Master India GST Software Pricing, Features & Reviews

What is Masters India GST Software?

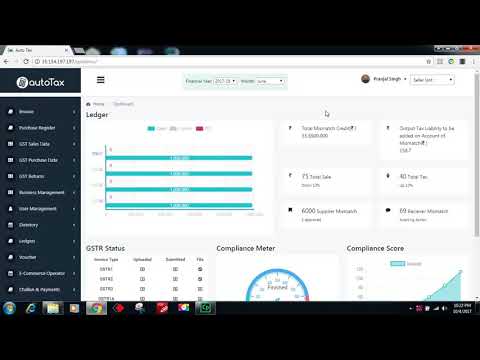

Masters India GST Software is one of the best GST software that helps in fastening the GST process and makes it more convenient and efficient. With this software, you may reduce the time it takes to file your GST returns by 50%.

This software helps in streamlining the entire GST process and is majorly used by all accountants, auditors, tax lawyers, CAs, enterprises, SMBs, business owners, and other professionals.

This software offers amazing features such as user management, dashboard, analytics, reporting, customer support, and more. In total, this software helps in reconciling sales & purchases, GST records, filing GSTR, and other returns.

Who Uses Masters India GST Software?

- Enterprises: Helps enterprises in managing GST compliance of all the clients at once.

- SMBs: Enables SMBs to reconcile file returns and tax records to guarantee that no sales are made without being recorded or purchases are made without a tax credit claim.

- CA’s & Accountants: Allows accountants and CAs to leverage delegation and business management to easily manage reconciliation & filing for hundreds of clients.

- Developers: Helps them to build a return filing feature in the accounting software using APIs.

Benefits of Masters India GST Software

- Quickly and accurately records all the purchases (even through unconventional means) to claim ITC (Input Tax Credit) accurately.

- Effectively integrates with Oracle, Tally, Custom ERP, SAP, Busy, etc.

- Helps in uploading, submitting, and filing the GSTR.

- Enables importing of purchase data and running sales reconciliation.

- Creates analytical reports for improved visibility into return filing and tax operations.

Pricing of Masters India GST Software

Masters India GST Software price details are available on request at techjockey.com.

Please request a call back for subscription-related details and to avail offers on premium packages.

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers