PayG Software Pricing, Features & Reviews

What is PayG?

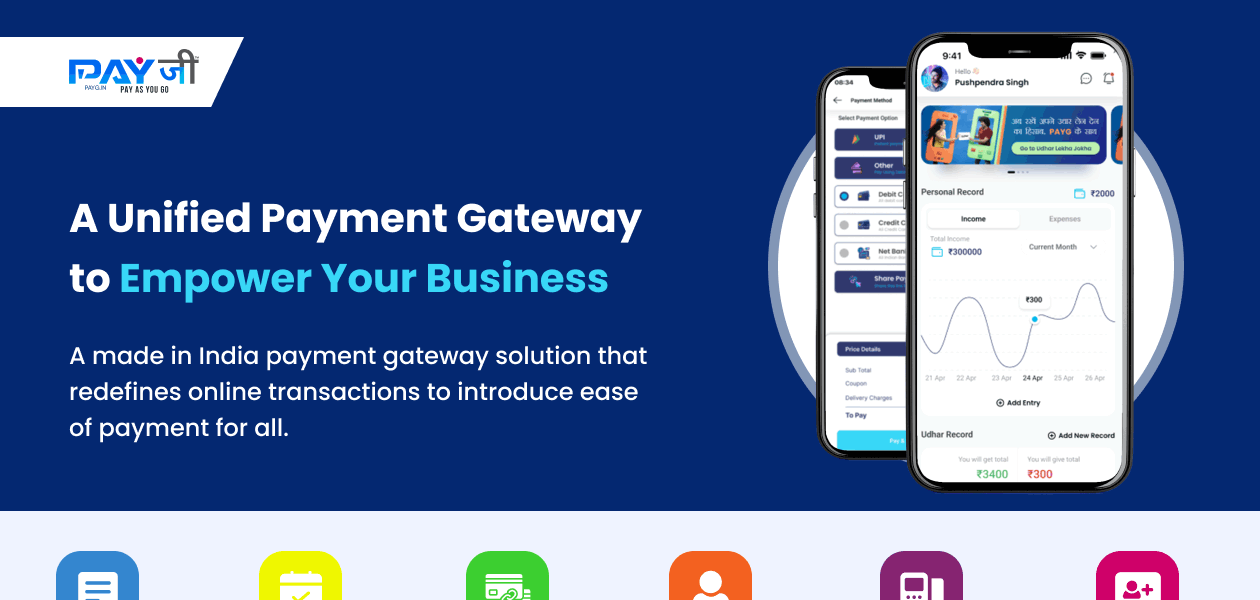

PayG payment gateway is an omnichannel payment solution helping businesses of all sizes receive online payments from any device or location. The payment processor offers virtual POS and future POS functionalities that can be integrated with different e-commerce platforms for processing payments. Merchants use PayG to establish online business stores without worrying about managing payments. It ensures quick payment link generation, batch processing and convenient checkout experience.

The payment gateway gives businesses an opportunity to expand their business operations, improve sales and build customer relation. You can track daily transactions, settlement details, refund requests and more through PayG powerful dashboard. It supports all major payment modes to increase the chances of payment success.

With PayG, you get a simple dashboard that shows all your transactions in one place. It’s easy to use, so you can quickly find what you need and keep track of your payments. Plus, you can customize it to match your business style and needs. PayG supports many different payment methods, like cards, UPI, and wallets. This means your customers can pay the way they like, and you can accept payments from anywhere in the world.

Why Use PayG Payment gateway for Online Payments?

- Contactless Payment: Accept online payments or in person across devices and browsers with PayG virtual POS system.

- Future POS: The payment gateway provider offers a scalable web-based billing app for both retail and non-retail businesses.

- Embedded Payment Ledger: PayG has an embedded payment ledger with reporting capabilities for collecting payments through Easy Collect ID.

- Customizable Pay Buttons: The payment gateway supports customizable pay buttons along with a built-in close loop wallet.

- Creating Catalogues: Create catalogues for seamlessly managing the inventory and collecting payments hassle-free.

- 24/7 Customer Support: PayG provides round-the-clock customer support to help you resolve any issues quickly and ensure smooth payment processing at all times.

- Customizable Payment Pages: Tailor the look and feel of your payment pages to match your brand, providing a seamless and professional experience for your customers.

Benefits of Using PayG for Online Payments

- Supports invoice, QR & link-based payment

- Transparent payment processes

- Higher success ratio in terms of online payment

- Flexible platform with an extensive API

- Advanced features for fraud prevention

- Personalized support for your business needs

- Zero setting up fee

- Account gets activated in minutes

- Easy integration and quick onboarding

Additional Features of PayG Payment Gateway

PayG offers many features to help you manage your payments effortlessly:

- Recurring Payments: Set up automatic payments for subscriptions and memberships.

- Instant Refunds: Process refunds quickly and easily to keep your customers happy.

- Smart Routing: Ensure successful transactions by routing payments through the best processors.

- Invoicing: Create and send professional invoices from the PayG dashboard.

- Partial Payments: Allow your customers to make payments in parts, making it easier for them to pay.

- Split Settlements: Automatically divide payments among your suppliers or partners.

- Real-time Notifications: Receive instant alerts and notifications for every transaction, helping you stay updated and manage your payments efficiently.

How Does PayG Work?

The latest version of PayG is primarily used for making contactless payment online. This payment gateway in India has an intuitive interface and is simple to use. PayG can be easily integrated with your existing online selling platform to ensure a smooth workflow. For more information, you can also refer to user manuals and take online PayG demo at Techjockey.com.

How to Use PayG?

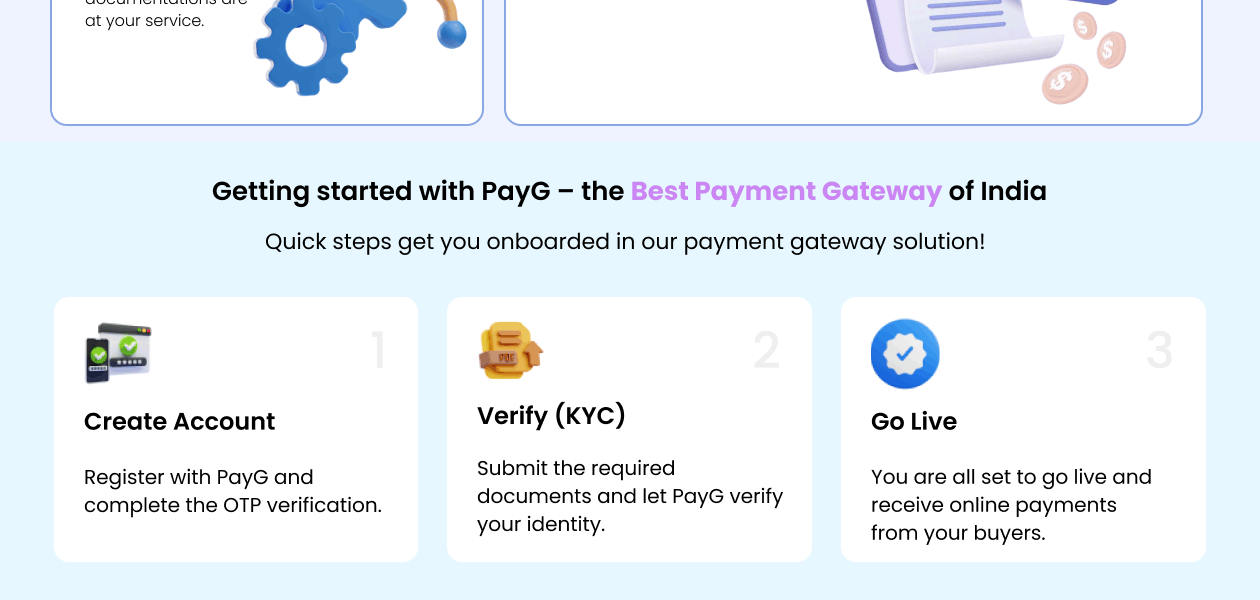

Get started with PayG in 5 simple steps:

Step 1: Buy PayG installation key from techjockey.com

Step 2: Directly login through the official website (web-based)

Step 3: Sign up & create your account

Step 4: Add users & assign permissions

Step 5: Get started with PayG

What is the Price of PayG?

PayG offers simple, transparent pricing with no hidden fees. The Standard Plan, ideal for startups and SMEs, has a 2% platform fee. The Enterprise Plan features custom pricing to match your business needs.

“PayG has been a great tool for managing my business payments. It’s easy to use and integrates well with my existing systems. The transaction process is smooth and quick.” Anjan - Aug 7, 2024

“PayG provides smooth and reliable transactions, which has been great for my business. The integration was easy, and it’s very user-friendly.” Rajan Hora - Aug 6, 2024

“PayG simplifies payment processing like no other. It’s easy to set up and has made managing my online payments so much easier. The integration with my website was seamless.” Rahul Kanujia - Aug 6, 2024

“The main issue I’ve faced is the lack of advanced reporting features. Also, customer support can sometimes take a while to respond.” Anjan - Aug 7, 2024

“One downside is the lack of customization options for the checkout process. Also, the fees can be a bit steep for high-volume transactions.” Rajan Hora - Aug 6, 2024

“The only downside is the occasional delay in customer support responses. It would also be great if they offered more competitive pricing for smaller businesses.” Rahul Kanujia - Aug 6, 2024

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers