- Schedule SPI: Clubbing of income from spouse/minor child.

- Schedule SI: Income taxed at special rates.

- Schedule EI: Exempt income (e.g., agriculture).

- Schedule PTI: Pass-through income from investment funds.

- Schedule FSI/TR/FA: Foreign source income, tax reliefs, and foreign assets.

- Schedule 5A: For taxpayers under the Portuguese Civil Code.

- Schedule AL: Assets & liabilities (mandatory if income > ₹50 lakh).

- Part B – TI & TTI: Computation of total income and tax liability.

- Tax Paid: TDS, TCS, advance/self-assessment tax details.

What Are the Steps to File ITR 2?

Step 1: Sign in to the ITR e-filing official portal by visiting https://incometax.gov.in.

Step 2: Now, a Dashboard will appear. Click e-File > Income Tax Returns > File Income Tax Return. Select the assessment year and choose Online Mode to file ITR.

Note: As linking PAN to Aadhaar is necessary, if it’s not so, you will see a pop-up stating that your PAN is inoperative. You can link it at the moment of filing by clicking on the button Link Now.

If already linked, choose “Continue” to proceed (though linking is strongly recommended to avoid restrictions).

Step 3: Select Filing Status as Individual or HUF, then click Continue.

Step 4: Select the ITR-2 from the dropdown menu and click Proceed with ITR.

Note: In case you don’t know which form to select, you can click on the button “Help me decide”. You will be asked a few questions, and the system will suggest the correct form.

ClearTax Income Tax

Starting Price

Price on Request

Step 5: Collect all the required documents as stated above. The portal will show you a list of documents like Form 16, Form 26AS, bank details, etc. Review all the documents thoroughly and click on Let’s Get Started.

Step 6: PAN, Aadhaar, bank details, salary income, TDS, etc., are filled automatically. Verify each pre-filled data carefully.

If required, update or edit the details.

Step 7: Enter Income & Deduction Details

Fill schedules as applicable:

- Salary/Pension – Income from Form 16.

- House Property – Rent, co-owner share, or interest on housing loan.

- Capital Gains – Sale of shares, property, mutual funds, etc. (enter separately for each property).

- Virtual Digital Assets (VDAs) – Crypto/NFT transactions.

- Other Sources – Bank interest, dividends, winnings, etc.

- Deductions – Investments and expenses eligible under 80C, 80D, 80G, etc.

- Loss Adjustments – CYLA, BFLA, CFL for setting off or carrying forward losses.

- Foreign Income/Assets – Fill FSI, TR, FA if applicable.

- Exempt Income – Agricultural income, PPF, etc.

- Assets & Liabilities – If income exceeds ₹50 lakh.

At the end of each section, click Confirm to save your entries.

Step 8: After confirming all sections, click Proceed. The system will auto-generate your Total Income (Part B – TI) and show a tax summary.

Step 9: Review your tax liability, if any. If there are any taxes payable, you will be shown two options: Pay Now or Pay Later. Pay Now is highly recommended to avoid interest/penalty.

After successful payment, you’ll be redirected back with a confirmation message.

Step 11: Click “Preview Return” to see the full draft of your ITR-2. If any errors appear, correct them before moving ahead.

Step 12: You must verify your return within 30 days of filing. Options include:

- E-Verify Now (Recommended) – via Aadhaar OTP, net banking, or pre-validated bank account.

- E-Verify Later – but must be done within 30 days, else the return is invalid.

- Send ITR-V by Post – Sign and send a physical copy to CPC, Bengaluru.

Once verification is complete, you’ll receive an acknowledgment with Transaction ID and Acknowledgment Number by SMS and email.

Note: You can also file ITR-2 using any good third-party income tax software to make the process a little easier with automation

ITR 2 filing last date For 25-26

Important Notes While Filing ITR-2

- Your PAN should be linked with your Aadhaar card; otherwise, your PAN becomes inoperative.

- Pre-validation of your bank account avoids any roadblocks to receiving refunds.

- If your income is less than INR 50 lakh, asset-liability details are mandatory.

- Losses must be correctly declared in CYLA, BFLA, and CFL schedules to carry forward.

- Foreign assets & income must be disclosed if you are a resident.

Conclusion

ITR-2 can feel like a complicated form to fill in, but it is easy when you have all your required documents and you follow the step-by-step guidelines. The e-Filing portal allows pre-filled data, hence saving time.

As a reminder, you must review all of your schedules, pay pending taxes, and carry out e-verification within 30 days. The correct and properly filled ITR-2 filing will not only ensure compliance but also assist you in getting the refunds at the earliest.

Mehlika Bathla is a passionate content writer who turns complex tech ideas into simple words. For over 4 years in the tech industry, she has crafted helpful content like technical documentation, user guides, UX content, website content, social media copies, and SEO-driven blogs. She is highly skilled in... Read more