How to File TDS Return Online: Quick & Simple Guide 2025?

If you are a business owner or a service provider, you know that managing tax is as important as breathing. It is crucial to comply with tax regulations to run your operations smoothly. One such responsibility is filing TDS online.

It doesn’t matter whether you are paying salaries or any professional fees- you must file a TDS return on time to avoid any penalties. Many businesses also use TDS return filing software to simplify and automate this process.

So, in the blog, we will discuss the step-by-step process of filing TDS returns online, including the documents you need, the due dates to remember, and common mistakes to avoid.

So, let’s get to it!

What is TDS (Tax Deducted at Source)?

TDS, or Tax Deducted at Source, is a method of collecting income tax at the point where income is generated. It’s a crucial component of India’s tax system.

In this system, when someone makes a payment (like salary, rent, or fees), they cut a small portion as tax and send it directly to the government on behalf of the person receiving the money. It helps make sure that taxes are paid on time and reduces the chances of tax cheating.

EasyOFFICE

Starting Price

₹ 2900.00 excl. GST

Why is TDS Necessary?

TDS is necessary because it serves multiple important purposes, such as:

- Ensures regular collection of taxes for the government.

- Reduce the chances of tax evasion.

- Helps the government maintain a steady cash flow.

- Makes tax payments easier and more manageable for individuals.

- Promotes transparency in financial transactions.

- Helps track the income of individuals and businesses.

- Reduces the burden of paying a large amount of tax at once.

Saral TDS

Starting Price

₹ 5640.00 excl. GST

Who Should File a TDS Return?

One thing to notice is that TDS return filing isn’t just for big companies; it is for anyone who deducts TDS and needs to file it. Here’s who should file:

- Businesses and companies make payments like salaries, rent, or contractor fees.

- Government offices that deduct TDS while making payments.

- Individuals or professionals (like doctors, lawyers, etc.) who are required to deduct TDS under the law.

- Partnership firms or LLPs that make payments where TDS applies.

- Banks that deduct TDS on interest earned from fixed deposits.

- Any person or organization that has a TAN (Tax Dedication and Collection Account Number) and deducts TDS.

Suggested Read: What is the Difference Between TDS and TCS?

Important Dates for Filing TDS Return

It is important to remember the TDS return due date so that you can stay on the right side of tax rules. TDS returns are filed every quarter, and each quarter has a specific due date. Let’s take a look:

| Quarter | Period | Last Date |

|---|---|---|

| Q1 | April to June | 31st July |

| Q2 | July to September | 31st October |

| Q3 | October to December | 31st January |

| Q4 | January to March | 31st May |

Documents Required to File TDS Return

When you are filing a TDS return, you will need the following documents:

- AN (Tax Deduction and Collection Account Number): This is a must for anyone deducting TDS.

- PAN details: You’ll need the PAN of both the person making the payment (deductor) and the person receiving it (deductee).

- TDS challan details: This includes information like the Challan Identification Number (CIN) for the tax payments made.

- TDS statement: Prepare the return file in the correct format as required by the Income Tax Department.

TDSMAN

Starting Price

₹ 4900.00 excl. GST

How to file a TDS Return?

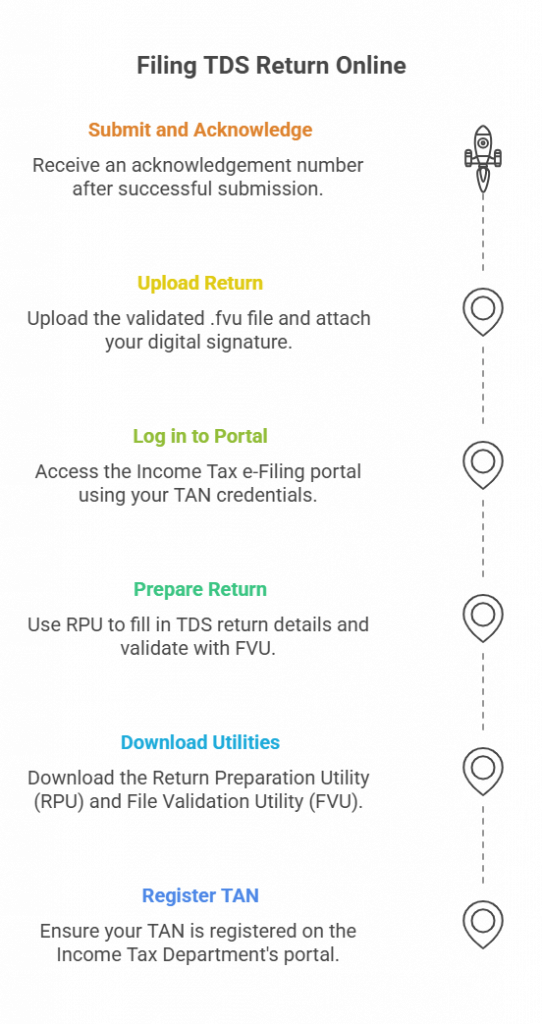

Follow these steps below to file a TDS return online:

Step 1: Get your TAN registered

First, make sure your TAN (Tax Dedication and Collection Account Number) is registered on the Income Tax Department’s e-filing portal. Visit the TRACES website and register yourself using your TAN.

Step 2: Use the Right TDS Return Preparation Utility

Download the Return Preparation Utility (RPU) and File Validation Utility (FVU) from the TIN-NSDL website.

Use the RPU to fill in your TDS return details.

Once done, validate the file using FVU. This generates a .fvu file, which is required for filing.

HostBooks TDS

Starting Price

₹ 4199.00 excl. GST

Step 3: Log in to the Income Tax e-Filing Portal

Visit- incometax.gov.in

Log in using your TAN credentials.

Step 4: Upload the TDS Return

Go to [e-File] > [Income Tax Forms] > [File Income Tax Forms]

Select the relevant form (24Q, 26Q, 27Q, or 27EQ) depending on the type of TDS.

Upload the validated .fvu file and attach your digital signature (DSC) if required.

Step 5: Submit and Acknowledge

After uploading, you’ll receive an acknowledgement number.

You can download this confirmation for your records.

Common Mistakes to Avoid During TDS Filing

Here are some of the common mistakes to avoid during TDS filing:

Using the wrong TAN or PAN: Always double-check the TAN and PAN of both the deductor and the deductee.

GEN e-TDS

Starting Price

₹ 3000.00 excl. GST

- Incorrect challan details: Mistakes in Challan Identification Number (CIN), payment date, or amount can lead to rejection.

- Filing under the wrong form: Choose the correct form (24Q, 26Q, 27Q, or 27EQ) based on the type of payment.

- Wrong section codes: Each type of payment (salary, rent, commission, etc.) has a specific section code—enter the right one.

- Mismatch in TDS amount and challan: Ensure the TDS deducted matches the amount mentioned in the challan.

- Not validating the file properly: Always validate your return using the FVU tool before uploading.

- Missing deadlines: Late filing leads to penalties, so always file before the due date.

Suggested Read: How to Make Online Payment of TDS: A Step-by-Step Guide

Conclusion

That being said, filing TDS returns doesn’t have to be stressful. As long as you follow the correct process, keep your documents ready, and file within the due dates, you’re good to go.

Shubham Roy is an experienced writer with a strong Technical and Business background. With over three years of experience as a content writer, he has honed his skills in various domains, including technical writing, business, software, Travel, Food and finance. His passion for creating engaging and informative content... Read more