What is GSTR – 11 and How to File It?

GSTR-11 is a core GST return form to be used only by a unique identity number (UIN)-registered entity, for example, embassies, UN bodies, and other notified entities.

It records information on taxable goods or services acquired by these entities, and they can claim a refund on the GST Paid. Although not mandatory on a quarterly basis, the correct filing of GSTR-11 for the relevant periods streamlines the refund claim.

This guide explains everything you need to know from when to file and why, to how to complete the form online.

GSTR-11 Meaning: What is GSTR-11?

GSTR-11 is a return form for entities with a Unique Identity Number (UIN). It contains a statement of all inward supplies (goods or services received) made to the UIN holder.

The main purpose of this form is to allow such organizations to claim refunds on the GST they have paid.

Only UIN holders are required to file GSTR-11, and it must be filed quarterly, but only for those quarters in which taxable inward supplies are received. If no such supplies are received in a quarter, filing the form is not mandatory.

When and Why Should You File GSTR-11?

There is no particular date to file GSTR-11. As it is a quarterly return, you can file it anytime once the quarter is complete. However, it is necessary to file before you apply for a refund claim through Form GST RFD-10.

What’s exceptional in this form?

If you haven’t received anything during a quarter, there is no need to file a NIL return.

However, for smooth processing of a refund, your GSTR-11 must be filed correctly and completely in respect of the quarter in which you made purchases.

Prerequisites Before Filing

Before you go forward to file GSTR-11, you must have the following:

- Active Unique Identity Number (UIN)

- Updated mobile number for EVC filing

- A valid Digital Signature Certificate (DSC)

Note: DSC is not required for UIN holders who haven’t provided PAN.

Step-by-Step Guide to File GSTR-11

GSTR-11 is entirely an online process through the GST portal to confirm or enter details of inward supplies. You can file it using a third-party GST software also.

Follow the steps below to file GSTR-11 through the official portal easily.

Step 1: Log in to the GST Portal

- Visit the government GST portal.

- Log in to the portal via your UIN and password.

- You will be navigated to the dashboard.

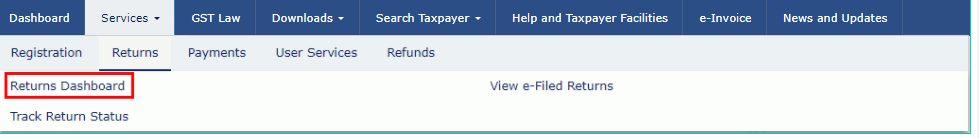

Step 2: Access the GSTR-11 Form

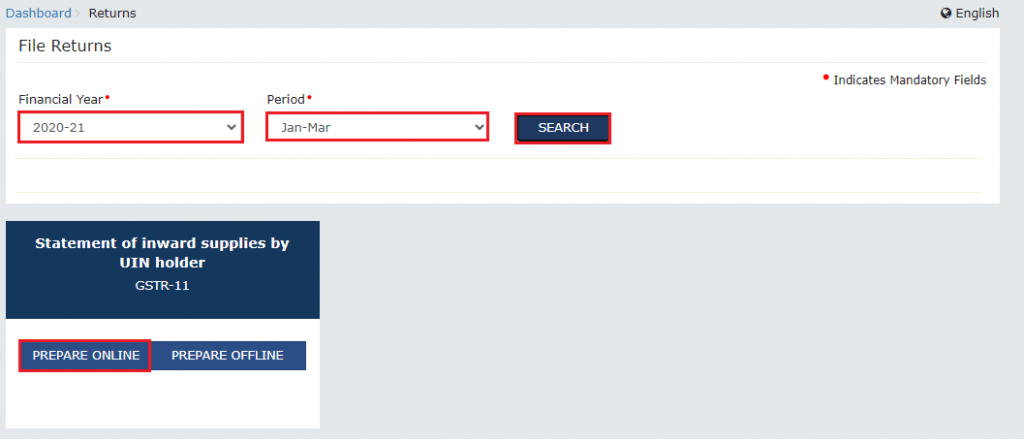

- Navigate to: Services > Returns > Returns Dashboard

- Choose the financial year and return filing period (quarter) for which you want to file the return.

- Click on ‘SEARCH’, then click ‘PREPARE ONLINE’ under Form GSTR-11.

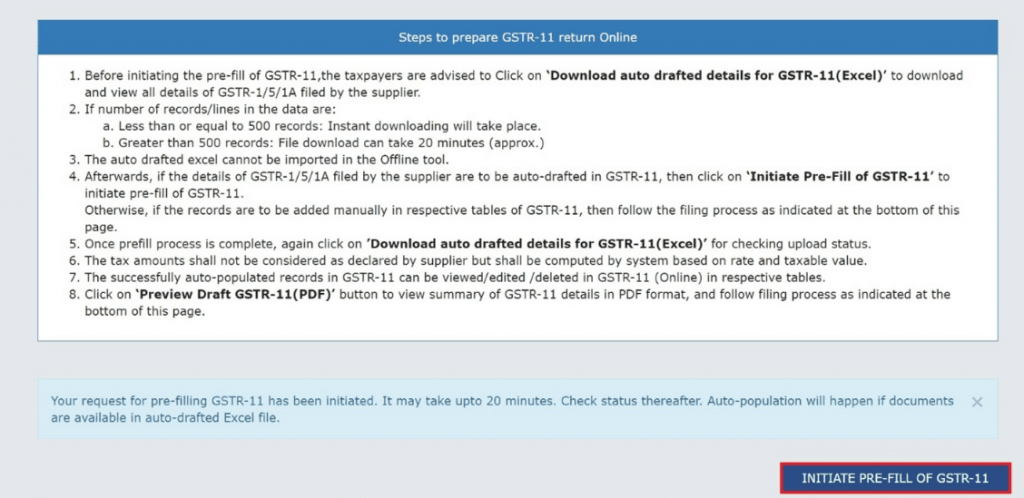

Step 3: Download Auto-Drafted Data (Optional)

- If any data is filed by your vendors in GSTR-1 or GSTR-5, you can download that.

- If you want to get your vendor’s invoice and note details, you have to click on the ‘DOWNLOAD AUTO DRAFTED DETAILS FOR GSTR-11 (EXCEL)’ button.

Option to download auto-drafted GSTR-11 details in Excel format from the GST portal.

- Review this data to cross-check with your own purchase records

Step 4: Initiate Pre-Fill or Enter Details Manually

- To pre-fill the form with supplier data, click on ‘INITIATE PRE-FILL OF GSTR-11’.

- This will auto-populate:

- Table 3A – Invoices received from registered persons

- Table 3B – Credit and debit notes received

- Table 3A – Invoices received from registered persons

- You may delete, update, or create new entries if you want to.

- You can also fill in the data manually without using the auto-fill option.

ClearTax GST

Starting Price

Price on Request

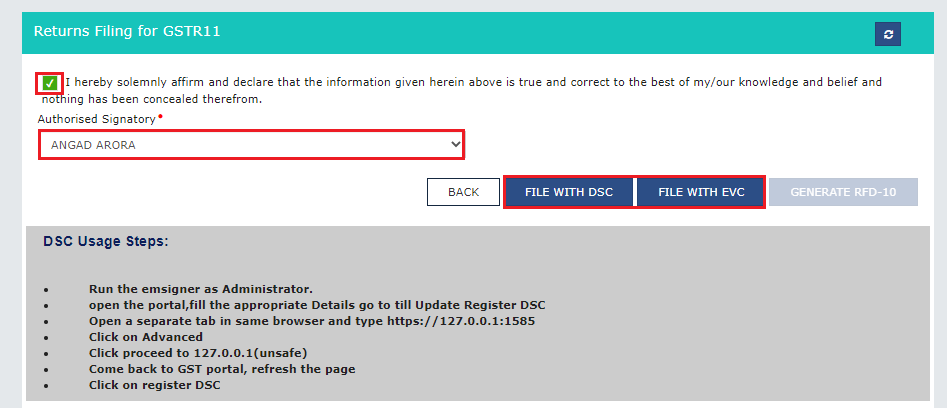

Step 5: Preview and File the Return

- Once all details are entered and verified:

- Click ‘PREVIEW DRAFT GSTR-11 (PDF)’ to download a summary of your return.

- Check for any errors or missing information.

- Tick the Declaration checkbox at the bottom.

- Select the Authorised Signatory from the dropdown menu.

- Click on the button ‘FILE WITH DSC’ in case you are using a digital signature or ‘FILE WITH EVC’ if you want to opt for OTP verification over your registered mobile/email.

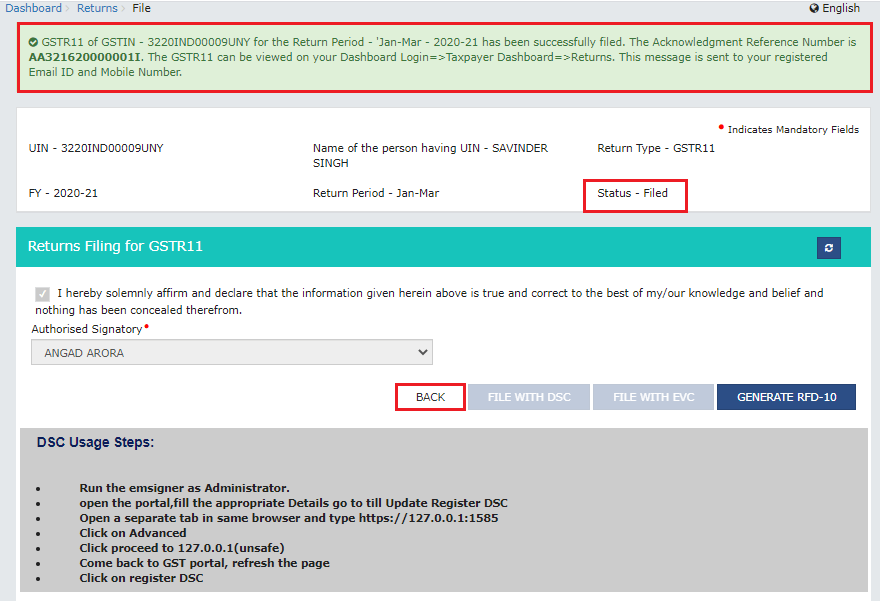

Post-Filing Actions:

- Once the filing is successful, you will see a generated ARN (Acknowledgement Reference Number) on the screen.

- You will get a confirmation SMS and email, too.

- A link will be enabled on your dashboard to file Form RFD-10 for claiming the refund.

This concludes the GSTR-11 filing process.

Auto-Drafted Details in GSTR-11

The GST portal auto-fills some of the details in GSTR-11 using information given by your suppliers in their GSTR-1 or GSTR-5 returns, to make it easier to fill out.

These auto-drafted details include:

- Table 3A – Details of invoices received from registered suppliers

- Table 3B – Details of credit/debit notes issued by suppliers

You can download these auto-drafted entries in Excel format by clicking the ‘Download Auto Drafted Details for GSTR-11’ button on the GST portal. However, before these entries appear, you need to manually initiate the pre-fill process by clicking ‘Initiate Pre-Fill of GSTR-11’.

Once populated, you can:

- View, edit, or delete any auto-filled data,

- Enter additional data manually if needed.

Note: Document already submitted or manually saved in GSTR-11 will not be overwritten through autofill. Rather, it will display the upload status as ‘No’ with a reason as ‘Document already exists’.

Conclusion

GSTR-11 is important for the UIN holders to remit refunds on GST they have paid within India. Filing GSTR-11 is mandatory to file in every quarter in which you receive taxable supplies, even though it may not be mandatory in every quarter.

Hence, it is advisable to file GSTR-11 before you claim a refund. The process has been simplified with auto-drafted data and online tools. Only ensure that all the information is revisited twice before submitting, since you are not allowed to revise it once you file it.

UIN holders must remain in compliance with GSTR-11 to receive timely refunds and operate GST without any hassles.

FAQs

Is it mandatory to file GSTR-11 every quarter?

Yes, it is mandatory if you have received taxable supplies for a quarter. However, you do not need to file a NIL return if you did not make any purchases.

Can I edit auto-drafted details?

Yes, UIN holders are allowed to edit or delete the auto-populated entries where necessary.

Do I need to pre-fill data from GSTR-1/5?

No, it’s optional. You can either use the ‘Initiate Pre-Fill’ option or enter the data manually.

How is GSTR-11 signed?

The form can be signed using either a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC).

Can I revise GSTR-11 after filing?

No, once you have filed the form GSTR-11, it cannot be revised.

Mehlika Bathla is a passionate content writer who turns complex tech ideas into simple words. For over 4 years in the tech industry, she has crafted helpful content like technical documentation, user guides, UX content, website content, social media copies, and SEO-driven blogs. She is highly skilled in... Read more