GST Tool Software Pricing, Features & Reviews

What is the GST Tool?

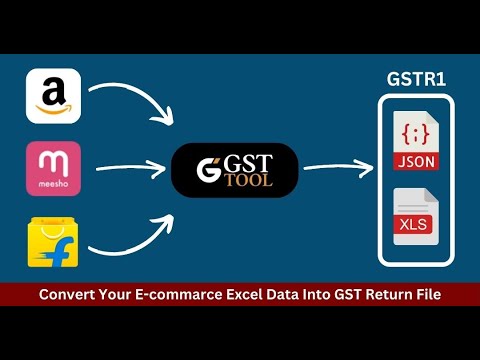

GST Tool helps businesses to simplify tax compliance for online sellers in India. It is an accounting software that focuses on the specific needs of businesses that sell on e-commerce platforms.

This GST software helps sellers take their sales data from marketplaces, prepare it correctly, and file their GSTR-1 returns with the official GST portal without manual hassle. It acts as a bridge between your sales data and government requirements.

The software is built to save time and reduce errors. It allows users to upload their e-commerce data, map the information to the correct fields, and then generate the necessary Excel and JSON files ready for filing.

Why Choose a GST Tool?

- Built Specifically for E-commerce Sellers: Tailored to handle sales data from online marketplaces, addressing the unique GST filing needs of digital sellers.

- Streamlines GSTR-1 Return Filing: Automates the process of converting marketplace data into the correct format (Excel/JSON) for direct upload to the GST portal.

- Simplifies 2A/2B Reconciliation: Helps you match your purchase data with your suppliers' filed data to accurately claim Input Tax Credit (ITC).

- Direct Data Export to Tally: Offers seamless integration to export processed data directly into Tally accounting software for complete bookkeeping.

- User-Friendly and Intuitive Interface: Designed to be easy to use, allowing sellers to manage GST tasks without being tax experts.

Benefits of GST Tool

- Saves Significant Time on Monthly Filing: Automates data preparation, cutting down the hours spent manually organizing and formatting sales data for GST returns.

- Reduces Errors and Compliance Risks: Minimizes manual data entry mistakes, leading to more accurate filings and helping avoid government notices or penalties.

- Maximizes Input Tax Credit Claims: Makes reconciling purchase invoices easier, ensuring you claim all the GST credit you are entitled to, improving cash flow.

- Improves Overall Accounting Efficiency: By integrating with Tally, it creates a smooth workflow from sales data to final accounts, reducing duplicate work.

Pricing of GST Tool

GST Tool price starts at INR 149 at techjockey.com. The pricing model is based on different parameters, including extra features, deployment type, and the total number of users. For further queries related to the product, you can contact our product team and learn more about the pricing and offers.

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers