Summary: Best Automated Algo Trading Software includes Zerodha Streak, AlgoTest, AlgoTraders, RoboTrade, Robotrader, Tradetontech, Omnesys Nest, Odin, MetaTrader 5, Algonomics, Etoro and Algobulls. These platforms offer a range of features to suit different trading needs and levels of expertise.

If you are a stock trader, you might have heard about algo trading, which has gained great popularity in recent times. So, exactly what is algo trading or automated trading, and how does it work?

Here, in this article, we’ll introduce you to the same and some of the best algo trading software in India that help you make more profits in the Indian stock market. So, let’s get started.

What Is Algo Trading Software?

Algo means algorithm, and trading refers to a process in which stock trading is done using algorithm-based software. Algo trading software automates all your activities as per some pre-programmed trading instructions.

These instructions are based on certain factors like price, time, volume, or any other mathematical model. Traders can set their algorithms that can buy and sell orders when the desired conditions are met.

With automated trading software, traders don’t need to continuously monitor live prices or graphs to place their orders manually. Algorithm trading can automatically do it for you when it identifies the right opportunity to trade.

It helps traders to increase their speed and accuracy, and never miss an opportunity to make a good deal.

12 Best Algo Trading Software in India for Automated Trading

| Algorithmic Trading Software | Best Algorithmic Trading Platform for |

|---|---|

| Zerodha Streak | Back Testing |

| AlgoTest | Algorithmic Trading |

| AlgoTraders | Reliable App for Trading Algo |

| RoboTrade | Automated & Manual Trading |

| Robotrader | Cost Effective Algorithmic Trading App |

| TradeTron Tech | Event & Quant Based Algo Trading |

| Omnesys Nest | Automated Software for Indian Markets |

| ODIN | Risk Management |

| MetaTrader 5 | Professional Traders |

| AlgoNomics | Using Multiple Trading Strategies |

| EToro | Copy Trading |

| AlgoBulls | Deploying Strategies for Various Assets |

Let’s check out a list of the best algo trading software in India with its pros and cons. It will help you find the best-automated trading software that will perfectly suit your requirements and styles.

Visit For: Fixed Asset Management Software | Investment Management Software | Stock Market Software

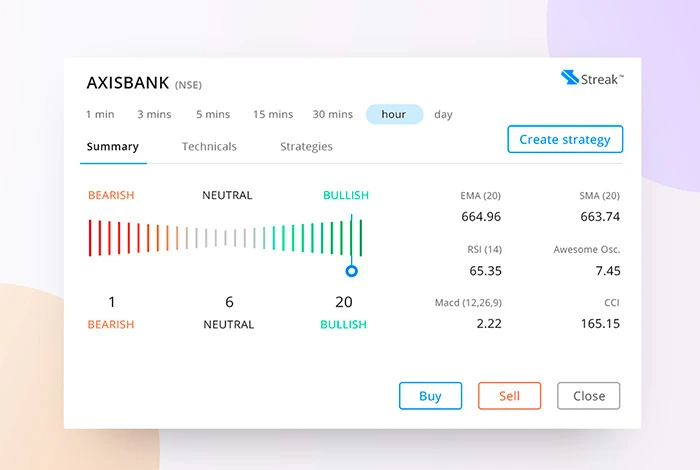

Zerodha Streak – Best for Back Testing

Zerodha Streak, one of the best algorithm software for trading in India that is only available to Zerodha subscribers. Traders can manage and plan their trades even when they are on the go.

This powerful automated trading software in India ensures that you don’t miss any opportunity with features like notifications, advanced strategy creation, multi-time frames, dynamic contracts, and more.

Features of Zerodha Streak

- No-Code Strategy Builder: Allows traders to create trading strategies without any coding knowledge through a user-friendly interface.

- Backtesting Engine: Enables backtesting of strategies on historical data to evaluate performance.

- Real-Time Alerts: Provides real-time notifications when strategy conditions are met.

- Technical Indicators: Supports over 80 technical indicators for strategy formulation.

- Paper Trading: Offers a virtual trading environment for testing strategies without real capital.

- Scanner Tool: Assists in stock selection based on predefined criteria.

Zerodha Streak Pros and Cons

Pros

- Suitable for both beginners and professional traders

- Access to various technical trading indicators

- Customization available for the scanning tool

- Effective back testing

Cons

- Manual intervention in trading is required

- It is not accessible for non-Zerodha subscribers

Zerodha Streak Pricing: Zerodha Streak offers two plans, Regular and Ultimate that cost ₹690 and ₹1400 per month. The Ultimate plan offers extra back tests per day, live strategies, unlimited scans, etc.

AlgoTest – Best for Algorithmic Trading

AlgoTest is a highly premium algorithmic trading software designed for beginners to simplify the algo trading process. With a strong community of satisfied clients, the software prioritizes delivering customer-centric service.

The software offers backtesting, forward testing, and live trading options and works well with various online trading solutions. Whether fine-tuning existing strategies or exploring new ones, AlogTest offers valuable data-driven guidance, thereby helping users make informed decisions.

The best part about AlogTest is that it can be seamlessly integrated with leading Indian brokers like IIFL Securities, Upstox, Angel One, and more.

Features of AlgoTest

- Backtesting: Provides advanced backtesting capabilities on historical data with comprehensive analytics.

- Options Strategy Support: Designed specifically for options traders to test multi-leg strategies.

- User-Friendly Interface: Simplifies complex trading logic for retail traders.

- Data Visualization: Offers graphical representations of strategy outcomes.

- Custom Metrics: Allows the definition of custom parameters for performance evaluation.

AlgoTest Pros and Cons

Pros

- It offers 25 free backtests every week

- With AlgoTest, you can easily deploy strategies by integrating multiple brokers

- AlgoTest is fast, and you can easily perform a five-year backtest in less than a minute

- Provides access to the real-time data

Cons

- It offers less advanced features compared to its counterparts

- The platform does not support all strategies, thereby reducing importance for some traders

AlgoTest Pricing: AlgoTest provides four different plans to the users, and its pricing cycle is based on the total number of credits that will allow the users to use the software easily. Starter plan can be purchased for INR 299, and you will get 300 credits.

The Explorer Plan, on the other hand, will cost around INR 899 with 1000 credits. Its Pro Plan retails for INR 1999 and offers 2500 credits. Lastly, the 4th plan, which is the Premier plan, will cost you INR 4,999 with 7500 credits.

AlgoTraders – Best Reliable Algorithmic Trading Program

AlgoTraders is one of the best open source algo trading platforms in India with immense popularity. Its latest version uses an Esper engine that helps it to operate at a very high speed. It can process 5 lakh events every second.

Additionally, it offers great experience with its intuitive user interface and reporting capabilities.

Features of AlgoTraders

- Multi-Asset Support: Compatible with equities, forex, commodities, and cryptocurrencies.

- Machine Learning Integration: Incorporates AI and machine learning for advanced strategy optimization.

- Algorithm Marketplace: Offers pre-built algorithms for various trading styles.

- Risk Management Tools: Includes integrated tools to manage exposure and positions.

- API Access: Provides API access for custom integrations and system enhancements.

AlgoTraders Pros and Cons

Pros

- Customer support offers online documentation and training

- Highly customizable tool to test different trading strategies

- Technologies like Java, Grail, Spring, etc., make it reliable

- Cost-effective

Cons

- Manual supervision is required

- Users might face technical glitches

AlgoTraders Pricing: AlgoTraders pricing is available on request at the official website.

RoboTrade – Best for Automated & Manual Trading

RoboTrade is a new algo trading app in Indian market that automates the stop loss process. The platform allows traders to apply and test their own trading strategies through automated and manual trading. The software uses AI and robotic understanding to facilitate fully automated trading in NSE, MCX, BSE, and F&O markets.

Features of RoboTrade

- Comprehensive Automation: Automates both the execution and monitoring of trades.

- Multi-Broker Support: Integrates with multiple brokers for seamless execution.

- Real-Time Analytics: Delivers up-to-date insights on trading performance.

- Custom Script Support: Enables traders to code their strategies.

- Alert System: Notifies users of market movements and triggered trades.

RoboTrade Pros and Cons

Pros

- Provides real-time data

- Option available for both, automated and manual trading

- Possess a 95% success rate

- Quick order execution

Cons

- Poor customer support

Robotrader – Best Cost Effective Algo Trading Software

Robotrader by Tycoon Pacific is a popular automated algo trading software in India that comes with a multi-user plug-in feature that allows multiple traders to use the same tool. Further, traders can set a maximum risk percentage which will tell the tool when to stop trading.

In addition to this, this software also enables traders to customize their strategies by combining certain parameters, with zero coding.

Features of Robotrader

- Portfolio Automation: Optimizes and automates entire portfolio management processes.

- Advanced Charting: Provides in-depth technical analysis with dynamic charting tools.

- Customization: Supports scripting for highly tailored strategies.

- Order Management: Includes advanced order types such as bracket orders.

- Multi-User Plugin: Allows multiple traders to use the same tool simultaneously.

Robotrader Pros and Cons

Pros

- Run reverse trading without facing any technical issues

- Allows users to set a daily maximum risk and profit percentage

- No need of coding, you can just drag and drop the strategy combination

- Cost-effective options for traders

Cons

- No free option available

- Knowledge of technical analysis and programming required

RoboTrade Pricing: Users can request RoboTrade pricing on its official website.

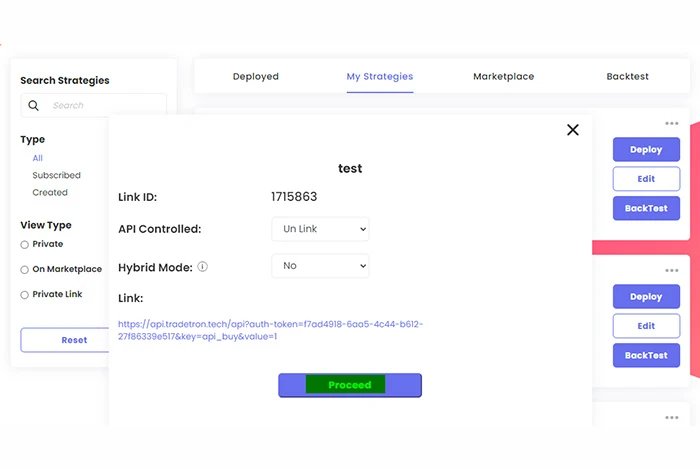

TradeTron Tech – Best for Event & Quant Based Algo Trading

Tradetron helps create and automate algo trading strategies without any code. With it, strategy creators can create and test conditions for a trading strategy and sell those to traders and investors.

Once tested, you can easily deploy strategies in the marketplace where other traders can use them.

Tradetron

Starting Price

₹ 300.00 excl. GST

Features of TradeTron Tech

- No-Code Strategy Builder: Features a drag-and-drop interface for creating automated strategies without coding.

- Cloud-Based Execution: Runs strategies on cloud servers for faster processing.

- Strategy Marketplace: Enables traders to share or purchase strategies on the platform.

- Performance Analytics: Provides detailed metrics for evaluating strategy effectiveness.

- Multi-Broker Compatibility: Supports integration with major Indian brokers.

TradeTron Tech Pros and Cons

Pros

- Easy-to-use features for beginner traders as well

- Access and customize a unique strategy developed by other traders

- Event and quant based algo strategies

Cons

- All major TradeTron features are available only in the paid version

- Free version allows you to run only one strategy that too with certain limitations

Read More: TradeTron Reviews: Unveiling Features, Benefits, and Performance

TradeTron Tech Pricing: TradeTron stock market algorithm software offers a free plan and four paid plans starting from ₹ 300. The paid plans allow users to create unlimited private strategies, conduct more back tests, make live auto executions, and more.

Omnesys Nest – Best Algo Trading Platform in India

Omnesys Nest, the best automated algo trading platform in India offers premium tools to enable multiple facilities to trade. Traders can run strategies such as order slicing, basket trading, 2I and 3I spreads, and more. With this automated trading software India, you can trade in exchanges like CDSL, NSE, and MCX.

Features of Omnesys Nest

- Institutional-Grade Platform: Designed for high-frequency trading and institutional investors.

- Market Data Integration: Offers real-time market data feeds.

- Algorithmic Strategy Support: Supports sophisticated trading strategies.

- Risk Controls: Built-in risk management and compliance monitoring.

- Exchange Integration: Seamless integration with exchanges and broker APIs.

Omnesys Nest Pros and Cons

Pros

- Versatile automated trading software for Indian market

- Ideal for professional experts

- Offers multiple programming models to give a strategic edge

- Generates detailed reports on financial data and market analytics

Cons

- Knowledge of programming and technical skills is required

- Requires users to pay a certain subscription amount

Omnesys Nest Pricing: Omnesys Nest offers three paid plans, annual, monthly, and lifetime starting from ₹15,000. Although you can also avail its 30–day free trial.

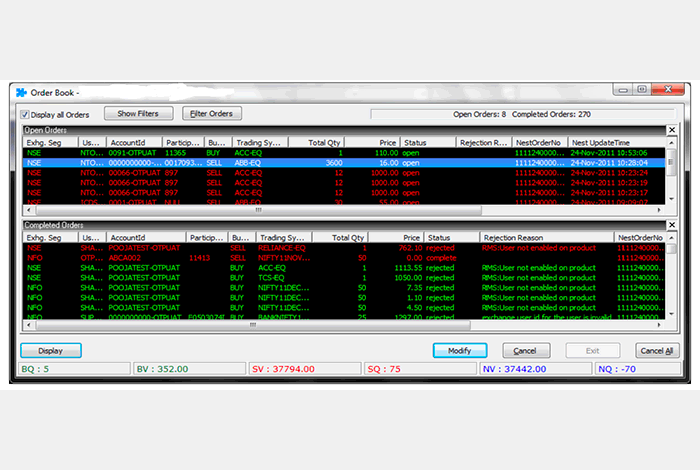

ODIN – Best for Risk Management in Algo Trading

ODIN allows traders to auto-execute trades based on their selected strategies. Traders can choose from a variety of strategies including spread, trading options, momentum, and execution based. With ODIN, users can completely control their direction of execution and automatically revise and modify their targets as per the execution plan.

Features of ODIN

- All-in-One Solution: Supports trading across multiple asset classes and markets.

- Algo Trading: Provides tools for automated strategy execution.

- Real-Time Monitoring: Tracks trades and portfolio performance in real-time.

- User Customization: Offers customizable dashboards and alerts.

- Broker-Neutral Platform: Compatible with various brokers for execution.

ODIN Pros and Cons

Pros

- In-built risk management feature

- Automatically calculate and execute complex strategies without human intervention

- Members can also trade on behalf of their clients

- Trade in currencies and commodities also

- API available for brokers

Cons

- Poor customer support

ODIN Pricing: To get the cost of ODIN algo trading, you can contact their support team on the official website.

MetaTrader 5 – Best for Professional Traders

MetaTrader 5 is a multi-functional algo software for trading that was formerly known as MetaTrader 4. This trading software allows traders to deal in commodities and stock, whereas the earlier one was a forex market-centric platform.

Additionally, it also offers services such as copy trading, freelance data for strategy developers, virtual hosting, trading robots, and more.

MetaTrader 4

Starting Price

Price on Request

Features of MetaTrader 5

- Multi-Asset Platform: Supports forex, stocks, and futures markets.

- Expert Advisors (EAs): Allows for the creation and deployment of custom trading bots.

- Backtesting and Optimization: Features advanced backtesting on historical data.

- Technical Indicators: Includes over 80 built-in indicators and drawing tools.

- Community Marketplace: Access to a marketplace of indicators and trading robots.

MetaTrader 5 Pros and Cons

Pros

- Advanced analytical tools

- Suitable for professional traders

- Allows users to generate and share reports

- Provides access to a custom graphical user interface

Cons

- The dashboard can be better

MetaTrader 5 Pricing: Brokers can get MetaTrader 5 price details by filling out a form available on their official website.

AlgoNomics – Best for using Multiple Trading Strategies

AlgoNomics is a free algo trading software that helps traders to prevent losses while trading with its diverse strategies. Users can define their own strategies or use the pre-defined strategies offered by the software.

In addition to this, traders can also use multiple strategies while trading which can be paused, stopped, or changed as per the user’s convenience.

Features of AlgoNomics

- Quantitative Strategies: Focuses on data-driven algorithmic strategies.

- Broker Integration: Direct integration with leading brokers for seamless execution.

- Risk Management Tools: Assists in managing drawdowns and position sizing.

- Custom Indicators: Allows traders to define proprietary indicators.

- Performance Reports: Provides detailed analysis of trading performance.

AlgoNomics Pros and Cons

Pros

- Simple and easy bulk trading

- Offers in-built risk management

- Access to pre-defined trading strategies

Cons

- Traders frequently face technical issues

- Scope for improvement in the user interface

AlgoNomics: You can fill in a contact form on AlgoNomics official website for pricing.

EToro – Best for Copy Trading

eToro automated trading software allows users to put their complete portfolio on autopilot with the copy trading feature. You can open an account with a minimum investment of $10, but you can begin with copy trading with $200 per trader.

You can follow some expert traders and mimic their trading style, and the algorithmic trading app without paying any charges to the platform.

eToro

Starting Price

Price on Request

Features of eToro

- Social Trading Platform: Enables copy-trading, allowing users to replicate successful traders’ strategies.

- Customizable Strategies: Supports manual and automated trading strategies.

- Cross-Asset Trading: Covers stocks, forex, ETFs, and cryptocurrencies.

- Comprehensive Dashboards: User-friendly dashboards to monitor performance and manage trades.

- API Access: Provides API support for developing custom trading solutions.

eToro Pros and Cons

Pros

- Charges zero fees to users for copy trading

- Easy account opening procedure

- Great customer support

- Social trading

Cons

- Users are charged high fees for inactivity and withdrawal

- Can hold cash only in USD currency

eToro Pricing: eToro is completely free, it doesn’t charge any commission or broker fees for algo trading.

AlgoBulls: Best for deploying strategies for various assets

AlgoBulls provides you with automated algorithms for trading. It can also be used for developing and deploying several trading strategies across various assets.

You can choose from different AI driven strategies and customize them with no coding experience required. With it, you also get a fixed income marketplace to easily invest in multiple bonds and non-convertible debentures.

Features of AlgoBulls

- AI-Driven Automation: Leverages artificial intelligence to optimize trading strategies.

- Multi-Market Coverage: Supports equities, derivatives, and commodities trading.

- Automated Execution: Automates the entire trading cycle from design to execution.

- Backtesting & Paper Trading: Offers robust backtesting tools and paper trading environments.

- Broker Integration: Compatible with leading Indian brokers for direct execution.

AlgoBulls Pros and Cons

Pros

- It can be used to build and monetize trading strategies

- Along with fixed trading strategies, it also helps with paper trading and back testing

- Includes 150+ trading indicators

- More than 500 algo strategies with 10 million plus customization options

- Helps you test your strategies before deploying them live on the trading market.

Cons

- Limited features available in its free plan

- Users have reported that the trading data provided by it is sometimes not accurate

Algobulls Algo Software for Trading Price: AlgoBulls offers a free plan. Its paid plan starts from INR 1180/month.

Compare Top Automated Algo Trading Software Price

| Algorithmic Trading Tool | Free Trial | Starting Price |

|---|---|---|

| Tradetron | Not available | INR 300/month |

| Algobulls | Not available | INR 1,180/month |

| Zerodha Streak | Not available | INR 690+ GST/month |

| AlgoTraders | Not available | Available on request |

| Omnesys Nest | Available | INR 15,000 |

Conclusion

The automated algo trading software is diverse, offering a range of solutions tailored to the unique needs of individual traders, professional investors, and institutions. From beginner-friendly platforms like Zerodha Streak and TradeTron Tech to advanced tools like MetaTrader 5 and AlgoTraders, there’s something for every skill level and trading style.

Each platform reviewed offers unique strengths, whether it’s powerful backtesting, AI-driven insights, or seamless broker integration. The ideal choice depends on your trading goals, technical expertise, and budget.

By leveraging the right algorithmic trading software, traders can automate strategies, minimize manual errors, and capitalize on market opportunities with precision and efficiency. Whether you’re just starting or are a seasoned trader, these platforms can help elevate your trading game to the next level.

Automated Algorithmic Trading Software Related Articles

Isha’s writing journey started way back in 2018 when she graduated in the field of Journalism & Mass Communication. Since then, she has been writing for all digital and print marketing assets including blogs, editorial reviews, landing pages, emailers, and more. She has contributed her writings to genres... Read more