What is GSTR-9 and How to File It on GST Portal?

Every journey, every story, every dream has a grand finale, and your GST journey is no different. Case in point: GSTR-9 annual return.

Serving as an extensive summary of all your monthly and quarterly filings, GSTR-9 is not just a form but an annual GST report card of your business, rating your financial discipline and growth over the year.

Now, the idea of filing it on the GST portal might look puzzling to some, but it is, in truth, quite manageable with the right guidance. Read on as we provide the same to you, no jargon, just smart compliance.

What GSTR-9 Mean?

GSTR-9 is an annual return form that every regular GST-registered Indian taxpayer must file at the close of a financial year. It serves as a unified declaration of all the monthly and quarterly GST returns, including GSTR-1, GSTR-3B, etc., shedding light on outward supplies, inward supplies, input tax credit (ITC), tax paid, refunds claimed, and demands raised in the year.

Filing GSTR-9 means providing an elaborate, year-end snapshot of your GST transactions. This return, as such, is not a mere compliance document, but a self-assessment tool that makes sure that all your GST dealings are reconciled and clear.

GSTR-9 Applicability: Who Should File GSTR-9 Annual Return?

The GSTR-9 applicability criteria are as follows:

The following set of people must file the GSTR-9 form mandatorily…

- All regular GST-registered taxpayers with an annual turnover above INR 2 crore

- SEZ units and developers

- Taxpayers who switched from the composition to the regular scheme during the year (for the period under the regular scheme)

The following set of people is exempted from GSTR-9 form filing…

- Composition scheme taxpayers

- Input Service Distributors (ISD)

- Casual taxable persons

- Non-resident taxable persons

- Persons paying TDS/TCS under sections 51/52

What are the Different Types of GSTR-9?

There are 4 types of GSTR-9 annual return forms under the GST law. Please refer to the table given below to learn more about them…

| Form | Applicability |

|---|---|

| GSTR-9 | Filed by regular taxpayers (standard GST registration) |

| GSTR-9A | Filed by composition scheme taxpayers (discontinued after FY 2018-19) |

| GSTR-9B | Filed by e-commerce operators required to collect TCS |

| GSTR-9C | Filed by taxpayers with turnover above INR 5 crore (audit & reconciliation) |

To read more about GSTR-9C, please read our blog.

What is GSTR-9 Due Date?

GSTR-9 due date falls on Dec 31st of the year that follows the relevant financial year. For example, Dec 31, 2026, would be the due date for GSTR-9 of FY 2025-26.

Yet the government may act via notification to declare a GSTR-9 extension on the GST portal. One should therefore keep checking the website to stay updated.

GSTR-9 Late Fee and Penalty

Delay in submitting GSTR-9 could lead to late fines, interests, and punishment that can be detrimental to the overall financial position of your company. Take a look at all the penalties below…

- GSTR-9 Late fee: GSTR-9 late fee is INR 50/day for businesses with turnover up to INR 5 crore, INR 100/day for those with INR 5–20 crore, along INR 200/day for businesses whose turnover exceeds INR 20 crore. However, the GSTR-9 late fee is capped within all the above cases. It is fixed at a rate of 0.04 and 0.5% of turnover in the relevant state or UT.

- Interest: You would also have to pay an interest of 18% per annum on any outstanding tax liability.

- Non-filing: In case, you completely fail to file the GSTR-9 annual return, you will be served with notices, audits, and further penalties.

GSTR-9 Format: Details to be Provided

Here’s a simple breakdown of the GSTR-9 format for your understanding…

| Section | Table | Details Required |

|---|---|---|

| Part I | 1-3 | Basic details (GSTIN, legal/trade name, FY) |

| Part II | 4-5 | Outward and inward supplies as declared in returns (GSTR-1, GSTR-3B) |

| Part III | 6-8 | ITC availed and reversed during the FY |

| Part IV | 9 | Tax paid as declared in returns |

| Part V | 10-14 | Transactions for the previous FY are declared in April-September of the next FY |

| Part VI | 15-19 | Other information: demands, refunds, late fees, HSN (Harmonized System of Nomenclature) summary, etc. |

Why is the GSTR-9 Form Important?

There are sundry ways in which the GSTR-9 form proves to be a tool of great significance in the GST ecosystem. Some of them are listed below for your convenience…

Legal Compliance

GSTR-9 is a compulsory filing requirement among taxpayers whose annual turnover exceeds INR 2 crore. Failure to comply may draw severe fines, interests, and legal implications as well. That is how GSTR-9 is meant to keep you on the right side of the law.

Transparency & Accountability

As already showcased in the GSTR-9 format given above, this form requires you to provide extensive details regarding your sales, purchases, ITC, and tax payments. This fosters greater transparency and accountability, enabling tax authorities to assess your reported information and check if you comply.

Critical for Audit Readiness

GSTR-9 is the backbone of GST audits. It consolidates all the information reported in various monthly and quarterly returns, providing a clear audit trail. Accurate GSTR-9 filing reassures auditors and minimizes the risk of additional scrutiny or penalties.

Reconciliation & Error Detection

The GSTR-9 filing process is a reconciliation exercise, allowing businesses to cross-verify data reported throughout the year. This helps identify discrepancies, mismatches, or errors in turnover, ITC, or tax paid, enabling timely corrections and reducing the risk of future disputes.

ClearTax GST

Starting Price

Price on Request

Facilitates ITC Claims

Accurate GSTR-9 annual return filing ensures your ITC claims are correctly reconciled with GSTR-2A/2B and your books. This avoids mismatches that could result in loss of credits or future litigation.

Enhances Financial Management

Compiling the GSTR-9 form encourages businesses to maintain meticulous records, which not only aids compliance but also improves overall financial management and decision-making.

Maintains Reputation & Standing

On-time and accurate filing of GSTR-9 can help companies get into the good books of tax officials, making it easy for them to operate and get access to upcoming benefits or plans.

What are the Prerequisites of Filing GSTR-9

Before starting the GSTR-9 filing process, ensure…

- All monthly/quarterly returns (GSTR-1, GSTR-3B) for the year are filed.

- Books of accounts are reconciled with GST returns, especially ITC and turnover.

- Download GSTR-1, GSTR-3B, and GSTR-2A/2B data for cross-verification.

- Any amendments or corrections in previous returns are noted.

- You have an active GSTIN as a regular taxpayer.

GSTR-9 Filing Process: How to File GSTR-9 on the GST Portal?

GSTR-9 filing process might seem difficult to execute on the surface, but by referring to the steps listed below, you can perfectly nail it. Here’s how…

Step 1: Visit www.gst.gov.in and log in with your GST credentials.

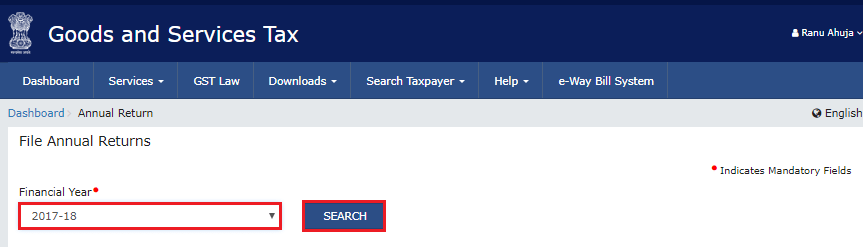

Step 2: Go to Services > Returns > Annual Return.

Choose the relevant financial year for which you are filing the GSTR-9 annual return

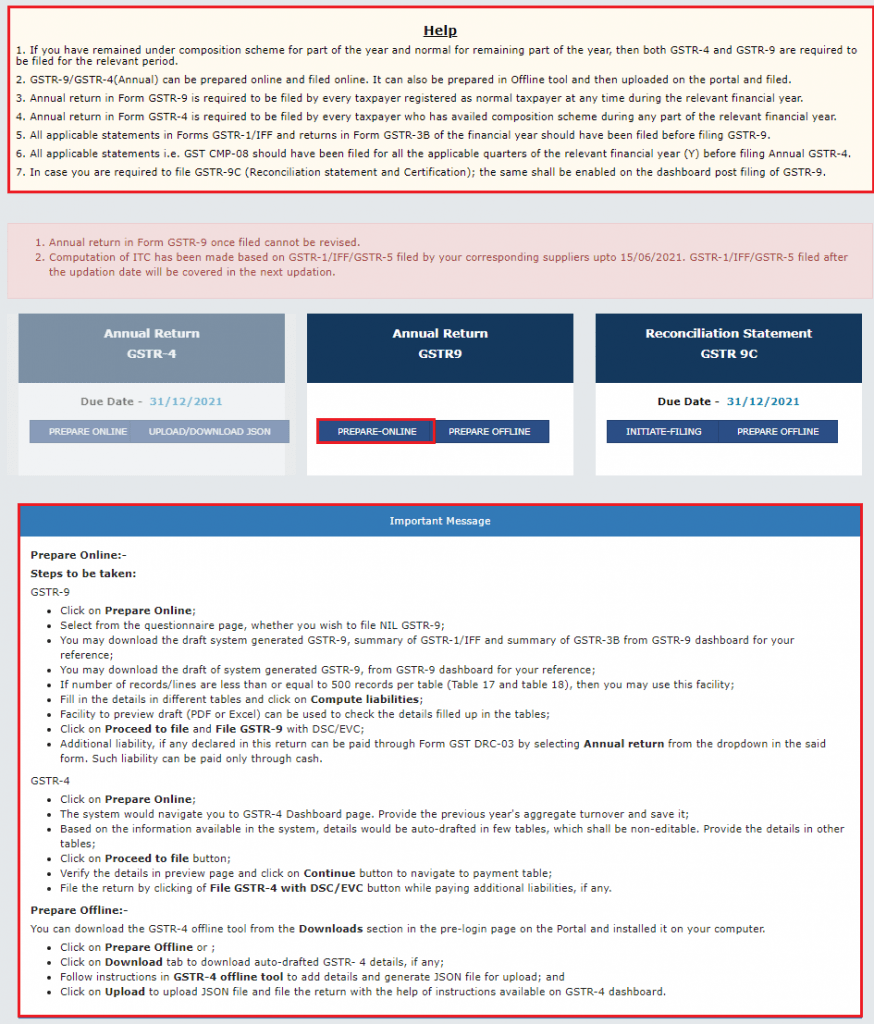

Step 4: Choose Prepare Online for direct entry or download the offline utility for bulk data

Step 5: If you had no transactions, select Yes for Nil Return and proceed.

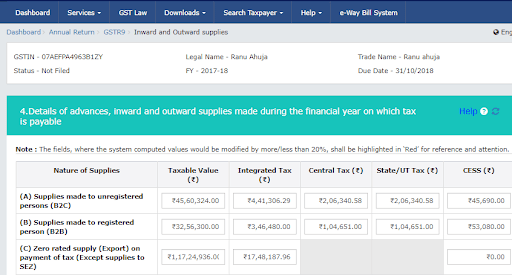

Step 6: Complete each column in accordance with the GSTR-9 format given above. You will get auto-populated data from GSTR-1, GSTR-3B, and Table 8A (ITC) too.

Step 7: Manually correct any missing/mismatched information.

Step 8: Cross-check all values with your books and financial statements. Reconcile ITC with GSTR-2A/GSTR-2B and your accounts.

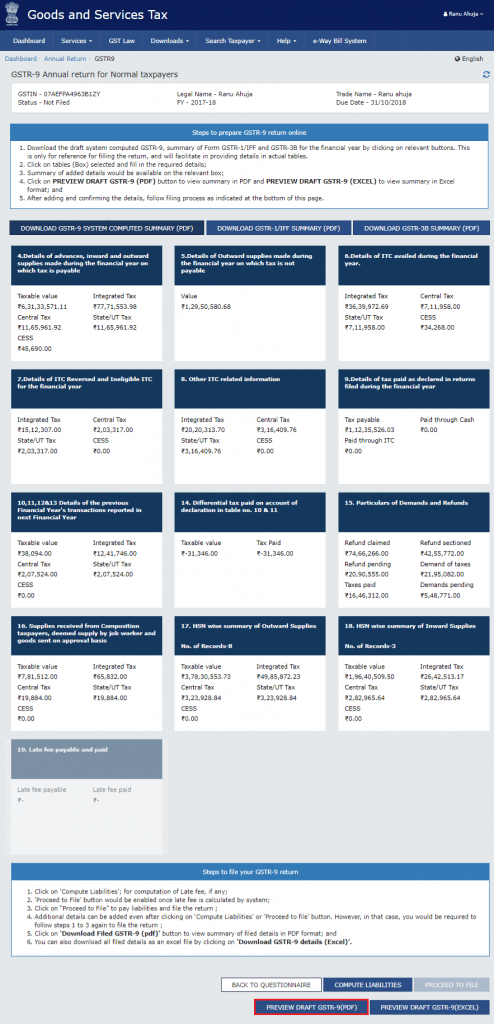

Step 9: Compute liabilities and pay late fees (if any).

Step 10: Preview the GSTR-9 draft and submit it electronically.

Step 11: You can finally file the return using a Digital Signature Certificate or an Electronic Verification Code.

Step 12: Download and save the acknowledgment receipt.

Suggested Read: What is GSTR-8 and How to File It on GST Portal?

Common Mistakes to Avoid While Filing GSTR-9

To err is to human, but when it comes to tax returns, it is essential to be as accurate as is humanely possible. Below are some common mistakes to avoid for hassle-free filing…

- Not reconciling GSTR-2A / GSTR-2B with ITC claimed, it can lead to incorrect ITC claims due to a mismatch with supplier data.

- A mismatch between GSTR-1 and GSTR-3B can cause discrepancies in reported sales and tax payments

- Mismatch in turnover figures can result in inconsistencies between GST returns and financial statements.

- Unreflected Input Tax Credits in GSTR-2A/2B might get disallowed if not supported by supplier filings.

- Non-disclosure of additional liabilities can attract penalties for unpaid or underreported tax dues.

- Overlap in Tables 6(B) and 6(H) is basically misrepresenting ITC availed and reclaimed, affecting accuracy.

- Difficulties in HSN summary reporting can lead to errors in classification and compliance issues.

- Filing without verifying with audited financial statements risks filing incorrect data.

- Submitting before thoroughly reviewing can make mistakes permanent as GSTR-9 cannot be revised.

Suggested Read: Please read more about GSTR-1 and GSTR-3B

What is the Difference Between GSTR-9 and GSTR-9C

GSTR-9 and GSTR-9C both ensure annual GST compliance, but the two forms vary significantly. While GSTR-9 is your annual summary, GSTR-9C acts as an audit and reconciliation statement for larger businesses.

For an in-depth comparison between GSTR-9 and GSTR-9C, refer to the table below…

| Feature | GSTR-9 | GSTR-9C |

|---|---|---|

| Purpose | Annual return (summary of GST transactions) | Reconciliation statement & audit report |

| Applicability | Regular taxpayers (above INR 2 crore turnover) | Taxpayers with turnover above INR 5 crore |

| Audit Required | No | Yes (by CA or cost accountant) |

| Filing | By taxpayer | By the taxpayer and the auditor |

Conclusion

All in all, filing GSTR-9 isn’t just a task; it is your business’s annual GST journey told right. From understanding GSTR-9 applicability to mastering the GSTR-9 filing process, every detail counts here. So, always keep an eye out for any GSTR-9 extension update, and don’t wait for the deadline to knock.

PS: If you need help with a GST software to accomplish the same, contact the Techjockey product team today itself!

FAQs

What is the turnover limit for GSTR-9?

Each and every registered taxpayer who has an annual turnover of over INR 2 crore is obliged to file GSTR-9.

Who is liable for filing GSTR 9?

GSTR-9 should be filed by all regular registered taxpayers under the GST, except composition taxpayers, casual taxable persons, and non-resident taxable persons.

Is CA required to file GSTR 9?

No, a Chartered Accountant is not required to file GSTR-9. However, if you are filing GSTR-9C, it must be certified by a CA or CMA.

What is GSTR 9 with an example?

GSTR-9 is an annual GST return summarizing all monthly or quarterly returns filed during the financial year. For example, if a business files GSTR-1 and GSTR-3B every month, GSTR-9 consolidates this data for the entire year.

Is GSTR 9 an audit?

No, GSTR-9 is not an audit; it is an annual return. The audit component comes with GSTR-9C, required for businesses with turnover above INR 5 crore.

Can ITC be claimed in GSTR 9?

No, Input Tax Credit (ITC) cannot be claimed in GSTR-9; it is only a summary return. ITC must be claimed in monthly returns like GSTR-3B during the financial year.

How to calculate turnover for GSTR 9?

Turnover for GSTR-9 is calculated by adding the total value of taxable, exempt, export, and interstate supplies made during the financial year, excluding inward supplies under reverse charge.

Is HSN mandatory in GSTR 9?

Yes, reporting HSN (Harmonized System of Nomenclature) codes is mandatory in GSTR-9 for taxpayers with turnover above INR 5 crore. Others may provide it optionally.

What is Table 4 in GSTR-9?

Table 4 of GSTR-9 captures details of outward supplies made during the financial year, including taxable, exempt, and nil-rated supplies, as reported in GSTR-3B. It helps reconcile annual sales with monthly returns.

Can we reverse ITC in GSTR 9?

No, ITC cannot be reversed in GSTR-9. GSTR-9 is a summary return and does not allow any new claims or reversals. Such adjustments must be made in GSTR-3B during the financial year.

What is the penalty for GSTR-9?

The penalty for late filing of GSTR-9 includes a late fee of INR 50 to INR 200 per day depending on turnover and capped at a percentage of turnover. Additionally, interest at 18% per annum is charged on any outstanding tax liability.

Can GSTR 9 be revised?

No, GSTR-9 cannot be revised once filed. Any errors or omissions must be addressed through other means like amendments in GSTR-1 or GSTR-3B of the relevant financial year.

Yashika Aneja is a Senior Content Writer at Techjockey, with over 5 years of experience in content creation and management. From writing about normal everyday affairs to profound fact-based stories on wide-ranging themes, including environment, technology, education, politics, social media, travel, lifestyle so on and so forth, she... Read more