Summary: Zoho Books is robust accounting software that can significantly ease the burden for businesses in filing GST returns. Let’s explore how to file GSTR 1 with Zoho Books, a powerful tool that can simplify GST return filing for businesses of all sizes.

All GST registered businesses in India are required to accurately file their monthly or quarterly returns through various forms such as GSTR 1. The filing process involves accurate reporting of outward supplies of taxable gods or services made by businesses.

As this task demands precision and adherence to strict timelines, using efficient software like Zoho Books can significantly ease the burden of filing any GST return. Zoho Books is a GST compliant accounting and tax filing software that can help businesses generate GSTR-1 based on the transactions recorded.

In this article, we will explore how to file GSTR 1 with Zoho Books, a powerful tool that can simplify filing GST returns for businesses of all sizes.

What is Zoho Books?

Zoho Books is an accounting software which is designed by Zoho Corporation. It is a one-stop solution to manage accounting tasks and organize your business’ transactions. It offers a secure location for users to manage their company’s bills and invoices, reconcile bank statements, and control spending.

What is GSTR-1?

GSTR-1 is an official sales return document required to be filed by every GST registered business or person. Taxpayers must submit their sales & outward supplies details in the GSTR 1 sales return. The Goods and Service tax 1 must be filed every month or quarter.

Who Does Not Need to File GSTR-1?

All registered taxpayers under GST, except for the following, are required to file GSTR-1:

- Composition taxpayers

- Non-resident taxpayers

- Online information database and access retrieval service provider

- Input service providers or distributors (ISD)

- E-commerce operators who collect TCS

- Person whose TDS (Tax deducted at source) is deducted

What is the GSTR 1 Due Date?

Taxpayers who have an annual aggregate turnover of less than INR 5 Crore can file GSTR1 and GSTR 3B. The due date to file GSTR 1 return is the 13th of the consecutive month in the succeeding quarter. However, taxpayers can submit their invoices every month.

How to File GSTR-1 with Zoho Books?

Zoho Books offers a simplified GSTR 1 filing process. You can harness the power of Zoho’s intuitive platform to effortlessly manage and submit your GST returns with accuracy.

Step 1: Enable API Access

The first step to file GSTR-1 with Zoho Books is to enable API access for Zoho Books into the GST Portal. Here’s how you can do it:

- Visit GST Portal (https://www.gst.gov.in/) and login using your credentials.

- Visit My Profile in the top right corner

- Go to Quick Links tab and click on Manage API Access

- Check the Yes option under the Enable API Request.

- Select Duration and Confirm it

Step 2: Push Transactions to GST Portal

Once you have enabled the API, the next step is to push your transaction to the GST portal.

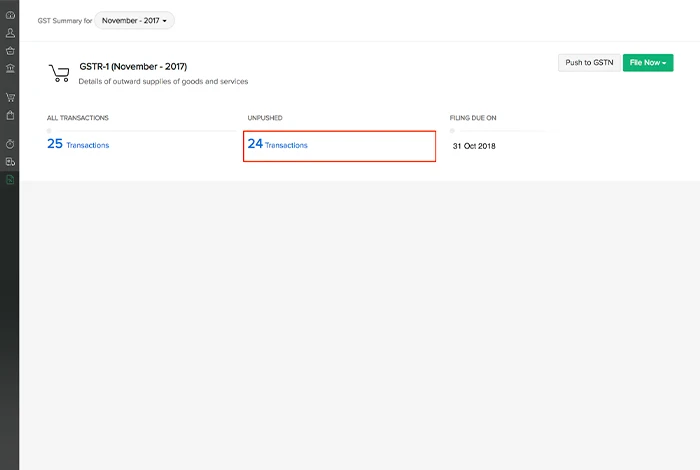

- Go to the GST Filing module in the left side bar of your Zoho Books organization

- Now select the Un pushed Transactions under GSTR-1 and you can view the HSN code, NIL, Transaction Summary, B2CS and Documents Issued.

- Enter the details of the documents issued before you push it to the GST

- Enter your Aggregate Turnover for the upcoming Financial Year

- Click Push to GSTN and wait for an OTP sent to your registered mobile number or email

- Enter the OTP received

- Finally, click the Push to GSTN button again to push your transactions

Once your transactions have been pushed into the GST portal, you will get a confirmation email and a notification in Zoho Books.

Step 3: File GSTR 1 Using Zoho Books

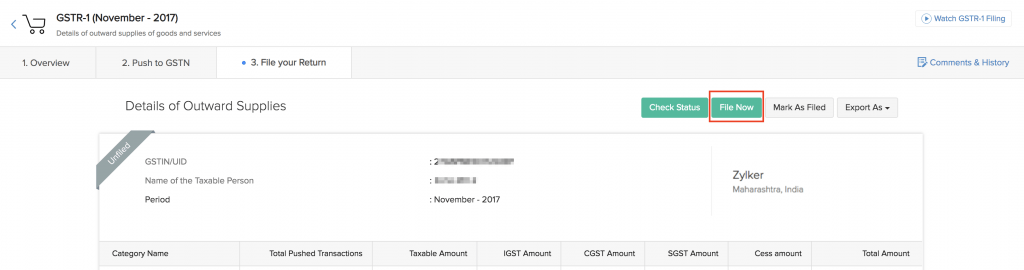

To file a GSTR 1 with Zoho Books, follow the steps below:

- Go to your Zoho Books dashboard and visit GST Filing

- Click on GSTR-1

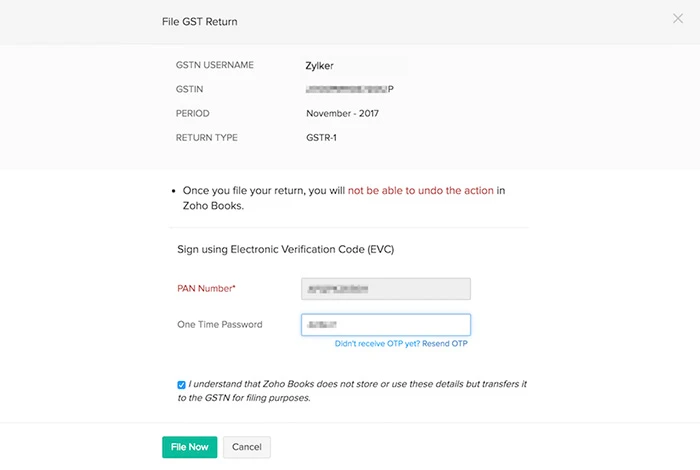

- Go to File Now and click on File Online button

- Enter your PAN card details and hit Generate OTP

- Now enter the OTP you received on your registered mobile number and click File Now option

- Your GSTR-1 will be filed

How to Mark Return as Filed in Zoho Books?

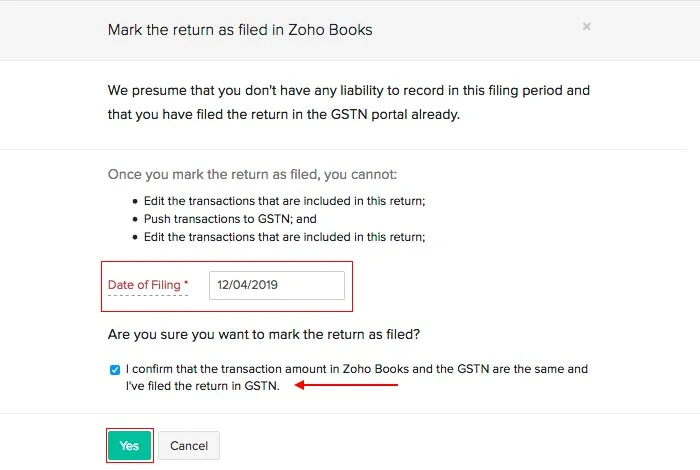

If you have filed the return directly through the GST portal, then you might have to mark the returns as filed into your Zoho Books’ dashboard. This will prevent you from any further confusion.

- Log into Zoho Books account once you have filed your return

- Navigate to the GST Filing section in the left panel

- Go to the File your Return tab and click Mark as Filed

- Now enter your date of filing in the pop-up

- Confirm your return filing by checking the box

- Click Yes and you’re done

Conclusion

Zoho Books emerges as a reliable ally which offers a seamless process to manage and submit GST returns efficiently. By simplifying tasks like enabling API access, pushing transactions, and filing returns, Zoho Books empowers businesses to meet compliance requirements effortlessly.

Make sure to stay updated with any changes in GST regulations and also seek support when you need any assistance while filing your GST returns. When you file GSTR-1 with Zoho Books, you can focus on growing your business while staying compliant with GST requirements.

FAQs Related to Filing GST with Zoho Books

When can I opt-in for Quarterly Return option for filing Form GSTR-1 return?

You can choose to file GSTR-1 quarterly if your business’ turnover during that financial year was more than INR 5 Crore.

Is Form GSTR-1 filing mandatory?

Yes, form GSTR-1 must be filed even if there is no transactional activity (Nil Return) by your business in the tax period.

What are the available modes of preparing Form GSTR-1?

You can prepare for GSTR-1 through various modes:

1. Through online entry on the GST Portal.

2. By uploading invoice and other Form GSTR-1 data using Returns Offline Tool.

3. By using third party applications like Zoho Books.

Shubham Roy is an experienced writer with a strong Technical and Business background. With over three years of experience as a content writer, he has honed his skills in various domains, including technical writing, business, software, Travel, Food and finance. His passion for creating engaging and informative content... Read more