More than 1.17 crore GSTR-3B returns were filed across India in March 2026, serving as strong evidence of how central this form is to our nation’s economic engine. Since the introduction of GST in 2017, GSTR-3B has, in fact, become an almost-obligatory practice, one that every GST-registered business, no matter how small, consistently adheres to.

But the rules of the game are changing fast. Starting 2026, taxpayers cannot edit their GSTR-3B tax liability directly. And if you miss filing for three consecutive years? The GST portal will bar you from ever submitting that return, leading to penalties, forfeited ITC claims, and possible GST registration cancellation.

Understanding GSTR-3B meaning thus isn’t a matter of choice, but an essential for survival and success. Read on as we break down what it is and how to file it on the GST portal, fact by fact, step by step.

GSTR-3B Meaning: What is GSTR-3B?

GSTR-3B is a summary return of sorts that all regular GST-registered taxpayers are required to file either monthly or quarterly. It contains all the information regarding outward supplies (sales), inward supplies (purchases), eligible input tax credit (ITC), and the tax payable and paid for a specific period.

GSTR-3B is much simpler than GSTR-1 in that it prefers summary numbers instead of invoice-level numbers, cementing its role as the foundation of GST return filing in India.

Some of the key characteristics of GSTR-3B are…

- Form GSTR-3B is mandatory for all regular taxpayers, including those under the QRMP (Quarterly Return Monthly Payment) scheme

- It requires reporting of total taxable value, tax liability, ITC claimed, and tax paid

- It must be filed even if there are no transactions (nil return)

- The filing of GSTR-3B is done online via the GST portal or through GST software like TallyPrime, Clear Tax GST etc.

Who Should File GSTR-3B?

GSTR-3B must be filed by…

- All regular taxpayers registered under GST (including those with GSTR registration)

- Taxpayers under the QRMP scheme (file quarterly, pay taxes monthly)

- Casual taxable persons

The following people are exempted from filing Form GSTR-3B…

- Composition scheme taxpayers (file GSTR-4 instead)

- Non-resident taxable persons

- Input Service Distributors (ISD)

- TCS & TDS deductors

Even if you, as a business owner, didn’t indulge in any sale or purchase during a specific period, it is necessary for you to file a Nil GSTR-3B return. This, so your business can remain compliant with all the GST regulations and dodge potential legal consequences.

When to File GSTR-3B Return?

GSTR-3B due dates are as follows…

- For monthly filers, 20th of the following month acts as the due date for GSTR-3B filing

- GSTR-3B due dates for QRMP scheme filers, conversely, fall on the 22nd or 24th of the month after the quarter ends, depending on which state they are registered in

Please know that GSTR-3B due dates can be rescheduled by the government at any point in time. This usually happens around festivals or when the GST portal experiences any technical glitch. So, make sure you check the portal (www.gst.gov.in) from time to time to stay abreast with any announcements made in this regard.

Form GSTR-3B Late Fee & Penalty

Failing to file GSTR-3B on time can lead to significant costs…

- Late Fee: INR 50 per day of delay (INR 20 per day for nil returns)

- Interest: If you, as a businessman, fail to file GSTR-3B on time, interest at 18% per annum will apply from the next day until the payment is completed.

- Maximum GSTR-3B Late Fee Caps: For businesses that have a turnover of up to INR 1.5 crore, the maximum GSTR-3B late fee is capped at INR 1,000. Those with a turnover between INR 1.5 crore and INR 5 crore, a maximum late fee of INR 2,500 gets applied. And for businesses with a turnover exceeding INR 5 crore, the GSTR-3B late fee can go up to INR 5,000.

Key Changes Made in GSTR-3B Filing in 2026

The government has introduced sundry changes in GSTR-3B filing to enhance its accuracy and compliance…

- Hard-Locking of Auto-Populated Values: From 2026, key fields in GSTR-3B (like outward supplies and ITC) are auto-populated from GSTR-1, GSTR-1A, Invoice Furnishing Facility (IFF), and GSTR-2B, and cannot be manually edited. You are thus required to make corrections, if any, in the source returns before filing GSTR-3B return.

- Three-Year Filing Limitation: You can’t file returns if they are over three years late from the original due date.

- Data Locking Post Filing: From 2025, once GSTR-3B is submitted and filed, it cannot be edited.

- Nil Return Simplification: Nil filers have a streamlined process with minimal data entry.

What’s the Format of GSTR-3B?

Refer to the table below to know the format of GSTR-3B in detail…

| S. No. | Section | Details to be Provided |

|---|---|---|

| 1 | Basic Details | GSTIN, Legal Name, Trade Name |

| 2 | Outward Supplies & Inward Supplies (Reverse Charge) | Sales you made (outward supplies) and purchases where you paid tax under reverse charge. You also break it down by tax types, such as IGST, CGST, SGST/UTGST, and Cess |

| 3 | Inter-State Supplies | Supplies to unregistered persons, composition dealers, UIN holders (auto-populated and non-editable from 2026) |

| 4 | Eligible ITC | ITC on inputs, capital goods, services, reverse charge, import of goods/services, and ineligible ITC |

| 5 | Exempt, Nil-Rated, and Non-GST Inward Supplies | Purchases from composition dealers, exempt, nil-rated, or non-GST items (broken down into inter-state and intra-state) |

| 6 | Payment of Tax | Tax payable and paid under IGST, CGST, SGST/UTGST, Cess; ITC utilized; balance tax deposited; interest and late fee paid |

| 7 | TCS and TDS Credit | Value of TCS and TDS deducted/collected for the period |

Step-by-Step Guide to Filing Form GSTR-3B on GST Portal

To make your GSTR-3B filing process easy and manageable, follow these steps…

Step 1: You first need to visit the GST portal (www.gst.gov.in) and login with your GSTIN and password.

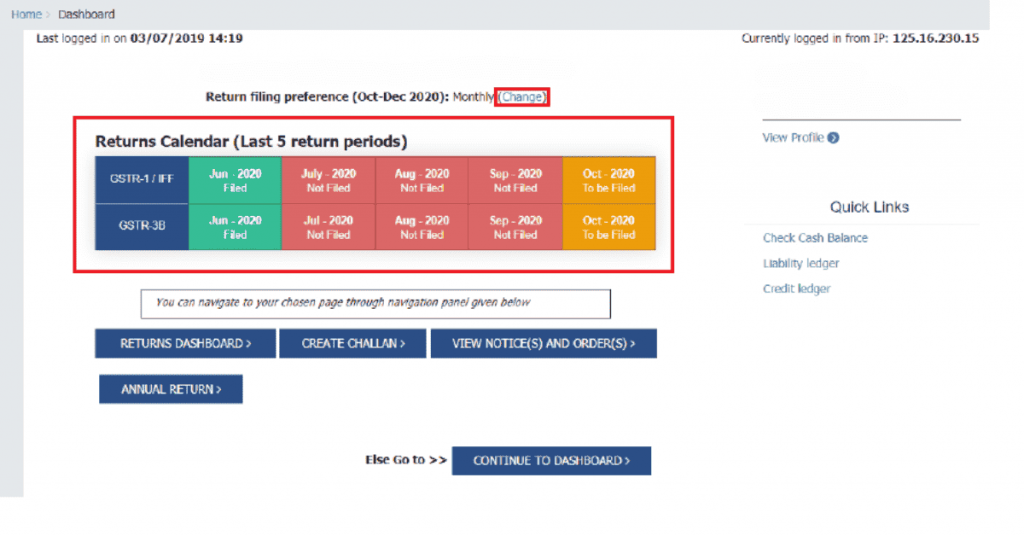

Step 2: Then, on the page, go to Services > Returns > Returns Dashboard.

Step 3: Select the Financial Year, Quarter (Quarter 1 – 4), and Period (Month) for which you want to file the return.

Step 4: Click on Prepare Online under GSTR-3B.

Step 5: A list of questions will appear. Answer with either Yes or No to display relevant sections of the form and click on Next. Please note that if auto-populated data from GSTR-1 or GSTR-2B is available, only the first question may appear.

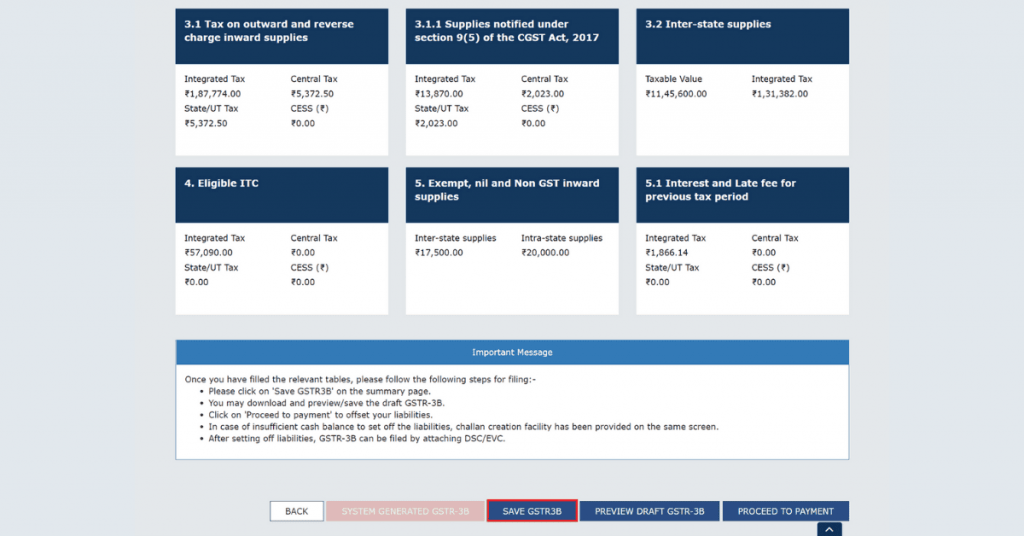

Step 6: Fill in the following return details…

- Outward Supplies: Enter taxable value and tax details for all categories, such as regular, zero-rated, nil-rated, exempt, reverse charge, and non-GST.

- Inter-State Supplies: Report supplies to unregistered persons, composition dealers, and UIN holders (auto-populated)

- Eligible ITC: Fill in ITC availed, reversed, and net ITC.

- Exempt/Nil-Rated/Non-GST Inward Supplies: Enter details as required.

- Payment of Tax: Confirm tax payable and paid, ITC utilized, and any interest/late fee.

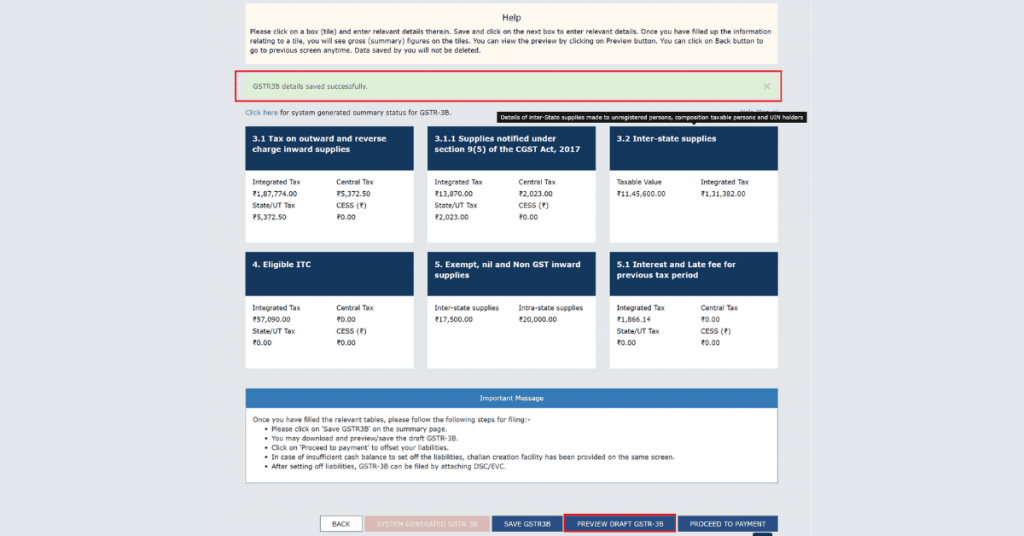

Step 7: Save and preview the return using the Preview Draft GSTR-3B option.

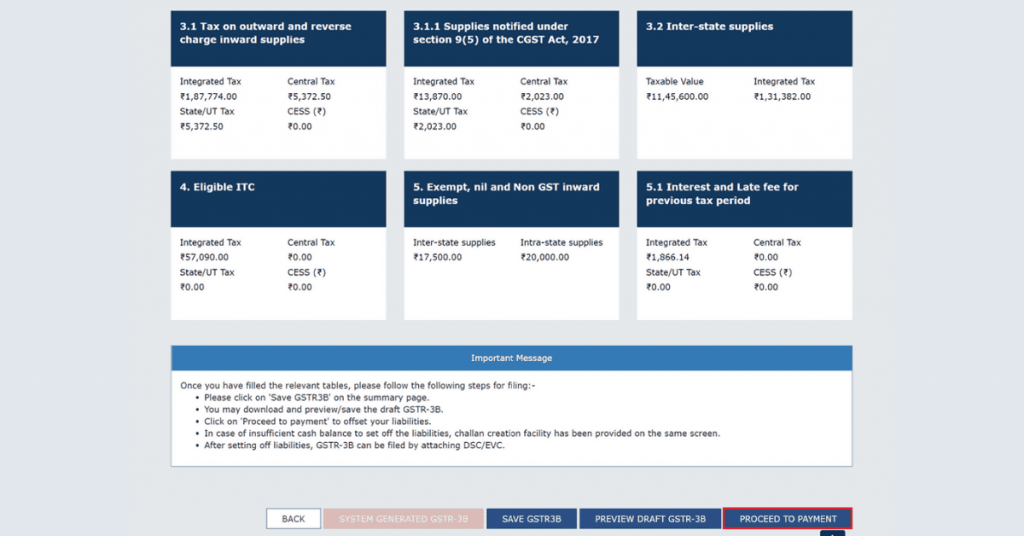

Step 8: Once verified, click Proceed To Payment. After submission, no modifications are possible.

Step 9: Offset tax liability using cash/credit from electronic ledgers.

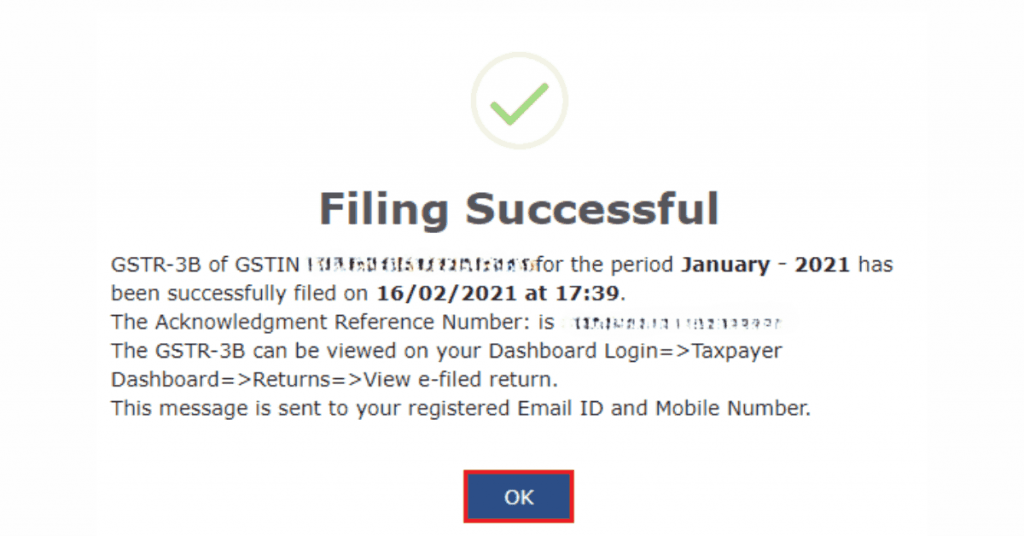

Step 10: Finally, file the return either using Digital Signature Certificate (DSC) or Electronic Verification Code (EVC). Don’t forget to download the acknowledgment for your records.

How to Perform a GSTR-3B Download from the GST Portal?

Follow these quick steps for a smooth GSTR-3B download from the GST portal…

- Go to www.gst.gov.in and log in with your credentials.

- Navigate to Services > Returns > Returns Dashboard.

- Select the Financial Year and return filing Period and click Search.

- Click on the GSTR-3B tile under the relevant month.

- Click Download Filed Return to initiate the GSTR-3B download in PDF format.

What Are Common Mistakes to Avoid While Filing GSTR-3B?

Keep the following things in mind in order to avoid making GSTR-3B filing mistakes…

- Mismatched Figures: Make sure that values in GSTR-3B are similar to those mentioned in GSTR-1 and GSTR-2B to prevent reconciliation.

- Incorrect ITC Claims: Only claim eligible ITC as per GSTR-2B. Ineligible ITC can lead to penalties and future reversals.

- Missing Nil Returns: Even with zero transactions, file a nil return to avoid late fees.

- Editing Auto-Populated Data: From 2026, manual edits to auto-populated data are not allowed, so don’t forget to make corrections in source returns.

- Ignoring Late Fees/Interest: Always pay any applicable late fee or interest to avoid future notices.

- Not Saving Drafts: Save your work frequently to prevent data loss.

What’s the Difference Between GSTR-1 and GSTR-3B?

To have an in-depth understanding of the difference between GSTR-1 and GSTR-3B is important for any and every GST-registered business. This, to avoid notices, penalties, and issues with ITC claims.

Refer to the table below to get a clear distinction between GSTR-1 and GSTR-3B…

| Parameter | GSTR-3B | GSTR-1 |

|---|---|---|

| Purpose | Summary return for declaring and paying monthly tax liabilities | Detailed return for reporting outward supplies (sales) |

| Details | Summary figures for sales, purchases, ITC, and tax paid | Invoice-wise details of all outward supplies |

| Frequency | Monthly (or quarterly for QRMP scheme) | Monthly or quarterly, depending on turnover |

| Filers | All regular taxpayers, even if no supplies made (must file nil return) | All registered taxpayers making outward supplies |

| Key Focus | Self-assessment and tax payment | Reconciliation and transparency of sales data |

| Editability | From 2026, many fields auto-populated and locked | Invoice-level data can be amended before filing |

| Importance | Ensures timely tax payment and ITC claims | Provides basis for recipients to claim ITC; required for annual reconciliation |

Conclusion

GSTR-3B is a sure shot way of keeping your business in sync with India’s tax ecosystem at all times. It is, in fact, a monthly declaration of sorts to put your integrity and financial discipline as a business owner in the spotlight.

So, make sure you file your GSTR-3B return religiously every month (or quarter) and never miss out on due dates. While we have listed the entire process of accomplishing the same online (via the GST portal itself) above, you can also make use of sundry GST software. Get in touch with the Techjockey product team today itself if you wish to take the technological route.

For a little caution today can save a lot of trouble tomorrow. Stay compliant, stay successful!

FAQs

Who has to file GSTR 3B monthly?

All GST-registered taxpayers in India are required to file GSTR-3B monthly, unless they opt for the QRMP scheme, in which case it gets filed quarterly.

What is the turnover limit for GSTR 3B?

There is no specific turnover limit for filing GSTR-3B. All regular GST-registered taxpayers must file it, irrespective of their turnover, unless they are under the QRMP scheme.

Who is eligible for GSTR 3B?

All GST-registered regular taxpayers in India are eligible to file GSTR-3B, except those who fall under the composition scheme, are non-resident taxable persons, OIDAR service providers, or Input Service Distributors

How to claim ITC in GSTR 3B?

To make claim of ITC in GSTR-3B, you need to reconcile your purchase invoices with GSTR-2B, insert admissible credit in Table 4A of the return, and ensure that the amount claimed is recorded in your books prior to filing with DSC or EVC.

What is the penalty for GSTR 3B?

The penalty for late filing of GSTR-3B includes a GSTR-3B late fee of INR 50 per day.

What happens if a supplier does not file GSTR 3B?

If a supplier fails to file GSTR-3B, they will be liable to pay late fees, interest, and penalties, will not get to claim Input Tax Credit (ITC) of the said period, and might get served with GST notices or compliance ratings.

Is GSTR 3B compulsory?

Yes, GSTR-3B filing is mandatory for all regular GST registered taxpayers in India, and from 2025, it has become non-editable with tightened compliance norms and a revised 3-year window of return filing.

Can we claim ITC after filing GSTR 3B?

No, you cannot make ITC declaration after GSTR-3B. In fact, with effect from Step-by-step guide on how to file GSTR-3B on GST portal with online tax filing illustration, the return would be locked as soon as submitted and no alterations or addition to ITC would be permitted.

How do I know if my GSTR 3B is filed?

To check whether your GSTR-3B is filed or not, you can log in to the GST portal, navigate to the section of View Filed Returns, select the Period, and make sure your status is shown as Filed with ARN and date.

Who will file GSTR 3B?

GSTR-3B has to be filled in by every ordinary GST registered tax person on a monthly or quarterly basis (in case of QRMP scheme), to report their tax liabilities and claim the input tax credit.

How to calculate GSTR 3B?

To compute GSTR-3B, you need to summarize your outward supplies, possible input tax credit, and tax payable during the period, and fill in the appropriate tables of the return before filing the return

What is the interest rate for GSTR 3B?

The interest rate for late payment in GSTR-3B is 18% per annum. It gets calculated on the net tax liability paid in cash, from the day after the due date until the date of payment.

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more