Payroll creation is an essential feature in Tally accountancy software, widely used by most small businesses. It helps generate accurate pay slips and maintains the pay records of all the employees.

Payroll creation in Tally ERP 9 also assists in calculating various statutory deductions and contributions. Tally ERP 9 has payroll creation features to simplify things for organizations that don’t want to spend considerable resources in a dedicated HR Payroll software.

Payroll management in Tally allows the business owners to maintain records of their employees, which are necessary for calculating salary, provident fund, and other allowances.

Using this feature, you can create different kinds of pay slips or payroll reports. But before you get started, you need to enable it. This article will take you through the feature for Payroll Entry in Tally accounting software.

Why Use Tally Payroll Feature Instead of Payroll Software?

There are hundreds of payroll software out there in the market, some even free. However, there are a few reasons you should choose Tally to create and manage the payroll of all your businesses.

No Additional Cost: You don’t need to purchase additional payroll software or hardware to create payrolls.

Easy to Use: It is easier for accountants to create payroll in Tally even with limited expertise. Other the other hand, dedicated HR software needs hands-on training.

Integration: Payroll needs to be fed into the accounting system to book salary expenses. In Tally, employees’ expenses are directly booked in salary expenses, and no additional data entry is required.

Suggested Read: Easy GSTR-9 Filing with the Latest Tally ERP 9 Release – Free Download

Features of Payroll Entry in Tally

Payroll entry in Tally is useful for SMBs, as it provides an affordable and easy way to generate pay slips and calculate net pay for their employees. Some of the other distinguishing features of Tally ERP 9 payroll functions are as follows.

Flexible and customizable criteria for organizations.

Accurate and updated calculation of Statutory Deductions

Proper deduction of TDS as per the taxable income of the employee

Unlimited grouping of Payroll Masters

Time/ Production/attendance based net pay calculation option

All-inclusive employee wise costing and cost center reporting

Multiple payroll or cost categories

Automated booking of salary expenses in Books of Account

Generates statutory challans and forms for EPF, NPS, and ESI as per regulations.

Employee loan tracking

Suggested Read: Step By Step Interest calculation in Tally (Simple & Advanced Mode)

Steps to Enable the Payroll Feature in Tally ERP 9

Payroll feature can be activated in three steps: Step 1: Enabling the Payroll Feature and Step 2: Enabling the Statutory Deduction and Step 3: Payroll Configuration.

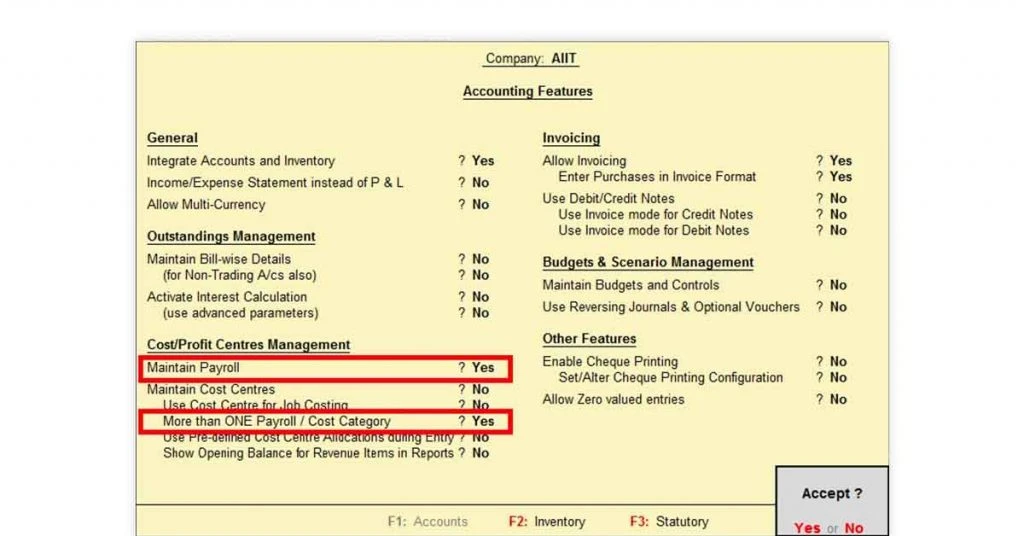

Step 1: Enabling the Payroll Feature

Tally Payroll feature can be enabled easily by following these steps:

- Go to Gateway of Tally

- Press F11 for the Feature Window

- Press F1 for the Accounting Features section

- Navigate to Cost/Profit Centers Management

- Set Option of Maintain Payroll to Yes.

- Press Ctrl +A to save the settings

If you need parallel allocation of an employee cost center, you can activate the Maintain more than one payroll or cost category option as well.

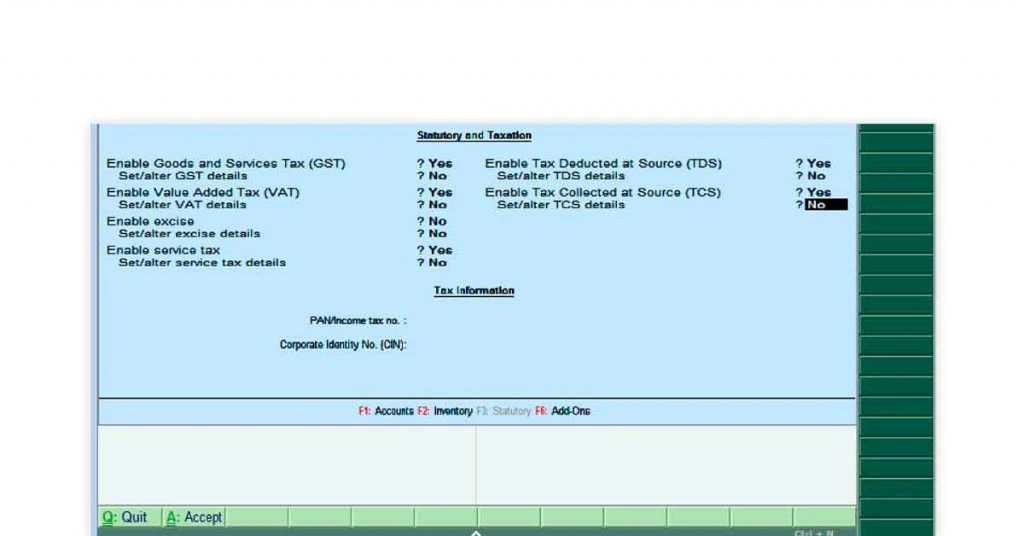

Step 2: Enabling the Statutory Deductions

Tally Payroll feature can be enabled easily by following these steps:

- Go to Gateway of Tally

- Press F11 for the Feature Window

- Press F3 for the Statutory and Taxation section

- Navigate to Enable Payroll Statutory

- Set the value to Yes

- Navigate to Set/alter statutory payroll details

- Enter “Yes” or “Y” as a parameter

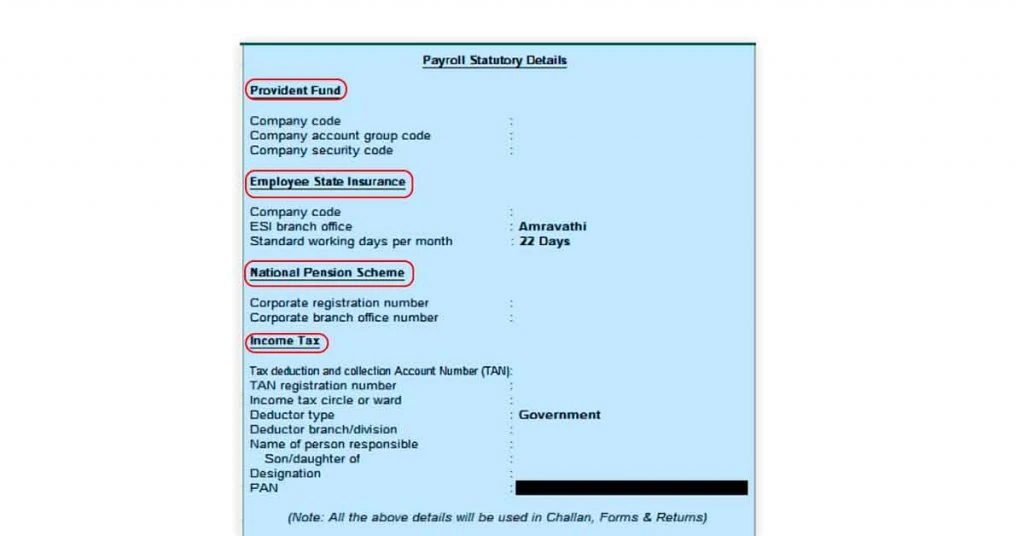

- Fill in all the relevant information about your company

- PF Details (Company Code, Group Code, and Security Code)

- ESI Details (Company Code, Branch Office, and Standard Working Days)

- NPS Details (Corporate Registration number and Branch Office Number)

- Income Tax Details (TAN, PAN, and other details)

- Press ENTER to save the setting.

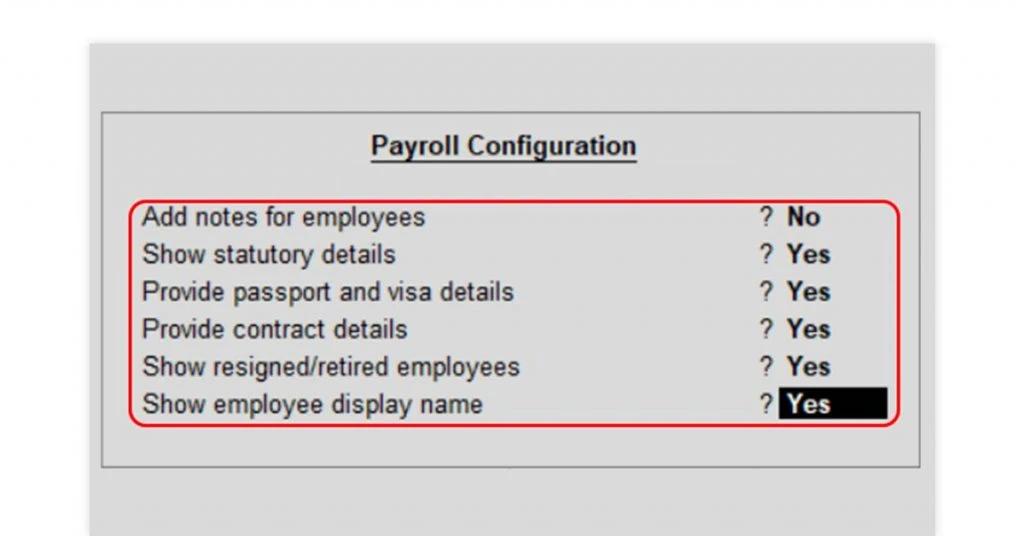

Step 3: Payroll Configuration

Here are the steps to Configure Payroll in Tally

- Go to Gateway of Tally

- Press F12 for Configuration Section

- Navigate to Payroll Configuration

- Enable and disable various fields based on your personal choice:

- Add notes for employees (Recommended Setting: Yes)

- Show statutory details (Recommended Setting: Yes)

- Provide passport and visa details (Recommended Setting: No)

- Provide contact details (Recommended Setting: Yes)

- Show resigned/retired employees (Recommended Setting: No)

- Show employee display name (Recommended Setting: Yes)

- Press Ctrl +A or Enter to Save.

Suggested Read: Difference between Tally ERP 9 Vs Tally Prime

Limitations of Payroll Feature in Tally ERP 9

Although Tally is a comprehensive ERP system capable of generation payroll, it’s not a dedicated payroll software and comes with some limitations. Here are some limitations of the Tally ERP 9 payroll feature:

Users must manually set exemption and slab rate to calculate TDS. Accountants need to define rules of TDS and applicable slab rates based on the age and resident status of the employee.

Tally doesn’t allow custom Net Pay calculation based on unique performance indicators as per the HR policy.

Employees cannot see their payslips online.

Tally ERP 9 cannot be integrated with any time and attendance system. So, manual feeding of data is required.

Cannot automatically send the payslip to employee’s email Id

Requires manual entry for exceptional items like Arrears, advance, Loans, VRS, etc.

If your organization is a startup or has tailored HR policy for your employees, it would be worth going for HR software for payroll management. Dedicated payroll software provides you with more customization options, no limitations, and better security over data than Tally.

Suggested Read: How to Record Sales & Purchase Entry in Tally with GST

FAQs

What is payroll entry in Tally?

Tally's payroll entry is a journal entry done to calculate net pay, TDS, PF, and other benefits payable to the employee. It also helps generate a payslip thereof.

Can we generate a payslip in Tally?

Yes, you can generate a payslip from Tally. The Payroll Feature of Tally ERP allows users to create and record salaries, statutory dues, incentives, and benefits for employees.

What is Maintain more than one payroll or cost category option in Tally?

This setting is used to enable parallel allocation of employee cost center. The user needs to define a new currency name during the currency conversion process.

How can we make a payslip in Tally Prime?

You can make payslips in Tally Prime following the steps, 1. Go to Gateway of Tally 2. Display 3. Payroll 5. Reports 4. Statements of Payroll 5. Pay Slip 6. Single Pay Slip and choose the employee you want to generate payslip for.

What is the use of statutory details in Tally?

It includes provident funds, gratuity, and other statutory deductions from an employee's salary. It also shows the exemption limit and slab rate on tax deduction.

Related Categories: Accounting Software | GST Software | Income Tax Software | HR Software | Financial Management Software

Rajan is pursuing CA with a keen interest in trends and technologies for taxation, payroll compliances, Tally Accounting, and financial nuances. He is an expert in FinTech solutions and loves writing about the vast scope of this field and how it can transform the way individuals and businesses... Read more