Collecting payments is one of the major concerns for every business, and for this, you need a secure payment gateway. A gateway that would allow you to collect payment from multiple methods like debit & credit cards, UPI, net banking, etc. All in all, the payment gateway should make it the payment collection process convenient for businesses as well as their customers.

Let’s compare the two major players, Cashfree and Razorpay, and find out which is the better one.

Cashfree Vs Razorpay: An Overview

Cashfree and Razorpay are two leading payment gateways used by businesses. However, both offer quite similar functionalities when it comes to modes and convenience of payment collection.

However, there are a few differences that can help you choose the better according to your requirements. For instance, Cashfree offers identity verification options which is missing a Razorpay. But the card issuance feature of Razorpay is better as it does not take any security deposit. Other than this, Razorpay is also available for iOS devices, whereas Cashfree’s app can only be used on Android devices.

Let’s have more detail into how both these payment gateways compare to each other:

Cashfree Payments Pros and Cons

Pros:

- Multiple payment modes: Cashfree supports a wide variety of payment methods, such as credit cards, debit cards, net banking, wallets, and UPI. This flexibility helps customers to pay using their preferred method which enhances their overall experience and potentially increases sales.

- Great customer support: Cashfree offers excellent customer service, with a responsive and knowledgeable team ready to assist with any issues or queries. This reliable support helps businesses resolve problems quickly and efficiently.

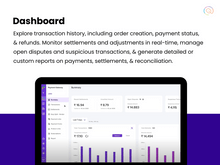

- In-depth analytical data: Cashfree provides comprehensive transaction data and insights. This analytical data helps businesses track their sales performance to optimize their operations and strategy.

Cons:

- No built-in store creation feature: Cashfree does not offer an integrated platform for creating and managing an online store. Businesses looking to set up an e-commerce site will need to use a separate service or platform for their store creation needs.

- Lacks Cryptocurrency support: Cashfree does not support cryptocurrency payments, such as Bitcoin. Businesses wishing to accept cryptocurrencies will need to find alternative payment gateways that offer this capability.

Razorpay Payment Gateway Pros and Cons

Pros:

- Best In-class Security: Razorpay ensures top-level security for all transactions. This means that your customers’ payment information is highly secure, which helps build trust and protect your business from fraud.

- Quick and Easy to Set Up: Razorpay is designed for simplicity and speed. You can set it up quickly and start accepting payments without extensive technical know-how, saving you time and effort.

- Global reach: With Razorpay, you can accept payments from customers around the world. This global reach helps expand your market and increases your business potential.

- Great Up-time and Success rates: Razorpay boasts excellent reliability with minimal downtime and high transaction success rates. This ensures a smooth payment experience for your customers and reduces potential loss of sales.

Cons:

- Costly International Transactions: Razorpay's fees for international transactions can be relatively high, which may increase costs for businesses dealing with customers from other countries.

- Lacks Cryptocurrency support: Razorpay does not support cryptocurrency payments, such as Bitcoin. Businesses wishing to accept cryptocurrencies will need to explore alternative payment gateways for this feature.

Cashfree vs Razorpay: Features Comparison

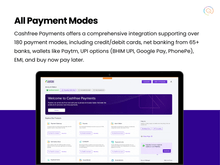

Cashfree vs Razorpay is quite similar when it comes to features. Both the payment gateways offer multiple options for payment collection, recurring payments, QR code scanning, split payment options, and more. However, when it comes to offering a Buy Now Pay Later feature, Cashfree is better than Razorpay as it supports more Pay Later payment options like Freecharge PayLater, Ola Money Postpaid, etc.

Let’s understand how these payment gateways work.

- Ease of Payment Collection: Both the payment gateways allow businesses to easily receive payments through multiple ways like payment links, forms, and QR codes. These payment modes can further be shared by businesses via SMS, email, chatbot, messenger, and more. This option is great for social media-based entrepreneurs and even D2C businesses for facilitating contactless payments.

- Buy Now Pay Later: The Buy Now Pay Later payment option of Cashfree is better than Razorpay, as it also supports the ‘No Cost EMI’ option. In fact, Cashfree also integrates with more Pay Later providers than Razorpay, these include Ola Money Postpaid, Kotak via Flexmoney, Freehcharge PayLater, and more.

- Payment Split: These payment gateways allow businesses to collect and split payments with their partners, vendors, and bank accounts. Thus, making it easy for businesses to disburse payments using a one-to-many collection model.

- Identity Verification: The identity verification feature offered by Cashfree is missing in Razorpay. Cashfree provides a comprehensive verification suite where users can do KYC before opening their accounts and even during onboarding. In addition to this, the verification suite also includes IFSC, UPI ID, Aadhaar, PAN, and GSTIN verification.

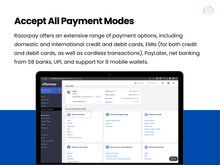

Cashfree Payments vs Razorpay: Payment Modes

Razorpay and Cashfree Payments both offer many ways for customers to pay. Razorpay has over 100 options, like all cards, UPI, EMI, and wallets, making checkout quick. Cashfree offers even more, with over 120 options, including any card, 65+ netbanking choices, UPI, Paytm, other wallets, EMI, and Pay Later options. Cashfree has a few more choices, which can be better for businesses wanting to give customers more ways to pay.

Cashfree vs Razorpay: Card Issuance

Cashfree and Razorpay issues cards for fintech corporates and their employees. These cards can be used as campus cards, expense cards, corporate credit cards, as loyalty wallets, and more.

However, the card issuance service of Razorpay is better than Cashfree as it does not charge any security deposit. Moreover, you also don’t require any personal guarantee or business savings.

Final Verdict: The card issuance service of Razorpay is better than Cashfree, as there is no need for a security deposit.

Cashfree Vs Razorpay: Target Users

The target users for both the payment gateways, Cashfree and Razorpay are the same that include:

- Startups

- Agencies

- SMEs

- Enterprises

Both platforms offer transaction-based pricing which is good for startups and SMEs. In fact, both these payment platforms also offer tailored pricing plans for enterprises to ensure low payment gateway charges.

Final Verdict: Cashfree and Razorpay both are suitable for startups, SMEs, as well as enterprises as they offer tailored pricing plans and individual transaction charges.

Cashfree Vs Razorpay: Deployment & Platforms Supported

Cashfree and Razorpay payment gateways both support cloud-based deployment type. Both the platforms can be accessed through their web portals on operating systems like Windows and MacOS.

However, in terms of app availability and accessibility, Razorpay is better than Cashfree, as it offers business apps for both Android and iOS devices. However, Cashfree only offers the app for Android devices. In fact, Razorpay has 10 lakhs+ downloads on Google Play Store, but Cashfree has only 1 lakh+ downloads.

Final Verdict: Razorpay is available on more platforms than Cashfree that includes Android and iOS apps, but Cashfree is can only accessed as app on Android devices.

Cashfree Vs Razorpay: Customer Support & Resources

Razorpay offers better customer support and knowledge base material to its users as compared to Cashfree.

Razorpay offers a 24*7 live chat option and a huge library of knowledge base material. These materials provide answers and guides for account activation, transactions, settlements, frauds, integration assistance, partner program, and more. In addition to this, there is support material especially for international payments, partner program, instant settlement, dispute resolution, and a lot more.

On the other hand, Cashfree also offers a 24x7 live chat option and provides support materials that include answers to general queries and step-by-step guides to general processes that related to refunds, disputes, settlements, account activation, etc. In addition to this, Cashfree also comes with a Customer Resolution Guide where users can track their refund & payment statuses. Moreover, they can also raise queries for payment, order fulfillment, cancellation, return, or fraud-related issues.

Final Verdict: Razorpay provides more knowledge base materials than Cashfree. However, both offer 24x7 live chat support.

Cashfree vs Razorpay: Pricing & Plans

As far as pricing is concerned, Cashfree is cheaper than Razorpay, as its charges for every transaction start from 1.90% onwards on payment methods like VISA cards, Mastercard, Jio Money, and net banking of 70+ banks. However, it charges 0% commission on transactions in the case of UPI and RuPay. But Razorpay users need to pay 2% platform fees on all transactions.

On the other hand, Razorpay is cheaper than Cashfree when you are dealing in international payments. Razorpay charges 3% platform fees per international transaction whereas Cashfree charges 3.5% + ₹7 additional for the same international transaction through Mastercard and VISA.

Final Verdict: Cashfree is cheaper for national transactions, whereas Razorpay is cheaper when you are making international transactions.

Techjockey’s Final Verdict

Cashfree and Razorpay come with a good list of features, however, choosing one from them entirely depends on your needs. If your business deals more in national payments, Cashfree is a better and cheaper option, with more Buy Now Pay Later Intergrations. However, if you majorly operate in the international market, Razorpay would be a better option for your business.

29 Ratings & 29 Reviews

29 Ratings & 29 Reviews