How to Change Contact Details in GST in 5 minutes? Follow These Steps

Contact information is of utmost importance when filing for GST returns as all the communication regarding updates, status, etc. would be directly sent as notification to the mentioned email id and telephone number. After adding all the requisite information, you can opt for changing the provided email ID or mobile number as and when the need arises. Here, you can find out how to change contact details in GST portal.

Simple Steps on How to Change Mobile Number and Email ID in GST

Follow the given information in the exact order for how to change contact details in GST portal. These 6 steps will take less than five minutes to change the contact number in GST along with the email ID.

Step 1- Login to gst.gov.in and click on ‘Register’ tab.

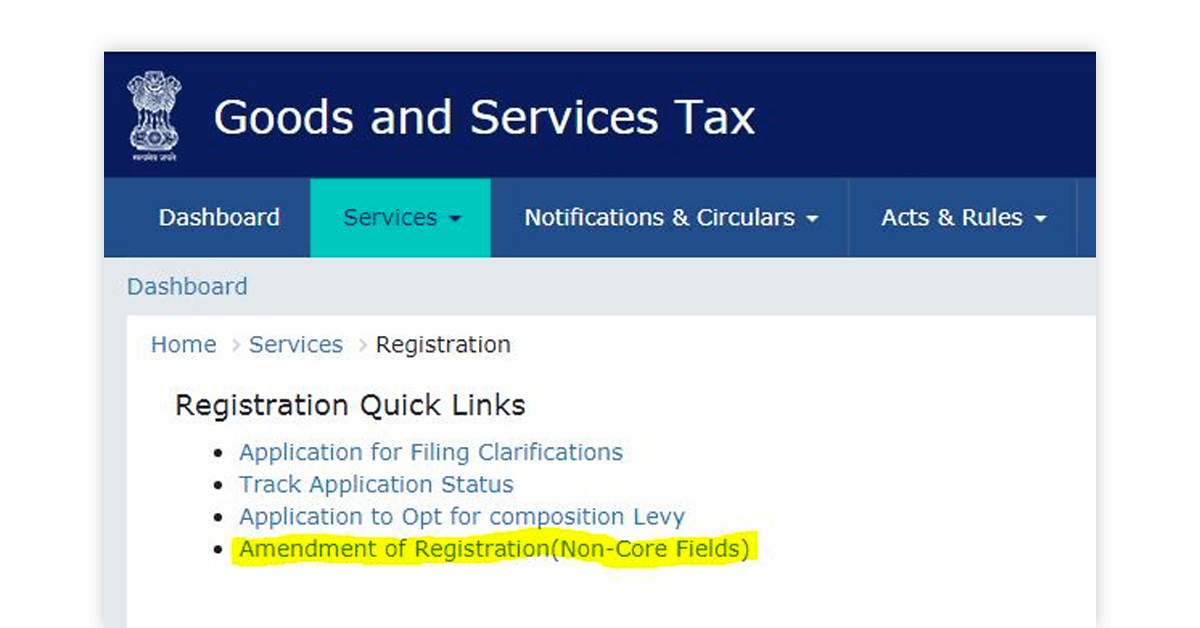

Step 2: In Registration Quick Links, Choose the option of ‘Amendment of Registration (non-core fields)’.

Step 3: You will come across multiple options, click on ‘Authorized Signatory’ tab.

Step 4: You will get details of the current Authorized Signatory. Click on ‘Add New’ to update new email ID and contact details of the signatory and ‘Save’.

Step 5: As soon as you verify, an OTP will be sent to the authorized signatory’s email ID and contact number.

Step 6: In the Authorized Signatory drop down, select ‘Name of the Authorized Signatory’ and Place. Change these details and sign the application digitally with options for:

- Submit with DSC (Digital signature)

- Submit with E-Signature

- Submit with EVC

And, you are done with how to change contact details in GST portal! Within a few minutes, you will receive the acknowledgment notification for the submission of your application to change contact details of the authorized signatory in GST portal.

Suggested Read: 11 Best Free GST Billing Software in India – Free Download

FAQs on GST Contact Detail’s Change Procedure

I am a taxpayer. Can I add myself as an authorized signatory to the GST portal?

GST returns are filed by taxpayers on monthly, annual or quarterly basis. Yes, you can add yourself as the authorized signatory to the GST by following the given steps.

Step 1: Visit the GST portal and click on the Services section for going to the option New Registration.

Step 2: Select the New Registration box and enter the GST Practitioner option from the ‘I am a’ tab.

Step 3: A dropdown menu would appear and there you have to choose your district/state.

Step 4: Add your name, PAN number, mobile number and email id. Press the Proceed button.

Step 5: Two OTPs will be generated one each on your mobile number and email address. Enter them and click proceed.

Step 6: A TRN would be generated, add the TRN along with the captcha and click on proceed.

Step 7: Quickly upload all the asked verification documents so asked for and proceed.

Step 8: The final form that you have now can be submitted in two ways- DSC and EVC/E-signature.

After form submission, a confirmation message would be displayed and from here on it will take up to fifteen days for you to finally register yourself as an authorized signatory or GST practitioner.Can two authorized signatories be added to one GSTIN?

Yes, in fact you can add up to ten authorised signatories to one GSTIN number. This can include partners, promoters and directors.

I am a partner currently, how can I become the primary authorized signatory?

A designated partner has all the rights to becoming an authorized signatory. Login to the GST portal, add your email address and contact details, along with declaration and acceptance forms on the GST portal. Attach your photographs as well as identity and address proof documents. All these documents can be signed digitally.

Upon the death of an authorized signatory, will the registration certificate be cancelled automatically?

Upon the proprietor’s death, you as a legal heir will have to file an application with the Proper Officer to cancel the registration certificate. This has to be done within 30 days of the death of the proprietor’s death.

In case of the death of primary authorized signatory, how to login to GST portal?

Supply to the jurisdiction officer documents such as the death certificate of the authorized signatory and succession papers to the jurisdiction office. Once confirmed, Proper Officer would add you as the deceased person's legal heir into the GST portal. As soon as you get added as the new authorized signatory, a new Id and password would be sent to your email address.

As you use this information to login, the portal would direct you to GST FORM REG-16, where you can select ‘Death of the previous signatory’ for cancelling previous login details and such information.How long does it take to change the mobile number and email id in GST portal?

You will have to fill up a registration form completing all the necessary steps for changing mobile number and email id of the authorized signatory in GST.

After finishing the required formalities, an email confirmation will be sent in 15-20 minutes about the change in contact details. The new GST portal helps people avoid going to the government office to change email id and contact details in GST portal.Do I have to wait for the approval by the assessing office to change contact details in GST?

Mobile number and email ID change in GST portal does not require the approval of an assessing officer. You can digitally sign your documents and get approval directly from the GST portal.

Also, for any GST related query kindly check latest GST Blogs.

Somya is one of the most experienced technical writers in the team who seems to be comfortable with all types of business technologies. She is a sensitive writer who ensures that businesses are able to find the right technologies through her writings. She would leave no stones unturned... Read more