GST or Goods and Services Tax has brought about a revolution in the way taxes were calculated and paid in the country in the past. Under the previous tax regime, taxes and registration numbers were separate for state and centre. But with the introduction of GST, all these processes and taxes came under a single umbrella and made the work of taxpayers easy.

In order to be a part of this process, individual businesses are required to get a GST Identification Number or GSTIN.

How to Apply for GSTIN Number in India

The registration process for GST Identification Number is simple. It can be applied using two methods – through GST Common Portal directly, or through facilitation centres, also known as GST Suvidha Kendra.

You can file for more than one application where in case there is more than one business located in a single state or multiple states.

Through GST Common Portal

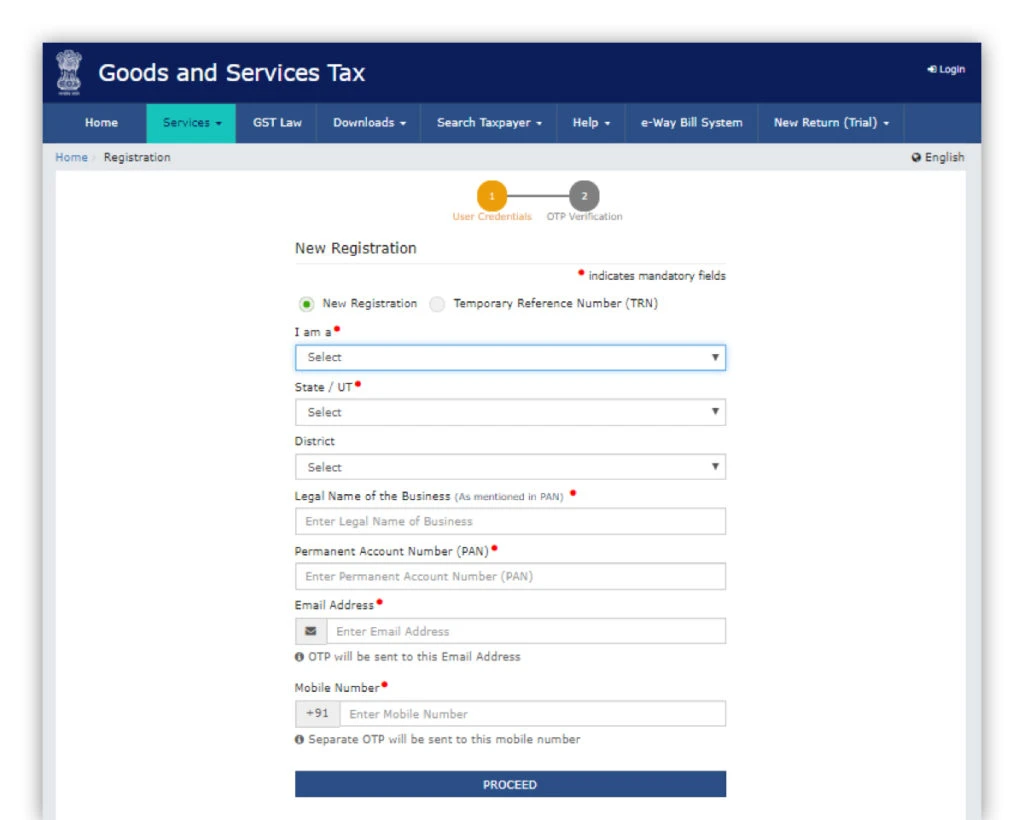

Step 1: Log on to the GST online portal and select ‘Register Now’ on the Taxpayers (Normal/TDS/TCS) field.

Step 2: Next, fill in ‘Part A’ of the form which includes fields such as legal name of the business, PAN and e-mail address.

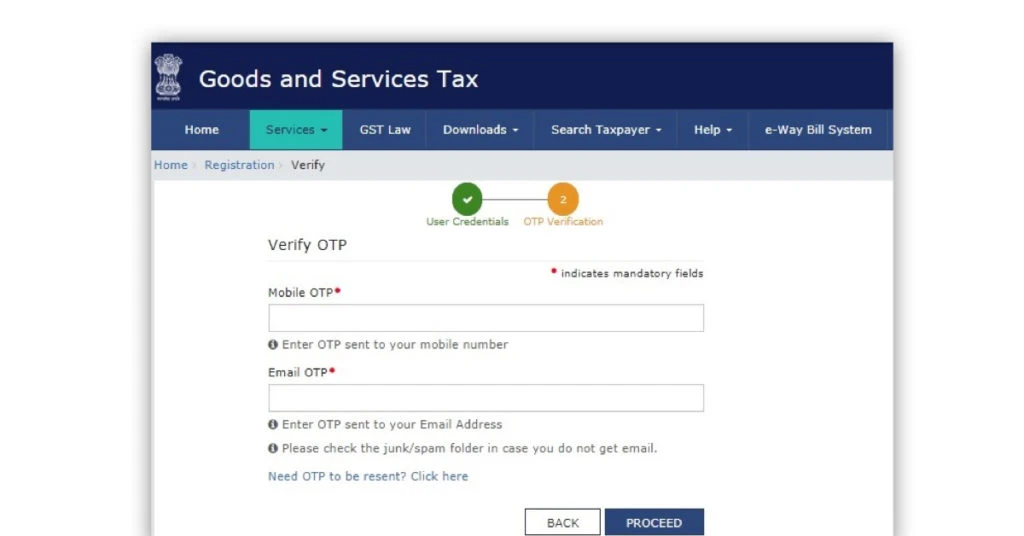

Step 3: After entering the details, an OTP will be sent to the phone number and email that you had entered earlier. It is to verify the details. Enter both the OTPs.

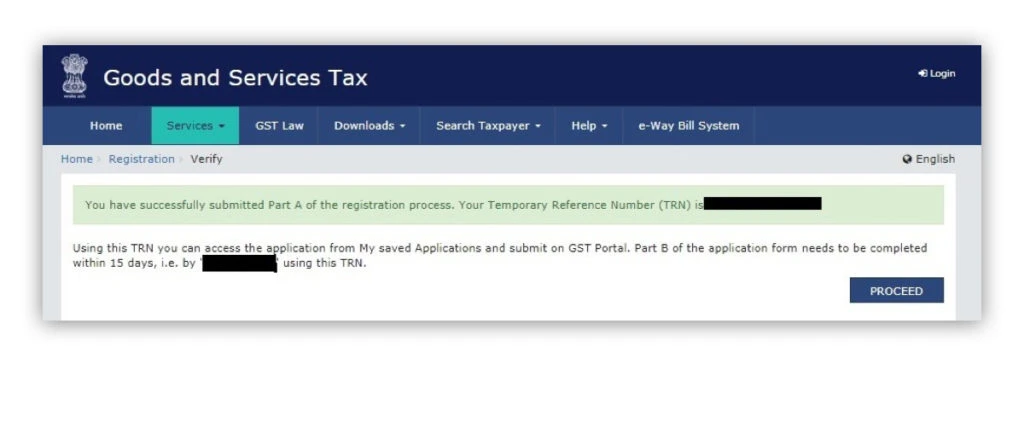

Step 4: The first part of the registration has been completed. The portal will send you an Application Reference Number (ARN) on your mobile and email address.

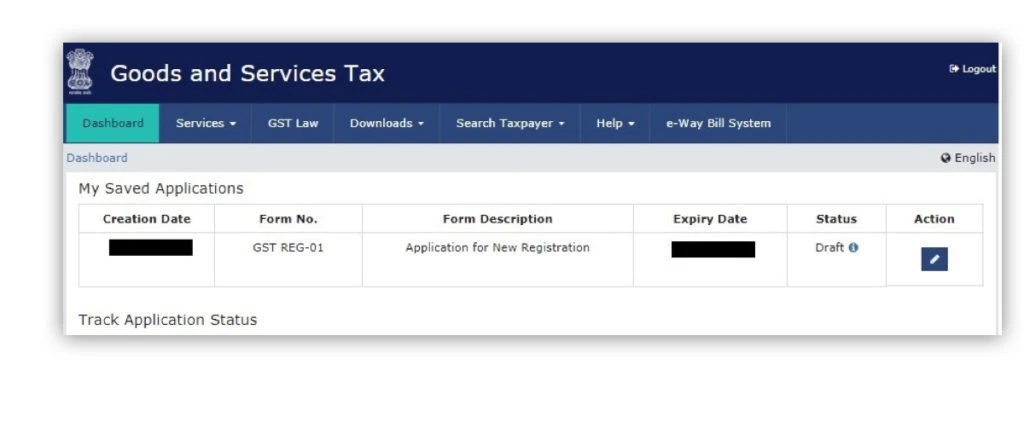

Step 5: Next you need to fill Part B of the application with the help of ARN. You will also be asked to upload the necessary documents to complete the registration.

Step 6: Fill in all the fields as instructed and upload necessary documents. Finally, submit the application.

Within 3-4 working days, GST officials will do a pre GSTIN verification of all the details provided by you. If you have provided all the details correctly, it will most likely get approved. In case any of the details are missing, you will be required to provide additional information. Once that gets sorted, your application will be approved, and a Registration Certificate will be provided to you.

Through Facilitation Centres (GST Suvidha Kendra)

A GST facilitation centre or GST Suvidha Kendra assists businesses and taxpayers in queries or issues related to GST. Governed by Central Board of Indirect Taxes and Customs (CBEC) they work as an initiative to help citizens in compliance and all matters related to GST.

You can visit any of these Suvidha Kendras with necessary documents where the GST official will register your application online. Once all the formalities are completed the official will provide the Registration Certificate.

Documents Required When You Apply for GST Number in India

In order to complete the registration process, the following documents must be submitted:

A. Digital Signature

The GSTIN number application requires a digital Class 2 signature of the applicant. Therefore, it is crucial to keep a digital copy of the signature before starting the GSTIN number registration process.

B. ID and Address Proofs

The applicant must provide their identity and address proof(s) such as PAN, Aadhaar card, driver’s license, voter ID or passport. Along with the ID proof, applicants must also provide their passport size photographs.

For address proof, any government authorized document with address mentioned is acceptable. Some of the documents that can be used as address proofs include Aadhaar card, passport, driver’s license and ration card.

C. PAN Card

All financial transactions and tax related activities have to be linked with PAN; whether it is for an individual or a business. Therefore, PAN must be furnished for the registration of GSTIN number.

D. Business Registration Document

It is mandatory to provide the proof of business registration especially in the case that the business is a partnership firm. In such cases, the partnership agreement needs to be furnished. In a limited liability partnership (LLP) or an organisation, the certificate from MCA is required to be furnished. For all other types of businesses such as clubs, trusts, government entities, the registration certificate is mandatory.

E. Address Proof for Business

The address proof for business premises is mandatory while filing GSTIN number registration. These are the documents that you can provide as the address proof:

- Owned Property

Any document of ownership of the property such as electricity bills, ration card, gas connection passbook etc. can be used as the owned property proof for business.

- Rented or Leased Property

A legally valid rent agreement specified for commercial use, along with the property tax receipt/ electricity bill or copy of ration card of the proprietor needs to be submitted.

- SEZ

In case, if the business is located in a special economic zone (SEZ), all the Government of India issued grants and certificates need to be furnished.

- Other Cases

For other cases such as the proprietor providing their premises on goodwill, a copy of the consent letter of the proprietor is required. You also need any proof of ownership such as a copy of ration card or electricity bill is required. This also holds valid for shared properties.

F. Bank Account Proof

For business-related transactions and tax compliance, the bank account proof is required. Documents such as a copy of bank statement, a cancelled cheque or the first page of passbook can be provided as a proof. These also need to have the name of business owner, MICR, account number and IFSC/branch code.

Advantages of Getting a GSTIN Number

A Goods and Service Tax Identification Number (GSTIN) provides the following benefits to business owners:

1. Legally Authorised to Sell Goods or Services

By acquiring GSTIN, an individual is legally recognised as a seller of goods and services. After this, he or she is counted as a business in the eyes of government entity. This gives them special benefits such as the utilisation of commercial allowances such as subsidies, and commercial gas and electricity connections.

2. Removes Tax on Tax

Getting GSTIN for your business removes the cascading effect of tax that was prevalent during the VAT regime. Earlier ‘Tax on Tax’ was levied which has now been eliminated with the help of GST.

3. Higher Threshold for Registration

Earlier, businesses with a yearly turnover of ₹5 lakh or more was liable to pay VAT. Now, the traders and businesses who have registered GSTIN get a threshold of up to ₹20 lakh. This exempts all the small traders and service providers.

4. Composition Scheme

By availing the Composition Scheme, small businesses with a turnover up to ₹75 lakh can lower their taxes by filing returns.

5. Simple and Easy Online Procedure

The whole GSTIN registration process is process is simple and can easily be done online. This is especially helpful for businesses who wish to move to electronic accounting. The best part about this is that they can also go online without having to travel and make rounds for filing their annual returns.

6. Less Compliance

In the VAT and service tax regime, each business and tax authority (State and Centre) had their own compliances.

By getting GSTIN, businesses will be able to file a single consolidated return. There are approximately 11 returns now, out of which 4 basic returns apply to all businesses.

Penalties for Not Getting GSTIN Number for Online or Offline Selling

If you do not get GSTIN for their business, you would be heavily penalised. 10% of the total tax amount or ₹10,000, whichever is more. This applies to all the defaulters who either evade tax partially or fully. In found out that a business is deliberately engaging in fraud, the penalty may go up to 100% of the total tax due.

FAQs on GSTIN Number Check

What is GST identification number?

All the businesses which has been registered under GST are provided GSTIN (full form: Goods and Services Tax). Under this, all businesses are need to register their business.

GSTIN Number can be generated for a particular business or multiple businesses. It has been made to ensure better compliance by businesses. You can go online for a GSTIN number check.How do I get a free GST number?

Free GST number can be achieved through GST Common Portal directly by applying and furnishing all the documents required for the registration. One just needs to log in to their official website: https://www.gst.gov.in/ and register themselves. It is an easy process and takes less time.

How do I get an individual GSTIN number?

As a business owner or a company, you can easily register your individual business or by visiting and registering at GST common portal online or through government facilitation centres known as GST Suvidha Kendra.

Anurag Vats is an in-house technical content writer at Techjockey who is fond of exploring the latest avenues in the field of technology and gadgets. An avid reader of fiction and poetry, he also likes to dabble with brushes and poetry and loves to cook in borrowed kitchens.... Read more