Since Goods and Services Tax came into being, it created a lot of buzz. The impact of GST on retail sector is definitely positive. It has brought down total indirect taxes, increased supply chain efficiency and facilitated seamless input tax credit. But how will a retail shop ensure to be benefited by GST? That’s where a GST billing software comes into play.

A GST billing software and retail software which is compliant for retail shops makes it easier for you to keep track of transactions and pay more attention to your business growth. Billing software for retail shops can be used across multiple sectors, be it medical store, garments shop, jewellery shop, trade and distribution, textile shops or supermarket.

GST means different things to different people. Businesses which are registered as regular dealers need to file a GSTR-1 on a monthly basis if their turnover goes more than INR 1.5 Cr.

However, businesses with aggregate turnover less than INR 1.5 Cr have to file GSTR-1 return on a quarterly basis. Both types of businesses need to file their GSTR-3B every month.

Composite dealers are supposed to file GSTR-4 on a quarterly basis. E-Way bill has become compulsory for interstate and intrastate movement of goods worth INR 50,000.

GST billing software ensures business continuity with optimum accuracy. It can generate sales reports which would help in business analysis and business growth. Billing software for retail shop also ensures that your GST returns are in sync with your books of accounts. It also reflects the same data for filing IT returns.

Popular Features in GST Billing Software

If you want to make your retail store GST enabled, you need to track and process every process including your point of sale and billing. The best GST billing software must have the following features:

- Faster checkout: The best GST invoicing software generates batch wise invoices.. All POS accessories like a printer, EDS machine, and scanner are integrated together, so that the billing processes can happen faster.

- Inventory Management: Billing software for retail shops should be able to manage inventory levels, set reorder notifications to replenish stock and save your losses due to expiry.

- Reporting: Reporting is a feature in GST billing software which helps in analysing function of the business; be it finance, sales, purchase, inventory, and accounting reports.

- Cloud Based Services: Now, with the enormous cloud space available, you can access every information, and operate your business from anywhere and everywhere with the help of internet.

- Auto GST Calculations: The best GST invoicing software will enable you to perform all the GST related calculations within a second. You need to charge GST on each and every sale that you do. You should keep GST invoices to claim a GST credit for a supply. Auto GST calculations help to keep everything ready before month end and enable you to claim GST returns as well.

- GST Filing: A GST billing software will definitely have a GST portal which will help monitor your transactions and directly file returns from the billing software for retail shops. With the best GST billing software, you can save time in filing GST Returns by using prepared invoices. It can identify errors before uploading to GSTN. You can also avoid penalties & claim correct input tax credits.

Best GST Billing Software for Retail Shops

Billing software for retail shops helps with the management of both small and large stores. Billing and invoicing software makes billing fast and easier and ensures complete monitoring of stocks. GST billing software also assists in vendor relationship management. Here’s a comprehensive list of top five GST billing software for retail shops:

Tally ERP 9

Tally.ERP 9 is a trusted software which generates GST invoices and transactions as per the GST format. You can file GSTR-1, GSTR-3B and GSTR-4 on your own by exporting data to the GST portal. This GST billing software has unique error detection and error correction capabilities that ensure that you file your returns accurately. It can also assist in the following functions:

- Accounts Management: This includes GST invoicing and purchase & sales management. Tally.ERP 9 gives complete support for all types of GST invoices and transactions. It lets you set the current currency rate along with standard selling or buying rates.

- Compliance: This GST billing software ensures that you file your GST returns correctly on time. You can view transactions and get reports for the entire financial year.

- Supports Banking Transactions: This GST invoicing software gives payment advice and generates cash deposit slips. You can get rid of manual errors, save time and effort in a single click.

- Faster Access to Business Reports: You can make business decisions based on the reports that you get through this software. It allows you to access balance sheets, P/L statements and perform advanced data analytics to get an insight of your business.

- Inventory Management: You can set an infinite number of categories and batches in your inventory. You can also monitor your inventory from anywhere in the world.

Marg ERP 9+

With Marg ERP 9+ software, you can automate various ERP components. You can control the business functions of all aspects including inventory, sales, distribution, procurement, accounting, etc. Marg ERP 9+ performs the following function:

- Easy & Fast Billing: It can generate batch-wise invoices with detailed information.

- Manage inventory efficiently: You will be able to manage inventory levels, set reorder points to replenish stock and save loses due to product expiry.

- GST filing: It is possible to put transactions in the GST portal and directly file returns from Marg ERP 9+.

- Auto-Bank Reconciliation: There is an option of availing online banking option with auto-bank reconciliation facility with a lot of banks in this GST billing software.

- Expiry management: With the help of this billing software for retail shop, you can keep track of expiry date and timely return to supplier before the product expires.

- Smart Purchase: You can check offers and deals from suppliers, cross-check offers, get supplier wise reports and view pending returns.

- Cashier and Home Delivery: You will be also able to take a step towards customer experience with the help of cashier management and home delivery features.

- Barcode Management: It helps encode & centralize all products information in a barcode so that it becomes simpler for store owners to quickly & accurately track products.

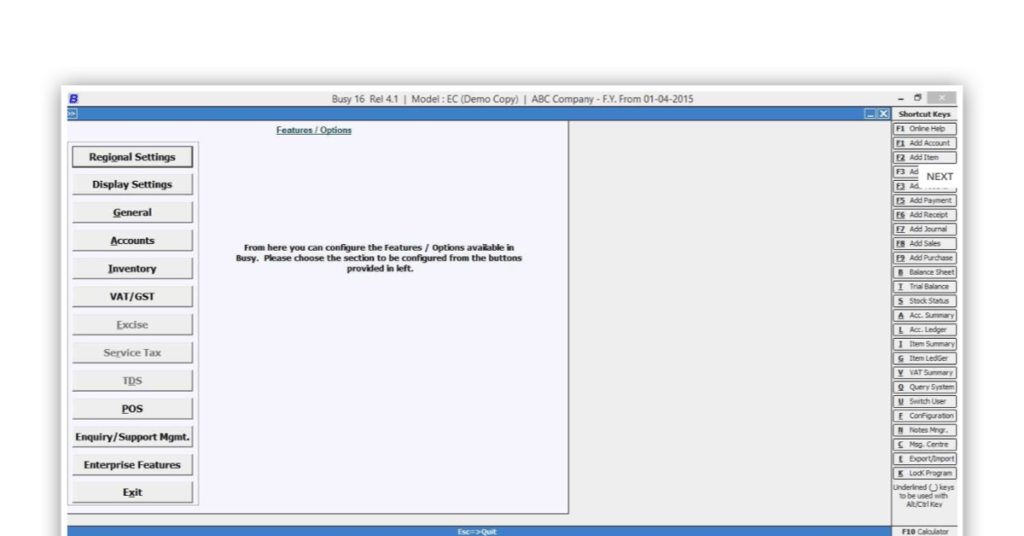

Busy Accounting Software:

Busy accounting software is a GST enabled software that can be used in micro, small and medium businesses. Busy accounting software is designed using a three-tier architecture in which the first-tier is the front-end accepting inputs from the user and giving the desired reports. The second tier is business logic that is invoked by the first tier to write or read data from the databases and the third tier is the actual databases where the data is stored.

Busy accounting software comes in 3 versions; basic, standard and enterprise.

Basic- It is suitable for micro and small businesses and only a single user can use it at once.

Standard- This version is suitable for small and medium businesses and is available in three variants: single, multiple and client-server.

Enterprise- It is designed for medium businesses and is also available in three variants i.e. single, multiple and client-server

This GST accounting software assists majorly with invoicing, payroll and inventory management. Along with these features, you will also take care of the following functions:

- Financial accounting: Everything including books of accounts, balance sheets and reports can be handled with the help of this software.

- Billing and invoicing: It supports VAT invoicing. You can also generate multiple taxes in a single invoice with the help of this GST billing software.

- Document management: You can generate user-configurable invoices, documents and letters with this software.

- Analytics and reporting: Keep a track of cash flow and get profitability reports with customisable parameters.

- Custom checks and controls: Set warning alarms and notifications according to your needs and give/restrict access to any information that you want.

Other utilities: Get pop-up calculator, year-wise data back-up and a powerful query system to search data on different criterion.

List of Top Accounting Software Solution for SMEs in India

Zoho Invoice

With the help of this GST billing software, you can generate invoices, automatically send payment reminders and get faster online payments. Zoho billing software for retail shop is an online solution that helps businesses with automated tools to ease out the entire invoicing process. You can make professional invoices, automate payment reminders, and accept card payments online faster. This billing software for retail shop is also multilingual and generates invoices in ten different languages. You can set up recurring billing profiles and charge customers automatically. Zoho invoice software also helps in:

- Payment management: You will be able to set up your preferred payment gateway, and start accepting card payments instantly. Customer information will be stored automatically and you can charge them on a weekly, monthly or yearly basis. Reminders can also be set with personalised notes.

- Estimates: The estimates can be automatically converted into invoices, saving the task of re-typing it. You can also keep track of discounts, note changes and monitor interactions with customers.

- Client Portal: With a dedicated and customized client portal, your clients can access their estimates and invoices. Zoho Invoice will also notify you when your clients have viewed or paid for an invoice. Clients can also download a PDF copy of their statement of accounts.

- Time Tracking: This GST billing software allows you to track the time spent on tasks by simply creating project workflow. You can also add tasks to a project and assign them to the staff, thereby improving productivity and teamwork. Billable minutes can be captured and entered into the software. Using this software, you can also customise and restrict access of your staff as well.

- Expense management: Pictures can be clicked and uploaded to this billing software for GST. Recurring expenses can be set up to work automatically, which would save time. You will also receive a complete break-down of the expenses and see them graphically for easy analysis.

GEN GST Software

This GST billing software is available both online and offline. The Gen GST software is OS independent which means that it can work on any operating system after installation. It is accessible anytime, anywhere giving you the option of assistance for GST billing and e-filing purposes. It has the following features:

- E-Filing: You can get 1-click e-filing of data, a dashboard and an option of importing and downloading data. You can compare tax data with every seller according to the registration details. You can find error reports and also validate GST numbers in bulk. You can now reconcile various types of GSTRs with input credit register. You can receive summarised rate wise sales figure reports at your convenience. You can also get return filing status to know whether GSTR-1 is filed or not.

- Import-export facilities: You can import/export data from third party applications. The billing software for GST supports exporting of data into the GST Govt. offline Tool & SAG Excel. Import or export GST returns and invoicing details in excel to software and export software data to excel.

- GST E waybill: This GST billing software can do E-way bill registration, generation, cancellation and rejection. You can also update any detail like e-way bill including the vehicle number, transporter ID, and more. This GST software will let you save details of bill like date of delivery, date of dispatch etc. to maintain complete bill status.

- Invoice management: GEN GST software will give you simplified billing with an easy to use interface, which saves money and time of the taxpayer. It can prepare invoice with digital signatures which can be sent directly to the customers. You can have an option of generating reports on invoices, debit notes and credit notes.

- Security: Give customisable user rights to different individuals. This feature would help in increasing security in this billing software for GST. With an administrator portal, you can screen all the login individuals who have visited the software and made any changes.

- Automatic synching: A feature of synching your data records is also available with this billing software for GST. Both the desktop and online version of the software will be synchronized and updated to give the exact tax regardless of any other factor.

Suggested Read: How are GST Billing Solutions Helping SMEs

Now you can perform the day-to-day time consuming activities efficiently with the help of these GST billing software tools. Since different businesses have different needs, it completely depends on your business requirements, which software you are going to purchase. You can check out more software applications according to your store requirements here.

Riya Basu, a core member of the content team at Techjockey.com, has previously worked with several brands related to lifestyle, travel, education and f&b. However, technical content writing is currently her niche with more than 2 years of experience in writing about business software and hardware. She is... Read more