What is ITR-3 & Who Can File It in FY 2024-25?

Too many forms, too many rules, and strict deadlines while filing ITR could be overwhelming. But among all, choosing the right type of ITR form is the most important step.

ITR-3 is one form out of the seven types that confuse most taxpayers. Who exactly needs to file it? What makes it different from the other ITR forms? And are there any new changes you should know about the FY 2024-2025?

These common questions arise if you are going to file the ITR-3 form. This blog post will walk you through everything about ITR-3, from its definition to who can file it and who cannot.

Let’s begin.

What is the ITR-3 Form?

ITR-3 form is for individuals and Hindu Undivided Families (HUFs) who earn from a business or a profession. It’s specifically designed for the income received from the profits and gains of a business.

So, the ITR-3 form is for you if you run a shop, showroom, are a freelancer or a trader, or run a business as a doctor, lawyer, or architect.

Who Can File ITR-3?

You may think ITR-3 is for whom? Here’s a more detailed list of explaining ITR-3 is for:

- ITR-3 form is for individuals and HUFs who have a business or a profession.

- For freelancers who get income from projects or clients.

- Those who generate income from dividends, interest, or house property, whether single or multiple.

- For people who earn from F&O trading, intraday trading, or share trading.

- Self-employed doctors, lawyers, designers, architects, and other professionals.

- Individuals who receive remuneration, interest, or commission from a partnership firm but not from LLPs.

- For taxpayers with capital gains from selling their property, shares, or mutual funds.

- Residents, non-residents, and even those with foreign income or assets.

The process of ITR-3 filing becomes easier when you use an income tax software that automates most of the tasks for you. You can also use the government portal directly to file ITR.

Who cannot File ITR-3?

It’s just as important to know who is not eligible:

- Salaried employees who do not earn from a business or profession do not come under ITR-3 applicability.

- Individuals with only capital gains, interest, or rental income.

In simple words, if you earn from sources limited to salary, pension, or basic investments, you don’t need Form ITR-3.

Due Date ITR-3 Filing in FY 2024-25

ITR-3 filing last date for taxpayers who do not require an audit is 15 Sept 2025. For taxpayers who require an audit can file it till 31 October 2025.

Filing ITR late will cost you penalties. It is always advisable not to wait until the last moment. Filing ITR-3 early can give you enough time to correct any errors found in the form and also keep stress away.

Major Changes in ITR-3 for AY 2025-26

Tax laws do not remain the same over the years. They can evolve with time and new financial updates by the government.

Here’s what’s new this time around:

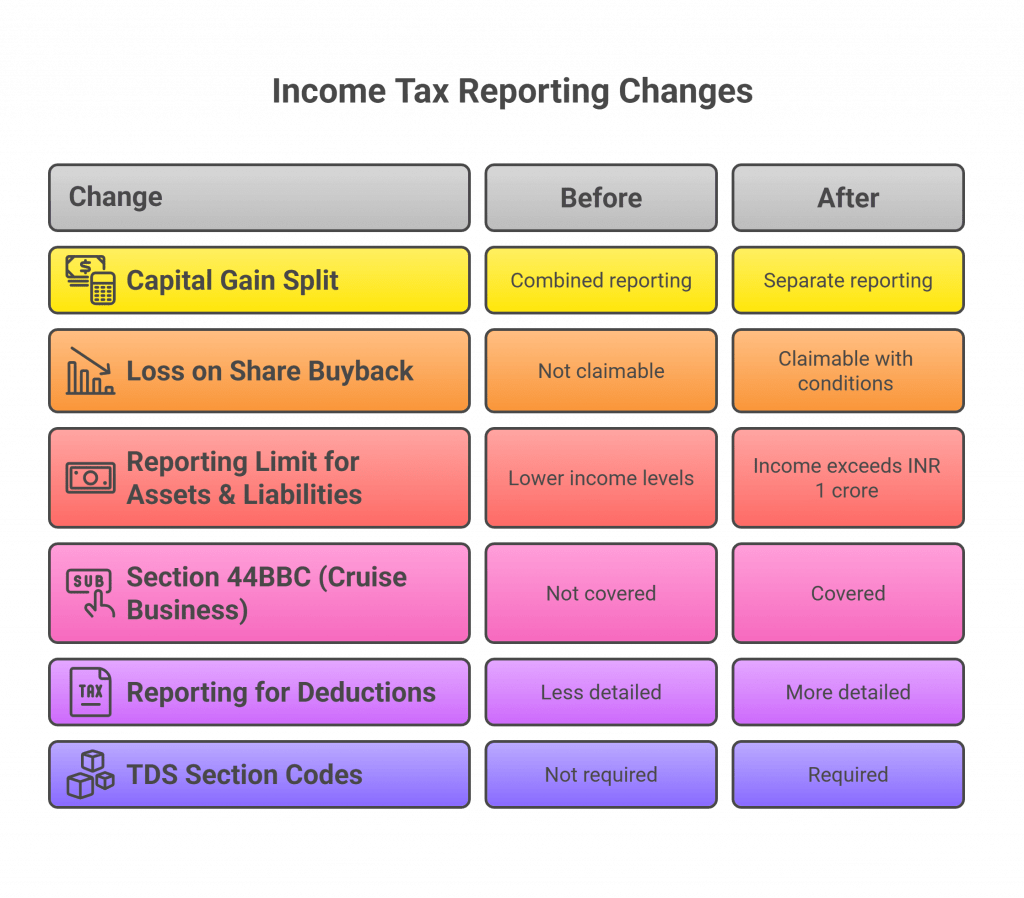

1. Capital Gain Split (Before/After 23rd July 2024)

You have to now report capital gains separately depending on whether they occurred before or after 23 July 2024. This change aligns with the Finance Act, 2024, to make tax treatment more transparent.

2. Loss on Share Buyback (From 1st October 2024)

If you suffer a capital loss from a share buyback, you can now claim it, but only if you report the related dividend income under Income from Other Sources. This ensures consistency between income and loss reporting.

3. Higher Reporting Limit for Assets & Liabilities

Previously, detailed disclosure of assets and liabilities was required at lower income levels. Now, you only need to provide this information if your total income exceeds INR 1 crore.

4. Addition of Section 44BBC (Cruise Business)

A niche update: non-resident cruise operators are now covered under a presumptive taxation scheme. 20% of passenger receipts are deemed taxable under Section 44BBC. While this won’t affect most taxpayers, it’s worth noting for those in this sector.

5. Enhanced Reporting for Deductions

Claiming deductions under sections like 80C (investments), 10(13A) (house rent allowance), etc.? You’ll now have to provide more detailed information. This reduces errors and ensures only eligible taxpayers claim deductions.

6. Reporting TDS Section Codes

A new requirement asks you to report the TDS section code in Schedule-TDS. This makes it easier for both you and the Income Tax Department to reconcile taxes deducted at source.

Key Updates Introduced in Earlier Years (Still Applicable)

Alongside the latest changes, a few updates from recent years are still in play:

- Schedule VDA: A special section to report income from crypto and other Virtual Digital Assets (VDAs). Every transaction, with purchase/sale dates, must be reported.

- Opting Out of the New Tax Regime: The form now includes questions about whether you opted out in previous years.

- Disclosure for Foreign Institutional Investors (FII/FPI): They must provide their SEBI registration number.

- Balance Sheet Reporting: Advances from related parties under Section 40A(2)(b) must be shown under Advances.

- Intraday Trading: A new Trading Account section requires turnover and income reporting.

Why is Filing ITR-3 Important?

Some taxpayers wonder that if TDS is already deducted, then why they should file ITR. Here’s why filing is important:

- It’s legally mandatory if your income falls under ITR-3 eligibility.

- You can claim refunds if excess tax is deducted.

- It builds a financial record, helpful for loans and visas.

- It ensures compliance and avoids penalties.

Final Thoughts

The ITR-3 form might look like a long, time-consuming, and complex form to file. But once you break it down, it’s a structured method of informing the government about your income, spending, and taxes.

Whether you’re a freelancer, business owner, or someone earning from trading, this form helps you to stay compliant. So, it’s high time to gather your documents, understand the latest updates, and file your return before the deadline.

Mehlika Bathla is a passionate content writer who turns complex tech ideas into simple words. For over 4 years in the tech industry, she has crafted helpful content like technical documentation, user guides, UX content, website content, social media copies, and SEO-driven blogs. She is highly skilled in... Read more