If you ever bought something online, then you might have and wonder how the payment goes from your pocket to the seller? Well, that’s where payment gateways come in. A payment gateway is a tool that processes online payments, making sure your money moves securely from your account to the seller's.

When we talk about payment gateways, Razorpay and Stripe have to be on our list. These two platforms are very popular around the globe due to their features and offerings. They both allow you to receive payments via multiple modes, including debit/credit cards, net banking, UPI, and more. In short, a payment gateway makes it convenient for users to receive payments and make transactions conveniently. But which platform is better?

Today, we’re going to talk about two popular payment gateways: Razorpay and Stripe, and compare the two of them in detail, to find the better one.

Razorpay vs. Stripe - An Overview

Both Stripe and Razorpay are major payment gateways that help in processing transactions.

Stripe includes features like payment handling, invoice, taxation management, recurring invoice, online payment, etc. On the other hand, Razorpay offers multicurrency processing of a payment, zero setup cost, online payment, multiple types of payment, invoices, and other features.

The major difference between Razorpay and Stripe is that Stripe offers just a payment service to all companies worldwide. Whereas Razorpay is not just a payment gateway, it also offers multi-currency processing, vendor payouts, subscription options, etc. for both businesses as well as individuals. However, currently, it is only concentrating on the Indian market.

Razorpay Pros & Cons

Pros:

- Focus on India: Offers comprehensive support for Indian payment methods like UPI and popular wallets, making it ideal for Indian businesses.

- Ease of Use: Streamlined setup process and user-friendly interface make it easy for beginners to integrate payments.

- Transparent Pricing: Clear pricing structure with a flat transaction fee provides cost predictability for smaller businesses.

- Customer Support: Renowned for prompt and helpful customer service within India.

Cons:

- Limited Features: Focuses on core functionalities and lacks advanced features like invoicing, detailed analytics, and in-person payments compared to Stripe.

- Primarily caters to the Indian market and doesn't support international currencies or regulations as extensively as Stripe.

Stripe Pros and Cons

Pros:

- Global Reach: Supports a wider range of currencies and regulations, making it a good choice for businesses with an international customer base.

- Advanced Features: Offers a comprehensive suite of features including invoicing, subscriptions, fraud prevention, detailed analytics, and in-person payment solutions.

- Customizable Integrations: Boasts a vast library of integrations and provides more customization options for developers to build complex payment workflows.

Cons:

- Focus on Developers: Geared towards developers and requires more technical expertise for setup and customization compared to Razorpay.

- Non-Transparent Pricing: Pricing is not publicly available and depends on transaction volume and features used. Can be expensive for low-volume merchants.

- Limited India-Specific Support: Customer support might not be as readily available or familiar with specific Indian needs compared to Razorpay.

Razorpay vs. Stripe: In Terms of Features

Both Stripe and Razorpay differ from each other when it comes to payment methods, fee structure, currency support, integrations and more. Here is a comparison of Razorpay vs Stripe in terms of features:

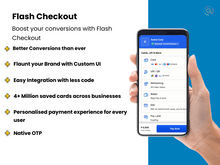

Payment Modes: Razorpay offers many payment methods like domestic and international credit and debit cards, EMIs, PayLater, net banking from 58 banks, UPI, and 8 mobile wallets. Stripe also accepts major debit and credit cards from all over the world and supports wallets like Alipay, Apple Pay, Google Pay, and PayPal. It also allows bank debits, transfers, redirects, and "buy now, pay later" options like Klarna and Afterpay.

Global Reach: Razorpay is great for businesses in India. Stripe works in 46 countries, making it better for international businesses. Both support different currencies, but Stripe's wider global reach gives it an advantage over Razorpay.

Currency Support: When we talk about Stripe vs Razorpay, currency support is one of the most important factors to consider. Stripe supports over 135 currencies, allowing you to charge and display prices in your customer's preferred currency, helping to avoid conversion fees and improve sales.On the other hand, Razorpay supports over 100 currencies, which is also great for international transactions. Overall, Stripe is better for businesses needing the widest range of currency options.

Settlement Period: Razorpay settles funds in 2 days for domestic transactions and 7 days for international ones. Stripe offers automatic payouts on a 5-day rolling schedule, or you can choose manual instant payouts that happen within 30 minutes. If you need faster access to your money, Stripe’s instant payout option is better.

Reporting and Analytics: Stripe offers detailed dashboards with in-depth transaction data, customer insights, and revenue reports. Razorpay provides basic reporting functions, but its analytics tools are not as detailed as Stripe's. If you need extensive data and insights, Stripe is the better option.

Comparison of Razorpay vs. Stripe in Terms of Pricing

Razorpay charges 2% plus 18% GST on every transaction, with special rates for big businesses making over ₹5 lakh monthly. Stripe charges 2% for Indian cards and 3% for international cards, with custom deals for high-volume businesses.

Razorpay or Stripe: Customer Service

As far as customer support service is concerned, Stripe offers 24×7 support through email and tickets. It also has some documents available on its website to help users with frequently asked questions. Additionally, it has a community of experts to help customers with their doubts and queries.

Razorpay offers customer support via guides and website documentation, community help, tickets, and emails. Apart from that, it also offers support via phone calls.

Overall, Razorpay wins in terms of customer service as it offers support via phone calls along with other modes of support.

Razorpay vs Stripe Payment Gateway: Integration

Razorpay provides smooth integrations with Indian platforms and services. It is known for its ease of use and pre-built plugins for popular platforms. On the other hand, Stripe has a slight advantage over Razorpay as it boasts a vast library of integrations with popular e-commerce platforms, accounting software, and business tools. Stripe has more options for integration with QuickBooks, WooCommerce, SendOwl, Baremetrics, Reetail, Sush.io, Novo, and more. It also offers more customization options for developers to build from scratch.

Razorpay or Stripe: Security

Both Razorpay as well as Stripe follows strict security standards. Stripe is PCI compliant and uses SSL support, credit card vaults, DCC, HTTPS & HSTS protection, etc. to secure its website. They offer robust security features like tokenization, fraud prevention tools, and adherence to industry standards like PCI DSS and SCA. Both are excellent in terms of security, ensuring safe transactions for your business.

Stripe vs Razorpay: Ease of use

Stripe is great for developers because it allows a lot of customization, but it can be harder to learn. Razorpay is easier to use and set up, making it a good choice for businesses that want a simple way to handle payments.

Razorpay or Stripe: Deployment

As far as deployment is concerned, both Stripe as well as Razorpay are cloud-based and are accessible on all major operating systems namely, Windows, macOS, Linux, and more.

Apart from that, they both are available on Android as well as iOS devices. As far as deployment is concerned, both Razorpay as well as Stripe weigh equally.

Which Is Better: Razorpay or Stripe?

After a thorough analysis, it’s time to declare the best among both the players. In terms of features, we can say Stripe is ahead of Razorpay as it supports multiple languages and currencies, and recurring payments, which isn’t available in Razorpay. Apart from that, Stripe also supports in-person payment options, but Razorpay doesn’t. The number of integrations offered by Stripe is also more than that of Razorpay.

However, in terms of customer service, in-person product training, and the customer base, Razorpay is ahead of the game. Overall, Stripe is a better option compared to Razorpay.

25 Ratings & 25 Reviews

25 Ratings & 25 Reviews