Summary: Tally is one of the most used accountings software in India. But do you know how to make bills in Tally? Let’s discover what GST bills are in Tally, information to include in the invoice, how to generate and print those bills with ease.

Tally is one of the most known accounting software in the market right now, and with the introduction of Goods and Service Tax (GST) in India, it has become a favorite tool for businesses and individuals alike.

If you have a business with the goods and service tax registration, then you must provide a bill for your goods and services. Many businesses have started looking for ways to record their financial transactions using GST accounting software.

So, how can you generate or make a bill in Tally? In this blog, I will discuss what the GST bills in Tally are, and how you can generate and print those bills.

What are GST Bills in Tally?

Bills or invoices are the key elements of any sales process. It is a primary document that acts as a receipt for the products or services that you have provided. GST bills consist of the list of those products or services with the total amount due.

A GST also has the total amount of tax charged on each service or product that a customer purchases from the seller. You can check the GST bill before SGST and CGST are raised on them.

Things to Include in GST Invoice

When you create a GST invoice in TallyPrime, there are certain things like details of products or services, receiver’s name, total amount before and after GST, billing date, etc. are mandatory and it should be included in the invoice. Below are some of the information that an invoice must contain:

- The name of the Supplier, his address and GSTIN (Goods and Services Tax Identification) number.

- The serial number of invoices must be less than 16 characters. It can contain both alphabets and special and numerical characters.

- Invoice’s issue date.

- Name, address, and GSTIN number of recipients.

- Description of product or services. In the case of commodities, details like total unit, weight, and code should be mentioned.

- The total value of the product or service.

- Total taxable value after any abatement or discount.

- The tax rate like IGST/CGST/UTGST/SGST or CESS

- Total amount of tax imposed on products

- Whether or not the tax is imposed on reverse charge

- Authorized signature or digital signature of supplier or his representative

How to Make Bill in Tally?

Tally is a popular accounting software that is widely used for managing financial transactions and generating various financial reports. Creating an invoice in Tally is an easy process and only involves a few steps like creating a sale or a party ledger, entering pricing details, etc. Here’s a guide on how to create an invoice in Tally:

First visit Tally Gateway, and then visit Accounting Voucher, or you can use the shortcut key- Go to Tally Gateway and use shortcut key V on the keypad.

- Step 1: First things first, go to Tally Gateway and click on Accounting Vouchers. Then, choose F8 Sales. Make sure to enter the bill’s serial number next to the invoice number option.

- Step 2: Now, in the Party A/c name column, just select either a cash ledger or a party ledger. Remember, if the party is registered, make sure to enter GST details accurately.

- Step 3: Pick the right sales ledger based on whether the sale is local or interstate.

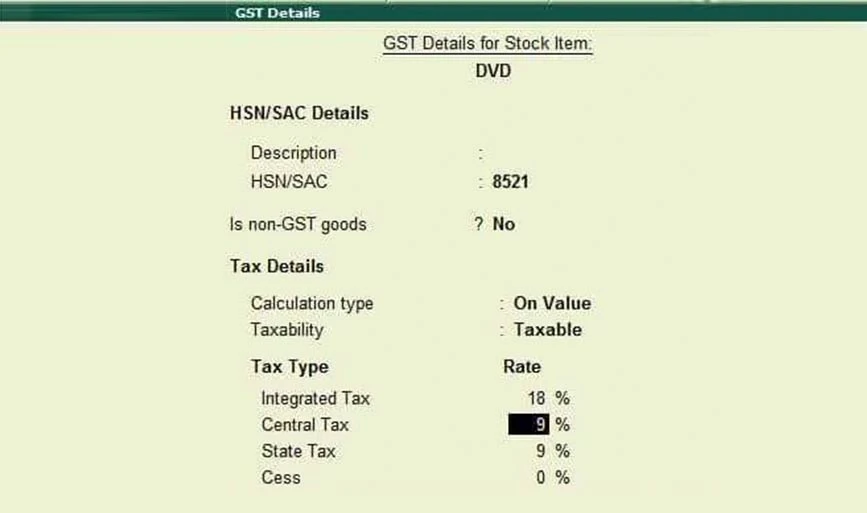

- Step 4: Now, choose the inventory item, and enter the quantities and rates.

- Step 5: Now it’s time to add the tax details. For local sales, choose state and central tax ledgers and select the integrated tax ledger for interstate sales.

- Step 6: Click Yes and Enter to accept the GST Invoice that’s been created.

You can also add more details like buyer’s order number, delivery note number, additional product description, tax column, etc., using F12: Configure.

How to Customize Bills in Tally?

You can easily customize your Tally bills with the help of add-ons. With add-ons, you can set the message that needs to be printed on the invoice, change captions, add terms & and conditions, and more. To customize your bill, follow the instructions below:

- Open the Tally app and go to your company

- Now, go to H: Help and Add-on Help to open the user manual.

- Press Ctrl + Alt + H to get Add-on help

- Now chose the Add-on according to your requirements

- Save and activate it to customize your bill

There will be multiple add-ons that you can choose from. Some of them are:

- Print Terms & Conditions on Invoice: This add-on feature will allow you to annotate and print terms & conditions for your invoices.

- Print an Invoice with Authorized Signature: It helps you to add an authorized signature for your bills.

- Autofill Distance E-waybill: This plugin allows you to save information in ledger master and automatically fill it in the E-way bill, which makes data entry error free and faster.

- Product Wise Tax Amount: With this add-on, you can print the tax amount according to the product and easily understand the invoice due to organized tax calculation.

- Invoice for GST Tax 6.4: With the help of this add-on, you can organize the way tax is deducted. It provides the GST amount for each item so that the buyer can understand tax percentages and what amounts are applied to it.

How to Print GST Bills in Tally?

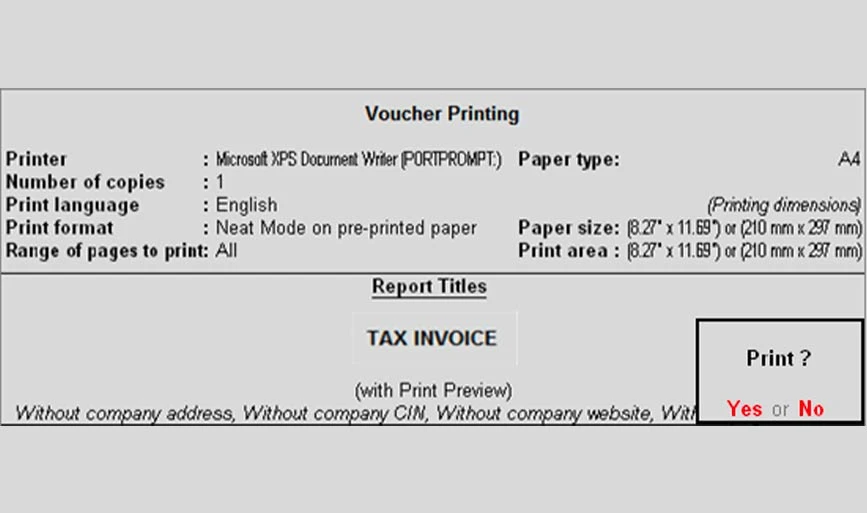

Once you have successfully created your bill, Tally will instantly show you the printing setting option- Print or Not. You can immediately print a Tally bill with a single click, or you can do it later.

Now, to print, either click the “print” button or use the shortcut Ctrl + P. Make any other settings on the configuration screen. Here, you can say how many copies you want and which printer to use.

According to GST rules, if you’re selling things with delivery, you need to make 3 copies of the GST invoice: one for the buyer, one for the delivery person, and one for yourself.

Conclusion

Generating GST bills in Tally is an easy process and includes essential details of buyers and sellers. From creating invoices to customizing bills with add-ons and efficiently printing GST bills, Tally can handle the entire cycle. This makes it a valuable tool for businesses navigating the complexities of Goods and Service Tax.

FAQs

Who is required to issue e-invoice under GST?

If a person is registered for GST and his turnover is more than 20 crores, he is required to issue an e-invoice under GST.

How to create invoice format in Tally?

It has an inbuilt Invoice format to create invoice format in Tally, which can be customized on Sales Voucher Setting.

What are the Tally Add-ons?

Add-ons are like plugins for Tally. These are customized modules which you can use to enhance Tally functionalities.

How to create a ledger in Tally?

To create a ledger in Tally, visit Gateway of Tally, then accounts Info and then ledgers. Now, click on the create option to generate a ledger.

What is a voucher in Tally?

An accounting voucher in Tally is a document that is used to record financial transactions like payments, purchases, sales, receipts, etc.

Shubham Roy is an experienced writer with a strong Technical and Business background. With over three years of experience as a content writer, he has honed his skills in various domains, including technical writing, business, software, Travel, Food and finance. His passion for creating engaging and informative content... Read more