Get Quote

We make it happen! Get your hands on the best solution based on your needs.

Core Functionalities

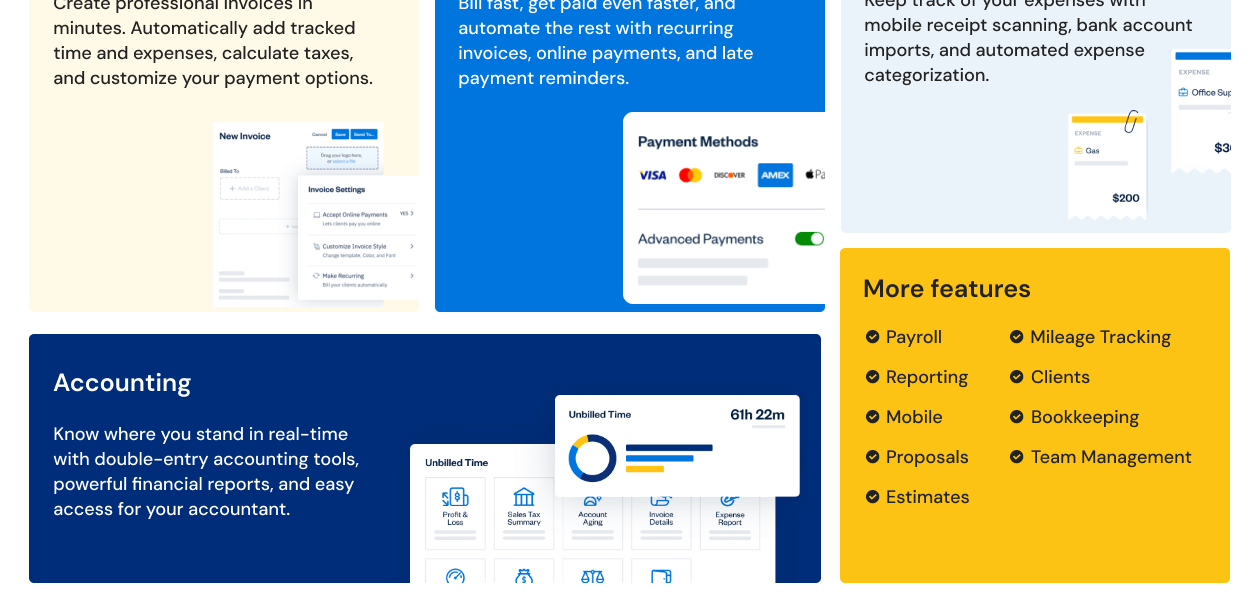

Billing & Invoicing

Retail and Point of Sale

Project and Workflow Management

Inventory and Supply Chain Management

Sales and CRM

Financial Management

Integrations Supported

Analytics and Reporting

Administrative Features

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

“FreshBooks makes creating estimates and invoices simple. It’s easy to submit proposals and track payments, streamlining the whole process.” Riyaz Ahamad - Jul 28, 2024

“FreshBooks is user-friendly and meets all my accounting needs. It’s cost-effective and offers great reports to track income and expenses.” Chandan Mondal - Jul 24, 2024

“FreshBooks makes sending invoices to clients and reconciling bank transactions simple and efficient. The automated features save me a lot of time and reduce the chance of errors.” Nishant - Jul 24, 2024

Cons

“I have no complaints about FreshBooks. It’s an excellent product that meets all my needs.” Chandan Mondal - Jul 24, 2024

“Sub-categorizing expense accounts requires creating journal entries, which can be confusing. I wish there were an easier way to manage this.” Nishant - Jul 24, 2024

“ACH payments can be slow to clear, causing delays in processing deposits. This can be a problem when clients need things done quickly.” Nishant Goyal - Jul 24, 2024

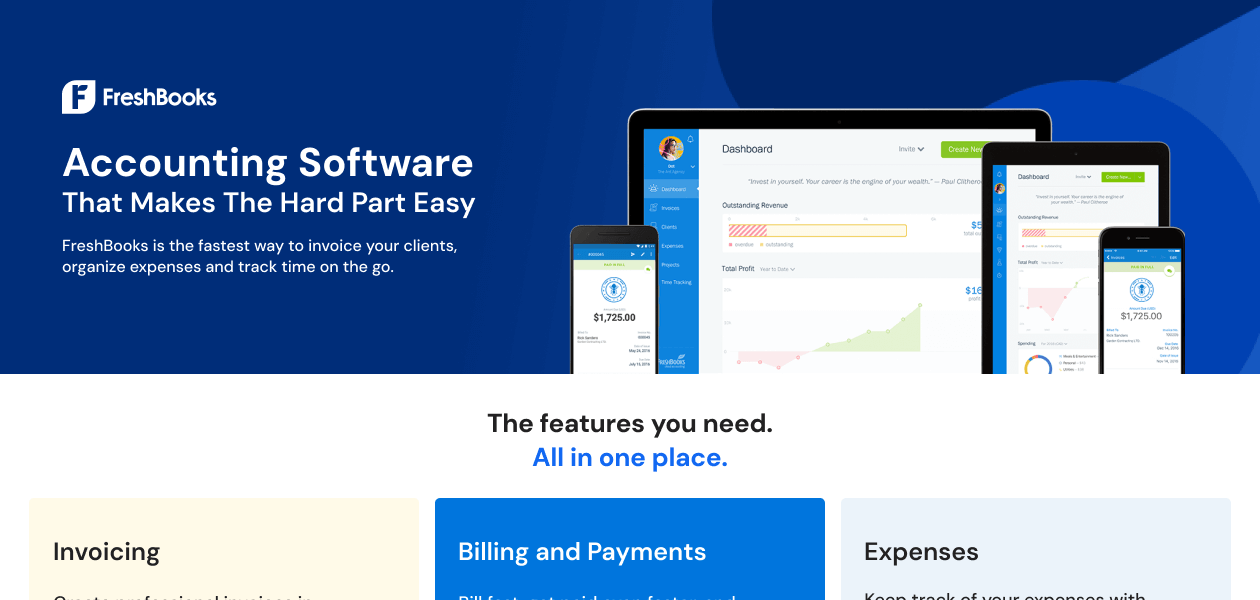

| Brand Name | Freshbooks |

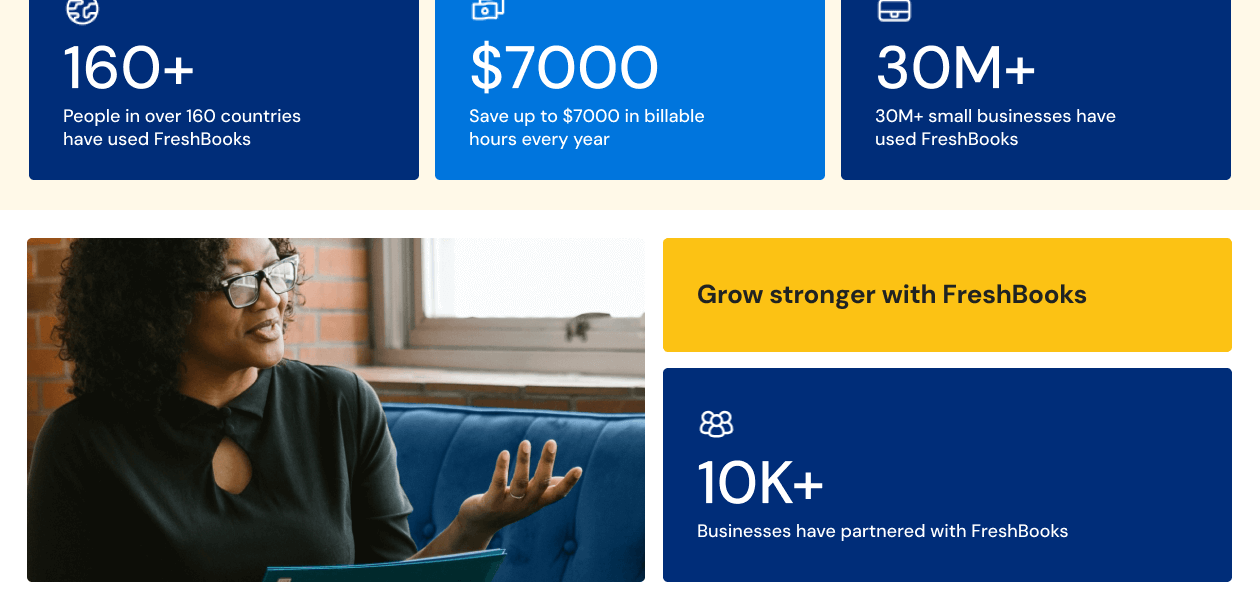

| Information | FreshBooks, cloud-based accounting software, allows owners to invoice clients, track time and run their small businesses in the cloud. |

| Founded Year | 2003 |

| Director/Founders | Michael McDerment |

| Company Size | 101-500 Employees |

Top Selling Products

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers