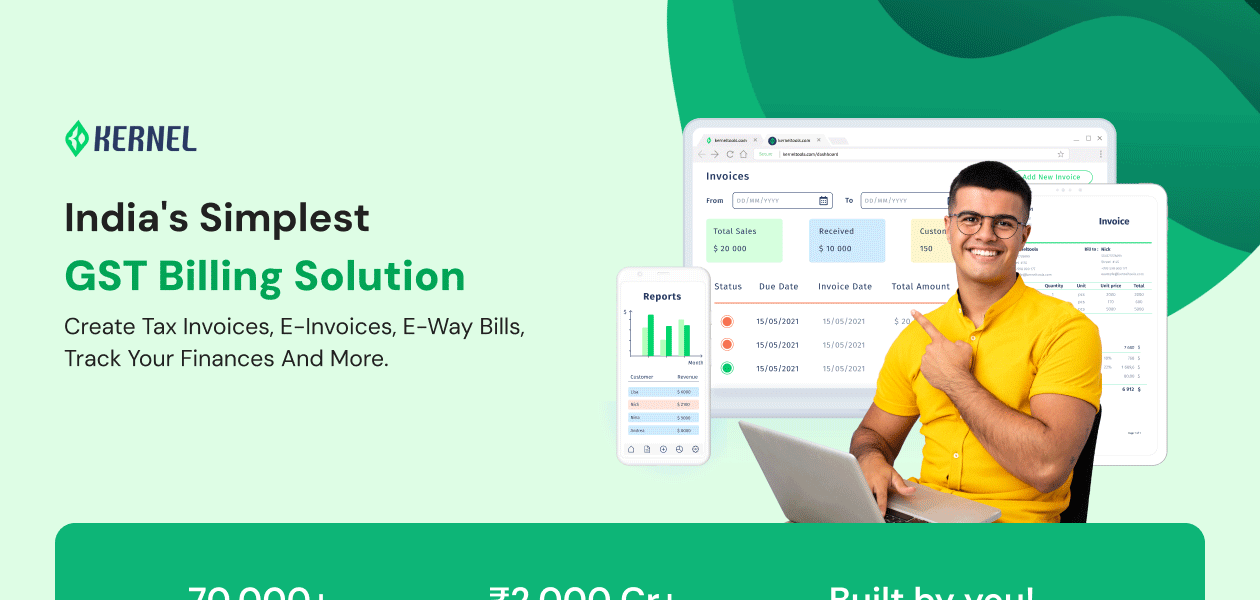

Kernel GST Billing Software Pricing, Features & Reviews

What is Kernel GST Billing Software?

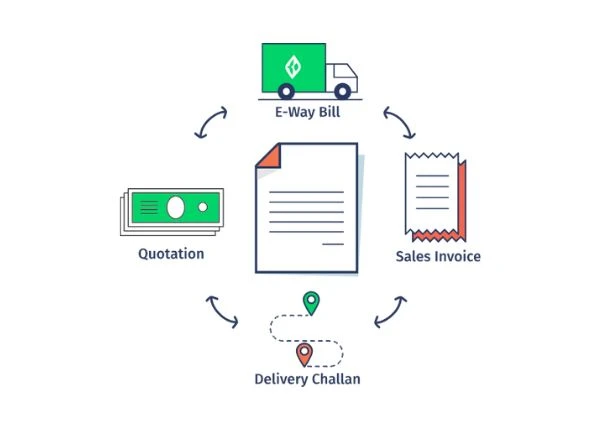

Kernel GST Billing Software is a highly efficient and simple-to-use application that can be used via desktop and mobile apps. This application software provides services for managing sales documents, GST billing, e-billing, and invoice generation. This application software helps business organizations manage all their sales documents, synchronizing data between computer and mobile automatically, generating e-bills instantly, managing expenses, and generating various reports on sales.

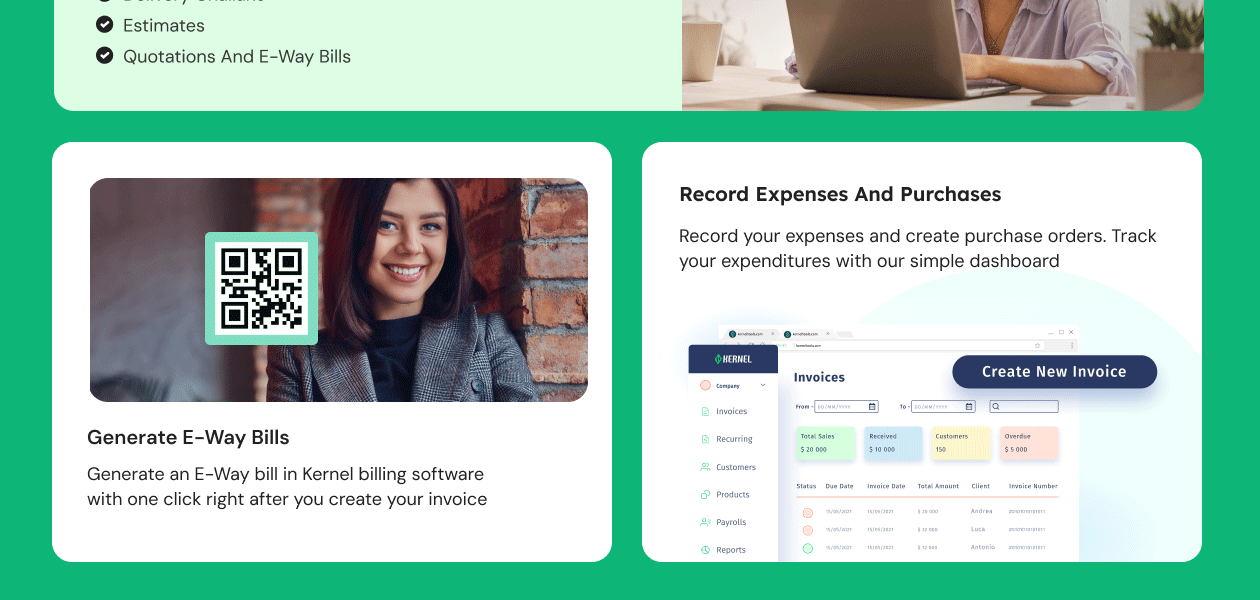

Kernel GST Billing software is accessed through secure authorized login. The workspace can be shared between accountants and employees to coordinate and communicate essential documents. Different sales documents, challan-based invoices, tax invoices, and quotations can be created in simple steps. These documents can be shared and shared in Excel or PDF format. The application software also provides details on products and inventories, cash inflows, and cash outflows and thus helps in managing and tracking expenses. Detailed reports on stocks, sales, and costs help make sound business decisions.

This GST billing software offers advanced inventory management capabilities, allowing businesses to track stock levels, monitor product movement, and generate inventory reports. With real-time updates and alerts, users can easily manage their inventory, avoid stockouts, and optimize their supply chain.

Another notable feature of Kernel GST is its comprehensive reporting and analytics functionality. The software provides valuable insights into sales trends, revenue patterns, and customer behavior through detailed reports and analytics dashboards. This data-driven approach helps businesses make informed decisions, identify growth opportunities, and improve financial performance.

Why Choose Kernel GST Billing System?

- Sales document: This application software helps create and keep various sales documents in one place. The workspace can be shared with authorized users to ensure seamless collaboration.

- Invoicing and e-billing: It allows you to create invoices in 2 minutes. The user must input client, product, and payment information, and the invoice is ready. The invoice can be shared with the client directly or downloaded as PDF.

- Schedule regular invoice: The user can schedule the regular e-bills and invoices for a particular date and time. The software will automatically send it at the scheduled time to respective clients.

- CRM integrated: The application integrates with CRM, allowing users to store and manage customer information.

- Product catalog and manager inventory: It allows creating and adding products and using them in sales documents.

- Reports: It allows for tracking cash flow, previous and current monthly expenses, and average payment time and generates various reports for analysis

Benefits of Kernel GST Billing Software

- Save time and effort: It eliminates paper-based manual invoicing by generating e-bills. It gives time to focus on business activities.

- Availability: It is easily accessible via the internet and can be used to synchronize data from mobile apps and computers.

- Simplicity: It has forms and navigational options that are user-friendly and simple.

- Multiple Languages: The application software can support English, Hindi, and Hinglish languages.

- Security: It uses SSL encryption and ensures data security.

- Data Backup: The data is automatically backed up on the cloud regularly, ensuring business data continuity.

- Data Export: It supports various export formats like Excel, export to Tally, and PDF format.

Pricing of Kernel GST Billing Platform

Kernel GST billing pricing is available on request at techjockey.com.

The overall pricing model is based on different factors such as personalization, extra features required, total users, and deployment type. Please feel free to request a call from our product experts if you want to learn more about our subscription plans or premium package deals.

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers