Sale and purchase are the most common entries in accounting. Recording transactions accurately is essential because most government regulations, taxation compliances, and accounting standards are based on business sales and purchase volume.

For example, businesses are liable for Tax Audit under section 44AB when sales receipt is more than one crore in a financial year.

Sale and purchase entry in Tally with GST is confusing because there are many factors that the accountants should consider. Inaccurate recording of GST could lead to problems like GSTR-2A mismatch, wrong ITC claims, and a wrong balance sheet. Here is your guide to record sales and purchase entry in Tally accurately.

Suggested Read: How to Create Ledger in Tally ERP 9

Purchase Entry in TallyPrime with GST

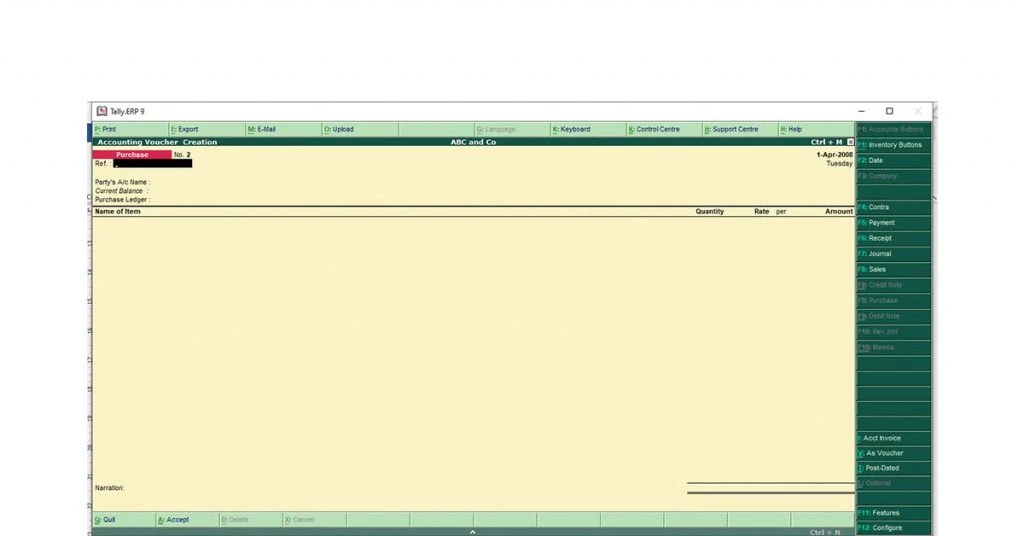

Take the following steps to make a purchase entry with GST in Voucher Mode in TallyPrime.

Step 1: Go to the Voucher Mode

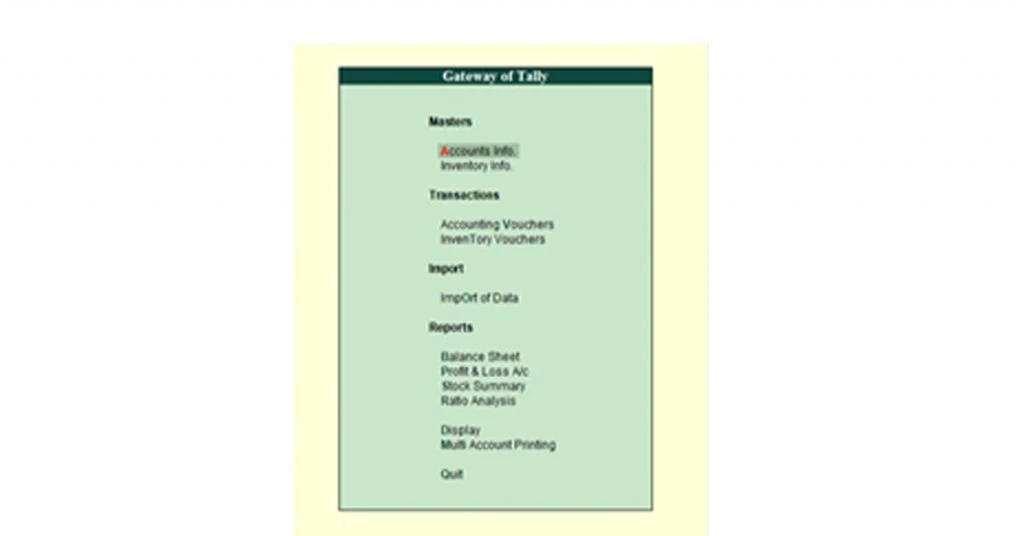

- Go to Gateway of Tally

- Select Vouchers

- Press the F9 key to open the Purchase screen

- Select as voucher from side screen or press ALT + V

Step 2: Fill the Fields

- Hit F2 button on Keyboard to change the date

- Select the supplier to be credited

- Enter the amount of purchase

- Debit the purchase A/c

- Enter CGST/SGST/ IGST paid on purchase in the correct ledger

Step 3: Other Details

- Enter Purchase order number

- Narration, mode of payment

Example of Purchase Entry with GST in Tally

Let’s learn with an example about how to make an entry for purchase in Tally easily:

ABC is a computer trader. ABC purchased a laptop (for selling) worth 15000 at credit from a local seller registered in the same state. GST applicable on the laptop is 18%.

- Select accounting vouchers

- Select Tally purchase voucher (If you are not already in purchase voucher) / alternatively, press F9

- Select voucher from the side screen/ alternatively, press Ctrl + V

- Enter all the details on their respective ledger:

- Credit the Supplier Account (Neelam Traders) by 15000+18% of 15000= 17700

- Debit Purchase A/c By 15000 (Actual Sales Value)

- Debit CGST (outward) 9% = 1350

- Debit SGST (outward) 9% = 1350

- Enter Narration

GST Purchase Entry in Tally as Invoice

Follow the steps mentioned to make an entry of sales voucher in Tally in Voucher Mode.

- Click/ enter on “Accounting Voucher” from Gateway of Tally

- Select purchase voucher or Press F9 in voucher mode

- Go to Invoice either by clicking “As invoice” on the side screen or pressing Ctrl+V (if you are not already in invoice mode)

- Enter the supplier invoice number, date, Party A/c Name, and other details

- Choose the purchase ledger

- Select the items purchased with predefined GST rates (Create a new item if it doesn’t already exist)

- Enter the number of items purchased

- Enter the price at which those are brought

- Per: Automatic field, which depends on the specifics while creating stock items.

(You can define taxability of the item while entering the stock item, and the purchase entry will automatically book the GST).

Suggested Read: Types of Voucher in Tally ERP 9 to Manage Transactions | Top Tally Alternatives

Sales Entry in Tally Prime with GST

You can take the following steps to make a Tally Sales entry with GST in Voucher Mode.

Step 1: Go to the Voucher Mode

- Go to Gateway of Tally

- Select vouchers

- Press the F8 key to open the sales screen

- Select Voucher from side screen or press Ctrl +V

Step 2: Fill the Fields

- Hit F2 button on keyboard to change the date

- Select the debtor to be credited

- Enter the amount of sales

- Credit the sales A/c

- Enter CGST/SGST/ IGST charged on sales in the correct ledger

Step 3: Mention Other Details

- Enter Ref No, Bill

- Narration: Mode of payment, the status of delivery, delivery challan number

Sales Entry in Tally with GST Example

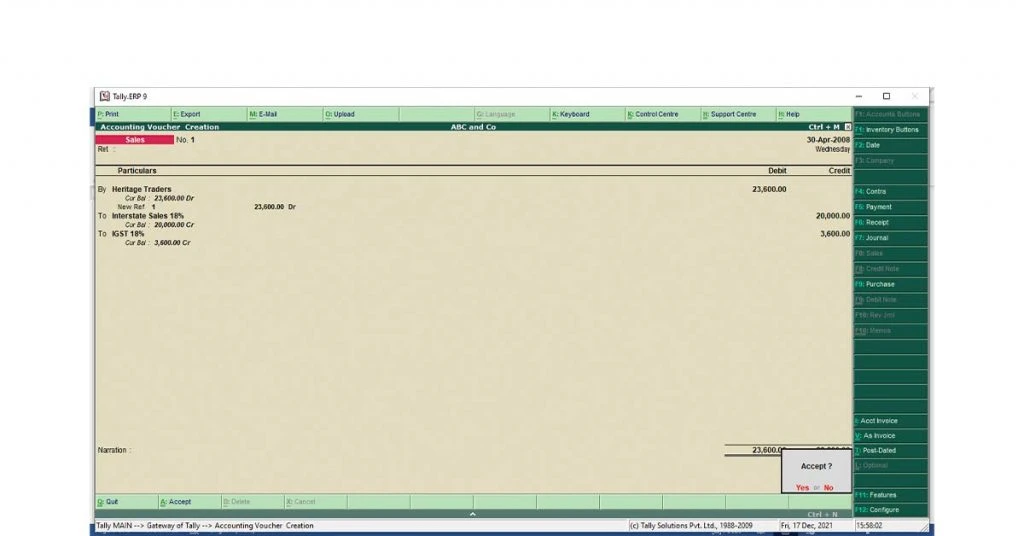

Here is an example of how you can make sales entry with GST in Tally:

ABC company Sold a laptop to Heritage Traders for ₹20,000 on credit. Sale is interstate, and GST chargeable is 18 percent.

- Select Accounting Vouchers

- Select Sales Voucher (you are not already in Sales Screen)/ Alternatively Press F8

- Select As Voucher from side screen (if not already) Alternatively, press Ctrl + V

- Enter All the details on their Respective Ledger:

* Debit the Sundry Debtor Account (Heritage Traders) by 20000+18% of 1=5000= 23,600

* Credit Sales A/c by 20000 (Actual Sales Value)

* Credit IGST (Inwards) 18% = 3600

* Enter Narration

Suggested Read: How to File GSTR 1 Using Tally.ERP 9 – A Step By Step Guide

GST Sales Entry in Tally as Invoice

Follow the steps mentioned below to make sales entry in Tally as Invoice:

- Click/ Enter on “Accounting Voucher” from Gateway of Tally

- Select Sales Voucher or Press F8 in Voucher Mode to enter Sales Screen

- Go to as Invoice either by clicking “As invoice” inside screen or pressing Ctrl+V (if you are not already in invoice mode)

- Enter the Invoice Number, date, Party A/c Name, other details

- Choose the sales ledger.

- Select the items sold with predefined GST Rates (Create a new item if the item doesn’t already Exist)

- Enter the number of items to be sold

- Enter the price at which the item is sold

- Per: Automatic field, which depends on the specifics while creating stock items.

- (You can define taxability of the item while entering the stock item, and the sales entry will automatically book the GST.)

Things to Know Before Making Sale & Purchase Entry in Tally with GST

It is extremely tough for beginners to understand all aspects of Tally sales and purchase transactions. As a beginner, here are a few things that you must know i.e., as voucher and item invoice recording.

Types of Sale and Purchase Recording in TallyPrime

Any purchase and sales entry in Tally with GST can be recorded in two different methods. The first is the voucher type, and the second is the Invoice type.

As Voucher: In this, you can record sales or purchases and GST payable or receivable as a voucher. There are no item-wise details and breakdown in voucher type entry. It is applicable primarily for service-based businesses and traders who don’t want to maintain stock, and item-wise breakdown can skip this part.

As Item Invoice Recording: There is an itemized breakdown of every sale and purchase transaction in this type of recording. Traders and manufacturers specifically use the method to record transactions at multiple GST rates.

Suggested Read: Best Reseller Apps in India for Selling and Online Shopping

Ledgers You Must Have Before Making Sale and Purchase GST Entry in TallyPrime

Most traders, departmental stores, etc., use POS software to record transactions and generate invoices. Recording transactions as vouchers is the most common type of sale and purchase GST entry in Tally ERP 9.

Ledgers that you should make before making purchase and sales entry in Tally with GST.

| Purchase Entry | Sales Entry |

| Intrastate Purchase (CGST and SGST) | Intrastate Sales (CGST and SGST) |

| Interstate Purchase (IGST) | Interstate Sales (IGST) |

| CGST (Receivable) | CGST (Payable) |

| SGST (Receivable) | SGST(Payable) |

| IGST (Receivable) | IGST(Payable) |

| Supplier/ Vendor Ledger | Customer / Sundry Debtor Ledger |

- While creating the ledgers of sundry creditors and sundry debtors, specify the GST implication of the party whether Registered, Unregistered, Intrastate, or Interstate.

- If your business has multiple lines of products charging different GST rates, it is advisable to create multiple GST ledgers for different tax rates for easy understanding and reconciliation.

| GST Rates | CGST Ledger | SGST Ledger | IGST Ledger |

|---|---|---|---|

| 5% | CGST@ 2.5% | SGST@ 2.5% | IGST@ 5% |

| 12% | CGST@ 6% | SGST@ 6% | IGST@ 12% |

| 18% | CGST@ 9% | SGST@ 9% | IGST@ 18% |

| 28% | CGST@ 14% | SGST@ 14% | IGST@ 28% |

Conclusion

If you follow the steps mentioned above, you will be able to make sales and purchase entries in both Tally ERP 9 and Tally Prime because their interface is almost similar.

If you are learning to account or searching for an accounting job as a fresher, it will be beneficial to get some hands-on experience on Tally. Purchase entry with GST in Tally is among the most frequently asked question by interviewers.

Suggested Read: Tally Introduction, Features & Specifications | How to Use Tally

Tally Purchase Entry with GST FAQs

How can I pass purchase entry with GST in Tally?

Purchase entry with GST in Tally can be passed in two ways: As a voucher and as an Invoice. You can navigate the purchase screen and fill the fields with the respective supplier's name, amount, purchase ledger, and GST applicability.

What is the purchase entry with GST?

A purchase entry with GST is a transaction entry passed when goods are purchased from other suppliers for trade. The purchase amount also includes the GST paid, which could be later claimed as ITC.

How can I post purchase entry in Tally?

You can pass the purchase entry in Tally by navigating to the purchase screen. 1) Select Accounting Voucher (on Gateway of Tally). 2) Select Purchase Voucher or Press F9 on the keyboard. 3) Choose to Enter Purchase as Invoice or Voucher as per your convenience through the side screen.

How do you enter entries in Tally GST?

Passing entries on Tally is done through Accounting Voucher. You can pass sales entries, purchase entries, journal entries, contra entries, receipt entries, and payment entries through their respective screens.

Is purchase debit or credit?

Since the purchase is a nominal account, any purchase is considered an expense and recorded as debit in double entry system. Also, cash, bank, or sundry debtors are credited at the same time.

What is the entry of purchase invoice?

To make a purchase invoice entry in the books, the following will be the journal entry: Purchase A/C Dr. To Supplier's A/C

What is the purchase account?

The purchase account is a ledger account in which all the purchase invoices and credit notes are recorded. It is a part of the company's chart of accounts.

Is purchase an expense?

The purchase account is a nominal account and is considered as an expense in the Profit and Loss statement.

What is the journal entry for GST?

The journal entry for GST will depend on the type of transaction. If it is a purchase, GST paid will be debited as an asset while on a sale, GST received will be credited as a liability.

Is GST debit or credit?

It depends on the type of transaction. GST is a debit when it is a purchase, as the amount paid is treated as an asset. Also, GST is a credit in a sale, as it’s a liability to be paid.

Can we post GST entry in Tally?

Yes, you can post GST entry in Tally. To do so, navigate to the Accounts Info. menu and select the GST details option. Enter the GSTIN, GST Registration Type, and other relevant information. Then, you can make GST entry while recording a sale or purchase.

How do I record GST paid on purchases?

You can record GST paid on purchases as debit while making an entry for purchase. Debit the purchase account exactly with the taxable value, and debit the CGST and SGST, or IGST with the amount of GST paid.

Is GST applicable on purchase order?

In general, GST is not applied to purchase orders, as it contains the details and value of goods to be purchased. However, some purchase orders might contain GST to avoid any confusion related to the value of purchases.

Rajan is pursuing CA with a keen interest in trends and technologies for taxation, payroll compliances, Tally Accounting, and financial nuances. He is an expert in FinTech solutions and loves writing about the vast scope of this field and how it can transform the way individuals and businesses... Read more