Are you finding it tough to accept international payments for your online business?

More and more stores are going online and reaching customers worldwide. But for our businesses to succeed, we need to handle international payments smoothly and safely. That’s where reliable international payment gateways come in.

These gateways not only help us get paid but also build trust with our customers and reduce payment failures. In this article, I’ll share the best international payment gateways in India that are easy to set up and use, ensuring hassle-free transactions for our businesses.

How to Receive International Payments in India Online?

If you want a quick transfer of international payments from clients abroad to your account in India in exchange for services/ goods, you must opt for an international payment gateway solution.

A payment gateway for international payments sends the information of your customer from your online portal to the associated bank or card’s network for processing.

The transaction details are sent back to the portal to inform customers whether the payment is complete with successful authorization or not. If the authorization is successful, money is transferred from the customer’s account to the merchant’s (seller) account.

For this, international payment gateways seek registration with banks as well as payment networks in different countries. You must pay at least a transaction fee to get services offered by an international payment gateway like PayPal.

What Is International Payment Gateway?

An international payment gateway is a tool that helps businesses like ours make and receive payments from anywhere in the world. It supports multiple currencies and different languages, making transactions smooth and easy.

Whether customers use bank transfers, debit cards, or credit cards, the payment gateway processes the payment and ensures it’s secure. It sends the payment information from our website to the bank or payment network, and then lets us know if the payment was successful.

By using an international payment gateway, we can reach more customers globally and provide them with a seamless payment experience.

Suggested Read: Best Payment Gateways in India For Secure Online Payments

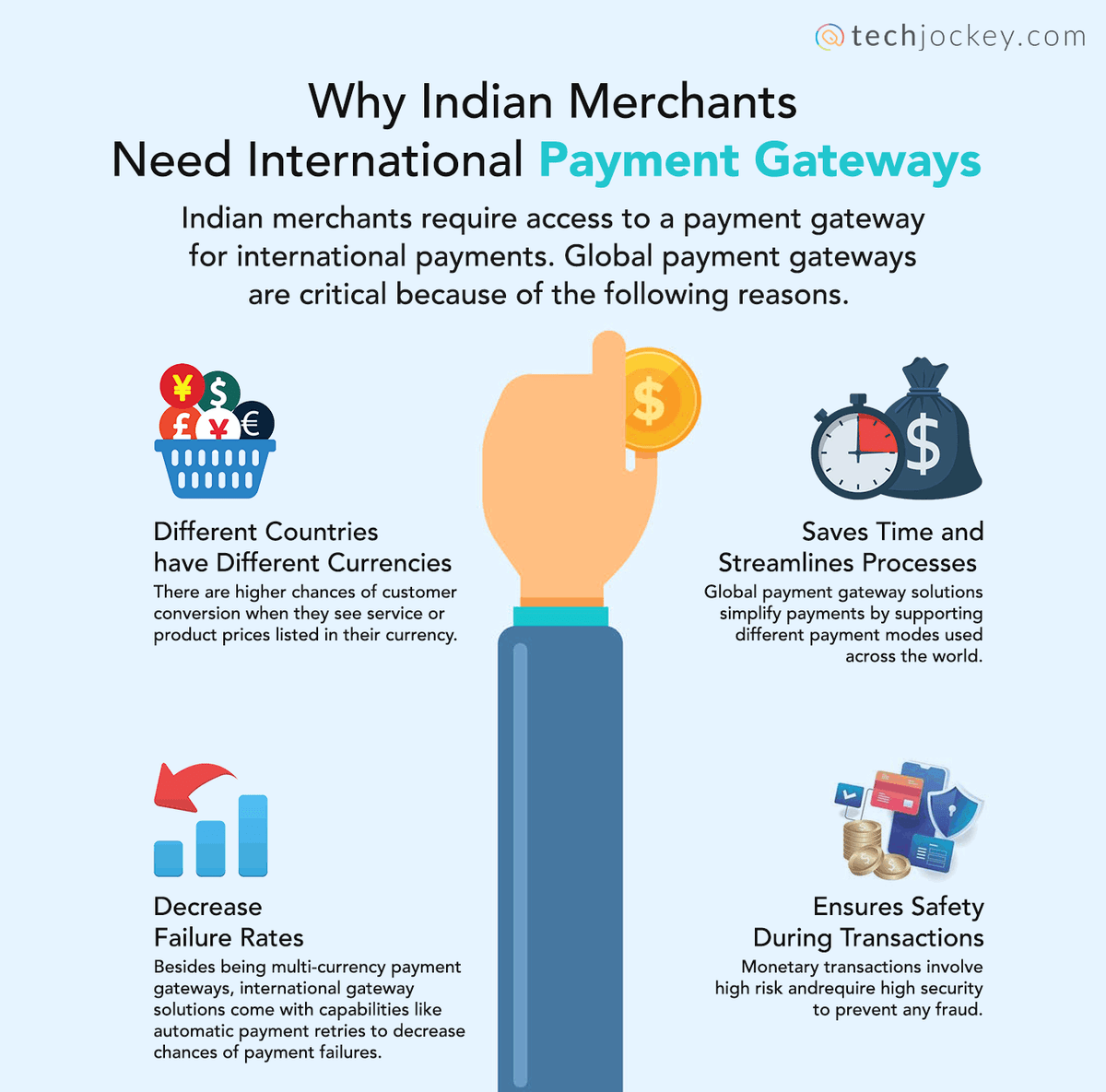

Why Indian Merchants Need International Payment Gateways?

As Indian merchants, having an international payment gateway is essential for several reasons:

- Support for Multiple Currencies: Customers from different countries use different currencies. When they see prices in their own currency, they are more likely to make a purchase. An international payment gateway allows customers to pay in their local currency, making it easier for them to buy from us.

- Saves Time and Streamlines Processes: International payment gateways simplify the payment process by supporting various payment methods used worldwide. They also offer customizable payment forms and quick settlement options, saving us time and making our operations more efficient.

- Reduces Payment Failures: These gateways have features like automatic payment retries, which help reduce the chances of payment failures. This ensures that customers do not have to enter their details repeatedly for recurring payments, leading to a smoother experience.

- Ensures Safety During Transactions: Handling monetary transactions involves high risks, and security is crucial. International payment gateways come with advanced security features like fraud detection and client identity verification, ensuring safe transactions.

- Builds Trust with Customers: Using a reliable international payment gateway shows customers that we take their security seriously. This builds trust and can lead to increased sales and customer loyalty.

By using international payment gateways, we can expand our business reach globally, provide a better customer experience, and handle transactions smoothly and securely.

Best 10 International Payment Gateways for Indian Merchants

Here’s the list of international payment gateways that are popularly used by businesses across industries to close deals globally.

1. Payflow by PayPal

PayPal has recently rebranded their payment gateway as Payflow. It is one of the most popular and trusted payment gateways for sending and receiving overseas payments. Indian merchants can offer local payment options and accept payment from over 200 markets in more than 20 currencies.

You can create customizable invoices, personalized payment links, add recurring payment options, and more to ensure smooth payment processes.

Things to Know About Payflow

- No set-up/maintenance fees

- Accepts both debit card and credit card payments

- Shopping cart integrations

- 24/7 transaction monitoring, seller protection, fraud prevention

- Works on web-browser

- Offers mobile app

Payflow Pricing Plans

You can sign up for free. Pricing plans for payment gateway India starts from 4.40% + Fixed Fee and it can vary according to the currency, types of payments, payment methods etc. Large enterprises can contact the sales team for a quote.

Payflow Pros and Cons

Pros:

- Widely acceptable in over 200 countries

- Strong invoicing features

- Wide range of payment solutions with over 26 currencies

Cons:

- There are some complaints about account and fund freezing

- The pricing plans can be high for SMBs

2. PayU International Payments

PayU payment gateway solution supports debit cards, credit cards, and net banking options in over 50 Indian banks for international payments. With PayU payment solution, businesses can accept cards issued in 130+ currencies with a single integration. You can analyze transactions in real time based on different parameters. It provides dedicated reports for a detailed understanding of conversion rates.

Things to Know About PayU

- Easy setup

- One tap payment

- Settlement in 130+ currencies

- Has Android & iOS SDKs

- Global bank partnerships to mitigate Forex risk

- Support for shopping cart & e-commerce plugins

PayU Pricing Plans

PayU charges 2% for Visa, Mastercard, Net Banking, BNPL, Wallets and domestic transactions. Whereas it charges 3% for Diners, American Express, EMI and International transactions. There will be 18% of GST applicable with a zero set-up fees.

PayU Pros and Cons

Pros:

Fast money settlements, typically within 1-2 business days

Variety of payment methods supported

Show your products prices in local currency

Cons:

- Lacks cryptocurrency support

- There have been reports of occasional delays in transaction

3. Stripe

Stripe gateway platform enables merchants to accept debit cards, credit cards, and other globally used payment methods across different online channels like marketplaces and e-commerce stores.

It provides customizable elements to help you design your own payments form that can be shared via a link. It also uses machine learning (ML) to recapture declines and decrease failed payment rates through smart retries.

Things to Know About Stripe

- Support for 135+ currencies

- Localized payment solutions with Bitcoin, ACH transfers, etc.

- Customizable invoices for recurring or one-time payments

- Android & iOS SDKs

- Financial reporting & consolidated reports

- Integrations with PCI compliance

Stripe Pricing Plans

It supports pay-as-you-go pricing starting at 2% for most domestic cards and 4.3% for cards issued anywhere to accept international transaction payments. You can contact their sales team to get pricing for a custom package.

Stripe Pros and Cons

Pros:

- No set-up fee, monthly fee or any hidden fee whatsoever

- Invoice support available

- QuickBooks + NetSuite support for automatic data sync

Cons:

- The customer support service could get better

- Higher chargeback rates

4. 2Checkout (Verifone)

2Checkout platform allows merchants to sell in 200 countries via over 45 payment methods, including standard credit/ debit cards, online wallets, and regional payment methods. It offers integration with a local payment processor to activate domestic cards in India.

You can create subscription renewal links for customers. This international payment gateway in India notifies customers about failed renewals via email to reduce the chances of lost revenue due to declined payments.

Things to Know About 2CheckOut

- 100 billing/ display currencies

- Security & fraud protection

- Global tax & regulatory compliance (2Monetize plan)

- Reporting & analytics

- Integration with 120+ carts

- Supports 30+ languages

2CheckOut Pricing Plans:

You can sign up for free. The transaction rates start at 3.5% + $0.35 for every successful sale.

2CheckOut Pros and Cons

Pros:

- Suitable for both digital goods and retails

- Multilingual international payment gateway

- Robust subscription management feature

Cons:

- 2Checkout’s account approval process can be lengthy

- ome users find the initial setup process and user interface of 2Checkout to be more complex

5. CCAvenue

CCAvenue is another popular international payment gateway used by Indian merchants to collect payments in 27 different foreign currencies. You can integrate shopping carts and customize the payments page to complement your website.

With marketing tools, you can create discounts and run promotional campaigns for the customers. If you do not have a website, you can use it to create a customizable storefront.

Things to Know About CCAvenue

- Numerous payment options (58+ Net Banking, 97+ Debit Cards, 15 Bank EMI, 13 Prepaid Instruments, 6 Credit Cards)

- PCI compliance

- Smart routing to best performing gateway

- Retry option to reduce the number of payment failures

- Checkout page in 18 Indian & International languages

Pricing Plans

There is no setup fee for Startup Pro plan. UPI Payments/ Rupay Debit Cards have no processing fee, while charges for other payment options begin from 2%. Software upgradation for the Payment Gateway India solution costs INR 1200/year.

CCAvenue Pros and Cons

Pros:

- CCAvenue provides merchants with real-time transaction monitoring and insightful analytics

- CCAvenue offers various features for free, including invoice payments, shopping cart integration etc.

- CCAvenue supports a wide range of payment methods

Cons:

Activating international payment options might involve additional documentation and approvals.

6. Skrill Payment Gateway

Skrill is a popular payment gateway used in India for international transactions. It allows quick and safe online payments in different currencies. Skrill is great for businesses and freelancers because it has low fees and good exchange rates. With an easy-to-use interface and strong security features, Skrill is a top choice for handling payments worldwide.

Things to know about Skrill

- Global Reach: Skrill supports payments in over 40 currencies and operates in more than 200 countries, making it a versatile choice for international transactions.

- Versatile Payment Options: Users can send and receive money via bank transfers, credit/debit cards, and other digital wallets, providing flexibility in how transactions are managed.

- Security: With encryption, two-factor authentication, and anti-fraud measures, Skrill ensures that user data and transactions are secure.

- User-Friendly: The platform’s intuitive design makes it easy for both new and experienced users to navigate and complete transactions.

Pricing:

While Skrill offers competitive rates and it charges somewhere from 1% to 5% of the fees for transactions based on payment methods.

Skrill Pros and Cons

Pros

- Enables quick transfers and payments, often processing transactions within minutes.

- Accepts multiple payment methods, including bank transfers, credit/debit cards, and other digital wallets.

- Simple and easy to use, making it accessible for all users.

Cons

Some users report delays and difficulties in reaching customer support.

The verification process can be lengthy and cumbersome for some users.

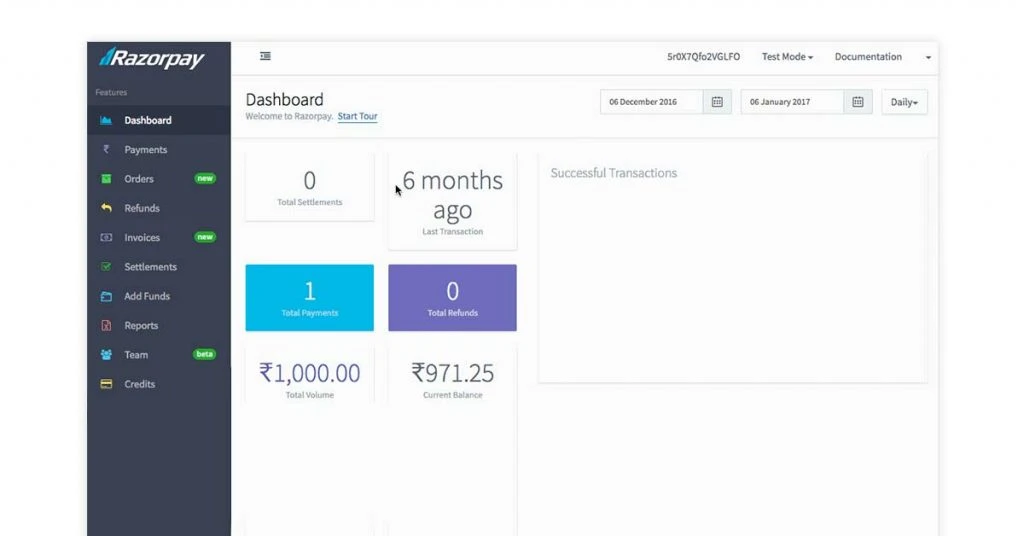

7. Razorpay International Payments

Razorpay gateway supports all major international cards and enables customers to choose from 92 different currencies. You can automate recurring transactions for different modes or share links via different communication channels for quick payments.

It also provides options on its dashboard to create promotional offers for different customer segments.

Things to Know About Razorpay International Payments

- Real-time currency conversion

- INR option for settlements

- Inbuilt PayPal integration

- Analytics on payments, refunds, etc.

- PCI DSS Level 1 compliant

Pricing Plans

There are no setup and maintenance fees. Transaction fee for the Standard Plan starts at 2 percent.

Razorpay Pros and Cons

Pros:

- Supports various payment methods, including credit/debit cards, UPI, net banking, and wallets.

- Easy integration with popular e-commerce platforms and websites.

- Offers detailed analytics and real-time updates on transactions.

- Faster settlement cycles for quick access to funds.

Cons:

- Charges a fee per transaction, which can add up for high-volume businesses.

- Some users report delays in getting support or resolution to issues.

- The refund process can be slow and cumbersome for some users.

Suggested Read: Razorpay Vs PayU Vs Instamojo Vs CCAvenue: The Best Indian Payment Gateways

8. Authorize.net

Authorize.net is a leading international payment gateway in India which offers secure and reliable transaction processing. It supports multiple payment methods, including credit cards, e-checks, and digital payments, ensuring convenience for businesses and customers. With advanced fraud detection tools, seamless integration options, and robust customer support, Authorize.net helps businesses efficiently manage their online transactions, enhancing the overall payment experience.

Things to Know About Authorize.net

Wide Payment Method Support: Accepts credit cards, e-checks, and digital payments.

- Advanced Security: Features robust fraud detection tools.

- Integration: Seamlessly integrates with various e-commerce platforms.

- Customer Support: Offers 24/7 customer service.

- Recurring Billing: Supports subscription-based billing.

Pricing:

Authorize.net has clear and straightforward pricing for its payment gateway. You pay $25 each month to use the service, and there’s no fee to set it up. For each transaction, the cost is 10¢, plus a 10¢ fee for daily processing. To use this service, you need to have a merchant account already. Authorize.net also offers extra services to help your business run smoothly.

Pros and Cons

Pros

- High-level fraud detection and encryption.

- Supports multiple payment methods.

- Trusted and widely used platform.

- Round-the-clock assistance.

Cons

- Cost: Higher transaction fees compared to some competitors.

- Complex Setup: Initial integration can be time-consuming.

9. Cashfree

Cashfree is another leading international payment gateway in India, renowned for its efficient and secure transaction solutions. It supports multiple currencies and payment methods, making it ideal for businesses of all sizes. With features like instant refunds, automatic reconciliation, and a user-friendly dashboard, Cashfree simplifies cross-border transactions. Its robust API integration ensures seamless connectivity, enhancing the overall payment experience for both merchants and customers.

Things to know about Cashfree International Payment Gateway

- Show items in 100+ foreign currencies and with a 2 days of settlements in INR

- Implements advanced security features such as Advanced Fraud Detection , tokenization, and encryption to ensure PCI DSS compliance and protect sensitive data.

- supports a wide range of payment methods including major credit cards (Visa, MasterCard, American Express).

- Offers robust APIs, SDKs, and plugins for seamless integration with various e-commerce platforms like Magento, WooCommerce, and Shopify.

Pricing:

Cashfree offers competitive payment gateway charges starting at 1.95% to around 3% per transaction with no setup or hidden fees. It supports over 100 currencies, provides real-time transaction fee reporting, and includes features like instant settlements and dedicated account managers for enterprises with custom pricing options.

Pros and Cons

Pros:

- 120+ payment option available

- Instant access to the funds within 15 minutes of payment capture

- Su[ports auto−reconciliation

Cons:

Initial setup and integration can be daunting for users without technical expertise

10 . Billdesk

BillDesk is a prominent name in the Indian payment gateway market that offers seamless online payment solutions for businesses. Renowned for its reliability and extensive network, BillDesk supports various payment modes, including credit/debit cards, net banking, and UPI.

Things to Know about Billdesk Payment Gateway

- Supports credit and debit cards, net banking, UPI, mobile wallets, and international payments, providing flexibility for customers.

- Facilitates automated recurring payments for subscription-based services, simplifying billing cycles.

- Offers a detailed dashboard for merchants to track transactions, generate reports, and manage accounts in real-time.

- Provides robust APIs for seamless integration with e-commerce platforms, mobile apps, and custom websites.

- Implements advanced fraud detection mechanisms to protect against fraudulent transactions.

- Automates the settlement of funds to merchant accounts, enhancing cash flow management.

Pricing:

The charges for Billdesk payment gateway is available on request.

Pros and Cons

Pros:

- Collaborates with over 50 banks, enhancing transaction success rates.

- Advanced fraud detection and prevention tools help safeguard transactions.

- Tailors payment solutions to meet specific business needs, including large-scale enterprises.

Cons:

- Charges higher transaction fees compared to some other payment gateways, potentially impacting small businesses.

- The initial setup process can be cumbersome, requiring technical expertise.

How to Choose the Right International Payment Gateway?

Keep in mind the following factors while choosing the international payment gateway to make the right choice.

- Budget: Based on the size of your business, the amount that needs to be processed by the payment gateway annually varies. Different international gateway payment vendors have distinct setup fees, processing charges, and annual maintenance fees. Choose the one that caters to your business and offers flexible pricing models.

- Country-wise support: Indian merchants must check the support for INR and other currencies depending on their target audience. Multi-currency payment gateways that support many languages are great for attracting customers outside India. Ensure that you check the terms and conditions to avoid confusion later.

- Payment modes: There must be several international gateway payment modes, including credit cards, debit cards, net banking, EMI, among other modern options. This will enable merchants to ensure that both one-time and subscription-based recurring payments occur smoothly.

- Security & compliance: While you want to make payments simple and quick for customers, it should not come by compromising security. Financial transactions require sensitive customer information and hence, your payment gateway must include tools to ensure security. There are different PCI (Payment Card Industry) compliance standards based on the choice of country. If a gateway is PCI compliant, it will adhere to international security standards.

Conclusion

Even though many Indian merchants stick to local payment options, going global with an international payment gateway can make a huge difference. These gateways help you expand your business, reach more customers worldwide, and stay ahead of the competition. With the right gateway, you can handle payments smoothly and securely, making your customers happy and your business more successful. So, why wait? Choose one of the top international payment gateways we’ve talked about and start growing your business across the globe today.

FAQs

Which is the best international payment gateway in India?

Stripe, PayU, and PayFlow are some of the best international payment gateway options in India. What suits you the best will depend on your budget, business size, and features required.

How to accept international payments in India?

You can accept international payments in India online by integrating international payment gateway services like CCAvenue and PayU for customers.

Related Categories: Payment Gateway | Order Management Software | Dropshipping Software

Shubham Roy is an experienced writer with a strong Technical and Business background. With over three years of experience as a content writer, he has honed his skills in various domains, including technical writing, business, software, Travel, Food and finance. His passion for creating engaging and informative content... Read more