There has been a rapid increase in the number of customers using banking services and serving all of them effectively is a daunting task. Software providers have integrated CRM software for banks that helps them serve their customers in a personalized manner, thereby boosting relationships and customer satisfaction.

CRM has become an integral part of banking infrastructure to manage their clientele. However, when it comes to CRM for the banking industry, there is a whole array of software available in the market. In this article, you will learn about the top CRM solutions for the banking industry.

What is CRM in Banking?

Customer Relationship Management (CRM) in the banking sector helps in managing a bank’s relationship with existing and potential clients through a set of collected data, integration of communication channels, and streamlining customer service.

CRM in the banking industry allows banks to collect, store, analyze and leverage valuable data to gain and retain high-value loyal clients.

Importance of CRM in Banking Industry

CRM is essential for every business that deals with many customers or clients. However, when it comes to entirely customer-dependent industries like banking, CRM is of utmost importance. Here are some of the reasons why CRM in the banking sector is crucial.

- Record and manage customer data, communications, and interactions across channels.

- Gives banks the ability to have a 360-degree view of their customers, understanding their needs better

- Allows Customer service team to better serve clients with personalized service

- Gives deeper insight into clients’ demographics, buying patterns, and data for better policies

- Identify and retain high-value loyal customers

- Allows teams to collect data for targeted marketing campaigns.

In short, a good CRM system can help banks improve customer satisfaction and loyalty, increase cross-selling and upselling opportunities, and boost efficiency.

10 Best CRM to Overcome Challenges in Banking Industry

- EngageBay

- Zoho CRM

- Nafhaa CRM

- Salesforce CRM

- HubSpot CRM

- Oracle NetSuite CRM

- Freshsales

- LeadSquared

- Solid Performers CRM

- automateCRM

Our experts have analyzed and reviewed hundreds of CRM software and shortlisted the top 10 CRM for bank industry.

EngageBay

EngageBay CRM is a comprehensive CRM software that integrates a large number of customer management, sales, and marketing tools making it a near-perfect CRM system for banks. Distinguishing features like behavior tracking and appointment scheduling are extremely beneficial for banks and insurance companies.

EngageBay Features

- Holistic 360-degree customer view

- Automatic lead scoring

- Centralized data sourcing

- Sales gamification

- Integrated interaction management

- Social media data extraction

- Consistent data and interaction

- Pipeline visualization

EngageBay Pricing: For large institutions like Bank, the All in One plan costs ₹1345/user per month for unlimited contacts.

Zoho CRM

Zoho CRM is one of the most popular CRM solutions on the market and for good reasons. It’s feature-rich, offers extensive integrations, and has both cloud-based and on-premises deployment options making it a versatile CRM system. Zoho also offers a Canvas and Developer platform that allows banks to tailor the CRM for specific banking needs.

Zoho CRM for Bank Features

- Smart selling with conversational AI

- Omnichannel customer interaction

- Intelligent alerting system

- Email and call prioritization

- Multiple pipeline management

- Blueprint and validation ruleset

- Mobile MDM & SDK

Pricing Zoho CRM: The pricing for Zoho CRM starts at ₹944 per month per user. The CRM Plus plans with maximum features cost ₹4130/user per month.

Suggested Read: Best CRM Software for Small Businesses in India

Nafhaa CRM

Nafhaa CRM by Silicon IT is a user-centric CRM solution that mainly focuses on customization and ease of use. Nafhaa goes beyond simple customer management and integrated marketing, customer service, and even supply chain management.

Nafhaa CRM Features

- Sales engagement tracking

- CXO dashboard

- Third-party software integration and API

- IPBX device engagement

- 50+ Integrations

- User hierarchy for data segregation

Nafhaa Pricing: Nafhaa costs ₹2832 User/year for the Business Pro plan.

Salesforce CRM

Salesforce CRM is one of the most popular CRMs on the market. It offers extensive integrations, industry-specific modules and provides a highly scalable CRM solution making it one of the best choices for banking CRM solutions. It helps banks deliver a customer-centric user experience.

Salesforce CRM for Bank Features

- Industry-specific customized solution

- Process automation

- Opportunity management

- Forecast and pipeline management

- Omnichannel lead management

- Social media insight collection

- AI-powered automation

Salesforce CRM Pricing: Salesforce provides customized pricing plans as per the requirements of the users. Contact Techjockey Team for detailed pricing.

HubSpot CRM

HubSpot CRM is a popular CRM solution that offers a wide range of features to help banks manage their customer relationships. The software is designed to provide a complete view of a customer, from initial contact to post-purchase follow-ups. HubSpot also offers extensive integration and plugins, making it a preferred choice for banks.

HubSpot CRM Features:

- End to end customer history tracking

- Lead scoring and management

- Configurable workflows

- Automated email and social media scheduling

- Data enrichment and segmentation

- Advanced reporting and analytics

HubSpot Pricing: HubSpot offers a free plan for small businesses. However, HubSpot offers custom pricing plans for banks and financial institutions. Contact the Techjockey team for detailed pricing.

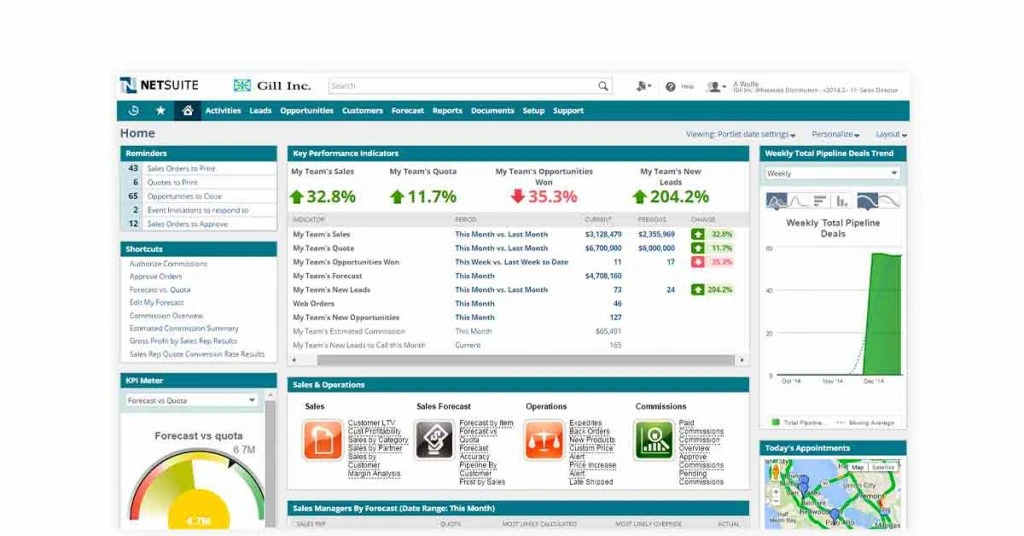

Oracle NetSuite CRM

Oracle NetSuite is a feature-rich Bank CRM system designed for banks and other financial institutions to deliver a personalized brand experience. Oracle CRM also offers a wide range of features to help banks manage their customer relationships, including lead management, opportunity management, and partner relationship management.

Oracle NetSuite Features:

- Salesforce automation

- Comprehensive reporting & analytics

- Quota management

- Partner relationship management

- Customer service management

- Industry specific modules

- Compliance management

Oracle NetSuite CRM Pricing: Oracle offers custom pricing plans for banks and other NBFI. Contact the Techjockey team for detailed pricing.

Freshsales

Freshsales is another comprehensive Banking CRM solution that boosts efficiency by streamlining and integrating the sales and marketing processes of banks. Freshsales banking CRM also offers extensive integrations and plugins, making it a versatile CRM software.

Freshsales Features:

- AI-powered chatbots and deal insights

- Fully customizable web forms

- Visitor intent tracking

- Predictive contact scoring

- Slack integration

- Dynamic forecasting

- Automated sales campaign

- Contract life cycle staging

Freshsales Pricing: Freshsales provides a ₹1651/per month/user (billed annually) Enterprise plan for Banks and financial institutions.

Suggested Read: Top CRM in Telecom Industry: Its Roles & Benefits

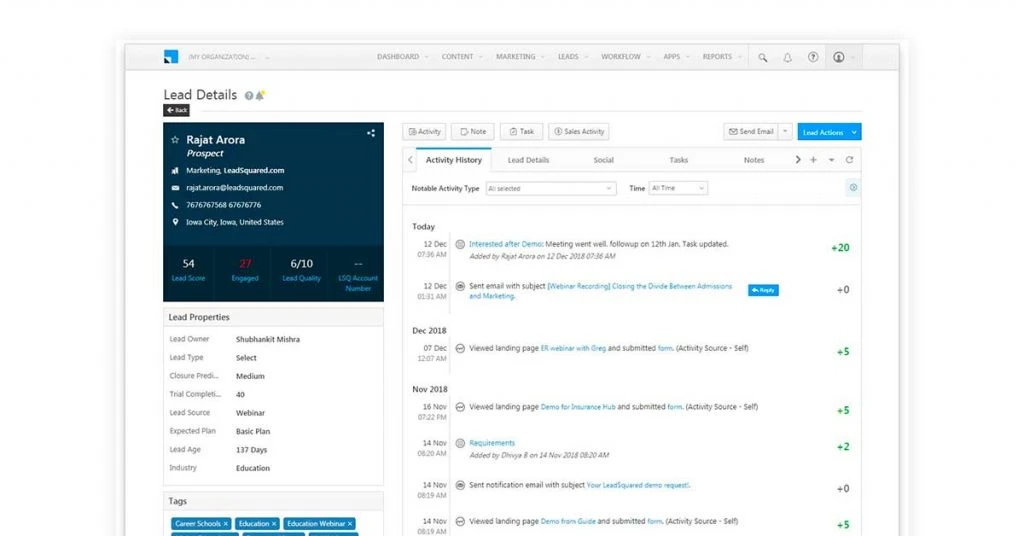

LeadSquared

LeadSquared is a leading one-stop banking CRM solution allowing banks to manage their entire customer lifecycle. LeadSquared CRM for banking lowers ownership and customer acquisition costs by streamlining the acquiring, onboarding, and engaging process.

LeadSquared Features:

- Workflow customization

- Enterprise grade security and control

- Multi-channel engagement

- Mobile CRM for bank agents

- Cross-sell/upsell engine

- Debt recovery module

- Corporate banking management

LeadSquared Pricing: LeadSquared has a custom pricing plan for large institutions like banks as per their requirement. Contact the Techjockey team for detailed pricing.

Solid Performers CRM

The Solid Performers CRM is a great choice for banks looking for comprehensive, affordable, and easy-to-use CRM software. It is a great CRM for financial institutions due to its additional modules like Document management, PI management, and deal management. It also has advanced reporting and analytics capabilities, making it a great choice for growing banks that what to close more leads and track performance efficiently.

Solid Performers CRM Features:

- Chatbot lead generation

- Ticket management module

- Campaign and invoice management

- WebForm builder

- Third-party integration and API

- Document management

- Customization dashboards

- Campaign management

Solid Performers CRM Pricing: Solid Performers CRM’s offer is a Triangle Plan subscription at ₹1151/user/month. However, it also provides custom plans for banks and other financial institutions.

automateCRM

automateCRM is a comprehensive cloud-based CRM software with open-source integration and full customization. The VI Data Studio helps to generate extremely vital analytics and reports for predictive analysis and marketing optimization.

AutomateCRM Features:

- Support and service automation

- Affiliates management

- Project management

- Drip marketing campaigns

- Message scanners

- Pipeline management and automation

AutomateCRM Pricing: The basic plan for AutomateCRM costs ₹590/user/month. However, financial institutions could contact the Techjockey team for custom plans as per their needs.

Benefits of CRM in the Banking Industry

Did you know: As per a global study by Accenture, 67% of customers are ready to share more information to banks if it means they will be entitled to new benefits.

While CRM is important in every industry, for the banking industry, it can help deliver a high-impact and personalized customer experience. Adopting CRM in banking ensures the following benefits:

- Streamlines Entire Operations: Streamlines and automates the entire client management and service operation of a bank. Right from marketing to sales to customer service through integrated workflows.

- Improves Customer Loyalty and Satisfaction: Provides a 360-degree view of customers and allows banks to provide personalized service for improved satisfaction.

- Increases Efficiency: Boosts efficiency by automating repetitive tasks and improving communication between departments.

- Smooth Workflows: Establishes workflows between different departments leading to improved communication and higher efficiency.

- Boosts Revenue: Provides better insights of customers for targeted products, services, campaigns, and policies for more revenue.

- Improves Decision Making: Provides a wealth of structured client data allowing banks to make better decisions about marketing, sales, and customer service strategies.

- Viable Reports and Analytics: Generates accurate and easy-to-read reports and analytics for setting targets, identifying gaps, and tracking progress.

- Efficient Communication: Bank call center ensures an easy flow of information and creates a relationship of trust. Customers can confidently share their information and requirements with bank professionals.

- Personalize Customer Journey: CRM for bank can keep track of customer behavior and predict their needs. Based on key data analysis, the software automatically sends out suggestions for how the bank can fulfill the expectations of customers.

- Strengthen Customer Experience: Banking CRM helps you record customer data and personal information which can be used to proactively deliver personalized services to customers. This helps banks to focus on the needs of its customers and in turn strengthen customer experience and loyalty.

- Effective Lead Management: Right from capturing leads to converting and nurturing them, bank CRM solutions help with the end-to-end lead management.

CRM in Banking Industry: Use Cases

Banking CRM is often used in sales, marketing and customer support/service departments. We are sure you might be wondering how banks are exactly putting CRM to their advantage.

Well, in addition to managing customer data, banks also develop strategies to retain customers. And the CRM enables them to learn more about their customers and comprehend their requirements.

In this section, we have discussed a few of the use cases to help you understand the adoption of CRM in banks.

- Segmented Marketing

Using the CRM system, banks can segment customers depending on their account information, services they use and so on. In this highly competitive market, relevant offerings and marketing additional products to existing customers are essential for keeping them engaged with your banking institution. CRM system in this regard helps build campaigns with personalized messaging that resonates with them.

- Personalization and New Opportunities

In banking, CRM fetches the information regarding a customer’s personal information, loan preferences & more. Service reps at banks can hence use this data to make customers feel valued while also exploring new prospects with them.

- Rethinking processes to improve profitability

Occasionally, banks should evaluate current processes to understand the workflow. Banking CRM software in this regard can help make data backed decisions. CRM for banks often creates reports that reveal which services are profitable, how many customers are actively using a particular service, and so on.

Hence, a concrete data can reveal these trends in the most accurate form, allowing banks to make data driven decisions which will eventually help improve profitability.

CRM in Banking: Out of The Box Vs Custom Solutions

Out of the Box CRM

It includes the functionalities that are in-built software vendor or can be configured easily with built-in workflow tools, templates, and the best practices provided directly by the vendor.

Pros and Cons:

- Faster deployment

- Standard features based on market analysis and customer needs

- A great pick for banks with little to no internal IT support

- This software lacks customized workflow features

- May include hidden fees like support fee or licensing fee

Custom CRM Solutions

Custom made CRM software is a tailor-made solution designed specifically to accommodate unique bank model. By using custom software that is catered to the unique needs of your bank, you will be able to stand apart from your competitors and deliver outstanding customer value.

Pros and Cons:

- Includes functions and features specific to your business needs

- Features can be scaled as your business grows

- Deployment slower than out of the box software

Challenges of CRM in Banking

Probably the biggest challenges of CRM in banking industry are related to data security and integration with existing systems. However, the best part is the top CRM providers in the banking sector are aware of these challenges and have incorporated security measures to address them. Let’s understand these challenges in detail.

- Data Security

The banking sector is highly concerned with data security and therefore aims to provide customers with more control over their personal records. Well, in addition to the personal record of the customers, the entire banking industry should also be secured against cyber-attacks and malicious activities designed to exploit services or networks.

Modern cloud-based CRM banking solution providers are aware of these concerns and provide high-level security measures such as role-based permission for information access. These roles can be defined by the administrator to ensure only specific users can access sensitive information. Encrypted transmissions and data center backups are just a few other ways CRM providers ensure data security.

- Integration of CRM with existing systems

One of the other serious complications in adopting CRM in banking is the integration of new solutions to the existing tech stack. However, CRM specialists can help you resolve this problem by seamlessly integrating the CRM solutions with your bank’s existing systems. They further ensure that the new function works seamlessly with other systems being used in your bank.

So, if you’re wondering when the banking sector should adopt CRM, the answer is right away!

FAQ Section

What CRM do banks use?

There are several CRM software options available to banks and other financial institutions. Some of the most popular CRMs used by banks include Freshsales, LeadSquared, Solid Performers CRM, and AutomateCRM.

How CRM is a useful tool in the banking sector?

CRM software is a versatile tool that is used to manage customer data, track customer interactions, and generate reports and analytics. Additionally, it is also used to automate sales and marketing processes, streamline communications, and improve customer service.

Do banks use Salesforce?

Yes, Salesforce is one of the most popular CRM software platforms used by banks. It provides various features and tools that are specifically designed to meet the needs of the banking sector.

How is Salesforce used in the banking industry?

Salesforce is used in the banking sector for several different purposes. For example, it is used to manage customer data, track customer interactions, generate reports and analytics, automate sales and marketing processes, streamline communications, and improve customer service.

Which is the highest-rated CRM in banking?

LeadSquared is one of the highest-rated CRMs for the banking industry. It offers a comprehensive suite of banking-specific features like borrower management and corporate relationship management that make it a great choice for banks.

Why is CRM important for banks?

CRM in bank is a useful tool for meeting sales and marketing goals as well as improving the overall customer retention rate. The CRM software integrates well with other banking software programs providing you with a single view of every customer account. It further enables you to help each customer along their journey. For instance, they assist them in opening an account, loan process & more.

What does CRM stand for in banking?

Similar to any other industry like business or retail, in the banking sector, CRM stands for customer relationship management.

What are the steps to implement CRM in banks?

In order to create CRM in the banking sector, the first and foremost thing you need to do is specify the goals of your bank. In addition, it is also important to define the list of requirements for the final CRM solution. Once you have identified goals, the next step is to look for a reliable CRM software provider that aligns with your bank requirements. Apart from this, it is equally essential to prepare your employees to switch to a CRM system.

Rajan is pursuing CA with a keen interest in trends and technologies for taxation, payroll compliances, Tally Accounting, and financial nuances. He is an expert in FinTech solutions and loves writing about the vast scope of this field and how it can transform the way individuals and businesses... Read more