How to File GSTR-9C on ClearTax GST Software?

Filing GST returns each year is a must for registered taxpayers in India. But if your company earns more than INR 5 crore annually, then filing GSTR-9C becomes mandatory. GSTR-9C is a reconciliation statement, and it ensures that the data you submit to the GST portal aligns with your audited books of accounts.

Owing to this, a significant number of businesses use automated GST Software like ClearTax to save time and avoid mistakes. The GSTR-9C filing process on ClearTax is reliable, fast, and easy, even for first-time filers.

So, let’s learn how to file the GSTR-9C return online with ClearTax. While at it, let’s also get a detailed walkthrough of GSTR-9C return steps on ClearTax and the top benefits of filing GSTR-9C via ClearTax.

What is GSTR-9C?

GSTR-9C is an annual return reconciliation form required under the GST Act. It matches the figures in your filed GST returns (like GSTR-9) with your audited financial statements.

If your turnover exceeds INR 5 crore in a financial year, filing GSTR-9C is mandatory. It confirms…

- The accuracy of your tax declaration

- That your tax paid, ITC claimed, and turnover match across records

- Any discrepancies are explained in detail

Earlier, this form had to be certified by a Chartered Accountant. Since FY 2020-21, it only requires self-certification, but it still needs to be accurate.

To help with this, most companies now prefer using tools like ClearTax. The platform makes the entire process, from reconciliation to filing, easy. The built-in ClearTax GST reconciliation tool makes sure that the numbers match, and issues get flagged clearly.

Suggested Read: What is GSTR-9C? A Complete Guide

Step-by-Step GSTR-9C Filing Process on ClearTax

Now let’s walk through the GSTR-9C filing process on ClearTax. This is the smart way to handle your filing in less time with fewer errors.

The GSTR-9C return steps on ClearTax include the following…

Step 1: Go to www.cleartax.in and sign in to your account.

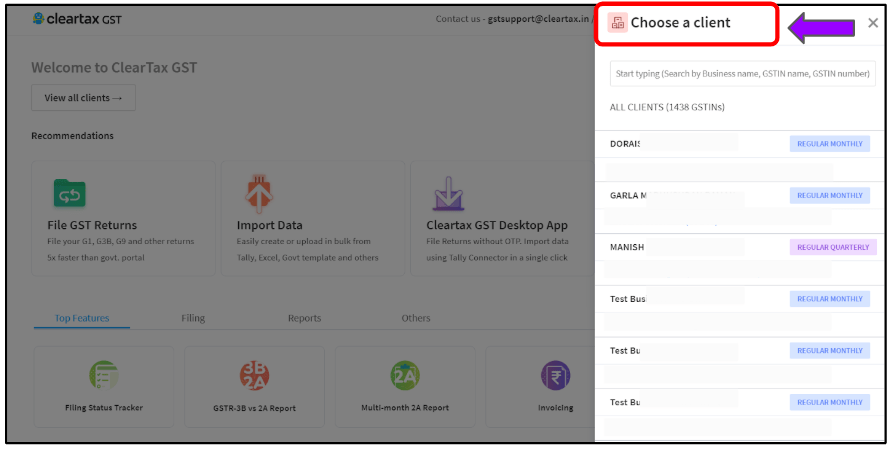

Step 2: Choose the relevant GSTIN from your business dashboard. Ensure that you’ve already filed your GSTR-9, because you can only begin GSTR-9C filing after that is complete.

Step 3: Using the ClearTax GST reconciliation tool, import GSTR-1, GSTR-3B, and GSTR-9 data directly from the GST portal

Step 4: Once data is uploaded, the system will automatically match turnover, tax paid, and input tax credit (ITC), showing mismatches side-by-side for review. All calculations follow the official GSTR-9C format in ClearTax.

Step 5: You’ll see the GSTR-9C format in ClearTax pre-filled using your imported data. Review each section, including:

- Part A: Reconciliation statement

- Part B: Self-certification

If there are differences between books and GSTR returns, you are required to explain them. You can enter clarifications, remarks, or supporting documents, all inside the platform.

ClearTax GST

Starting Price

Price on Request

Step 6: Upload supporting documents, including…

- P&L Statement

- Balance Sheet

- Notes to accounts

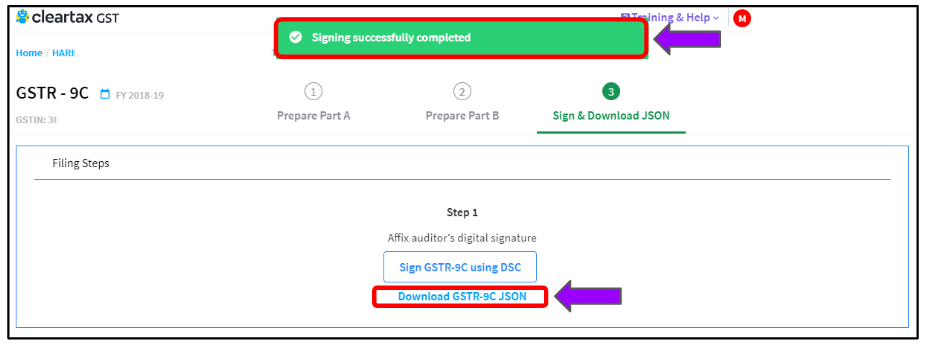

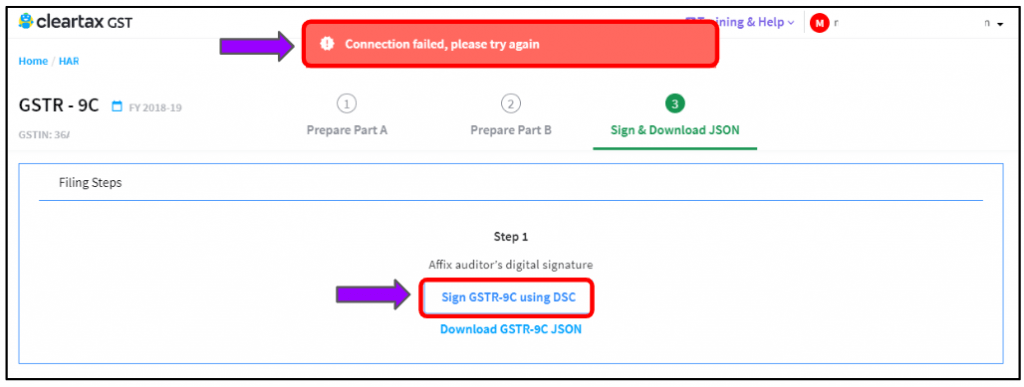

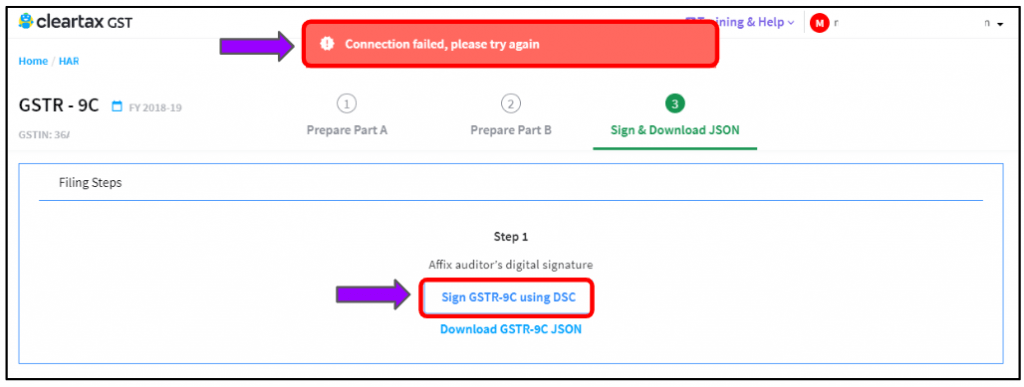

Step 7: Once verified, click Generate GSTR-9C JSON. This file format is required to upload your return to the official GST portal.

Advanced users usually take this step further and upload GSTR-9C JSON on ClearTax once more for final verification. This lets them double-check before heading to the portal.

Step 8: Now, upload the JSON to the GST portal and the file return. You can refer to our blog to know how to accomplish this in detail.

Step 9: Submit and e-Sign (using DSC or Aadhaar OTP)

Once filed, you can download the filing acknowledgment for your records. That’s how easy it is to complete the GSTR-9C return steps on ClearTax!

Benefits of Filing GSTR-9C via ClearTax

There are major advantages to managing your filing through ClearTax. Here are the top benefits of filing GSTR-9C via ClearTax…

- Trusted GST Software Across India: Thousands of businesses rely on ClearTax for monthly and annual GST returns. The platform is government-approved and compliant with all GST filing rules, including updates to the GSTR-9C format in ClearTax.

- Auto-Reconciliation: With the ClearTax GST reconciliation tool, you never have to manually compare entries across returns and books. In fact, 95% of reconciliation work is done automatically.

- No More Manual Errors: GSTR-9C is a sensitive form. Small mistakes can cause investigations or notices. ClearTax Auto-checks help you eliminate errors, which makes ClearTax GSTR 9C filing secure and risk-free.

- Guided Interface & Tutorials: The design is user-friendly and built for both tax experts and new users. You get a full ClearTax GSTR-9C filing tutorial, demo videos, and step-by-step instructions.

- Built for CAs & Finance Teams: If you are a CA handling multiple clients, you’ll love bulk upload features and dashboard filing for different GSTINs. One could never find an easier answer to how to file the GSTR-9C return online than this!

- Correct Format & JSON Generator: You never need to worry about the format. The software builds your GSTR-9C using the latest templates and automatically creates the correct JSON. Simply click to download and upload to GSTN. You can also upload GSTR-9C JSON on ClearTax to see a live preview, a rare feature in most GST tools

ClearTax GST

Starting Price

Price on Request

Conclusion

Filing GSTR-9C does not need to be a cause of stress. Whether you are a small business or a large company with multiple GSTINs, the GSTR-9C filing process on ClearTax will save you time and reduce compliance risk.

From importing data, reconciling with your books, reviewing your return, and uploading to the GST portal, every step is built right into the software. What else does a taxpaying business in India need?

So, get in touch with the Techjockey team and get your hands on the ClearTax GST software today itself!

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more