Calculated Price (Exclusive of all taxes)

₹ 400Calculated Price (Exclusive of all taxes)

₹ 1000Calculated Price (Exclusive of all taxes)

₹ 1500We make it happen! Get your hands on the best solution based on your needs.

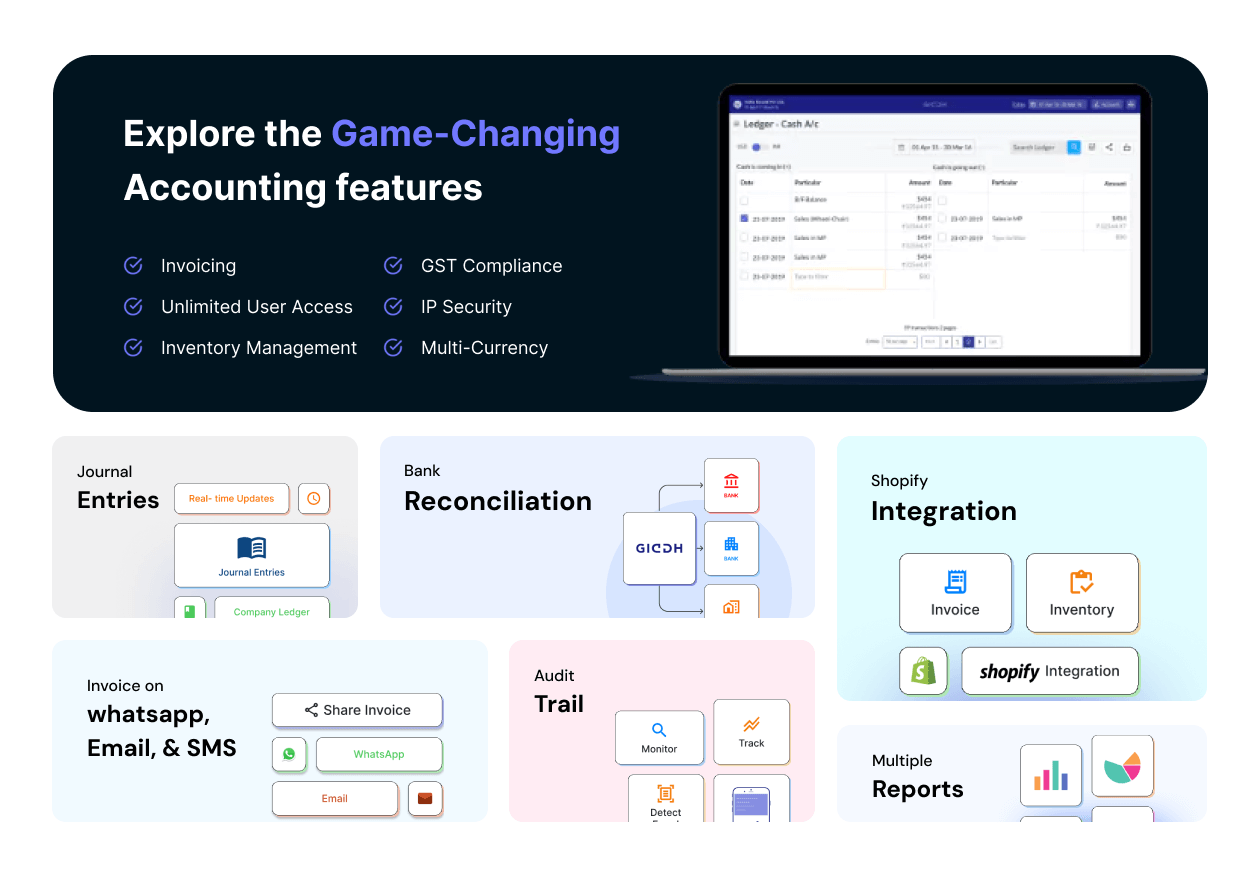

Core Functionalities

Billing & Invoicing

Retail and Point of Sale

Project and Workflow Management

Inventory and Supply Chain Management

Sales and CRM

Financial Management

Integrations Supported

Analytics and Reporting

Administrative Features

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

“Very easy to use with a good screen layout and reasonable pricing.” Nandini Keshwani 11 - Jul 10, 2024

“Uses ledger-based entry, offers branch accounting, easy GST integration, vendor management, and is very user-friendly with good pricing.” Ramesh Kumar - Jul 10, 2024

“Giddh is great for detailed financial reports. It gives real-time data and clear visualizations, making it easy to make smart financial decisions and grow the business.” Sunita Khurana - Jul 10, 2024

Cons

“Needs better reporting, fewer clicks, and lacks payroll management.” Ramesh Kumar - Jul 10, 2024

“In addition to being an amazing piece of software, Giddh is a comprehensive accounting programme for small businesses, thus they need to create a mobile app.” Stuti Pathak - Sep 6, 2022

“Fewer reports would improve reporting. - There were a lot of clicks and mouse movements. - No payroll administration.” Vivek Kumar - Sep 6, 2022

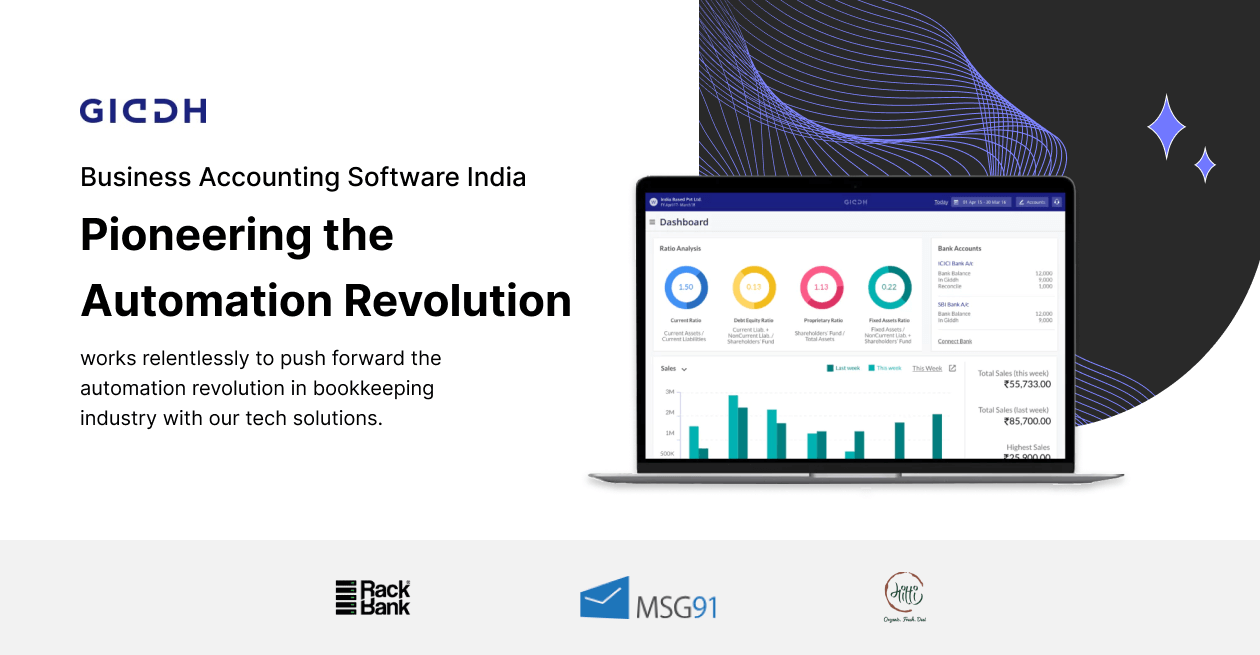

| Brand Name | Giddh |

| Information | Giddh is a team, or rather a flock of hardworking and visionary people, just like a ????? (a vulture) is. With various departments working in harmony, we relentlessly work towards the optimization in the field of cloud accounting. |

| Founded Year | 2015 |

| Director/Founders | Ravi Paliwal, Shubhendra Agrawal |

| Company Size | 1-100 Employees |

To create a credit note or debit note in Giddh, follow the steps given below:

Top Selling Products

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers