Get Quote

Get Quote

We make it happen! Get your hands on the best solution based on your needs.

Core Functionalities

Payment Methods

Subscription Management

Administrative Features

Security Features

Integrations Supported

Alerts & Notifications

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

“I can't think of anything positive to say about Stripe. My experience was horrible from start to finish.” Janvi Suman - Jul 1, 2024

“Honestly, there are no pros to using Stripe. Any small benefit they offer is completely overshadowed by the huge risks involved.” Manvinder - Jun 26, 2024

Cons

“It’s a bit pricier compared to some other payment gateways out there.” Nandini Sharma - Jul 1, 2024

“I haven't come across any drawbacks with Stripe Payments. It fulfills all my needs effortlessly. ” Rohit Banodha - Jun 21, 2024

“There's nothing wrong with it. The dashboard is user-friendly and convenient. I just need to spend a bit of time learning how to use all its features.” Janvii Khera - Jun 21, 2024

| Brand Name | STRIPE |

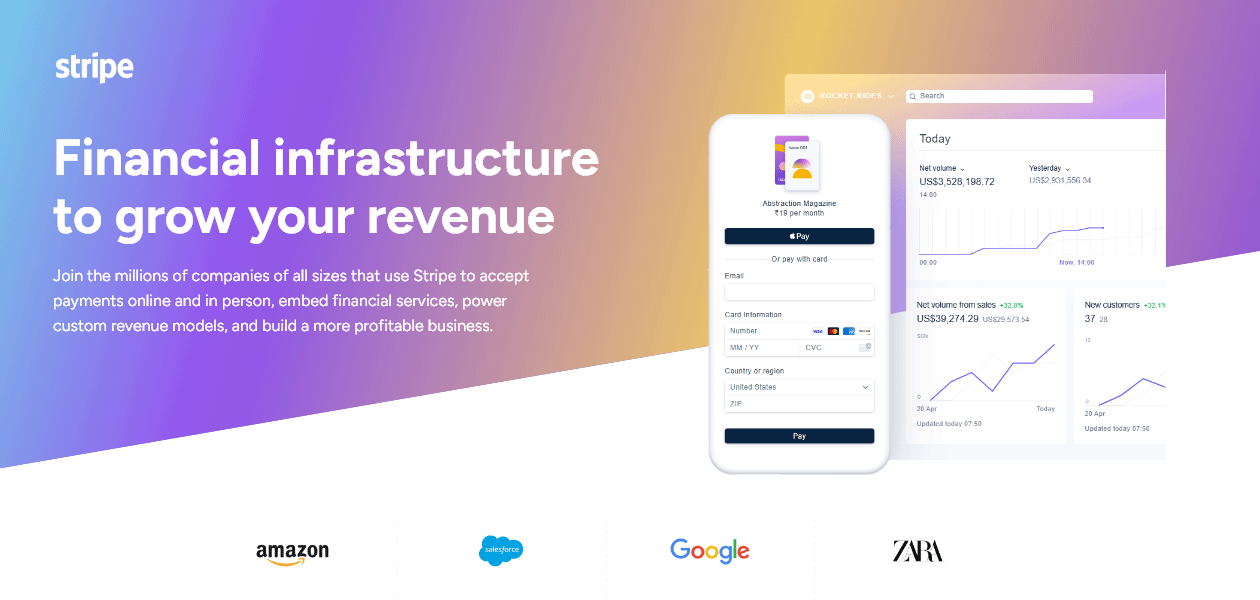

| Information | Stripe Billing lets you bill and manage customers however you want—from simple recurring billing to usage-based billing and sales-negotiated contracts. |

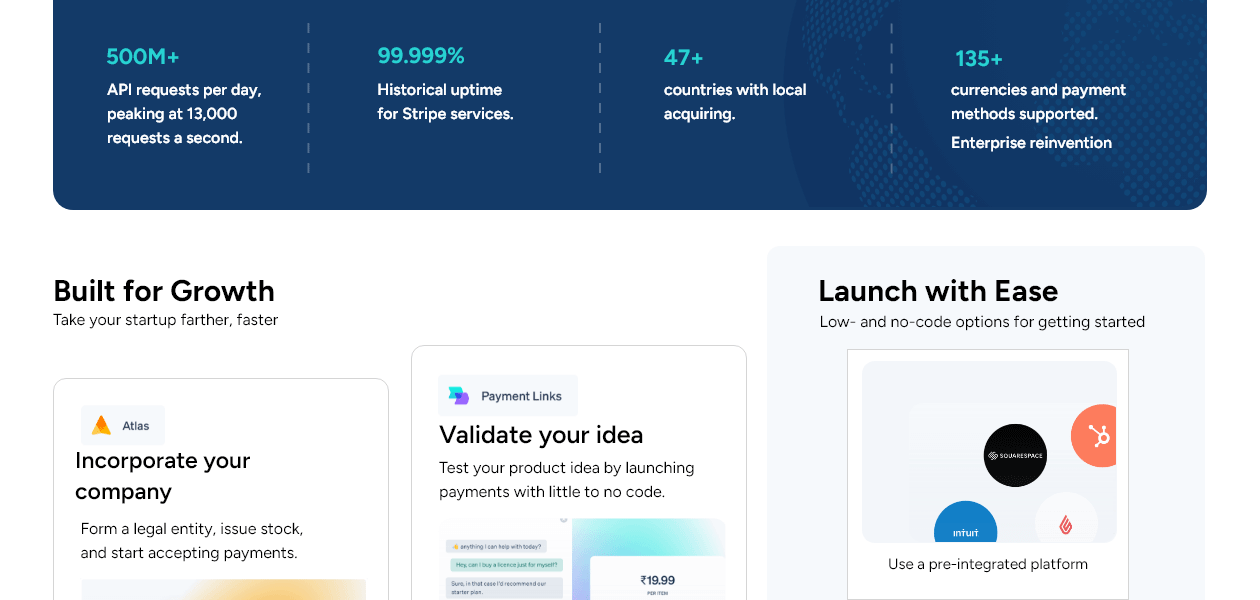

| Founded Year | 2010 |

| Director/Founders | Patrick Collison, John Collison |

| Company Size | 1000+ Employees |

While transferring a Stripe account to a different organization because of a business sale or acquisition, the process varies depending on whether the new owner is in the same nation or not. follow the steps given below depending on the criteria:

Simply update the account details in Stripe, including the owner’s details, company URL, bank account information, and credit card statement information. Stripe support can confirm the information that needs to be updated.

The new owner must open a fresh Stripe account for the new country. After which, a data transfer from the old account to the new one can be requested by contacting Stripe Support.

If the new owner does not use Stripe, invite them to join the account with Admin rights. Ownership can be passed to them after they accept the invitation.

Transfer the ownership to the existing user after granting them the admin privileges.

Request support from Stripe by contacting them and providing them with the names and dates of birth of the previous and new owners and the new owner's email address.

To prevent payments from being paused, designate a replacement representative within seven days.

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers