What are the Types of GST Returns: Forms, Due Dates & Penalties

GST (Goods and Services Tax) was introduced in the year 2017 to unify different indirect taxes under one umbrella. As a result all entities involved in business activities were mandatorily required to complete GST registration before filing forms for GST return, offline or online.

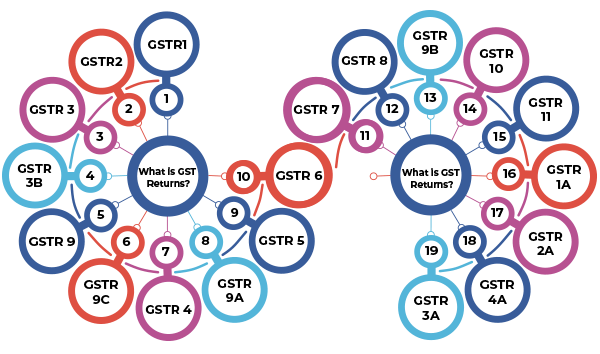

What is GST Returns?

With business owners and dealers having to submit GST returns, monthly or annually, GST document covers all information regarding sales, purchases, outward supplies and input tax credit. This information so provided is then calculated for assessing complete GST’s liability within a particular tax period. Taxpayers must file their GSTR returns diligently every month, year or quarterly to avoid penal interest and late fees.

What are the Different GSTR Return Types?

GSTR returns so filed are on the basis of the kind of business a taxpayer is involved in. As a result, there are different types of GST returns to be paid monthly, annually or quarterly.

GST Return Forms for Businesses

GSTR 1

GST monthly return filled by taxpayers is categorized under GSTR 1. It is a return filed for furnishing details of all sales transactions done during a tax period. Covering all outward supplies of goods and services, it is also filled for reporting credit/debit notes issued.

Small taxpayers with ₹1.5 crore turnover in the previous financial year can file for a GST quarterly return. At the end of the month, succeeding the quarter, these can also be applied as GST quarterly returns. Tax payers are free to opt for this or the monthly option.

Suggested Read: How to File GSTR 1 Using Tally.ERP 9 – A Step By Step Guide

GSTR 2

GSTR 2 is a GST monthly return form considered for the inward supplies so received. It comprises taxpayer’s information, time period for return and final invoice level information of all purchases done. Further in this form, GST returns details can be edited.

GSTR 3

GSTR 3 is a monthly GST return that covers both outward and inward supplies, tax liabilities, taxes paid and the claimed input tax credit. On the basis of GSTR 1 and GSTR 2, GSTR 3 is auto generated in nature.

GSTR 3B

GSTR 3B online is filed by normal tax payers who have been registered under GST. Tax liability ascertained, tax paid, outward supplies and input tax credit so claimed are all covered under GSTR 3B. it was issues as a relaxation step for businesses that had just moved on to GST.

Suggested Read: How to file GSTR-3B Online – Step by Step Guide

GSTR 9

Annual return under GST filing is clubbed under the GSTR 9 tax category. It includes upcoming payable taxes and the ones already paid, outward supplies done so far and inward supplies of the previous year falling under the following heads- IGST, HSN codes, CGST and SGST. All tax payers registered under the GST need to fill this return.

Suggested Read: Easy GSTR-9 Filing with the Latest Tally ERP 9 Release – Free Download

GSTR 9C

GSTR 9C is to be paid by taxpayers with an annual turnover in a financial year of more that ₹2 crores. It is a reconciliation statement between GSTR 9 so filed and audited statements of the registered taxpayer. For audited statements, the taxpayer has to get her or his books audited from a chartered accountant or a cost accountant.

GSTR Return Types for Businesses Operating Under Composition Scheme

GSTR 4

GSTR 4 is a GST quarterly return form submitted by taxpayers who have opted for composition scheme under the GST. Here tax payers on a fixed rate pay taxes for their turnover which reaches up till ₹1.5 crore. Currently, GSTR 4 has been replaced by CMP-08, which is to be paid on a quarterly basis.

GSTR 9A

GSTR 9A filing is an annual return under GST for composition taxpayers. All GST quarterly returns submitted so far get consolidated to fall within GSTR 9A GST type. GSTR returns in 9A are paid annually by registered composition taxpayers for a financial year.

GSTR Return Types for Other Business Dealers/Owners

GSTR 5

Outward supplies done, inward supplies received, debit and credit notes, tax liabilities and taxes paid so far are covered by GSTR returns 5 sub type. These are paid by foreign nationals doing business in India and are paid on monthly basis.

GSTR 6

ISD (Input Service Distributor) file GSTR returns of this category. Submitted on monthly basis, the form comprises details of documents issued so far for distributing input credit, input tax credit received and supply details for invoices from GSTR 1, GSTIN number of the one receiving credit and ISD ledger.

GSTR 7

GSTR 7 is filled as monthly returns by taxpayers who need to deduct TDS under GST. This form is comprised of details such as TDS deducted so far, claimed TDS refund and TDS liability payable. Other details such as penalties and interests are also covered here.

GSTR 8

E-commerce operators who need to collect tax at source (TCS) fill up these monthly GSTR returns. It contains details of supplies done from ecommerce platform and TCS collected so far aside from taxpayer’s name, GSTIN and of course, time period of the return.

GSTR 9B

GSTR 9B is the GST annual return format. GSTR returns submitted under the 9B category are annual return under GST duly filled by ecommerce operators that receive tax deducted at source.

GSTR 10

GST final return is filed through the GSTR 10 form. It is filled by a taxpayer whose registration has either been surrendered or cancelled. It is to be finally paid within three months of the cancelation or surrender notice. The form contains details of liabilities, supplies, collected taxes and payable taxes.

GSTR 11

People with UIN (Unique Identity Number) have to file for GSTR returns of this subtype. It is filed for receiving refunds under GST of goods and services so purchased by embassies and diplomatic missions within the country. GST returns details here consists of received inward supplies and refunds claimed.

If You Need to Make Any GSTR Return Amendment

GSTR 1A

Those who have cross checked their GST return status and found any mismatches can opt for GSTR 1A for making amends or corrections. One of the examples of such mismatch is difference between GSTR 1 form filled by the taxpayer and GSTR 2 form filled by his customers.

These Returns are Drafted Automatically

GSTR 2A

GST return form under GSTR 2A category contains details of inward supplies of goods/services. GSTR returns under GSTR 2A are read only in nature and require no further action. Purchases done from registered suppliers in a tax periodfall under the inward supplies type of goods and services.

GSTR 4A

GSTR 4A is an auto generated form created from information supplied in GSTR form numbers 1, 5 and 7. The form is furnished as GST quarterly return by composition dealers.

What If You Forget to File GSTR Returns?

GSTR 3A

It applies to you if you forgot to file GSTR returns, GSTR 3A is issued directly by the tax authority.

Who Should File GST Return?

Those registered under GST act are required to submit details of sales as well as purchases done for their good/services. Details also need to be provided of taxes paid and collected so far. Refer the next section for identifying who needs to apply for GSTR returns based on the form type.

- GSTR 1 is to be filled by registered taxable suppliers.

- GSTR 2 has to be submitted by registered taxable recipient.

- GSTR 3 is furnished by taxpayers after finalising details of taxes paid, outward and inward supplies.

- Composition suppliers file GSTR 4.

- GSTR 5 is to be filed by non-resident taxpayers.

- Input service distributors furnish GST details in GSTR 6 form.

- Authorities undertaking tax deducted at source comply with GSTR 7.

- E-commerce service providers and tax collectors fill up GSTR 8.

- GSTR 9 form is for registered taxpayers and it is paid annually.

- Those taxpayers with their businesses cancelled or surrendered go for GSTR 10.

- Any person with UIN claiming refund files all information regarding inward supplies in GSTR 11

Who Should File GST Nil Return?

If no invoice has been generated by your company in a month, you have to file for GST nil return. Unless, there is a late fee of Rs 20 per day. You need GSTR 1 and GSTR 3B forms for filing GST nil return and

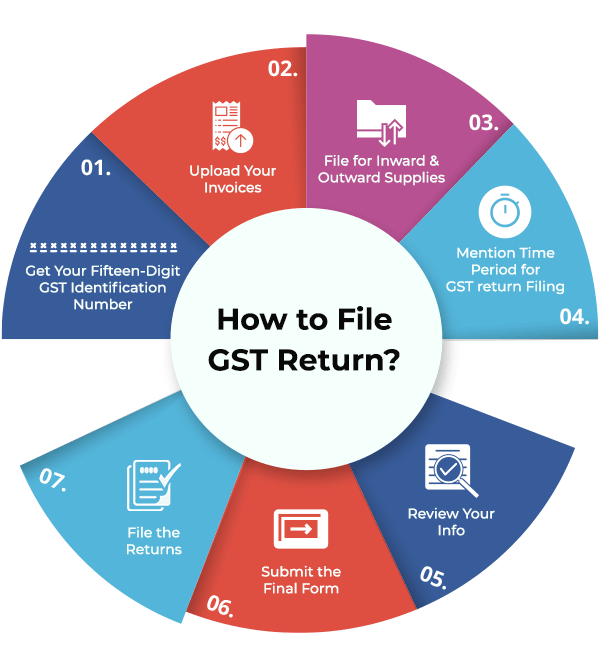

How to File GST Return?

Taxpayers need to submit tax returns to the GST department of India monthly, quarterly or annually. With automated tax filing systems, you can login through government portal for paying GST.

Step 1: Get Your Fifteen-Digit GST Identification Number

As you visit the portal, a fifteen-digit GST identification number would be issued. This number incorporates your PAN details and state code.

Step 2: Upload Your Invoices

Next upload your invoices to receive an invoice rule reference number.

Step 3: File for Inward & Outward Supplies

Once done with invoice uploading, file for outward supplies and inward supplies of taxable goods/services.

Step 4: Mention Time Period for GST return Filing

Enter other details as asked in the form such as time period for which the tax is filed, etc.

Step 5: Review Your Info

Review the information so provided through the preview option attached.

Step 6: Submit the Final Form

Step 7: File the Returns

How to Check Your GST Return Status?

Taxpayers who gave already submitted the GST returns are provided with an ARN or Application Reference Number. With the help of this number, you can check the GST return status after furnishing GST returns details.

Once you have this information, visit government GST portal, enter the necessary details including ARN number and click on service option to track return status.

GST Return Due Dates Updated

GST return forms are released by government every year alone with their respective due dates and GST return last dates. To fill up GSTR returns based on their sub type, follow the information given in the next section.

In an effort to provide relief for businesses suffering due to economic impact of Covid-19, the news of GST return date extended has come as a big relief to business owners and dealers.

| GST Returns Types | Details | Periodicity | Due Date |

|---|---|---|---|

| GSTR 1-Monthly | Submission of Details of Sales | Monthly | 11th of Next Month |

| GSTR 1-Quarterly | Submission of Details of Sales by Quarterly Filers Having Annual Sales Turnover < 5cr | Quarterly | 13th of Succeeding month of Quarter |

| GSTR 3B-Monthly | Summarised Return & Payment of GST | Monthly | 20th of Next Month |

| GSTR 3B-Quarterly (Turnover <5 crore) & Category X States | Summarised Return & Payment of GST | Quarterly | 22nd of Next Month |

| GSTR 3B-Quarterly (Turnover <5 crore) & Category Y states | Summarised Return & Payment of GST | Quarterly | 24th of Next Month |

| GSTR 4 (For Composition Dealers) | Submission of Details of Sales during the FY | Annual Return | 30th June of Succeeding FY |

| GSTR 5 (For Non-Resident Taxable Persons) | Summary of Details of Sales by Non Resident | Monthly | 20th of Next Month |

| GSTR 5A (For OIDAR Service Providers) | Return for Online Information Database Access or Retrieval Service Providers | Monthly | 20th of Next Month |

| GSTR 6 (For Input Service Distributor) | Summary of Input Tax Received and Distributed | Monthly | 13th of Next Month |

| GSTR 7 (For TDS Deductors) | Summary of Tax Deducted at Source by any registered person | Monthly | 10th of Next Month |

| GSTR 8 (For eCommerce Operators) | Summary of Tax Collected at Source | Monthly | 10th of Next Month |

| GSTR 9 (Annual Return) | Summary of all the outward and inward supplies made during the FY | Annual Return | 31st December of Succeeding FY |

| GSTR 9C (Reconciliation Statement) | Reconciliation Statement of GSTR 9 vs Books (for turnover > Rs. 5 crore) | Annual Return | 31st December of Succeeding FY |

| GSTR 10 (Final Return) | Final return for cancelled or surrendered GST registration | One-time filing | Within 3 months of cancellation |

| GSTR 11 (For UIN Holders) | Details of inward supplies for UIN holders claiming refund | Monthly | 28th of Next Month |

| CMP-08 (For Composition Dealers) | Challan cum Statement for quarterly tax payment | Quarterly | 18th of Month Succeeding Quarter |

| ITC-04 (Job Work Statement) | Statement of goods sent to or received from job worker | Annual/Half-yearly | 25th April (Annual) / 25th Oct & 25th Apr (Half-yearly) |

| GSTR 1 IFF (Invoice Furnishing Filing) | Submission of Details of B2B invoices for QRMP taxpayers | Monthly (Optional) | 13th of Next Month |

| GSTR-2A (Auto-generated) | System-generated statement of inward supplies from suppliers’ returns | Auto-generated monthly | Available for viewing (not filed) |

| GSTR-2B (Static Statement) | Static monthly statement of eligible input tax credit | Auto-generated monthly | Available by 14th of Next Month |

| PMT-06 (Payment Challan) | Electronic challan for GST, interest, penalty, and fee payments | As required | Generated at time of payment |

Annual Return GST Due Dates

Annually GSTR 9, 9A and 9C are to be filled and submitted for the previous financial year. For example, GSTR 9, 9A and 9C forms for the year 2026 would cover financial year 2024-25. Secondly, these GSTR returns are to be filed by taxpayers with an annual turnover of more than two crores.

- Time period (annually)

- Due date- September 30, 2026

Late Fees for Not Filing GSTR Returns

The maximum late fee has been fixed to ₹5000 for all GSTR returns except GSTR 9. For each day delayed, a fine of ₹200 would be levied.

Overdue fine for annual returns under GSTR 9 category has the capping of 0.25 percent of the turnover for the financial year. And, the amount that defaulters need to pay is Rs 200 per day.

How to Download GST Return Form?

You can only download GST final return, GST monthly return, GST annual return from the government portal.

Summary

With extended GST return dates, businesses have got some relief in filing returns. You can access all the necessary GST returns details including GST return status and GST return date here and submit the GST accordingly.

Somya is one of the most experienced technical writers in the team who seems to be comfortable with all types of business technologies. She is a sensitive writer who ensures that businesses are able to find the right technologies through her writings. She would leave no stones unturned... Read more