How to File GSTR-3B Using TallyPrime?

Filing GST returns is a standard practice in India that over 1.5 crore taxpayers adhere to every month. For most of them, GSTR-3B is the most crucial return that, if filed on time, helps ensure consistent cash flow through accurate input tax credit claims. That’s where TallyPrime steps in.

If you have ever wondered how to file GSTR-3B in TallyPrime or struggled with the GSTR-3B return filing process in general, this guide is for you. TallyPrime simplifies everything, from generating accurate reports to reconciling data and submitting returns. You can even download GSTR-3B from TallyPrime in just a few clicks, making compliance faster and easier.

Let us walk you through the entire process so you can file confidently, stay compliant, and only focus on growing your business.

What is GSTR-3B?

GSTR-3B is a monthly summary return that every regular GST-registered taxpayer in India is required to file. Unlike detailed returns like GSTR-1, which provide invoice-wise details of outward supplies, GSTR-3B is a self-declared summary of your tax liabilities and input tax credits for a given tax period.

In simple terms, GSTR-3B contains:

- Total outward supplies (sales) and the tax collected on them.

- Total inward supplies (purchases) eligible for input tax credit.

- The net tax payable is after adjusting the input tax credit.

- Any interest or late fees payable.

Filing GSTR-3B on time is mandatory. Failure to do so attracts a GSTR-3B late fee of INR 50 per day (INR 25 CGST + INR 25 SGST), capped at 5% of the tax due. Hence, understanding the GSTR-3B return filing process is crucial for every business.

Suggested Read: Step-by-Step Guide to File GSTR-3B Online

Generate GSTR-3B in Tally: How to File GSTR-3B Using TallyPrime?

When you generate GSTR-3B in Tally, things become smooth and less error-prone. Here’s a detailed step-by-step guide on how to file GSTR-3B using TallyPrime…

Step 1: The first and most important step is to ensure all your sales and purchase transactions are recorded properly in TallyPrime. Every invoice should include GST details such as…

- GSTIN of the supplier and recipient

- Taxable value

- Tax rate (CGST, SGST, IGST)

- Tax amount

TallyPrime automatically classifies these transactions under the correct GST heads. Accurate data entry here is essential because the GSTR-3B report is generated based on these entries.

Step 2: Once your transactions are recorded for the tax period, open the GSTR-3B report. Here’s how you can do that…

- From the Gateway of Tally, navigate to Display More Reports > Statutory Reports > GST > GSTR-3B.

- Alternatively, press Alt+G, type GSTR-3B, and press Enter.

- Select the month and year for which you want to file the return. This will open the auto-filled GSTR-3B form.

Step 3: TallyPrime’s GST return automation feature auto-fills the GSTR-3B form using your recorded transactions. You will see two views of the auto-filled GSTR-3B report…

- Return View: This shows the summarized data exactly as per the official GSTR-3B format.

- Nature View: This breaks down the data by the nature of supplies, tax rates, and taxable values.

Carefully verify the details in both views. Check if the outward supplies, inward supplies eligible for ITC, and tax amounts are accurate. If there are any discrepancies, kindly revisit your invoice entries and correct them.

TallyPrime

Starting Price

₹ 750.00 excl. GST

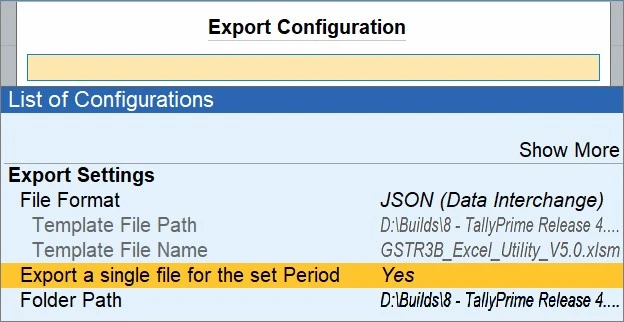

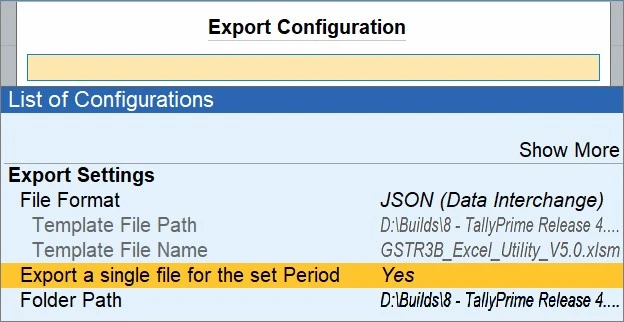

Step 4: After verifying the data, you need to export the GSTR-3B JSON file (a format accepted by the GST portal). Here’s how you can do that…

- Press Alt + E or click the Export button.

- Select GST Returns as the export format.

- Choose the location on your computer to save the file.

- This will generate the JSON file for GSTR-3B upload. This JSON file contains all the return data in a format that the GST portal can read and process.

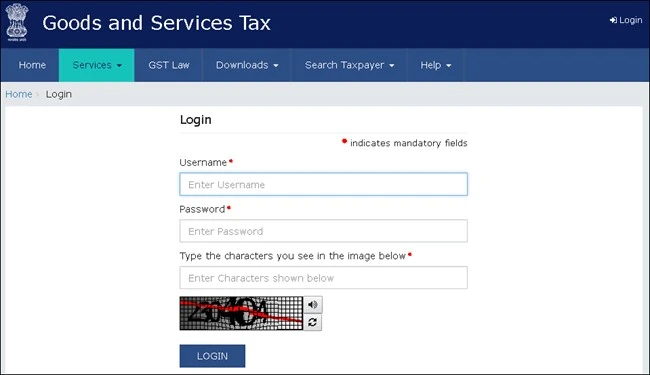

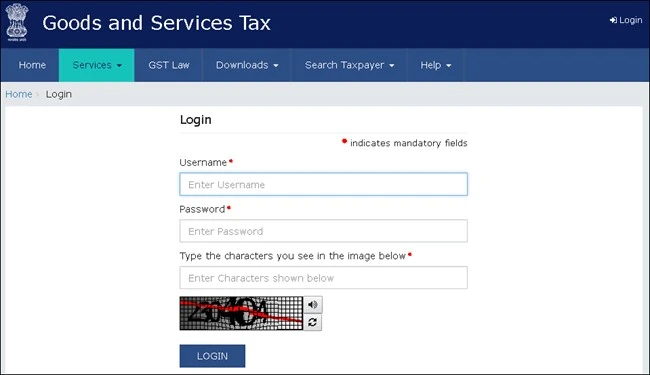

Step 5: Now, log in to the official GST portal using your credentials and file the return…

- Go to Services > Returns > Returns Dashboard.

- Select the financial year and month, then click Search.

- Under the Monthly Return GSTR-3B section, click Prepare Offline.

- Upload the JSON file exported from TallyPrime.

- Verify the data on the portal and submit the return.

- Pay any tax dues, if applicable.

Alternatively, you can use the GST Offline Tool by importing the Excel or CSV file exported from TallyPrime, but using the JSON file for GSTR-3B upload is the most straightforward method.

Well, that’s all that there is to the GSTR-3B return filing process when using GST return automation tools like Tally. You can refer to our blog on for an in-depth guide on how to achieve the same directly on the GST portal.

How to View GSTR-3B Report on TallyPrime?

Here are 3 simple steps to view the GSTR-3B report in TallyPrime…

- Go to Gateway of Tally > Display More Reports > Statutory Reports > GST > GSTR-3B

- Choose the month and year for which you want to view the report.

- The report will show all relevant sections. You can drill down into each section, check for incomplete transactions, or export the GSTR-3B JSON file for filing.

How to Download GSTR-3B on TallyPrime?

After filing GSTR-3B in TallyPrime, you may want to download a copy of it for your records or audits.

Here’s a step-by-step guide on how to download GSTR-3B on Tally…

- Go to Gateway of Tally > Display More Reports > Statutory Reports > GST > GSTR-3B.

- Select the relevant return period.

- Use the Export option to download the GSTR-3B report in Excel, PDF, or XML format.

Why Should One File GSTR-3B Using TallyPrime?

Filing GSTR-3B in TallyPrime offers several important benefits that make it a preferred GST software for many businesses. Some of them are listed below for your understanding…

- Automation & Accuracy: TallyPrime automatically imports data from your sales and purchase invoices to create an auto-filled GSTR-3B. This eliminates human errors that are normally incurred during the manual preparation of returns. The software also makes sure that your data is properly mapped to the applicable GST tables. This, to facilitate the proper calculation of tax.

- Saves Time: The process of compiling GSTR-3B data manually can be tedious and time-consuming. With TallyPrime, however, you can create and export a GSTR-3B JSON file with only a couple of clicks. This makes everything much faster and saves you ample time each month.

- Real-time Updates: As you enter transactions in TallyPrime, your GSTR-3B report gets updated automatically. This real-time reflection helps you keep track of your monthly GST liabilities and input tax credits so as to ensure that you are always ready to file.

- Seamless GST Return Automation: TallyPrime integrates GST compliance features directly into the accounting workflow. This means you do not need to switch between multiple platforms. You can prepare, track, export, and download GSTR-3B returns using the same software.

- Compliance Assurance: The in-built GST compliance engine in TallyPrime will make sure that your transactions are classified in the correct manner. It checks the GSTINs, tax rates, and invoice types, thereby minimizing the risk of making wrong returns and incurring penalties.

- Data Security & Record Keeping: All your GST transactions and returns are stored securely within TallyPrime’s database. This makes it easy to retrieve past returns or audit your GST data whenever needed.

- Easy Download & Sharing: You can download GSTR-3B reports anytime in multiple formats. This is useful for sharing with auditors, tax consultants, or for internal record-keeping.

TallyPrime

Starting Price

₹ 750.00 excl. GST

Conclusion

Filing GSTR-3B is essential for every GST-registered business in India, but when done manually, it can lead to sundry unprecedented errors. When you generate GSTR-3B in TallyPrime, as a robust GST software, however, the entire process can be simplified. For it not only automates data collection and return generation, but also enables easy export of the JSON file for GSTR-3B upload.

Understanding how to file GSTR-3B in TallyPrime thus is essential for businesses looking to stay compliant and optimize their tax processes. We, at Techjockey, can help you avail the said GST software at a competitive price. What’s stopping you then? Give our product team a call today itself and let Tally do the talking in your stead.

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more