What is GSTR-10 and How to File It on GST Portal?

Every GST-registered business in India starts with a wave of filings, invoices, and compliance obligations. However, when it’s time to wrap things up, be it due to closure, normal restructuring, or a simple decision to opt out of GST, there is one last thing you need to file: Form GSTR-10.

Also known as GSTR-10 final return, it serves as your last formal farewell to the GST ecosystem, where you summarize all your pending liabilities and walk away unencumbered (hopefully so). Let’s explore more about the said form in this comprehensive guide, one key feature at a time…

GSTR-10 Meaning: What Form GSTR-10 Means?

GSTR-10 is a one-time return that taxpayers are obligated to file if their GST registration is cancelled or surrendered. As the final return under the Goods and Services Tax (GST) regime, Form GSTR-10 is meant to ensure that all your overdue tax liabilities, including tax payable on closing stock, get settled before the taxpayer exits the GST ecosystem.

This return acts as a final reconciliation, confirming all your dues are paid, all input tax credits (ITC) claimed, and no loose ends remain. If you happen not to file a GSTR-10 return, you might find yourself in a legal crisis, incurring penalties and interest, or worse, lose your ability to re-register under GST.

GSTR-10 Applicability: Who Should File GSTR-10?

Understanding GSTR-10 applicability is crucial. Not everyone registered under GST needs to file Form GSTR-10. It is specifically for those who are exiting the GST system.

The following set of people must file the GSTR-10 return…

- Any business or individual whose GST registration is cancelled, either voluntarily or by the tax authorities

- If a composition taxpayer’s registration is cancelled, they must file GSTR-10

- Individuals or entities who voluntarily registered under GST and later decide to cancel their registration

GSTR-10 applicability does not extend to the following categories of taxpayers…

- Input Service Distributors (ISD)

- Non-Resident Taxable Persons

- Tax Deductors at Source (TDS)

- Tax Collectors at Source (TCS)

- Casual Taxable Persons

These exemptions are in place because their registration is temporary or limited in scope, and their exit is handled differently under GST law.

What is GSTR-10 Due Date?

The GSTR-10 due date is yet another important aspect to be mindful of when it comes to filing this return. For missing out on your GSTR-10 return deadline is directly proportional to financial losses in the form of late fees and other penalties.

GSTR-10, as such, should be filed not later than 90 days from the date of cancellation or that of receiving the cancellation order, whichever happens later. For instance, if you happen to terminate your GST registration on Feb 1, 2025, and receive a cancellation order for it on Feb 10, 2025, you need to file the GSTR-10 final return by May 10, 2025.

Please also note that it is extremely important to adhere to the GSTR-10 due date, for extensions in this domain are very rare.

GSTR-10 Late Fee and Penalty

Failing to meet the GSTR-10 due date can be costly. Here’s what you need to know about the GSTR-10 late fee and penalty…

GSTR-10 Late Fee: INR 200 per day; capped at 0.25% of the taxpayer’s turnover in the relevant state or union territory.

Penalty: If you continue to stay non-compliant, you will be slapped with sundry legal notices. You might also lose out on your ability to re-register under GST in the future.

GSTR-10 Format: Details to be Provided

The GSTR-10 format is an amalgam of all relevant information needed for a smooth exit from the GST system. Here’s a detailed table outlining the information that you, as a taxpayer, are required to provide…

| Section/Fie | Details Required |

|---|---|

| GSTIN | Your unique GST Identification Number |

| Legal Nam | Registered taxpayer’s name |

| Business/Trade Name | Name of the business |

| Address for Correspondence | Updated address for future communication |

| ARN of Surrender Application | Application Reference Number for surrender/cancellation |

| Effective Date of Cancellation | Date when cancellation/surrender takes effect |

| Cancellation Order Details | Tax Payable on Closing Stock |

| Closing Stock Details | Details of stock held on the day before cancellation (inputs, semi-finished/finished goods, capital goods, input services) |

| Tax Payable on Closing Stock | Unique ID and date of the cancellation order (if applicable) |

What are the Benefits of GSTR-10 Filing?

GSTR-10 filing offers several tangible benefits that go beyond mere compliance. Here’s a comprehensive look at the key advantages…

Legal Closure & Protection

Filing GSTR-10 final return is a way of formally closing your GST account, leaving no statutory obligations. This cushions you against any future legal notices and penalties for non-compliance. It is your last round of due diligence where any tax due, as well as the input tax credits, are settled.

Avoidance of Penalties & Interest

No late fees, interest, and other penalties have to be paid in case the GSTR-10 filing is done on time. Lack of compliance, on the contrary, might lead to financial losses in addition to avoidable legal issues.

Re-registration Readiness

A duly filed GSTR-10 final return acts as a tool of great significance in case you decide to register again under the GST regime in the future. It demonstrates that you left the system on good terms, making it easier for you to rejoin, should the need arise.

Professional Reputation

Completing your final GST return demonstrates professionalism and responsible business practices. It projects an excellent light on your business and may further your chances of getting partnerships, investments, or other prospects later.

GSTR-10 Filing Process: How to File GSTR-10 on the GST Portal?

It is extremely easy to file GSTR-10 on the GST portal. Here is a step-by-step guide to help you through the GSTR-10 filing process, one detail at a time…

Step 1: Visit the GST portal (https://www.gst.gov.in/) and enter your username and password to log in.

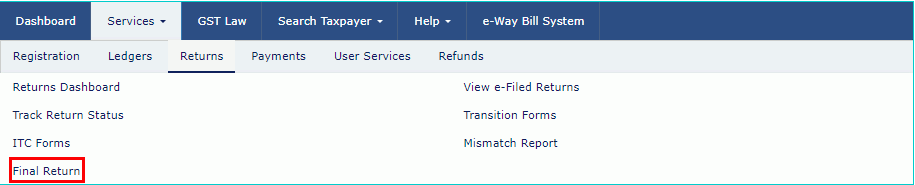

Step 2: Go to Services > Returns > Final Return. This will take you to the GSTR-10 filing page.

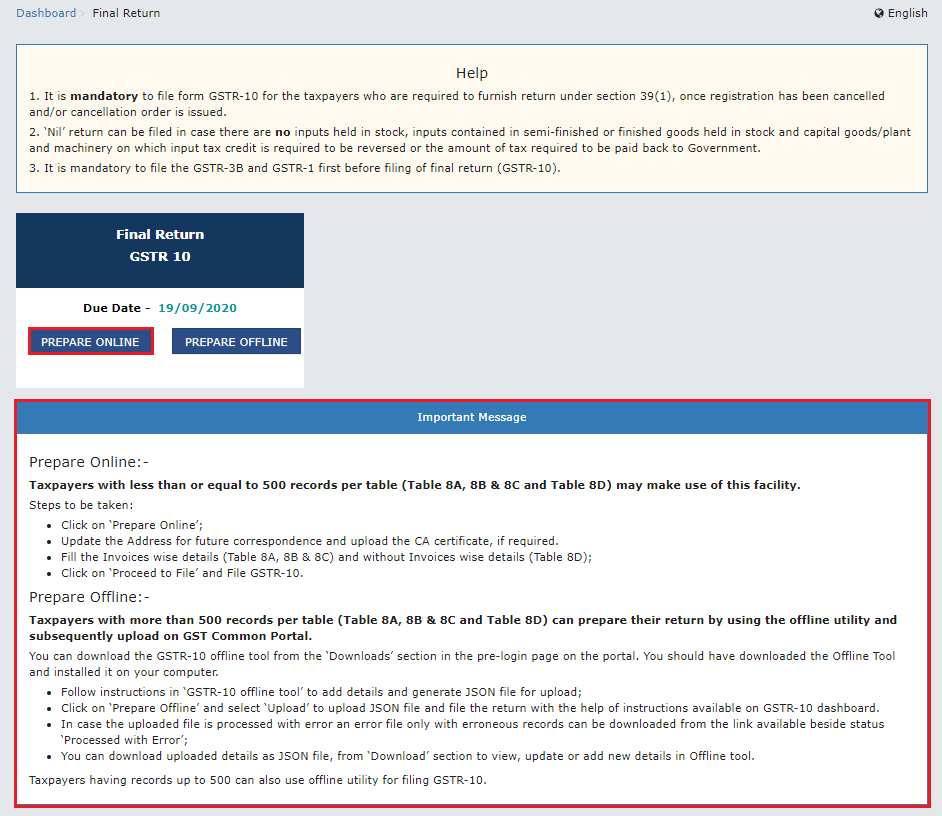

Step 3: Click on Prepare Online to start the GSTR-10 filing process.

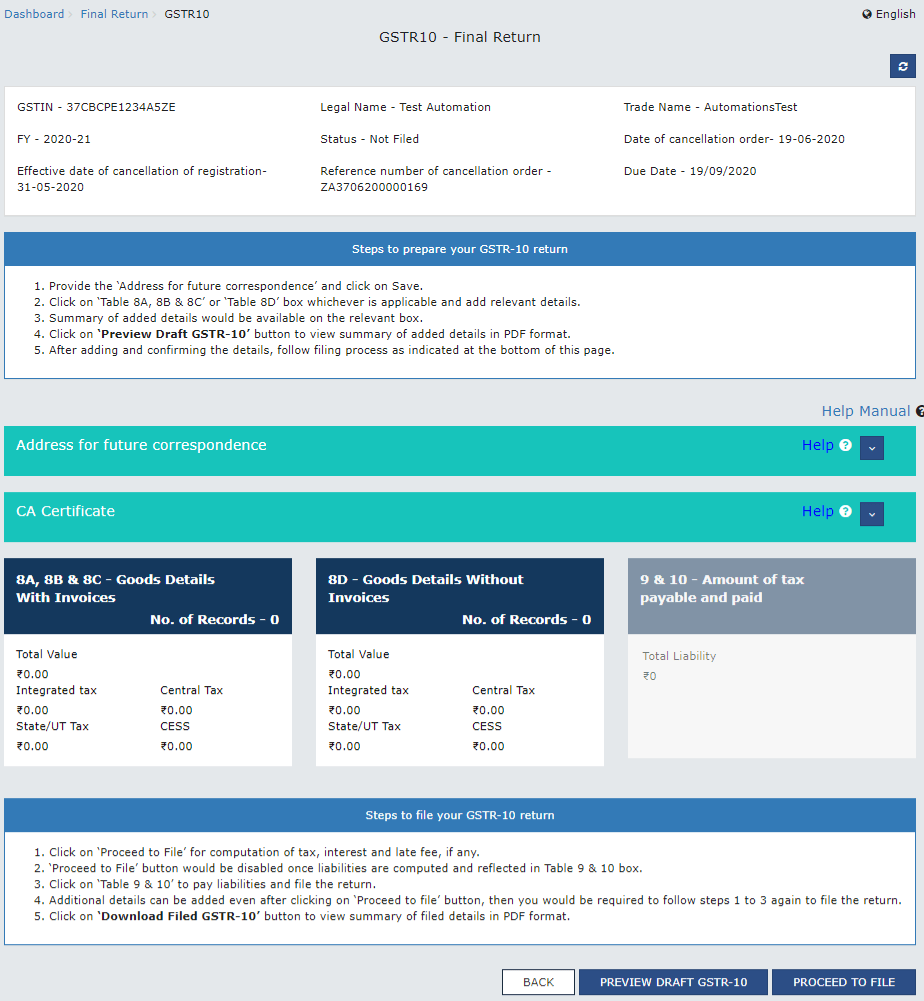

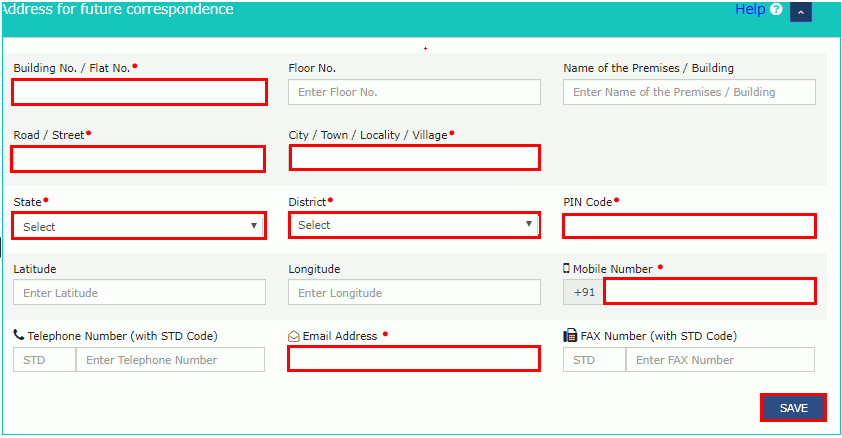

Step 4: Enter or update your correspondence address. This is important for future communication from the tax authorities.

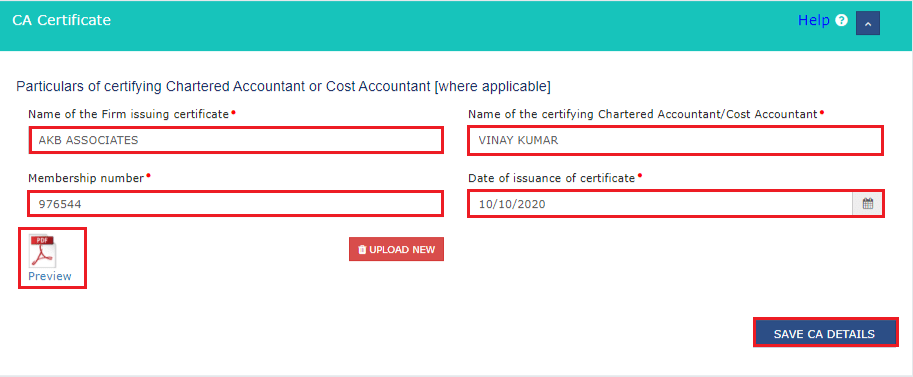

Step 5: If you are using a Chartered Accountant or Cost Accountant for filing, enter their details here. This step is optional but recommended for professional assistance.

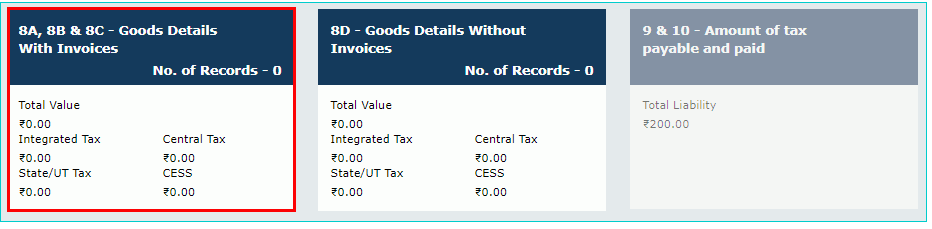

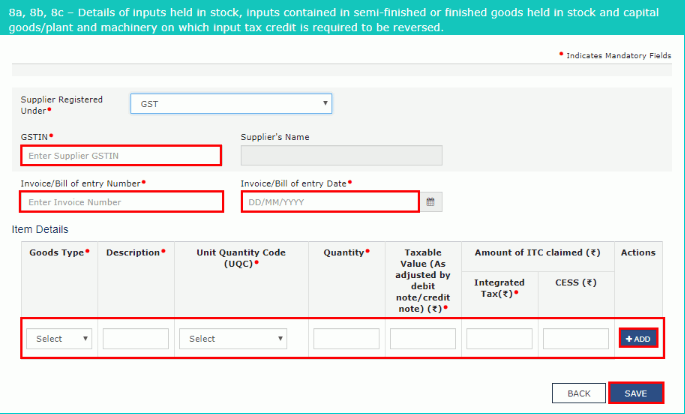

Step 6: Provide details of the stock held on the day before cancellation (refer to the GSTR-10 format given above) …

- Inputs: Raw materials and components.

- Semi-Finished/Finished Goods: Partially or fully completed products.

- Capital Goods: Machinery, equipment, and other assets.

- Input Services: Services received but not yet utilized.

Step 7: Carefully review all the information you have entered and click on Save to proceed.

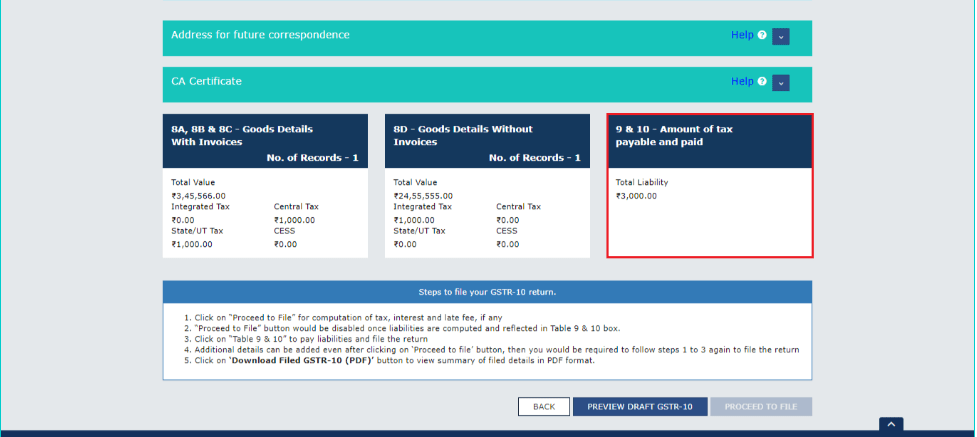

Step 8: If any tax or late fee is due, make the payment through the GST portal.

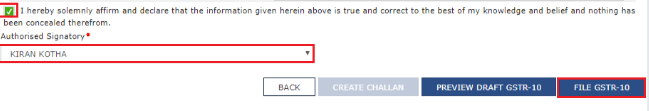

Step 9: Click on “Preview Draft GSTR-10” to preview everything before making payment.

Step 10: Click on File GSTR-10 to file your return.

Step 11: Complete the filing process by signing the return using your Digital Signature Certificate or Electronic Verification Code.

Step 12: Once the return is filed, download or print the acknowledgement.

Common Mistakes to Avoid While Filing GSTR-10

Even experienced taxpayers can make mistakes when filing GSTR-10. Here are some of the most common ones amongst them that you can avoid to ensure a smooth GSTR-10 filing process…

- Missing the GSTR-10 due date can lead to late fees and penalties.

- Providing inaccurate details of closing stock as can cause discrepancies and potential legal issues.

- Not filing all pending GSTR-3B and GSTR-1 returns before filing GSTR-10. The portal may not allow you to file GSTR-10 in this case. (To know more about GSTR-3B and GSTR-1, read our blogs.

- Using an outdated correspondence address, owing to which you might miss out on important communications from the tax authorities.

Not paying any outstanding tax or late fee before filing GSTR-10, as it can lead to legal action - Entering the wrong Application Reference Number (ARN) or cancellation order details. This can lead to rejection of the return.

- Not saving the acknowledgement or payment receipts. Owing to which, you would face difficulty in proving compliance if audited.

What’s the Difference Between GSTR-10 and GSTR-9?

Though both GSTR-9 and GSTR-10 get referred to as the grand finales of the GST ecosystem, it is important to know the difference between the two for those filing. While GSTR-9 is an annual return for all Indian regular taxpayers, GSTR-10, on the other hand, is a one-time final return for those totally exiting the GST system.

Suggested Read: For more information refer to our blog on GSTR-9

Take an in-depth look at all the differences between GSTR-9 and GSTR-10 in the table below…

| Feature | GSTR-9 (Annual Return) | GSTR-10 (Final Return) |

|---|---|---|

| Who Files? | All regular taxpayers | Only those cancelling/surrendering GST |

| Frequency | Annually | One-time |

| Purpose | Annual summary of all GST returns | Final settlement of tax and ITC on exit |

| GSTR-9 & GSTR-10 Applicability | Ongoing businesses | Businesses exiting the GST system |

Conclusion

Filing GSTR-10 means carrying out your final act of compliance. As post this, you will be officially placed outside the purview of the Indian GST regime. However, to think of it as a mere existing formality isn’t right, too, for it’s a crucial step in ensuring you leave the tax ecosystem with a clean slate.

Those filing can also make use of GST software to make the process easier for them, but the procedure listed above is equally enough to make your final bow count. So, what are you waiting for? Planning to leave? Leave with style!

FAQs

What is GSTR-10 used for?

GSTR-10 is a final GST return filed by taxpayers whose registration has been cancelled, used to declare closing stock and settle any pending tax liabilities.

What happens if GSTR-10 is not filed?

If GSTR-10 is not filed on time, the taxpayer faces a late fee of INR 100 per day (INR 50 CGST + INR 50 SGST), capped at 0.25% of turnover, and may also receive a notice from tax authorities demanding compliance within 15 days.

Is a CA certificate mandatory for GSTR-10?

No, a CA certificate is not mandatory for filing GSTR-10. However, it may be required in specific cases, such as when the taxpayer has closing stock but lacks proper tax invoices for the inputs.

What to do after filing GSTR 10?

After filing GSTR-10, you will receive an acknowledgement (ARN), and your GST liabilities and ledgers are updated, marking the official closure of your GST registration.

How to check GSTR-10 filing status?

To check your GSTR-10 filing status, log in to the GST portal, go to Returns > Track Return Status, select GSTR-10, and view the status for the relevant period

What is the due date for GSTR-10?

The due date for filing GSTR-10 is within three months from the date of GST registration cancellation or the date of the cancellation order, whichever is later.

How to cancel GSTR-10?

GSTR-10 cannot be cancelled once filed, as it marks the official closure of your GST registration. However, in rare cases, a tax officer may restore your GST registration even after GSTR-10 has been submitted.

Is GSTR-10 mandatory?

Yes, GSTR-10 is mandatory for any taxpayer whose GST registration has been cancelled or surrendered. Failing to file it can lead to penalties and legal consequences.

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more