ClearTax Income Tax Software Pricing, Features & Reviews

What is ClearGST?

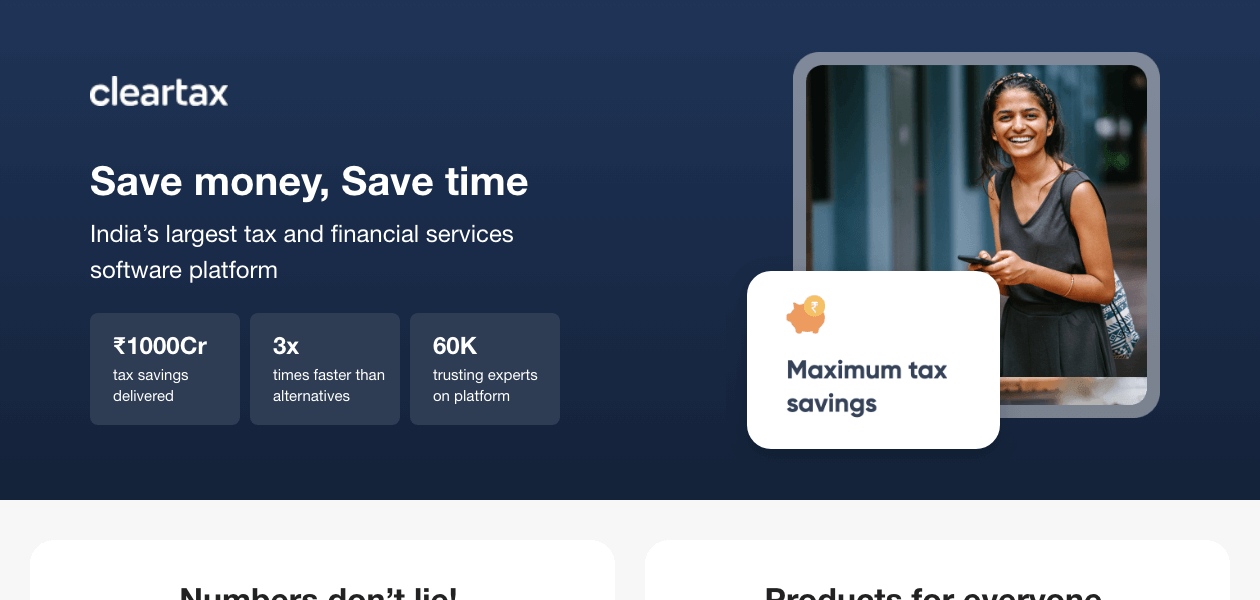

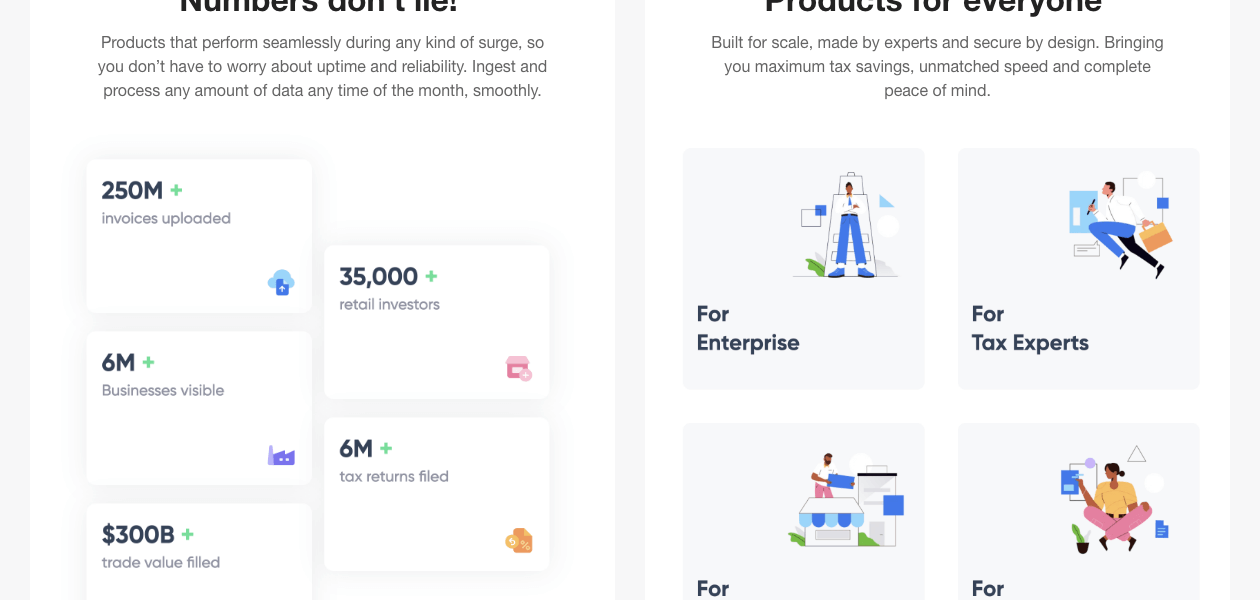

ClearTax is an income tax software used by tax experts, vendors, and financial service providers for GST returns filing and end-to-end direct & indirect taxation. The income tax return software offers enterprise-grade e-way billing & e-invoicing, advanced reconciliation & smart reporting functionalities.

ClearTax GST software provides a host of features for filing returns and ensures maximum tax savings for both self and the salaried professionals & organizations. The income tax calculation software supports an AI-powered reconciliation engine for identifying unused input tax credits & automating data imports.

You can match thousands of invoices in a minute while detecting tax credits. You can further connect ClearTax GST software with all major ER solutions to import data with bank-grade security. Experts at ClearTax performs detailed validation to manage your GST compliant functions faster.

Why Use ClearTax GST Software?

- Core GST filing: The income tax filing software helps with challan payment and data importing.

- GST data pulls: The software offers multi-month reports for pulling the last two year’s invoice histories.

- Advanced reconciliations: Use features like G8 vs purchase register & 2A vs purchase register for vendor-wise matching and advanced reconciliations.

- Ledger reports: The income tax calculation software gives access to ledger reports and summaries through sales-purchase-stock reports.

- Compliance overviews: The income tax software with its CFO dashboard gives an overview of credit, tax outflow, sales and purchases for checking vendor compliance.

- G1-G9C reports: ClearTax supports fast G1-G9C reports with reports for smart reconciliations.

- Connectors & templates: Connectors, templates and custom mappers for importing the data.

- Generating e-way bills: Generate fast e-way bills and schedule them fast with ClearTax also supporting hundred plus validations.

Why Use ClearTax ITR Software?

- Multiple income scenarios: People with all types of income sources can use ClearTax for filing returns. Source of income could be foreign, regular salary or money from capital gains.

- Claim deduction: E-file your IT returns with ClearTax and avail tax benefits just in case you missed submitting the investment proofs.

- Adjusting the losses: Adjust losses and calculate tax accordingly with the income tax software.

- Form 16 uploads: Upload form 16s from different employees and e-file immediately your returns.

Why Use ClearTax TDS?

- Bulk PAN verification: The income tax software verifies in bulk the PAN of deductee in deductor’s TDS.

- Traces integration: Use the feature for importing files related to previous TDS returns

- Preparing TDS returns: ClearTax TDS software helps identify delayed payments and prepare & file the TDS returns.

- Validation: ClearTax software makes it easy to match PAN with TRACES either one by one or in bulk for validating the returns.

Benefits of ClearTax GST

- Simplified GST return filing toolkit with automatic ingestion capabilities

- The software connects with all major ERPs and provides error-free data importing capabilities

- AI powered matching capabilities for detecting hundred percent tax credits and matching with around six thousand invoices

- Smart analytics with multiple redundancies to ensure that GST filings never go down

- ClearTax makes it easy to pull GSTIN and GSTR without interruption and at scale

Benefits of ClearTax ITR Software

- Financial documentation as the returns filed get saved for future reference and investment purposes

- Timely return filing for avoiding tax notices and claiming refunds

- Form 16 upload option for finishing ITR return filing within minutes

Benefits of ClearTax TDS Software

- The software is best for generating form 16 and filing TDS

- Easy to prepare correction and regular e-TDS statements online

- Quick option for matching PAN with TRACE records

- Pre-set alerts and warnings for late-payments and unconsumed challans

Key Functionalities of ClearTax GST

- AI powered reconciliations for eliminating filing errors

- Insightful reports for comparing invoices and GST returns

- HSN and supplier summaries for cash, ledger and stock

- Easy to switch between web and desktop apps

- GST compliant stock management and payment tracking

- Onboarding module for vendor rating

- GST health check for checking multiple GSTINs

- Integrated business view for checking tax outflow and inflow

Key Functionalities of ClearTax ITR

- Five-step process for filing e-returns

- Claim deductions for automatic adjustments to TDS

- Reports on profiled capital gains

- Automatic selection of relevant ITR form for claiming refund

Key Functionalities of ClearTax TDS

- Online FVU generation/submission

- Tracing integration through auto-file imports

- Deductor dashboard for information on deductees

- Early warning system for detecting potential TDS notices

- FVU generation and handling

How Does ClearTax Work?

The latest version of ClearTax is primarily used for filing and validating returns. It has an intuitive interface and is simple to use. ClearTax can be easily integrated with your existing systems to ensure a smooth workflow. For more information, you can also refer to user manuals and take online ClearTax demo at Techjockey.com.

How to Use ClearTax?

Get started with ClearTax in 5 simple steps:

Step 1: Buy ClearTax installation key from techjockey.com

Step 2: Directly login through the official website (web-based)

Step 3: Sign up & create your account

Step 4: Add users & assign permissions

Step 5: Get started with ClearTax

What is the Price of ClearTax?

Price of ClearTax income tax software is available on request at techjockey.com.

ClearTax price may vary based on factors like customization, additional features required, number of users, and the deployment type. For subscription-related details and offers on premium packages, please request a call back from our product experts.

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers