Summary: Bookkeeping Software can help small businesses in uploading, maintaining, and tracking receipts to maintain track of all expenses. What software can you use for this purpose? Find out in the article below!

Every organization needs to maintain a record of all the financial transactions on a regular basis to ensure that their book of accounts remains up to date. The recorded financial data can then be used for further interpretation and analyses by accountants.

However, maintaining a record of each transaction becomes tiresome for organizations and may lead to inaccurate and double data entry, errors in tax calculations, compliance issues, data theft, etc.

But, with the best bookkeeping software, you can automatically maintain the record of all the transactions hassle-free. With booking software, you can record, track, and maintain all the expenses and receipts for the current financial year in chronological order.

Further, you can also use it for creating general ledgers, calculating tax, generating invoices, and so on.

What is Bookkeeping Software?

Bookkeeping Software helps organizations to record several types of financial transactions including purchases, sales, receipts, and payments. With this software, a bookkeeper can summarize all the financial transactions in a systematic and chronological manner. Therefore, helping businesses by presenting all the incomes and expenditures in the book of records.

The data stored and recorded in the bookkeeping software serves as an input for accountants to interpret the financial data and create different financial statements.

Check our elaborated article on What is Bookkeeping? Types, Benefits & Examples to know in detail.

List of 7 Best Bookkeeping Software for Small Business

Bookkeeping software can help small businesses with multiple tasks such as recording financial transactions, creating general ledgers, processing invoices, and so on. Here are some of the best online bookkeeping software you can consider for this purpose.

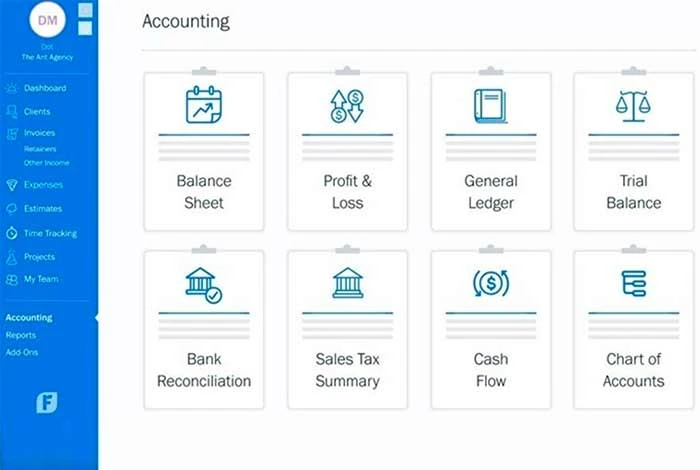

FreshBooks

FreshBooks is an accounting and bookkeeping software to maintain and track the record of all payments and expenses. It is a good software for tracking expenses, generating invoices, sending estimates, tracking and organizing client’s data, etc.

If you need features for creating general ledger, and generating profit and loss statement and expense report, then FreshBooks is the right choice.

Features of FreshBooks

- Supports invoice customization

- Generates multi-currency bills and invoices

- Automatically calculates tax

- Tracks time for different projects

- Automatically converts estimates into bills

- Reconciles bank statements automatically

FreshBooks’s Pricing: No free plan available | Paid plan starts from INR 697.47/month

Free Trial of FreshBooks: 30 days available

Melio

Melio account payable solution helps firms to receive and make payments to different vendors via ACH, check, and credit card. With it, you can manage your clients’ payments and set up the payment workflow with manageable permissions.

You can use this tool for scheduling payments, splitting bills, assigning clients to team members, combining vendor’s invoices, making international payments, etc.

Melio Features

- Bills and invoices management

- Customizes payment requests for customers

- Supports ACH bank transfers

- Processes vendor’s payment in bulk

- Supports recurring payments to vendors

- Integrates with QuickBooks Online, Xero, FreshBooks, etc. to manage payment workflow

Pricing of Melio: Free to use | You only need to pay for certain services like sending payment by card

Free Trial of Melio: It is a free accounts payable software

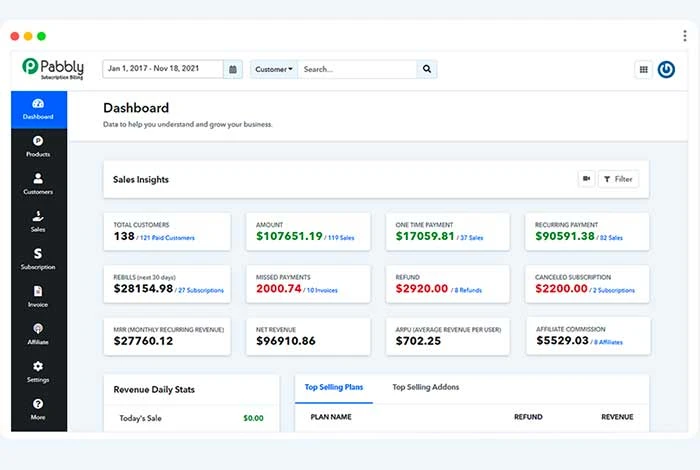

Pabbly

Pabbly subscription management software provides users with real-time insights on monthly payments, net revenue, active customers, new subscriptions, etc. This software can be used for automating the business workflow, customer communication, and invoice generation.

Further, it offers in-built affiliate marketing management modules to easily track the affiliate sales on different websites.

Features of Pabbly

- Automates recurring billing procedures

- Dunning management for collecting outstanding dues

- Customizes the checkout pages for customers

- Enables you to offer one-time and multiple payment options to your customers

- Automatically checks VAT numbers by sending the validation request to the VAT system

Pabbly’s Pricing: It offers a single pricing plan starting from INR 3,198.39/month, which is billed annually.

Free Trial of Pabbly: Not available

Suggested Read: Best Mobile Bookkeeping Apps for Android & iPhone

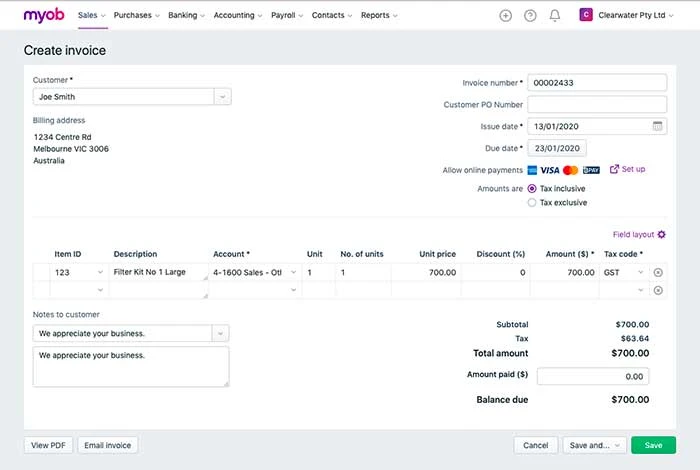

MYOB

MYOB is an online accounting software to help businesses streamline and automate key accounting and booking tasks. It can be used for creating BAS statements with pre-fill GST info, generating different GST compliant reports, sending STP compliance reports to ATO, etc.

Some other common features of MYOB include inventory and cash flow management, multi-currency payments acceptance, real-time collaboration, and so on.

Features of MYOB

- Automatically reconciles bank statements

- Creates and sends invoices

- Tracks and manages expenses

- Automatically calculates GST and other taxes

- Manages employees’ timesheets for accurate payroll processing

- Tracks profit and loss of different projects

Pricing of MYOB: No free plan available | Paid plan starts from INR 1,230.34/month

MYOB’s Free Trial: 30 days available

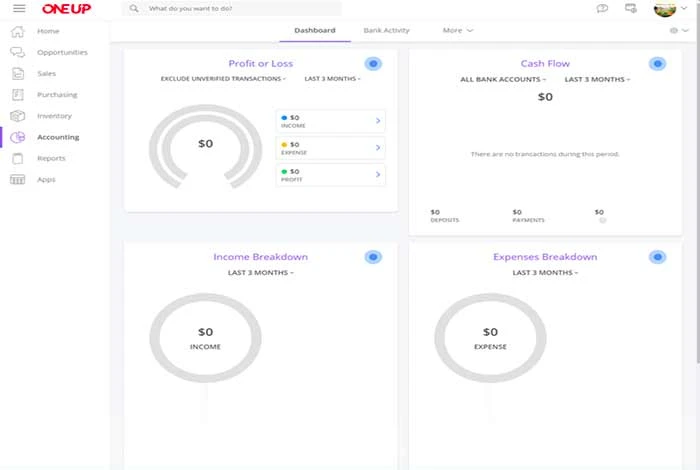

OneUp

OneUp helps you in managing everyday tasks related to accounting, bookkeeping, customer relationship management, and inventory.

You can use this bookkeeping software for sending invoices, viewing outstanding invoice payments, adding payment details in accounting software, and reconciling bank statements.

It also helps in sending quotes to customers, viewing sales opportunities, and entering inventory details in accounting books.

Features of OneUp

- Generates invoices directly from quotes

- Offers customizable templates to match your business

- Retrieves banking transactions by adding banking credentials

- Maintains automatic bookkeeping for accurate data entry

- Automatically tracks and manages inventory levels

- Categorizes all bank entries

- Generates picking lists for product delivery directly via sales orders

OneUp Pricing: No free plan available | Paid plan starts from INR 738.35 /month

Free Trial of OneUp: 30 days available

OnPay

OnPay payroll services help in managing payroll operations of growing businesses. It can be used for PTO management, payroll processing with latest COVID regulations, generating e-signature documents, accepting, and approving leave requests, running unlimited pay runs, etc.

This solution can also be used for creating organization charts, generating 401(k) retirement plans for employees, and offering pay-as-you-go compensation plans.

Features of OnPay

- Multiple options for making payments

- Offers different pay rates for employees

- Manages garnishment orders

- Generates and exports several payroll reports

- Automates employees’ onboarding workflows

- Runs payroll compliance audits

OnPay’s Pricing: OnPay pricing starts from INR 3,281.60 base fee and INR 492.24/month/person

OnPay’s Free Trial: 30 days available

Tiplati

Tipalti accounts payable automation software is for automating repetitive payable operations and maximizing business profits. It can be used for managing cashflow, viewing spend insights performance, processing invoices, managing supplier’s documents, reconciling payments, managing purchase orders, etc.

With its built-in compliance, you can also reduce payables tax, regulatory issues fraud, audit risk, and so on. Moreover, it offers a payment cost calculator to understand the organization’s productivity in invoice processing and payment collection.

Tipalti’s Features

- Multi-language vendor’s portal for supplier’s management

- Advanced Optical Character Recognition for capturing and processing invoices

- Supports 120 international currencies for receiving and accepting payments

- Ensures IRS tax compliance for users

- 2 and 3-way purchase order matching for data accuracy

- Reconciles all the reports with the ERP system for faster financial year closure.

Pricing of Tipalti: Tipalti pricing starts from INR 12,220.31/month for a single platform and changes as the business grows.

Free Trial of Tipalti: Not available

Difference Between Bookkeeping vs Accounting

Bookkeeping and accounting are different from each other in several aspects. Bookkeeping does not involve data analysis whereas it includes accounting.

Similarly, accounting involves financial statements which are not a part of bookkeeping. Here are some other differences you will find between bookkeeping and accounting:

| Metrics | Bookkeeping | Accounting |

| Definition | Bookkeeping is about recording and maintaining financial transactions for a given financial year. | Accounting is about preparing and analyzing various financial statements from the bookkeeping data. |

| Financial Statement Preparation | Under bookkeeping, financial statements are not prepared. | Under accounting, various financial statements are prepared like balance sheet and profit and loss account. |

| Financial Position | Bookkeeping does not represent the financial position of an organization. | Accounting represents the financial position of an organization. |

| Person Involved | The person who records the transactions is called the bookkeeper. | The person who prepares and analyzes statements is called an accountant. |

| Objective | The purpose of bookkeeping is to sum up all the financial transactions of a firm for a specific period. | The purpose of accounting is to interpret financial information for decision making. |

| Expertise | Bookkeeping does not require any specific knowledge because it generally involves data entry. | Accounting does require specific knowledge of accounting procedures and policies. |

Conclusion

Bookkeeping software is an asset for organizations as it can help them keep their book of records updated by automatically recording different financial transactions. Accountants get easy access to all the financial data at one place to prepare financial statements.

FAQs

Which bookkeeping software is best?

There are several types of bookkeeping software that you can use for recording financial transactions. Some of the best options include Zoho Books, FreshBooks, OneUp, MYOP, etc.

How is software used in bookkeeping activities?

Software can help a lot with automatically recording your organization’s expenses and receipts, categorizing them, and adding their data to the accounting software. Further, it can also be used for processing and sending invoices.

How to use bookkeeping software?

To use bookkeeping software, you need to login with your mail ID or number. Once done, you can add your organization details to start using the software. After that, a new account will be created that you can use for recording and maintaining the data of financial transactions.

What is a bookkeeping software system?

Bookkeeping software helps in simplifying and automating data entry, presenting important financial information, and generating different financial reports for analyses. Altogether, it records and presents information to make it easier for accountants to analyze financial health.

What is the easiest bookkeeping software to use?

Bookkeeping software would enable users to use all the features in a hassle-free manner even with the minimal accounting and bookkeeping knowledge. You can consider FreshBooks, Zoho Books, Melio, etc., for hassle-free bookkeeping and accounting.

What is the easiest bookkeeping software for small business?

If you run a small business, then there are many bookkeeping software solutions to manage everyday bookkeeping operations under budget. Some of the best options you can consider for this purpose include Wave, FreshBooks, Xero, Melio, etc.

What is the best home bookkeeping software?

You can choose from multiple software programs to track and manage your personal receipts and expenses. Some of the best bookkeeping software are Xero, AccountEdge, QuickBooks Online, Lendio, MYOB, etc.

Is bookkeeping the same as accounting?

No, bookkeeping is not the same as accounting in several aspects. For example, bookkeeping involves the recording and tracking of financial transactions. Whereas accounting involves the interpretation, classification, and analysis of the accounting and financial data of a company.

What is the simplest bookkeeping software?

You can choose from multiple bookkeeping software solutions that are quite easy to use for your bookkeeping requirements. A few popular options are Tipalti, Zoho Books, Melio, OneUp, and FreshBooks for this purpose.

What is the best free bookkeeping software?

There are several free software solutions available for bookkeeping, recording expenses and receipts, adding debit and credit transactions in Journal, etc. Some of the top choices include Wave, ZipBooks, GnuCash, CloudBooks, Sunrise, etc.

Varsha is an experienced content writer at Techjockey. She has been writing since 2021 and has covered several industries in her writing like fashion, technology, automobile, interior design, etc. Over the span of 1 year, she has written 100+ blogs focusing on security, finance, accounts, inventory, human resources,... Read more