Summary: More than 10 lakh businesses use Tally software to easily generate e-invoices, manage accounting, and do a lot more from a single solution. Read the article below, if you want to learn more about TallyPrime and its unique functionalities to streamline different business processes.

Tally Introduction

Tally basic software is an all-in-one solution to simplify tasks related to banking and finance, GST compliance, taxation, accounting, e-invoicing, e-way billing, and more. It is complete business management software helping businesses manage key operations from a single solution.

With this software, they can generate bills and invoices, manage their inventory, record cashflow and credit transactions, manage payroll, stay compliant, reconcile bank statements, etc.

Suggested Read: What Tally in Hindi

Benefits of Tally Basic Accounting Software

Basic introduction of Tally computer software can help businesses in several ways such as providing multiple billing formats, cash flow projection, inventory management, e-invoicing, etc. Let’s learn about all these features in detail.

- Multiple Billing Formats: This solution provides several commercial billing options to complement your business requirements. It also lets you customize billing formats for different goods and services.

- Expiry Date Management: It simplifies the expiry date of products by creating and maintaining a batch summary report. It includes details by manufacturing date, expiry date, and number of days left for the expiry.

- Supports Multi-Currency Transactions: With the support for multiple currencies, you can generate invoices, get quotations, accept or receive payments in the international currency. Moreover, it also adjusts currency rates through auto calculation.

- Projects the Cash Flow: The software considers different instances of expected inflow and outflow and accordingly depicts the cash flow for the specific period. Basic Tally computer software also generates reports for the same to plan savings and expenditure.

- Stay Audit Trail Compliant: With TallyPrime, you can stay audit trail compliant by creating and maintaining all the transactions along with other details like date and time. It also notes the number of users and deleted transactions data.

- Cheque Management: Easily view, track, and search for your cheque details by keeping all the data in different cheque books. It offers different cheque books for different banks with unique specifications.

- Easy Export Data: TallyPrime lets users export data in six different formats including ASCII (Comma delimited), Excel (Spreadsheet), HTML (web-publishing), JPEG (Image). It also supports PDF (Portable Document Format), and XML (data interchange) format.

- Maintain a Manufacturing Journal: Maintain the manufacturing journal for your business that includes records for raw materials procured, total materials sold, product cost. Also record the data for finished products, scraps, and by-products with computer Tally software.

- Create a Detailed Bills of Materials: With TallyPrime, you can easily define raw materials and components along with their quantity needed to create a finished product. It also lets you mention the by or co products of finished goods.

- Easily Cancel E-Invoice: If the IRN number has already been registered for an invoice then you can easily cancel the e-invoice by sending data to IRP portal directly.

Suggested Read: Difference Between Tally ERP 9 Vs Tally Prime | How to Make Debit Note and Credit Note Entry in TallyPrime

Features of TallyPrime

Some key features of TallyPrime include-

- GST Compliant Invoicing: TallyPrime has made it easy for businesses to generate fully GST compliant invoices along with IRN and GST numbers. Further, you can also custom them with the business’s logo and other preferences.

- Purchase and Sales Management: Easily manage different types of purchase and sales processes with up-to-date data through the solution.

- Multiple Stock Valuation Methods: The solution lets you value your stock items through several methods including FIFO Perpetual, Average Cost, Last Purchase Cost, LIFO Annual, etc. It also supports LIFO Perpetual and LIFO annual methods.

- Business Reports: You can generate different reports for ledger, purchase, cashflow, sales, profit, loss, inventory items, and more with TallyPrime. Easily personalize the reports by saving them in various ways as per your choice.

- Receivable and Payable Management: TallyPrime makes it easier for businesses to track and maintain the record of all the account receivables and payables through the IRN number.

- E-Invoices and E-Way bills Generation: Through integration with GSTN and e-way portal, TallyPrime helps business generate accurate e-invoices and e-way bills, thus saving time and effort.

- TDS and TDC Management: TallyPrime has simplified the management of TDS and TDC filing by detecting incomplete or wrong information. All the return filing forms are designed to detect errors and ensure 100% accurate TDS and TDC filing.

- Auto Bank Reconciliation: With TallyPrime, you can easily reconcile bank statements automatically by uploading e-statements from the bank. It lets users reconcile bank statements for up to 100 banks.

- Cash Deposit Slips Generation: This software lets you generate accurate cash deposit slips by automatically filling details directly from the bank ledger. Therefore, eliminates the need to deposit cash slips manually in bank.

- Previous Tax Regimes Management: The solution lets you manage all the business data for the previous tax regimes including VAT, Excise, or CST. You can also generate reports for these tax regimes for an entire financial year with it.

- GST Return Filing: It lets you file for GST return directly through the integration with GSTN portal. You just have to fill all the GST-related details accurately. It comes with a built-in error detector and corrector to ensure all the details are filled in accurately.

- GST Compliance for Composition Dealers: It helps all the dealers who have opted for the composition scheme to stay compliant by recording supply bills. Tally introduction also generates GSTR-4/CMP-08 in the prescribed format for easy return filing.

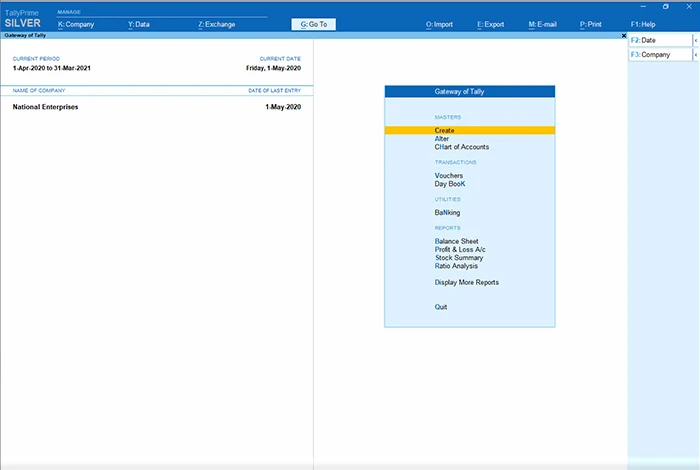

How to Use Tally Software?

Follow the below steps to easily use computer Tally software:

- Create the Company Account: Set up your company on the account Tally introduction basic software by adding the name, address, current financial year, business, type, industry, etc.

- Configure All Features: Once the account is completed, configure all the features you want to use. Choose from inventory, banking, GST and compliance, credit and cash flow, accounting, reporting, etc.

- Load all the Company: After this, your company details will appear by default on TallyPrime whenever you open the solution.

- Update the Company Details if Needed: If there has been any change in the company’s data in terms of tax details, business type, etc., you can easily update it through the company alteration section.

- Configure Security Settings: You need to configure all the security settings to prevent unauthorized access to the company’s data by setting user-based permissions. It also provides encryption for data security.

Suggested Read: How to Create Ledger in Tally ERP 9 (Tally Prime) │ Tally Alternatives

Where to Use Tally Software?

Basic introduction to Tally computer software can be used in the following industries:

- Banking and Finance: TallyPrime helps banks and financial institutions with bank reconciliation, financial reports and cash deposits slips, etc. They can also use it for managing post-date cheques.

- Business Corporations: Corporations can use it for filing GST returns, managing payroll, generating business reports, managing previous tax regimes data, etc. It also assists them in filing TDS and TDC in the prescribed format directly.

- Manufactauring: Manufacturing businesses get help with inventory, purchase and sales orders, and manufacturing journal management with Computer Tally software. Further, they also get help with stock valuation, cash flow projection, e-invoices generation, and more.

Related Categories: GST Software | Expense Management Software | Income Tax Software

FAQs

Does Tally charge interest?

No, Tally does not charge any interest in its services. However, it does charge for its services and offers different types of plans.

Does Tally shows credit report?

Yes, you can also generate credit reports under the named account payables. It shows all the amount a company is liable to pay to the debtors.

Is Tally important for banking?

Yes, Tally can help businesses to simplify and manage various banking operations. It can help them with automated bank reconciliation, cash deposit slip generation, cheque management, e-payments, etc.

Why is Tally important?

Tally is an important software that lets users manage and maintain key operations of the business. You can manage all key processes of the business starting from inventory, accounting, banking, payroll, etc. Some key features include GST invoice generation, inventory management, bank reconciliation, purchase and sales management, etc.

What is the basic concept of Tally?

The basic concept of Tally introduction is to help businesses automate multiple tasks related to inventory, accounting, e-invoicing, cash flow, etc. It offers multiple key functionalities for this purpose including credit management, reports generation, stock level management, e-way and e-invoice generation, and more.

Varsha is an experienced content writer at Techjockey. She has been writing since 2021 and has covered several industries in her writing like fashion, technology, automobile, interior design, etc. Over the span of 1 year, she has written 100+ blogs focusing on security, finance, accounts, inventory, human resources,... Read more