Get Quote

Import data directly from any ERP

No matter what platform you use, we will help you connect with it. SAP, Oracle, Microsoft, Tally or any other ERP.

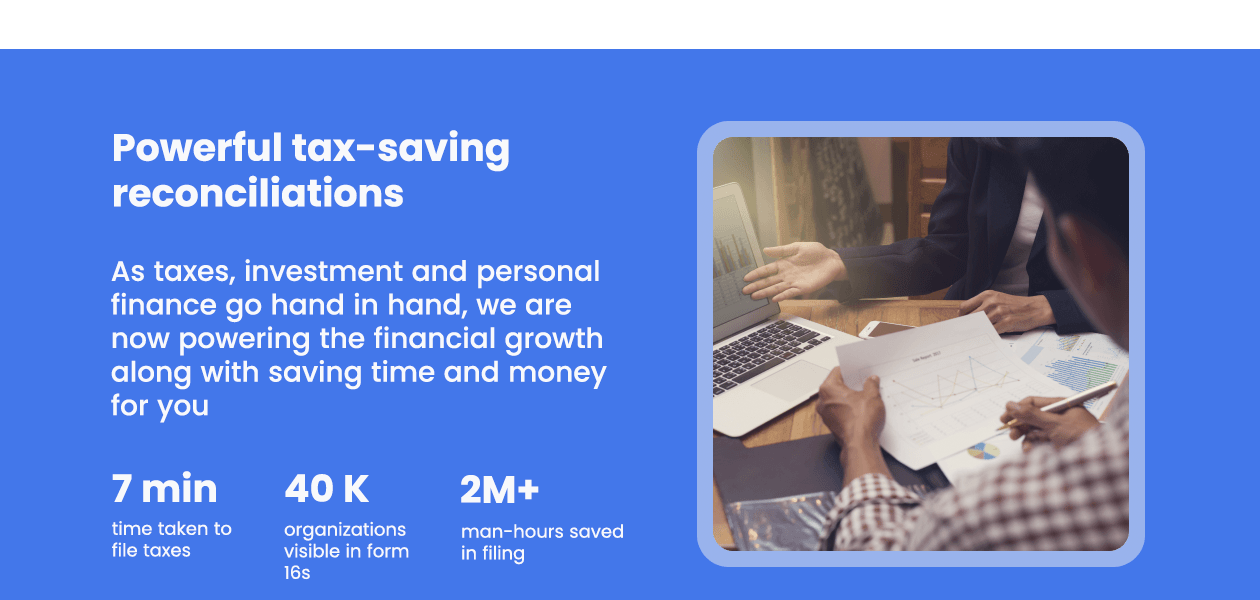

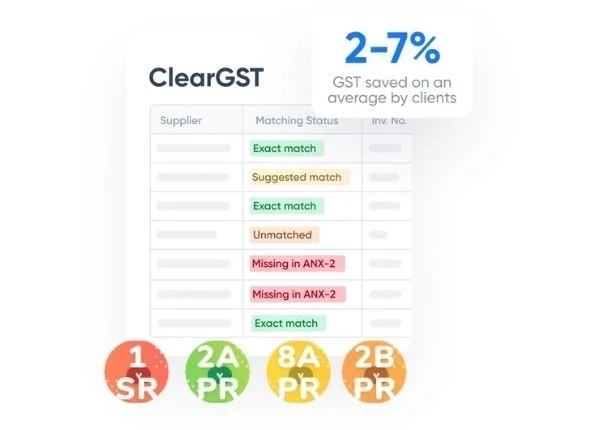

Powerful tax-saving reconciliations

Eliminate filing errors and save your clients’ money with our GST platform that is 3x faster and detects 100% input tax credits with AI powered reconciliations.

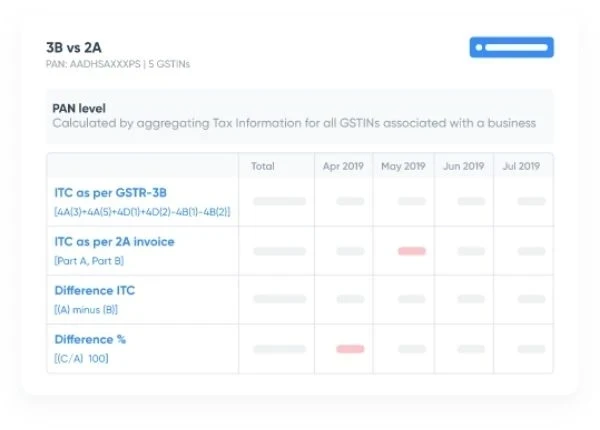

Smart, insightful reporting

Generate smart reports for your clients. Compare GST returns and invoices for any history, view balances for stock, ledger and cash, get summaries by HSN, suppliers and more.

Integrated invoicing and payment tracking

Fully integrated GST compliant invoice creation, payment tracking and stock management for enabling growth and compliance

We make it happen! Get your hands on the best solution based on your needs.

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

“It is very simple to use and has a very intuitive interface. I was able to create my first GST return in less than 10 minutes. The import facility is nice.” Manish Jain - Mar 15, 2021

“Cleartax updates it GST software frequently as per the rules and amendments. This software is easy and the reporting is simple and easy to use.” Trishla Prasad - Aug 22, 2020

Cons

“Takes a little time while importing large amount of data from excel.” Ankit Bhilwaria - Aug 9, 2021

“Only cloud based, offline version is not available. Even though GST bills can be prepared offline it syncs with servers as soon as you go online.” Kalpritam Paul - May 18, 2021

“The invoice template couldn’t be customized as per our brand color.” Manish Jain - Mar 15, 2021

| Brand Name | ClearTax |

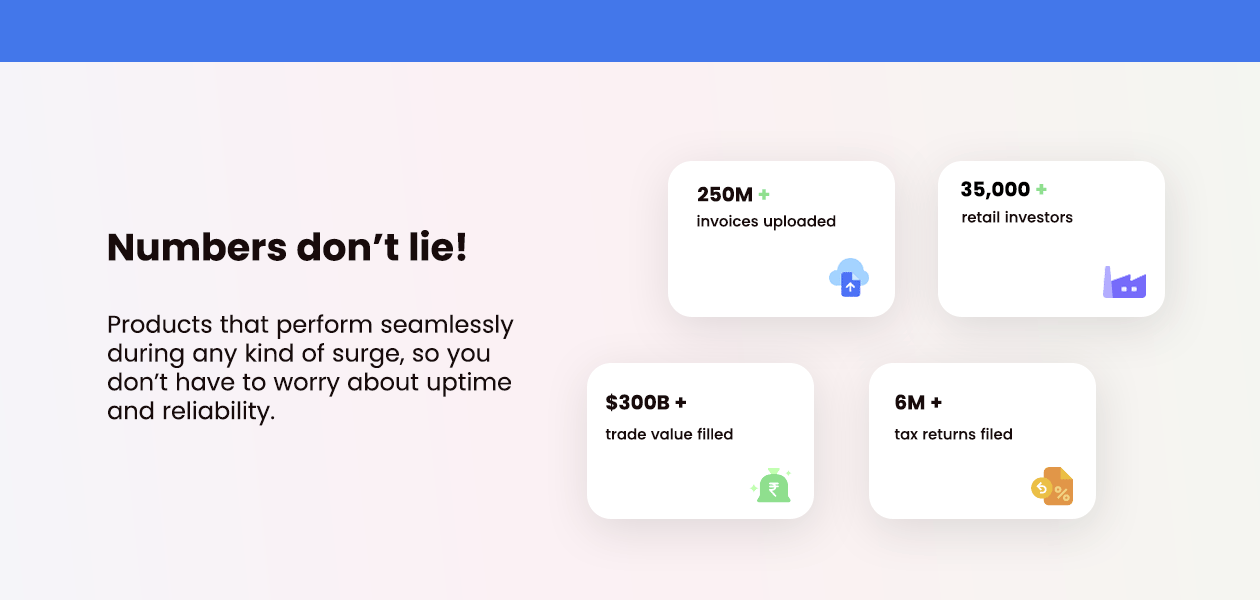

| Information | we are on a mission to simplify financial lives for all Indians. We are India’s leading fintech company, helping individuals, tax practitioners and businesses master taxes and save money and time through hassle-free filings. |

| Founded Year | 2011 |

| Director/Founders | Ankit Solanki, Archit Gupta, Srivatsan Chari |

| Company Size | 101-500 Employees |

| Other Products | TaxCloud, ClearTax Invoicing Software, ClearTax Income Tax, ClearTax TDS |

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers