List of Best 22 Accounting Software for Small Business in India 2026

Summary: Have you ever faced issues while managing your financials? If yes, then having the right software solutions in place is crucial. This is where accounting software comes to the rescue. In this list of accounting software article, let’s see the significance of choosing the right tool to facilitate small businesses in making informed decisions.

The accounting needs of small businesses are completely different from those of large enterprises. SMBs need accounting software that is easy to use, agile, and affordable. Furthermore, when searching for the best solution, SMEs look for the ones that serve their business objectives, are cheap, and are easy to use for them. We’ve curated a list of accounting software to ease the process.

However, choosing the best accounting solution for your business is a tedious task and involves a lot of research. This choice can make or break a business, as an accounting solution helps small businesses make informed decisions. At present, a lot of solutions are available in India, and being an SME, you would not want a complex solution for your accounting operation.

Best Accounting Software List for Small Business in India

| Accounting Tools | Best Accounting Software for |

|---|---|

| TallyPrime | Overall best accounting solution for small business |

| Zoho Books & QuickBooks | eCommerce Sellers |

| FreshBooks | Service Providers |

| KhataBook | Shopkeepers |

| myBillBook | Retailers |

| Zoho Books | Online Merchants |

| Xero | Freelancers |

| Busy | Manufacturing Business |

| Marg ERP | Traders |

| Zenscale | SMBs |

| Sage | Freelancers and SME Businesses |

| Vyapaar | Best Smartphone Accounting Software |

Top 5 Accounting Software Comparison List in India

| Name | TallyPrime | myBillBook | Zoho Books | Busy | Khatabook |

|---|---|---|---|---|---|

| Starting Price | ₹750/Month | ₹217/Month | ₹749 /Month | ₹3,600/Year | Custom Pricing |

| Suitable Industry | All types | Trading, Retail and Service Provider | Ecommerce, Mutti Branch trading | Manufacturing, FMCG, Healthcare | Self Employed, Freelancers and Stores |

| Deployment | Web Based | Hybrid | Web Based | On premise | Web Based |

| USP | Comprehensive accounting | Affordable and GST Compliant | Integration with eCommerce vendors | End-to End process Accounting and overhead tracking | Affordable and smartphone optimized |

| iOS App | No | Yes | Yes | No | Yes |

| Android app | No | Yes | Yes | No | Yes |

What is Financial Accounting Software?

Financial Accounting software is used to manage and record accounting operations and compute financial data of a business. The names of the tool mentioned in the best accounting software list help with keeping track of all financial transactions of a company and generating reports.

Accounting is one of the most important administrative tasks in any business or organization. It provides necessary data for external and internal audits, timely reports, and financial analyses of a company’s finances, required for internal and legal purposes.

Apart from this, it also provides insights into various quantifiable parameters such as inventory management, payroll, sales, purchases, credits, and debits, to name a few.

22 Best Accounting Software List for Small Business in 2026

- TallyPrime

- myBillBook

- Profitbooks

- Busy

- Marg

- Zoho Books

- MProfit

- QuickBooks

- Khatabooks

- Wave Accounting

- FreshBooks

- NetSuite ERP

- FreeAgent

- Vyapar

- Xero

- Bookkeeper

- myBooks

- Logic ERP

- AlignBooks

- ZipBooks Computer Accounting System

- Zenscale

- Sage

Here’s the list of top accounting software for small businesses to ensure smooth and simple accounting transactions.

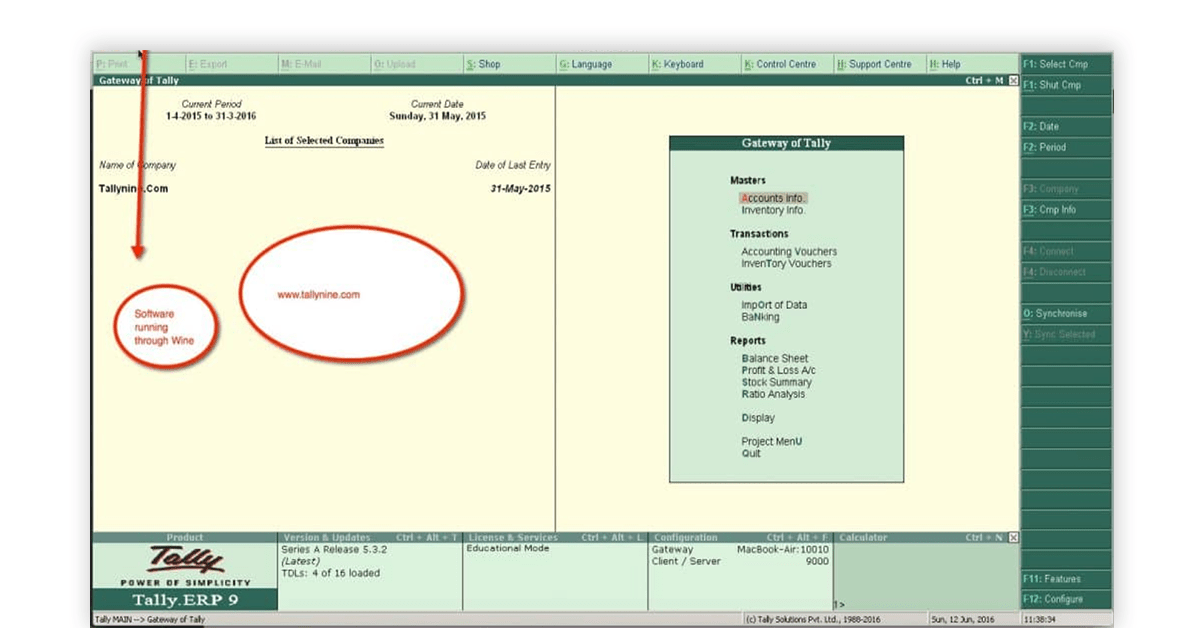

TallyPrime (Tally.ERP 9)

TallyPrime is a market leader in the business accounting software category for small and medium-sized businesses. It serves the purpose of accounting, sales, purchase, inventory, and payroll for an organization.

The design of this is specific to accounting purposes. Tally.ERP 9 is a robust solution that helps track GST-related statutory changes. It enables business compliance and minimizes any chance of rejections of GST returns filed by you. The system will automatically detect errors in your GST filing and make corrections.

TallyPrime

Starting Price

₹ 750.00 excl. GST

In-built correction capabilities make GST filling error-free and quick. Right from generating invoices to filing GST returns, every process can be made easier with this best GST accounting software in India.

Hence, SMEs can streamline their finance and control-related operations such as bank reconciliation, budgeting, inventory valuation, internal audits, etc. through Tally accounting solutions.

Check Tally ERP 9 Free Demo: Tally ERP 9 Educational Version Free Download

TallyPrime or Tally ERP 9 helps in managing:

- GST compliant Invoicing and GST return filing

- Payroll Preparation

- Stock control and item-wise inventory keeping

- Journal & Ledger posting

- Debit & credit notes for returns and refunds

- Trial balance preparation for financial audit

- Balance sheet Finalization

- P&L, Cashflow and Fund Flow Preparation

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| End-to-End accounting and GST invoicing of multi-branch businesses. | 7-days | ₹750/month for one user | Web based |

myBillBook

myBillBook is smartphone accounting software for small and medium businesses. Available at a very nominal price, it has a user-friendly interface specially designed for Indian shop owners who are smartphone-friendly. myBillBook keeps track of payments made to suppliers, customers, and staff. Furthermore, you can also easily manage your GST and manage stocks with this app.

This GST billing software allows businesses to records all purchases, sales, expenses, and profits of a company. myBillBook offers customizable GST invoice templates and advanced analytical reporting helping business owners the financial health of their business

This accounting software for small businesses can be integrated with your bank account and GSTN enabling businesses to reconcile accounts and generate e-way bills.

myBillBook

Starting Price

₹ 3599.00 excl. GST

Distinguishing Features of myBillBook:

- E-invoicing, account Payable (AP) and Accounts Receivable (AR) management and expenses tracking

- Tracking and communicating dues, payments, and receipts

- Generating advanced reports through smart phone

- Reconciling bank accounts and GST returns

- Generating e-way bills

- Managing inventory, Stock lever and re-orders

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Single Branch/Store bookkeeping | 14 days | ₹217/month | Hybrid, Windows, Android, iOS |

Profitbooks

Profitbooks cloud accounting software is specifically designed for small businesses. It is a cloud-based accounting solution that lets you create invoices, track expenses and manage inventory, helping you save time and manage finances efficiently.

After creating purchase orders, businesses can easily email them to their vendors by using ProfitBooks. Nonetheless, this GST ready software helps with the allocation of inventory to the right warehouse so that the purchase record can be maintained accurately.

The inventory management module of software for accounting in India allows tracking of every item while it’s transferred from warehouse to the logistics packaging. As it is a cloud-based accounting solution, the information can be accessed remotely, thus ensuring mobility.

ProfitBooks

Starting Price

₹ 749.00 excl. GST

ProfitBooks Software also helps with:

- Tracking your receivables

- Managing online payments

- Get detailed tax reports

- Track inventory lifecycle

- Creating unlimited customers & vendors

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Remote bookkeeping and invoicing | Free Forever Plan | ₹499/month for SMB Plan | Web based, Android, iOS |

Busy

Busy accounting software is developed by Busy Infotech Pvt Ltd. It is an integrated business software helping SMEs manage accounting, sales, purchase, VAT, CST, currency, payroll and multi-location inventory. Businesses with global outreach can rely on this best account software to have a better control over their finances.

Its multi-currency feature along with user-configurable invoicing makes accounts management easier for businesses. User-configurable documents further make reporting and analysis easier for growing businesses.

Busy Accounting Software

Starting Price

₹ 4999.00 excl. GST

Features of Busy Software for Accounting are:

- Multi-currency financial accounting packages

- Bill of Material

- GST invoicing & reports

- Multi-location inventory management

- Cost budgeting

- Overhead tracking

- Process accounting

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Complete financial accounting & advanced inventory management | 30 days | ₹3,600/Year | On-premise |

Suggested Read: Best Free and Open Source Accounting Software

Marg Accounting Software

Marg Software is developed by Marg Compusoft Pvt Ltd and is well known among small and medium enterprises of India. It is simple to use, easy to configure and flexible in customization. Whether your business operates in retail, distribution or manufacturing, this GST software for accounting in India is an ideal pick.

With Marg free accounting software, you can complete payroll processes and tax requirements accurately. Its bill audit feature leaves no scope for mistakes, making bill generation and delivery easier.

From GST billing to filing, all processes can be streamlined with Marg. It can also effectively manage transactions related to accounting, purchase, taxation, invoicing, inventory etc. of the SMEs.

Marg ERP 9+

Starting Price

₹ 5550.00 excl. GST

Features of Marg Accounting Software Ensures:

- Easy & fast billing

- Efficient reporting

- GST tax calculation

- Barcode management

- Tax reconciliation, etc.

- GST Billing

- E-Way bill Generation

- Industry specific accounting solution

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Invoicing and managing account payables | None | ₹8991/Year | Web-based |

Zoho Books

Zoho Books is a user-friendly online accounting software designed for SMEs. Using this tool for accounting, you can send professional invoices to clients and ensure that you are receiving online payments really quick. Businesses are widely using this account software to know every detail of their expenses and bill their clients easily.

This software helps track and categorize expenses in real-time to have better control over a company’s cash outflow. You can connect Zoho Books to your bank account and updates regarding your cash flow will start showing up. Not a single transaction will go unnoticed with Zoho Books at your disposal.

With automated workflows, Zoho Books is helping businesses to manage all their accounting operations effectively on a single platform.

Zoho Books

Starting Price

₹ 899.00 excl. GST

Zoho Books Key Features Include:

- Automatic bank feeds and payment notifications

- Online collaboration with customers

- Time tracking

- Integration with eCommerce platforms

- Inventory management

- Invoice tracking

- GST and Bank Reconciliation

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Core accounting of multi-branch company, & online Sellers | 14 days | ₹749 /Month | Web based, iOS, Android |

MProfit

MProfit software is a leading portfolio management and accounting software for Indian Investors, traders, family offices, advisors, CAs and corporates. This software helps with automatic posting of entries and assists in portfolio management. Entries like dividend pay-out, interest income, dividend reinvestment, capital gains and P/L can be tracked accurately with this software.

You can also import bank statement, which will help in maintaining bank and cash accounts efficiently. Accounting will not be a cumbersome task anymore, as this software for accounting provides balance sheet and trail balance reports which are simple and easy to understand.

Other important features are for financial management solution along with mobile support. This software makes business processes easier and effortless by promising simplified accounting solutions.

MProfit

Starting Price

₹ 18000.00 excl. GST

Major Features of MProfit Software

- Multi class asset tracking

- Data auto import /export for 700+ broking software in 5000+ formats

- Analytical and performance reporting along with portfolio insight

- Capital Gain calculator for both long term and short term gains

- Budgeting and Investment

- Complete portfolio management along with F&O, equity, bonds and mutual funds.

- Bonus calculations

- Loan and advances

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Managing accounts of investment companies & clients | 30 Days | ₹200/Month (for Lite) | Web-based, Android, iOS |

QuickBooks

QuickBooks accounting software is designed by Intuit Inc for various types of small businesses. It is an online accounting software with an easy to use interface and tools. You can directly connect your bank account to QuickBooks to import and categorize transactions automatically.

Also, you can sync this software with your popular apps to take pictures of your expense receipts and maintain records automatically. Other popular features of QuickBooks online accountant are invoice tracking, payment reminders, reports and expense management.

You can access dozens of reports to keep track of every expense. Its mobile app is ideal for managing all your accounting processes on the go! However, it is to note that, the service of QuickBooks has been discontinued in India due to some reason.

QuickBooks

Starting Price

$ 3.50

QuickBooks Payroll Offers More than 40 Reports Including:

- Profit & loss account

- Balance Sheet

- Cash Flow Statement

QuickBooks payroll helps manage day to day accounting transactions, billing and invoice activities, inventory, and budgeting, with mobile support for iOS and Android users.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Automating bookkeeping of growing service & SaaS providers | 30 days | $15/Month | Hybrid, Android, iOS |

Suggested Read: Top Advantages of Accounting Software for SMBs and Startups

Khatabook

Khatabook is a comprehensive mobile bookkeeping app that facilitates small business owners to generate GST-compliant invoices, and track sales, expenses, and payments through their smartphones.

It has an extremely user-friendly mobile interface that allows shopkeepers and laymen to manage the finances of their entity without hassle. Khatabook has a digital ledger app that allows proprietors to record, manage and track sales, purchases, refunds, and returns.

It could also send automated payment reminders to your customers and also reminds you of payment due dates. It also has BizAnalyst app that allows users to view Tally data on phone.

Khatabook

Starting Price

Price on Request

Khatabook Important Features:

- Keep track of daily sales, purchases and expenses

- Send bill reminders and get notified when payments are due

- Create and send GST-compliant invoices through smartphone

- Reconcile your finances with ease

- Get real-time insights into your business health

- Manage your supplier ledger along with all the transactions

- View your entire Tally data on your phone

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Record keeping and expense tracking of shops, restaurants & other small business | None | Custom pricing | Hybrid, Android, iOS |

Wave Accounting

Wave accounting is a free cloud accounting software for small businesses. It is a secure and popular accounting solution to manage day-to-day business transactions and generate financial statements such as Profit & Loss statement and Balance Sheet. Key features of this business software include invoicing, payroll, receipts, and direct deposit.

You can connect your bank accounts with Wave software in minutes so that all transactions start appearing in your bookkeeping records instantly. It’s finally the time to say goodbye to manual receipts and track everything automatically.

Also, with a comprehensive insight of your accounts and transactions, you can make better business decisions to increase the cash flow.

Wave Accounting

Starting Price

$ 16.00

Wave Accounting Features:

- Track all your income & expenses

- Prepare smartly for the tax time

- Ensures multiple bank and credit card transactions

- Ensures data transactions

- Makes tax handling easy

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Invoicing, managing account payables and preparing Financial Statements | Free | $16/month | Web-based |

FreshBooks

FreshBooks is a one-stop solution for accounting and finance management in a business. It helps businesses meet their basic accounting needs such as raising invoices, and subscription management with ease.

Since it is intuitive and minimalistic, one doesn’t have to spend time on paperwork and can generate enterprise-standard invoices. It can also automate usual accounting tasks such as recording expenditures, time-tracking and following-up with clients.

The solution for accounting can easily be integrated with other compatible applications to provide a seamless experience. As it is a package, it comes with all the relevant tools required for accounting, eliminating the need for additional software.

One of the best features of FreshBooks is that all the financial processes can be executed from its dashboard. Since FreshBooks is a cloud-based software solution, one can be assured of it being secure and can remotely access it on multiple devices, such as phones, tablets and laptops.

Freshbooks

Starting Price

$ 2.10

FreshBooks cloud accounting helps with:

- Invoicing

- Projects

- Expenses and Payments

- Estimates

- Time Tracking

- Reports and much more.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Invoicing and Accounting of BPO‘s & KPO’s | 30 Days | ₹475/month | Web based, Android, iOS |

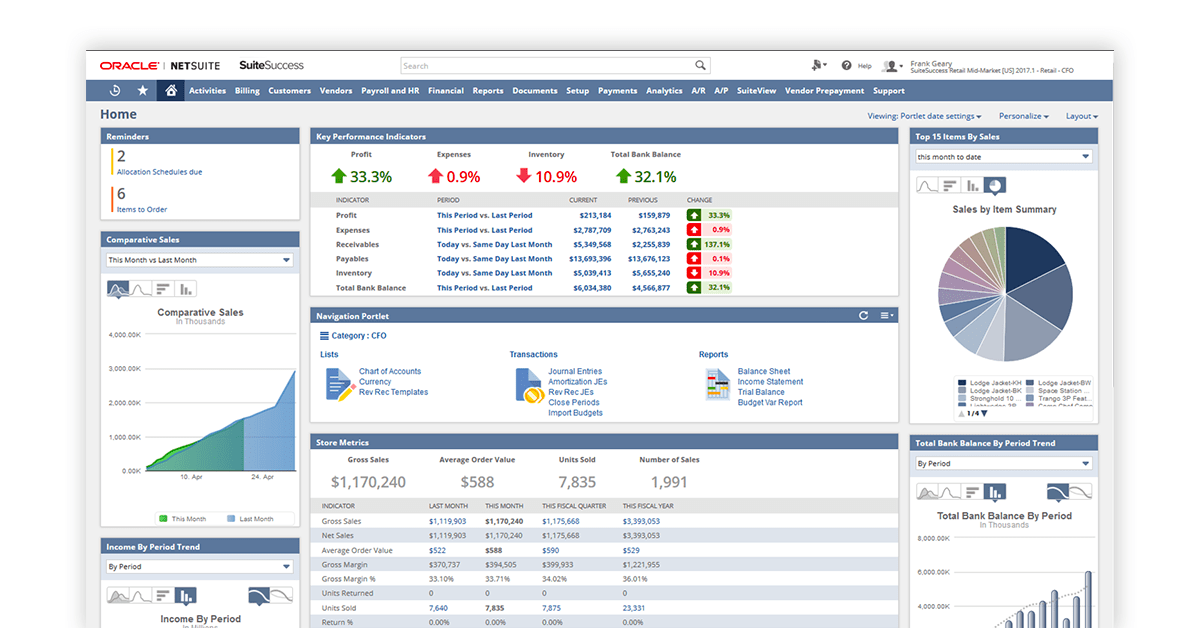

NetSuite ERP

NetSuite ERP is another cloud-based enterprise resource planning (ERP) software powered by Oracle. It enables businesses to manage their financial processes while also generating insights regarding the overall performance of the company.

NetSuite manages and automates various practical accounting areas such as finance, revenue, inventory, orders, invoices, billing, CRM and e-commerce. The ERP provides seven inter-connected components and utilizes data from a common database.

Oracle NetSuite ERP

Starting Price

Price on Request

NetSuite Software for Accounting Offers Businesses Component-Specific Features:

The well-known software in the market, especially in medium businesses, Netsuite ERP provides a comprehensive package for businesses of all sizes.

- Manage accounting-related tasks and map financial insights and forecasts.

- Revenue recognition and tracking

- Financial planning, reporting, budgeting, scheduling, predicting and rendering real-time data.

- The software helps in the automation of processes, and assists in legal, regulatory and risk addressable.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Comprehensive accounting of businesses with multiple branches, departments and outlets | Free Demo only | Price on Request | Hybrid |

Suggested Read: Best Free Accounting Apps for Small Business and Bookkeeping

FreeAgent

FreeAgent is a complete software for accounting package especially created for small and medium businesses, accountants, expenditures, payroll managers.

It also offers accounting management tool to other employees involved in the financial part of the business. In addition, it also provides mobile apps for Android and iOS operating systems.

Freeagent

Starting Price

$ 22.00

FreeAgent Features:

- FreeAgent provides features such as scheduling invoices and setting up of periodic payments, while it also sends automated reminders to the clients.

- With the help of this software, accountants can keep a record of expenditures by uploading photographs of receipts, on FreeAgent app.

- The software solution provides an inbuilt stopwatch tool for the management of employee working hours and timesheets. It also provides a common dashboard for all the tools, which offers insights to main metrics. With the help of this, businesses are able to keep a record of estimates, invoices, and target statuses.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Bookkeeping, invoicing & expense tracking of multi-project businesses | 30 days Free trial | $11 per month | Web based, Android, iOS |

Vyapar

Vyapar is a free business accounting software listed and designed keeping Indian SMEs in mind. It provides a plethora of different tools for tasks such as inventory and invoice management, GST application, etc.

It has all the features required for small businesses to assist in their regular accounting requirements while also reducing manual paperwork. Vyapar provides a comprehensive package for businesses of all sizes.

Vyapar Billing Software

Starting Price

₹ 1199.00 excl. GST

Vyapar salient features include:

- Vyapar provides a variety of GST invoice templates to choose from. They also provide GST mobile app, through which businesses can print their online invoices.

- With the help of this account software for PC, you can keep a track of your organization’s stocks in real-time, receive stock alerts and get information about the inventory whenever you want.

- With its free accounting app, you can track your inventory quantity and stock value along with information on parameters like expiry date, batch number, slot number etc.

- Keeping track of unpaid bills and proforma invoice can be managed with Vyapar GST billing software-based app and payment reminders can be sent to prompt customers.

- Focus on billing while this takes care of tracking pending payments and reminds customers to ensure payment is collected faster.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Bookkeeping of retail shops and self-employed businesses | No | ₹3,399 / year for desktop & mobile access | Hybrid, Windows, iOS, Android |

Xero

Xero Accounting software has been developed by Xero, a public technology company based in New Zealand and is steadily building its global presence.

Xero provides three different plans based on the journey of a business. Early Plan is for businesses that have just started their venture. Growing plan is for those companies which have made their mark and are slowly growing. Established Plan is for those companies which have had a long run and are at the top tier of the industry.

Xero Accounting Software

Starting Price

$ 29.00

Let’s have a look at important features of Xero software:

- Payment integration

- Contacts, Asset and Inventory Management

- Invoicing and Billing

- Bank connections & reconciliation

- Business performance dashboard

- Multi-currency accounting

- Pay runs and Quotes

- Reporting & Tax Filing

- Project management

- Purchase orders

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Bookkeeping and accounting payable and receivable management | 30 Days | $29/month | Cloud Based |

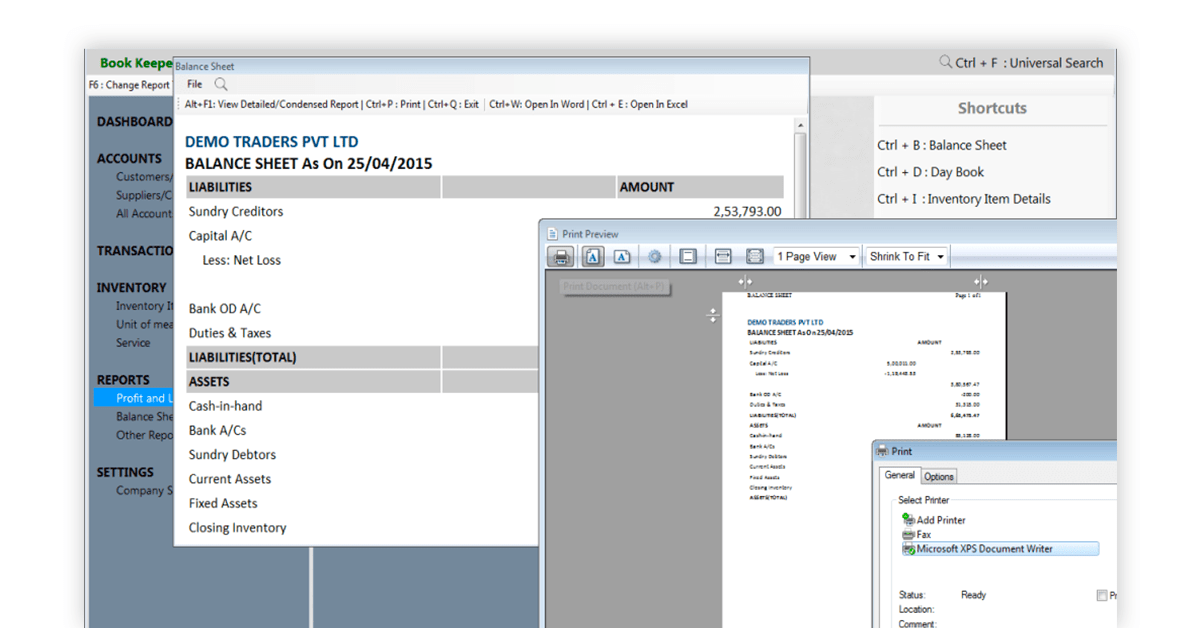

Bookkeeper

Bookkeeper is one of the most simplified accounting tool available for Windows, Android and iOS platforms. Its easy-to-use UI enable users to manage inventory and invoices, map estimates, monitor expenses & generate receipts, keep a track of daily transactions, manage reports & ledgers and much more.

Furthermore, it helps as GST invoice generator and provides access to your data across devices with the help of its synchronization feature.

Book Keeper Accounting Software

Starting Price

₹ 610.00 excl. GST

Some of the key features of Bookkeeper include:

- Expense Tracking and Management

- Inventory and Manufacturing Management

- Invoice

- Mobile Support

- Multi-user login

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| eCommerce accounting & e-Invoicing | No | Price on Request | Web, Android, iOS |

Suggested Read: Best Bookkeeping Apps for Android and iPhone to Manage Small Business Accounting

myBooks

myBooks is one of the leading accounting software that caters to the requirements for the Indian businesses. The best account software provides exemplary GST compliance system that allows users to work effortlessly.

It facilitates even beginners to get started as it simplifies accounting processes. It uncomplicates accounting jargons and streamlines daily workflows.

Zetran Mybooks

Starting Price

$ 4.99

Important features of myBooks software for accounting:

- Automated bank feeds to get the transaction-related information in real-time.

- Enterprise level data security system prioritizes data confidentiality.

- Simplified Invoicing for accurate management of billing details.

- Multi-currency transactions facilitate your business to interact with global markets with precise forex rates.

- Easy-to-use dashboard provides in-depth reports on daily accounting workflows.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Bookkeeping and financial record preparation for FMCG, Manufacturing, Retail and Service | 30 days | ₹99/Month | Web, Android, iOS |

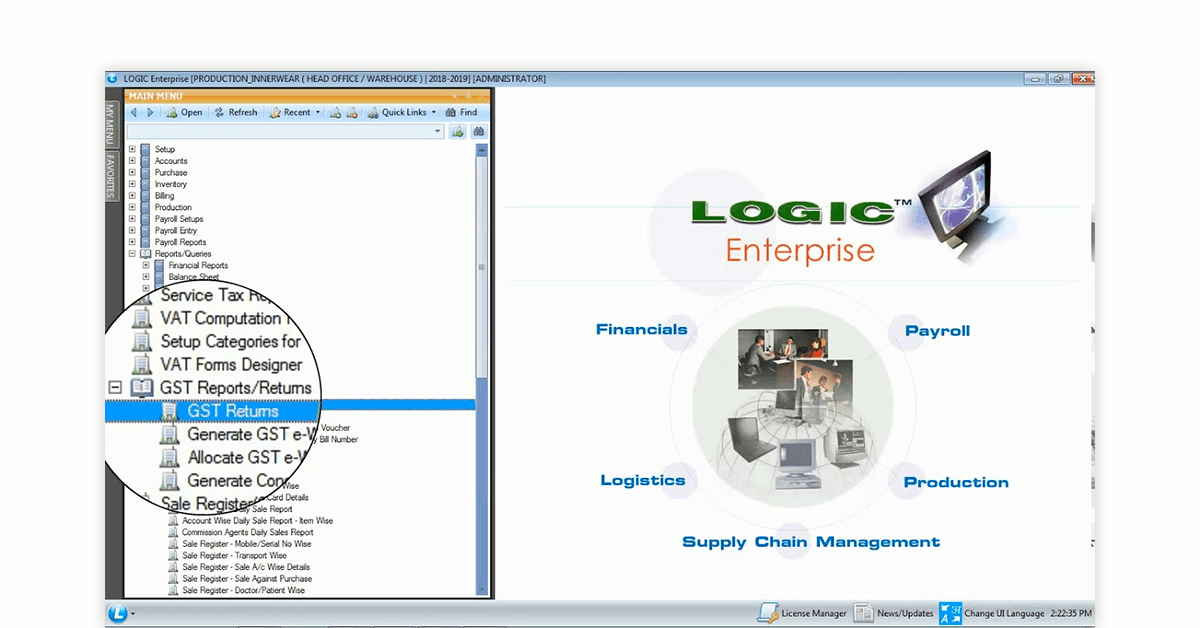

Logic ERP

Accurate forecasts and financial planning are important for managing the budget of an enterprise. Built-in within Logic ERP and accounting software, you will thus find robust tools for not only budget management but also financial consolidation and franchisee accounting.

The general ledger support option is another key feature in this accounting management software that helps companies maintain balance sheets and undertake profit/loss analysis with ease.

Businesses also rely on this ERP software for managing inventories as well as handling retail operations such as billing, customization of reports and stock auditing. Logic ERP is critical for one more reason, which is that it helps different departments across a company make informed financial decisions.

How do departments do this? They do this by utilizing the available management solutions for handling assets, human resources and cash. You can efficiently run your business operations using Logic software for finance and accounting management capabilities.

Logic ERP - Retail Software

Starting Price

Price on Request

Aside from financial accounting, you can also use Logic ERP and accounting software for:

- Sales order tracking

- Centralized procurement system

- Dynamic pricing for avoiding overhead costs

- Assortment and merchandizing analysis

- Integration with eCommerce portals

- Recording business transactions

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Automating, integrating, & streamlining entire accounting process | Free Demo | Custom Pricing | Cloud, On-premises |

AlignBooks

Use GST enabled AlignBooks business accounting software for e-way bills generation and submitting returns. Besides quick backups for preventing data loss, the platform’s advanced billing and accounting capabilities are critical for managing daily business operations.

Built-in further into AlignBooks online accounting software, you would further find MIS reporting and asset management functionalities for periodic regular depreciation statements.

This advanced accounting and online invoicing software are deployed primarily for advanced support features such as IMEI and batch management, performance tracking as well as double unit systems. You have the option to deploy a document classification feature to segregate brand or category wise the different transactions.

The best part about using AlignBooks is the supplier master that helps with automated TDS deduction. Besides business setups of different kinds, the software is an ideal choice amongst professionals for multifunctional support.

AlignBooks

Starting Price

₹ 10000.00 excl. GST

Top Features of AlignBooks

- Service invoices and customizable templates

- Automated GST form filling

- Easy management of outstanding bills

- Approval hierarchies for monitoring every transaction

- Barcode generation for adding more information inside documents

- Predefined excel file formats for bulk vouchers and invoices

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Invoicing and managing AP/AR of retail stores and other sole proprietorship businesses | 15 days | ₹2550/Year | Web based, Android, iOS |

ZipBooks Computer Accounting System

ZipBooks accounting management software is a reliable solution for tracking transactions and maintaining accounting records. The software also has a history option for maintaining account receivables to monitor how the business is performing. You are further free to prepare a snapshot of payment trends to plan budgets as per loan-cash-flows.

The business accounting software makes a note of taxes collected to ensure accuracy of tax payments. Trial balance statements are available as well for recording debits/credits for every general ledger account. The best part is the system attached for making double entries so that checking balance for every account is easy.

Additionally one of the main advantages of using this software is it helps single click option for entering bank information so that accessing information of any bank account is super quick.

ZipBooks

Starting Price

₹ 4999.00 excl. GST

Core support features ZipBooks Computer Accounting System:

- Bank reconciliations

- Auto categorization of transactions

- Project accounting

- Account receivables and payables

- General ledgers for developing financial statements

- Accounting access for developing financial reports

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Auto billing, payment and expense tracking and financial reporting of growing organization | 30 days | $11 per month | Android App, Web based |

Zenscale

Zenscale ERP

Starting Price

Price on Request

Zenscale’s accounting software is an integral component of their cloud-based ERP system tailored for SMBs. This software is a part of Zenscale’s modular ERP system and can be used independently or with other modules like inventory management or payroll.

It includes features to perform essential accounting tasks such as accounts payable/receivable, general ledger management, and financial reporting. These features facilitate efficient financial management and accurate record-keeping for businesses.

This helps enhance accuracy through centralized data management and offers scalability to support business growth. Apart from that, it offers centralized accounting data that allows for streamlined workflows, reduced errors, and improved financial insights.

Core support features Zenscale Accounting Software:

- Accounting capabilities including accounts receivables and payables.

- Maintenance of the Central Ledger for keeping track of financial transactions.

- Offers modular framework that helps seamlessly integrate with other modules of Zenscale including inventory management & payroll management.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Maintaining central ledger, generating financial statements, payroll management | Yes | ₹3000/Month | Windows, macOS, Linux, Android, etc. (cloud-based) |

Sage Accounting System

Sage Accounting

Starting Price

Price on Request

Sage Accounting Software, formerly referred to as Sage One, is designed to streamline financial management for freelancers and small businesses. It facilitates the efficient handling of invoices, expenses, and bank reconciliation within a single platform.

With the added advantage of accessibility from any location, it also helps with cash flow forecasting and tax management. This cloud-based software is user-friendly and adaptable to grow with your business, offering scalability and the capability to seamlessly integrate with payroll and other Sage tools.

It helps in enhancing accounting workflows and ensures accessibility, collaboration, and automatic updates. This makes it a comprehensive solution for businesses seeking efficient financial management.

Key Features of Sage Accounting System:

- Enables expense tracking, bill payments, and bank reconciliation.

- Offers forecasting tools for cash flow to get knowledge of financial health, predict upcoming expenses, etc.

- Allows for calculating VAT returns and streamlining the record-keeping process.

- Provides automatic updates regarding the latest features as well as security updates.

| Best For | Free Trial | Starting Price | Deployment |

|---|---|---|---|

| Simplified tax management, automatic updates, cash flow management, scalability, etc. | 30 days | ₹4,913/Month | Windows, macOS, Chrome OS, etc. (cloud-based) |

Key Features List of Small Business Accounting Software

When we talk about the list of accounting software for small businesses, the key features that come to our mind are:

- User-friendliness: The software should be user-friendly and easy to operate so that even a layman like a shopkeeper or self-employed person can use it without any difficulty.

- Affordability: The cost of the software should be reasonable and within the budget of a small business.

- Timesaving: The software should save time by automating various accounting tasks, such as monthly recurring invoicing, payment processing, sending payment alerts, etc.

- Smartphone Enabled: Having a mobile app for accounting software would make it extremely agile and easy for business owners to keep track of transactions.

- Scalability: The bookkeeping solution must be scalable so that it can grow along with the business.

- Integration: Small business accounting systems should be able to integrate with other business applications like CRM, Payment apps, and eCommerce sellers.

- Billing and Printing: It must have the capability to generate invoices and support thermal printing.

Types of Accounting Software List

Before choosing from the wide list of accounting software, understanding different types of accounting solutions is crucial.

1. Spreadsheets

Electronic spreadsheets are one of the most convenient accounting tools for small businesses. The prices of leading spreadsheet software available in the market are inexpensive. Moreover, users can customize easily, depending upon the needs of the business.

This means that there is a chance of accounting errors when it comes to spreadsheets. If the organization is small, the chances of making errors are fewer.

2. Commercially Available Software

Commercially off-the-shelf software is one of the most widely used software across the globe. It can be customized to meet the requirements of businesses and provide multiple stages for the detection of data errors. Additionally, it provides reports that can be customized depending upon the user’s requirements.

There are a number of COTS packages that have been designed for specific industries. Each of these packages has the necessary tools required by particular industries to manage their ledgers.

3. Enterprise Resource Planning Software (ERP)

Collects and assimilates data from various parts of a business and collates them in one place. This helps in keeping records of different departments and branches, eliminating the problem of managing the data individually.

Most of them provide cloud-based record-keeping and accounting tools to manage ledgers and books remotely. This software is used by large organizations who have multiple offices and branches. ERP Software solutions take time to be integrated, depending on how big a company is.

4. Custom Accounting Management Software

This software is custom-developed for an organization. Moreover, this approach is usually taken when an entity’s needs are so specific that they cannot be met by a COTS or ERP package.

However, this rarely happens, as most of the features that any organization needs are available in the packages. In addition, custom software tends to glitch and needs more upkeep than commercial packages.

5. Financial Management Software

If you need a comprehensive system to track and maintain your accounts, general accounting software, also known as core accounting software listed, is the ideal solution for you. These platforms automate and track data and share them between different modules to ensure accuracy and consistency.

Many modern tools also incorporate AI and machine learning to enhance their capabilities.

Key Functions:

- General Ledger: A complete record of all the business’s transactions, automatically updated after each transaction to eliminate manual data entry.

- Accounts Payable: Automates the recording and payment of short-term debts to suppliers and creditors, ensuring timely payments and balanced debt management.

- Accounts Receivable: Automates the collection and application of payments from customers, facilitating efficient management of outstanding balances.

6. Payroll Management Software

Payroll software is designed to handle the complexities of managing employee paychecks and taxes. It ensures accurate and timely payment of wages, calculates taxes, bonuses, and deductions, and can handle currency conversions for international employees.

7. Inventory Management Software

Businesses focused on selling products can benefit from inventory management software, which provides real-time tracking of stock and allows sorting by various characteristics such as size and color.

It also facilitates tracking of purchase orders and demand, while also providing alerts for perishable items nearing expiration, minimizing errors in inventory management.

8. Invoicing Software

Invoicing software simplifies the process of creating and sending professional invoices with minimal effort. It integrates with accounts receivable systems to streamline billing and ensure prompt payment for services rendered, making it particularly valuable for service-oriented businesses.

These software solutions play a critical role in optimizing operational efficiency and ensuring financial accuracy for businesses of all sizes.

Conclusion: Which Tool to Use From the List of Accounting Software?

To conclude this accounting software list, it is necessary for every business because it helps them prepare invoices, track expenses, manage inventory, track payments, and more. Choosing an accounting software for SMB can be a difficult as many options are available in the market with different traits.

This list of accounting solution will be handy for you in selecting the right tool for your business, which fits your requirements and budget and helps you to streamline your accounting functions.

Above all, you must be thinking that when there are so many accounting software list in India, why bear an additional cost? That is simply because free software offers limited features. Thus, it’s better to invest today than regret later

FAQs on Accounts Related Software

What are the top 10 accounting software in India?

Giddh Accounting, Zoho Expenses, Quickbooks, Freshbooks, Wave, Busy, Marg, Vyapar, HDPOS and AlignBooks.

What is the best accounting software for small businesses?

There is no easy answer to this question as it depends on the specific needs of your business. Small businesses should always choose easy, agile, and scalable accounting software. myBillBook, Vyapar, Tally Prime, Busy and Zoho Books are some popular accounting solutions for SMBs.

What are the benefits of using accounting software for small businesses?

There are several benefits of using accounting software for small businesses like automated billing, expense, payable and receivable management, sales/purchase tracking, and much more. In addition, it also keeps track of tax obligations, statutory compliance, and inventory management effectively.

What is the best way to choose accounting software for my small business?

The best way to choose accounting software for your small business is to first identify your specific needs and preferences. Then you can shortlist and compare different accounting software based on their features, ease of use, deployment and agility.

How software for accounting can help us?

Accounting software can help you manage your finances effectively by providing accurate and up-to-date records of sales, purchases, expenses, returns, payments and receipts. It also helps save time by automating recurring invoices, reconciliation, and payments.

What should you consider while choosing accounting software?

There are many factors to consider when choosing accounting software, including the size of your business, your industry, your specific needs, and your budget. Besides, also make sure that the accounting software is easy to use, intuitive, and doesn't require expertise.

Which accounting software will be right for my business in the long-term?

The software that meets your specific needs today and is able to grow with your business. Also, it's important that the software is easy to use, has an intuitive UX and the software provider provides hands-on training.

Is free accounting software useful?

There are many free accounting software options available, and they can be a good option for businesses with a limited budget. However, free software is often limited in terms of features and functionality, so it's important to consider your needs before choosing free software.

Also, you can check the comparison between Zoho Books and TallyPrime!

Kalpana’s tech writing journey began in 2017 with Techjockey, and she truly belongs here! If she was not a technical content writer, she would have been a coder. Technical writing, especially for business software, is her passion, and she enjoys every bit of it. From addressing the pain... Read more